Accounting software helps streamline accounting and bookkeeping tasks.

Fueled by grants and contributions, nonprofit organizations often face increased requests for accountability and transparency in financial reporting. Recording donations, managing payroll, and handling cash flows are some of the common issues these organizations face.

In case you are starting afresh as a nonprofit business and wondering how to document funds and expenses meticulously, you probably need to look for an accounting system for your organization. Accounting software for nonprofits allows users to streamline accounting tasks, track grants and endowments, manage reimbursable grants, generate financial statements, and more.

While there are dozens of easy-to-implement accounting software options available on the market, they are often pricey. You may not want to invest in an expensive accounting solution, especially if you are just getting off the ground. Fortunately, there are several tools available that allow you to manage your nonprofit’s finances for free.

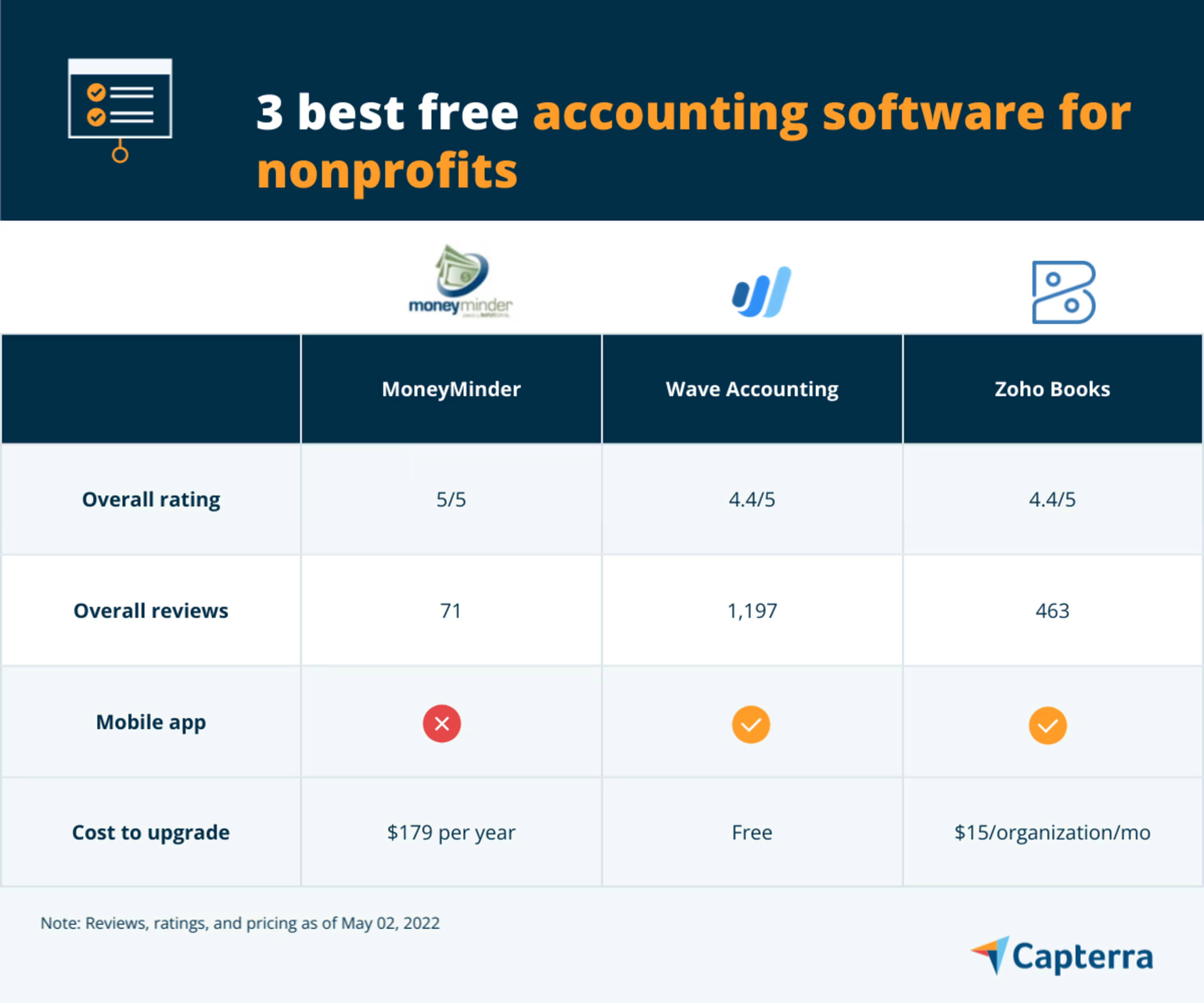

This article highlights the three best free accounting software for nonprofits (listed alphabetically) based on user reviews and ratings.

