Learn how to create and use a budget for your business using our free template.

According to the U.S. Bureau of Labor Statistics, 20% of small businesses fail within their first year. And while reasons vary, their failure is often due to cash flow problems.

Don’t let your business become another statistic. To give your new small business its best chance at survival, you’ll need to learn how to take inventory of your income and costs—your cash flow—and track what you’re actually making and spending. In other words, you need a budget.

Making a useful budget for your small business doesn’t have to be complicated. All you need is a spreadsheet tool such as Microsoft Excel to create a budgeting tool of your own. Even better news? We've already made a free small-business budget template for you.

How to use our free small-business budget template

Rather than create a budget spreadsheet yourself, use our budget template spreadsheet to jumpstart your budget plan. We’ll show you how in four easy steps.

Step 1: Take inventory of income to determine what you can spend

You can’t create a budget without taking inventory of your income. Why not? Because your income determines how much you’re able to spend.

To find out how much you’re bringing in, you can refer to your profit and loss (P&L) statement, also known as your income statement. An income statement shows how much profit your company has made, or how much you’ve lost. It has three components:

Revenue: Income generated through the sale of goods and services from business operations, after deducting returns and allowances such as discounts.

Expenses: Cost to produce goods and services sold as well as operating expenses.

Profit: Cash your company makes from business operations, including gross profit, operating profit, and net profit.

Don’t have an income statement handy? No problem. We’ll cover that later on.

For this first step, we’re most interested in your revenue. Depending on your business model, you might have several sources of revenue, such as a subscription service or online classes. To get an accurate budget, make sure to include all streams of revenue in your inventory.

