Accounting software helps streamline accounting and bookkeeping tasks for small businesses.

Small business owners wear many hats, and accounting is just one of the many business operations they have to manage. Keeping a manual track of income and expenses, preparing financial statements, and staying compliant with tax laws can be difficult to manage daily. One solution to these challenges is the use of accounting software.

Accounting software provides small business owners a centralized platform to manage their finances, including income and expenses, cash flow management, and budgeting. This software automates several time-consuming tasks, such as bookkeeping and invoicing, allowing you to focus on growing your business instead.

This article highlights, in alphabetical order, the top five accounting software for small businesses based on user reviews. For each product, we include overall user ratings along with the highest-rated parameter, review excerpts from industry professionals, and product pricing. Read more.

Searching for an accounting firm to hire for your business? We’ve got you covered. Check out our list of companies in the following areas:

1. BQE CORE Suite

Trial/Free Version

- Free Trial

- Free Version

Highest-rated parameter

Commonly used by

Starting price

Device compatibility

Screenshots

Financial health dashboard in BQE CORE Suite (Source)

Here are some review excerpts from small business professionals who have used BQE CORE Suite for accounting:

"Overall positive, I feel that if I am ever in need CORE would be quick to respond and very helpful.It has been easy to train staff to use CORE for time tracking.We would love to learn to use more of CORE to get our productivity levels up"

"Easier way to attach documents to expense entries, quick way to overview and process time card summary reports.It has aided with the collection of receipts for all of our field team members.I am very pleased with the Time subscription, and project management subscription.The software is very intuitive and quick to learn."

"BQE Core is an amazing software that allows for greater insight into accounting and invoicing management.By incorporating a visually pleasing and easy to use overview and intuitive operational tools, BQE Core maximises productivity and profitablity.Overall a must have platform for any business."

Read all BQE CORE Suite reviews here.

2. Patriot Accounting

Trial/Free Version

- Free Trial

- Free Version

Highest-rated parameter

Commonly used by

Starting price

Device compatibility

Screenshots

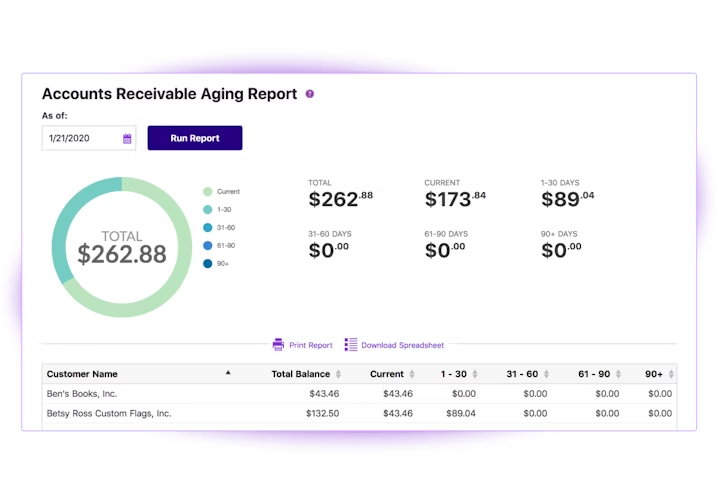

Accounting receivable aging report in Patriot Accounting (Source)

Here are some review excerpts from small business professionals who have used Patriot Accounting for accounting:

"The software is easy to use, if you make a mistake, it's easy to fix or correct.I am able to add multiple bank accounts so I can track my transfers easily.The staff is very helpful whether I call in or as for help over the messaging platform they are always quick to answer my questions and email me the conversations so I can refer back if I need to."

"I really like Patriot because it is extremely user friendly.I have a very small side business.I dont use alot of the features but to track daily income and expenses is great.I also do not have a ton of time to spend, so checking in weekly with the easy to use features is so nice.Customer support has been wonderful as well."

"I appreciate this software in helping me organize and keep track of my expenses.I like the ease of having everything in its place when it’s time to do taxes.I enjoy the general ledger and being able to input a date and find the expense or invoice.I’m a first time software accounting user and patriot made it very easy!"