Check out the complete list of nonprofit accounting tools in Capterra’s software directory.

Searching for an accounting firm to hire for your business? We’ve got you covered. Check out our list of companies in the following areas:

1. MoneyMinder: Features budget templates for custom budgets

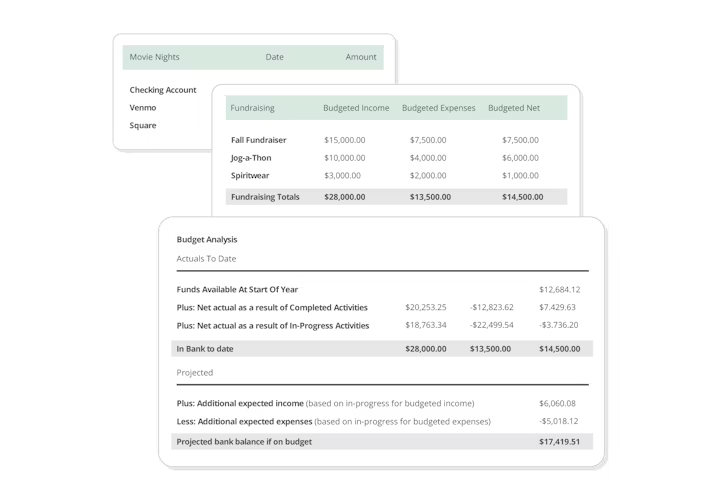

MoneyMinder is an online accounting solution for nonprofit organizations that allows users to manage their finances, reconcile bank accounts, and track volunteer activities. The software features budget templates that can be modified while creating custom budgets for the nonprofit organization. These budgets can be categorized based on different activities, such as fundraising, administration, and programs. You can keep track of your budget and compare it with the actual expenses to set future goals.

MoneyMinder offers volunteer management tools that allow nonprofits to track volunteer hours in relation to events and generate reports. The nonprofit accounting software also allows you to manage members’ information, track dues, and record membership fees at different levels. In addition to managing volunteers and members, the accounting solution allows you to manage donors. The software allows you to send acknowledgement receipts to donors.

MoneyMinder also features a document library that contains all the commonly used forms, templates, and documents that can be used for quick references. These include meeting agendas, audit findings, check letters, and internal revenue service (IRS) documentation for nonprofits.

MoneyMinder offers customer support via phone, email, and chat.

Key Features

- Accounting

- Accounts receivable

- Bank reconciliation

- Budgeting/forecasting

- Donation tracking

- For nonprofits

Trial/Free Version

- Free Trial

- Free Version

Cost to upgrade

Device compatibility

Screenshots

Reconciling bank statements in MoneyMinder

2. Wave Accounting: Offers finance and invoice dashboards

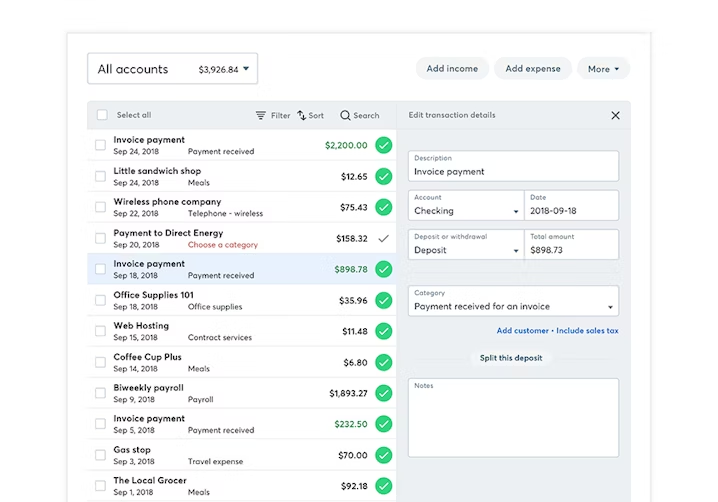

Wave Accounting is an online invoicing and accounting solution that simplifies nonprofit bookkeeping processes. Some of the notable features of the software include payment tracking, payroll management, credit card processing, and finance management, among others. Wave Accounting features a finance dashboard that displays cash flows, bills, net income, bank account statements, and other financial insights useful to a nonprofit treasurer.