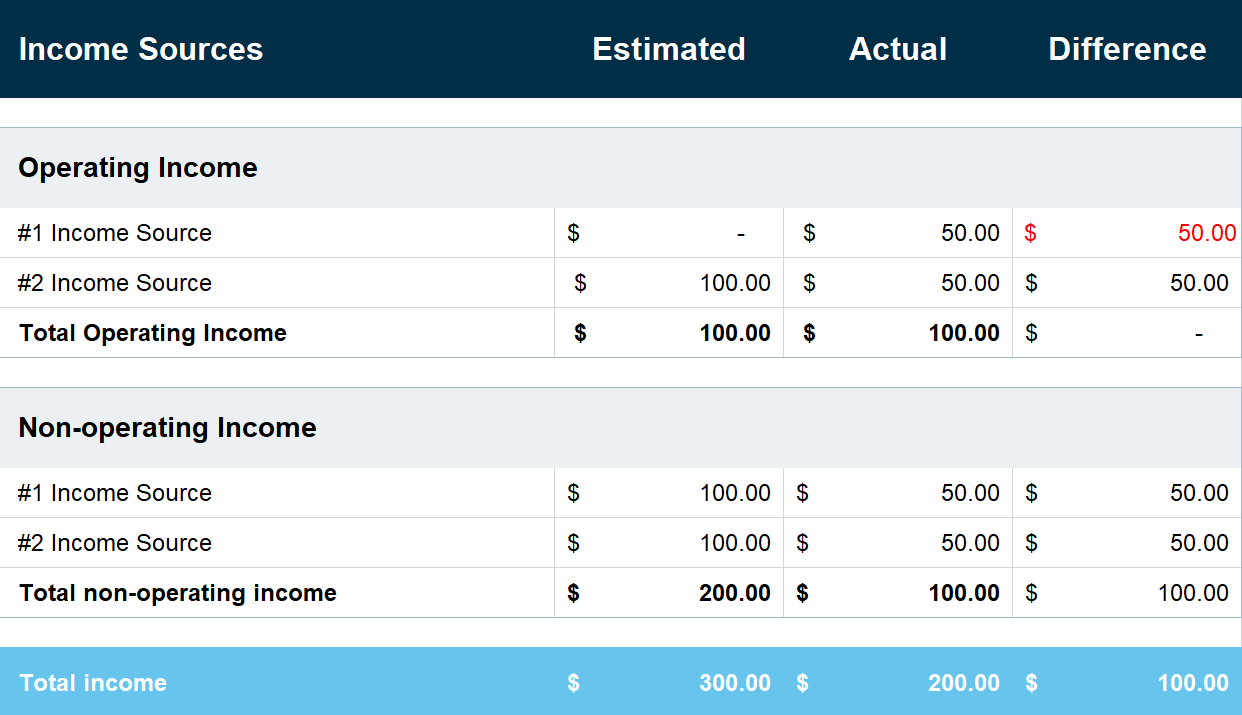

You’ll notice we’re using the terms revenue and income interchangeably here. That’s because revenue and total income have the same definition—the total cash inflow from your primary income-generating activity. Your income can be further broken down into two categories: operating income and non-operating income.

Operating income refers to your earnings before interest and taxes. Non-operating income includes any money you’re making from activities unrelated to your core business operations, such as interest or rent.

The bottom line? If you’re making money from it, include it in your income sources. Check out the image below for an example of what this looks like within our template:

Fields to input income information in our business budget template

Step 2: Subtract fixed and variable costs from your income

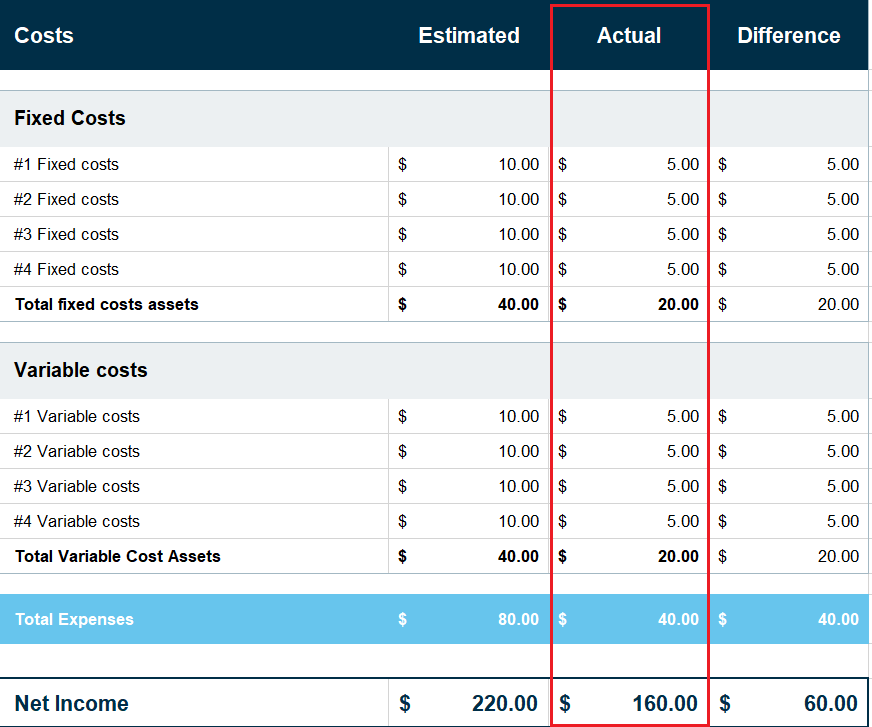

Once you’ve taken inventory of your income, you can subtract fixed costs. Fixed costs include annual or monthly expenses such as rent, insurance, membership fees, subscriptions, or anything else that you pay the same amount for on a recurring basis. Planned expenses are easy to predict because they’re consistent.

Variable costs, however, are a different story. These include expenses such as utilities, marketing, materials, payroll, and travel, and their cost may fluctuate from month to month. To estimate their total for your budget, you can refer to old receipts and invoices.

Note: Speaking of travel, or any other expenses incurred by individual employees, it can help to have a business expense template to distribute so that you can factor those costs into your budget. We’ve included one in our free download for you to use.

Once you’ve identified all fixed and variable costs, subtract those from your income. You now have your net income.

Step 3: Input actual income and costs

You’ve estimated what you think you might make and spend—now it’s time to track the actual dollar amounts.

Fields to input actual income and costs highlighted in our business budget template

Here’s where you’ll revisit our business budget template on a monthly basis to track what you’ve actually spent on each line item you entered in step 2. You’ll do this to see if what you estimated reflects the actual expenses leaving your bank account.