Real all Patriot Accounting reviews here.

3. QuickBooks Desktop Premier

Trial/Free Version

- Free Trial

- Free Version

Highest-rated parameter

Commonly used by

Starting price

Device compatibility

Screenshots

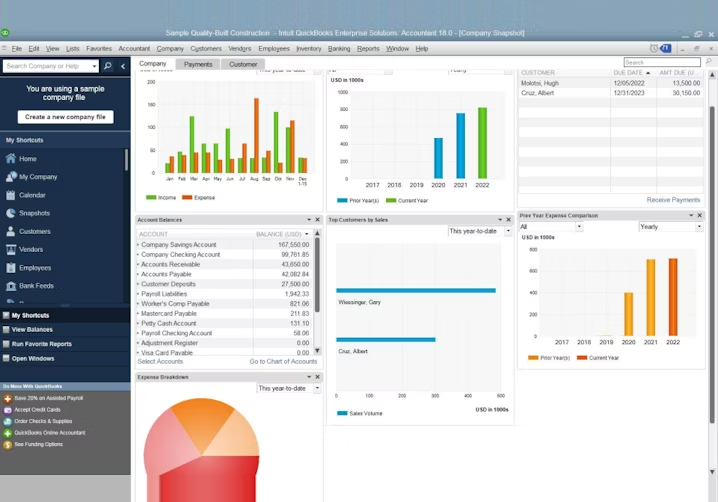

Financial planning dashboard in QuickBooks Desktop Premier (Source)

Here are some review excerpts from small business professionals who have used QuickBooks Desktop Premier for accounting:

"Quickbooks Desktop is great accounting software.There are powerful tools to adjust the books quickly such as adding transactions in batches, recategorizing multiple transactions, full access to various report and filters, etc."

"I love that Quickbooks online is user friendly with an easy-to-understand interface.I like that the features and reports can be easily customized.My favorite features are the reconciliation process , versatility of reports, and the ability to Memorize transactions—these features save so much time."

"Overall QuickBooks premiere is a great well-rounded software that is easy to use."

Read all QuickBooks Desktop Premier reviews here.

4. Xero

Trial/Free Version

- Free Trial

- Free Version

Highest-rated parameter

Commonly used by

Starting price

Device compatibility

Screenshots

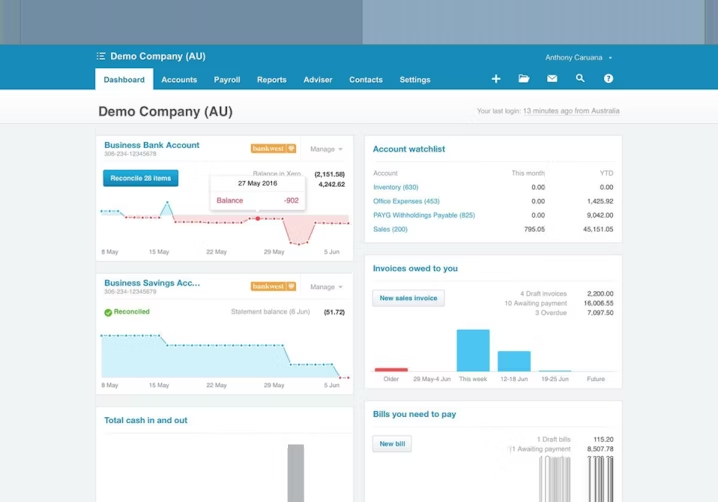

Demo company accounts dashboard in Xero (Source)

Here are some review excerpts from small business professionals who have used Xero for accounting:

"Xero is a very visually pleasing software, especially for Accounting software.It's easy to use (in general) and it definitely has a strong set of core features (invoicing, billing, etc.).The ease of setting up online payments and creating custom document templates is great.It integrates well with our ERP (Unleashed)."