The nonprofit accounting software allows you to create custom invoices using several built-in invoice templates available in Excel, Google Docs, and PDF formats. The software also allows you to schedule invoices for a later date and set recurring invoices for any day of the week or month. Wave Accounting also features an invoice dashboard wherein you can see details related to billing and invoicing, such as overdue payments, outstanding invoices, and next payouts, among others.

The fund accounting software provides you with different reports that allow nonprofits to manage their operations. Examples include donation reports, profit/loss reports, transactions reports, and expense reports.

Wave Accounting is completely free for use, and you receive all the features offered by the vendor in the free version itself. Customer support options for Wave Accounting include email and chat.

Key Features

- Access controls/permissions

- Accounts payable

- Accounts receivable

- Billing and invoicing

- Cash management

- Fund accounting

Trial/Free Version

- Free Trial

- Free Version

Cost to upgrade

Device compatibility

Screenshots

Tracking receivables and expenses in Wave Accounting

3. Zoho Books: Accept donations in multiple currencies

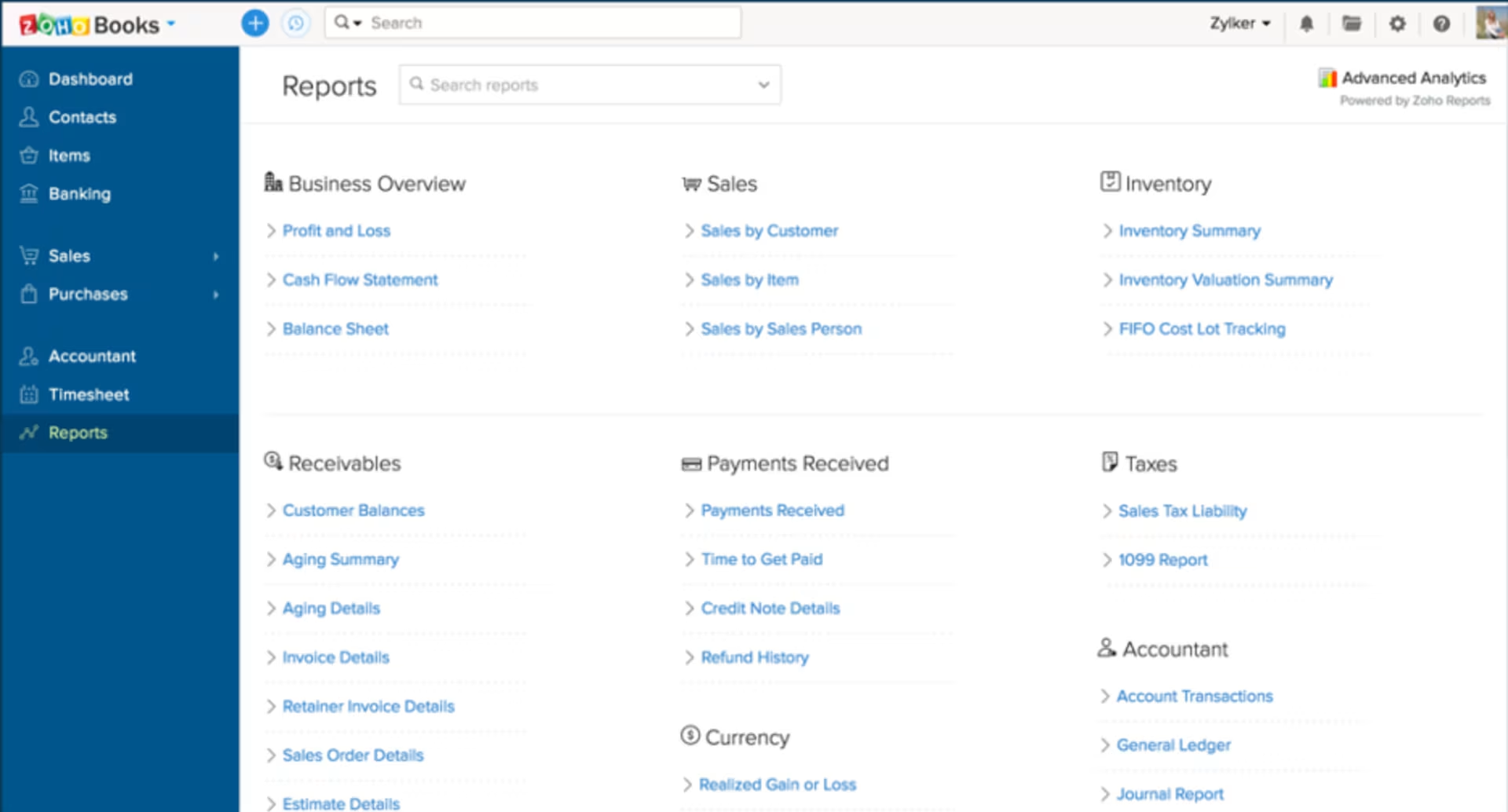

Zoho Books is an accounting software solution that allows nonprofits to manage their expenses, track donations, send donation receipts, and generate detailed reports for purchases, inventory, and activity logs. The software features a dashboard that provides you an overview of the total receivables, payables, cash flow, income, expenses, and bank account transactions of a small business or a nonprofit organization.