Why is this step so important? Because it’s like holding a mirror up to your finances. Your intentions might be good when it comes to what you should be spending, but if you aren’t going to adjust this in practice, you won’t find much use in a budget. Which brings us to our fourth and final step: Use this information to make better decisions for your small business.

Step 4: Make better financial decisions for your small business

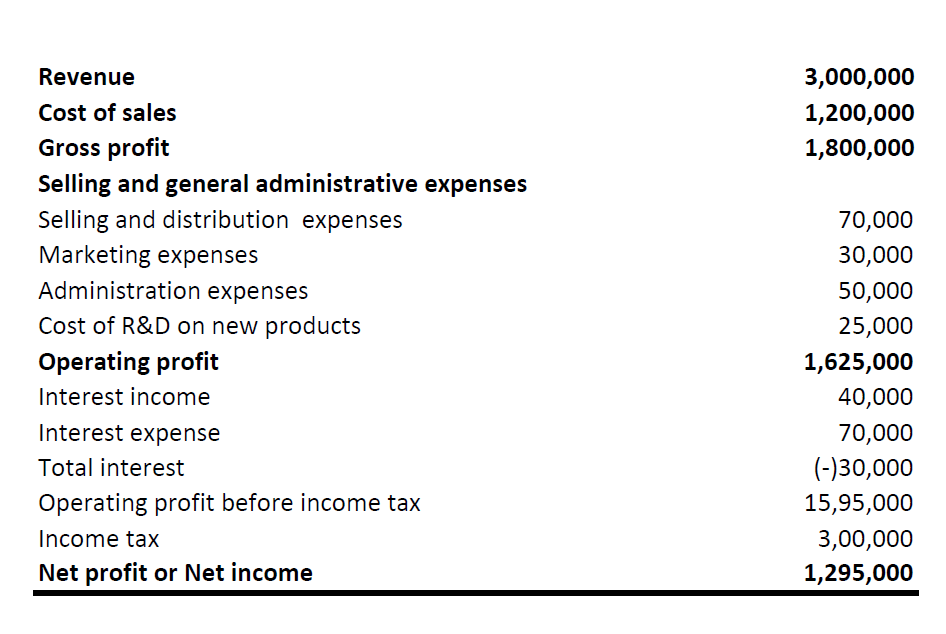

Now that we’ve discussed how to track your income, expenses, and actual costs, you can better understand your finances—and make better financial decisions for your small business—by creating an income statement.

As we mentioned earlier, your income or profit and loss (P&L) statement shows how much profit your business has made, or how much you’ve lost. It’s useful to have on hand as you create your business budget because it serves as your baseline. See below for an example.

An illustrative example of a simplified income statement (Source)

Once you complete steps 1 and 2 above to calculate your net income, you’ll have all the information you need to create an income statement. If your net income is positive, congratulations! Your business is profitable.

You’re losing money if your net income is negative, but don’t panic. Knowing is half the battle, and by facing your financial situation, you’re already on the road to better budgeting practices.

Capterra tools and tips

If numbers aren’t your forte, or if working with a Google Sheet rather than Excel is more your speed, we’ve got you covered. Here are some resources that can provide some extra help with budgeting:

Budgeting software can help you allocate, manage, and track annual budgets. It makes it easy to analyze financial data and predict expenses, and it eliminates errors associated with manual data entry and spreadsheet-based budgeting.

Bookkeeper software helps small and midsize business owners keep track of their financial data.

Google Sheets is a useful and accessible tool to keep track of your budget, and it’s easy to convert our template. Just go to your Google drive, select “New,” and select “File upload.” From there, you can upload our Excel spreadsheet and continue working in a Google Sheet instead.

Help us help you with your business budget

You’re one step closer to having a better handle on your business’s finances with these four steps.

While the steps we covered are a good place to start, they’re meant to serve as a foundation for your budget. Once you’re comfortable, you can factor in a safety net, or go through your costs to weed out nonessentials. Accounting software can help you manage transactions and provide a real-time analysis of your financial status, including cash flow and expense management.

If you’re ready to get your business’s finances in order, download our free template.