"Xero makes managing the finances for a business really straightforward.The user interface is intuitive and it centralises all my accounts information.One of my favourite features is the the dashboard, which is clear and customisable, and gives a great summary of the position position at any time.The software also integrates really well to other platforms for things like receipt capture and detailed business analysis."

"Easy to use, Has great in-depth features for compiling company specific reports, managing channels and customers.Invoicing is a breeze, keeping track of invoices and bills is super easy and user management is also quite flexible."

5. ZarMoney

Trial/Free Version

- Free Trial

- Free Version

Highest-rated parameter

Commonly used by

Starting price

Device compatibility

Screenshots

Reporting dashboard in ZarMoney (Source)

Here are some review excerpts from small business professionals who have used ZarMoney for accounting:

"Excellent tool , easy to use, effective and when completed, the invoice emails directly to customer.Inexpensive and has great reporting functions as well.It has all you need for a small business."

"Very good price; good functionality; I like how I can see which invoices are unpaid and which ones have been paid; keeps track of overall income; I hope to use it for expenses as well as payroll, but I'm not sure if payroll is included; the main thing for me is having one database for customers where we can manage services provided and invoicing..."

"great customer service / sales !thanks, Jeremy!....ZarMoney seems amazing so far, and i am glad that i can get help on the phone"

Real all ZarMoney reviews here.

What features do accounting tools offer?

The core features of an accounting solution include:

Accounts payable: Monitor outstanding debts by tracking payments owed to creditors and suppliers, ensuring prompt payment and maintaining financial stability.

Accounts receivable: Track outstanding invoices and the money owed from clients.

Bank reconciliation: Compare accounting/financial records with corresponding bank statements, including deposits, withdrawals, payments, receivables, and other financial data that affects the business’s funds.

Financial reporting: Document all financial transactions to prepare performance reports that reflect your financial position and profit earnings against the expenses.

General ledger: Validate the company’s debit and credit records using trial balance. The financial entries include accounts payable, accounts receivable, cash management, and fixed assets.

All products listed in this report include the features mentioned above.

Besides these core features, accounting software for small businesses also commonly tend to offer:

Billing and invoicing

Budgeting/forecasting

Expense tracking

Fixed asset management

Multi-currency support

Payroll management

Project accounting

Payment processing

Bank account management

How to choose the right accounting software for small businesses

Here are some factors you should consider to choose the best accounting software for your small business:

Consider accounting features specific to your business: Identify your unique business challenges and choose a solution that offers all the capabilities you require to solve them. For instance, if you need to track expenses and revenue, monitor recurring invoices, or generate periodic financial reports, select a tool that offers these capabilities. Other advanced features might include the ability to manage client records, generate invoices, and integrate with other business accounting software.

Evaluate automation capabilities: Small businesses primarily invest in an accounting software solution to reduce inaccuracies caused by manual data entry and automate recurring processes. Hence, it is important to consider the degree of automation a solution provides while evaluating accounting software. The best accounting software should be able to verify entries for accuracy, auto-detect wrong or duplicate entries, correct errors, and automate recurring functions.

Check reporting features: As a small business owner, you need periodic reports on accounts payable/receivable and your financial position. Your small-business accounting software should let you generate intuitive reports that showcase profit and loss data, cash flow, financial position, and other relevant metrics. It should also enable sharing of reports with internal and external stakeholders.

Common questions to ask software vendors before purchasing accounting software

Does the software integrate with other systems such as payroll and invoicing?

An ideal accounting solution should easily integrate with your existing payroll, financial management, bookkeeping, and invoicing software. Such integrations help simplify data migration for your business and save time.

What are the security measures in place to protect sensitive financial data?

When finalizing an accounting tool, check for security features such as role-based user access and two-factor authentication. Such security measures are important to prevent unauthorized access to your financial data.

How is data backed up, and can it be easily restored in case of an emergency?

It's critical to have cloud storage to perform regular data backups, ultimately preventing data loss due to physical damage to your systems or cyberattacks. Moreover, businesses need to comply with regulations related to data protection, data retention, and data privacy. Backing up accounting data can ensure compliance and avoid legal and regulatory penalties.