As a nonprofit treasurer, you can categorize and track your expenses by adding them under multiple expense accounts and associating them with a vendor or a client. Zoho Books also provides functionality for donor management. It allows you to maintain a record of all your donors and their contribution to your cause. You can also use the software to manage taxes associated with donations.

The nonprofit bookkeeping software allows you to create and share professional-looking invoices for your clients and accept donations in multiple currencies. While the location of your organization determines the default currency, there are several other currency options that you can choose from to accept donations from donors all across the world.

Zoho Books integrates well with several major online payment gateways, such as Stripe, PayPal, Authoize.Net, Payflow Pro, and Square. The vendor offers phone, chat, and email as customer support options.

Key Features

- Accounting

- Audit trail

- Billing and invoicing

- Contact managment

- Multi-currency support

- For nonprofits

Trial/Free Version

- Free Trial

- Free Version

Cost to upgrade

Device compatibility

Screenshots

Report options in Zoho Books

How to choose the right free accounting software for nonprofits

Accounting for nonprofits is quite different from for-profit accounting, so selecting the right software can be a bit more complex. Here are a few important considerations you can keep in mind before finalizing the best free accounting software for nonprofits.

Select a tool that allows you to track and manage donations: Nonprofit organizations receive donations in various forms, including grants, dues, and pledges. These require effective documentation and specialized tracking as the inconsistencies in managing funds can lead to reputational damage, fines, or even legal action. Before investing in a free accounting tool, make sure that the software can track donations in all forms via a common portal. It should also provide functionality for managing donor receipts and generating reports to showcase the amount received and its utilization.

Select a tool that offers invoice customization: Your free accounting software should allow you to create professional-looking invoices and customize them for donations or any goods and services that you provide. The software should also allow you to download and share customized invoices in multiple formats, including Word, PDF, and Excel.

Select a tool that offers automation of accounts payable/receivable: Given the number of donations received by nonprofits and the extent of their services, nonprofit organizations need to have a system that streamlines and automates accounts receivable and payable for them. While selecting a free tool, ensure that the software provides features for vendor records management, payment date calculation, finance-related alerts, and advance payment scheduling. The best accounting software should also allow you to automate and manage collections. Therefore, the software must have sales tax calculation, commission tracking, and credit card processing features.

Common questions to ask when choosing free accounting software for nonprofits

Selecting the best free accounting software for nonprofits can be overwhelming at times, especially with so many options available on the market. Here is a list of some important questions to ask before making your final decision.

Does the software provide reporting and budgeting capabilities?

Reporting requirements for nonprofit organizations are unique. The reports must always be accurate and detailed enough to ensure transparency and adherence to audit demands. Look for a tool that allows you to generate fund accounting reports, financial reports, donor contribution reports, and budget-to-spending comparisons. Also, make sure that the software allows you to present these reports in multiple formats, including Excel and PDF, among others.

Does the software offer bank reconciliation?

Bank reconciliation is important to ensure transparency in financial operations and prevent cash manipulations. Before investing in a free accounting system, ensure that the product can review, categorize, and reconcile bank account transactions at periodic intervals. Several free tools also allow you to set filters to locate specific transactions. Besides basic reconciliation, look out for any such additional features.

Does the software support multiple currencies?

Nonprofit organizations frequently receive funds from multiple donors and countries. Before you invest in the best accounting software, check if the platform allows you to accept donations in multiple currencies.

How did we choose these products? We didn’t—you did.

To find your ideal software match, you need information you can trust so you can save time, stay on budget, and focus more energy on growing your business. It’s why we vet and verify all our user reviews and recommend only the tools endorsed by people like you.

In other words, our product recommendations are never bought or sold, or based on the opinion of a single individual—they’re chosen by your peers, reflecting the views and experiences of our independent base of software reviewers.

At Capterra, we objectively select and rank products based on a methodology developed by our research team. Some vendors pay us when they receive web traffic, but this has no influence on our methodology.