Running payroll internally can be a headache for small businesses. Luckily, software can help reduce payroll stress and make sure your employees and Uncle Sam get paid on time.

There is very little (if any) room for human error in payroll. Unpaid employees are disgruntled employees, and an unpaid Internal Revenue Service (IRS) can be downright scary.

While larger businesses may have an entire department dedicated to payroll services or outsource payroll responsibilities to a third party, small-business owners typically have fewer resources.

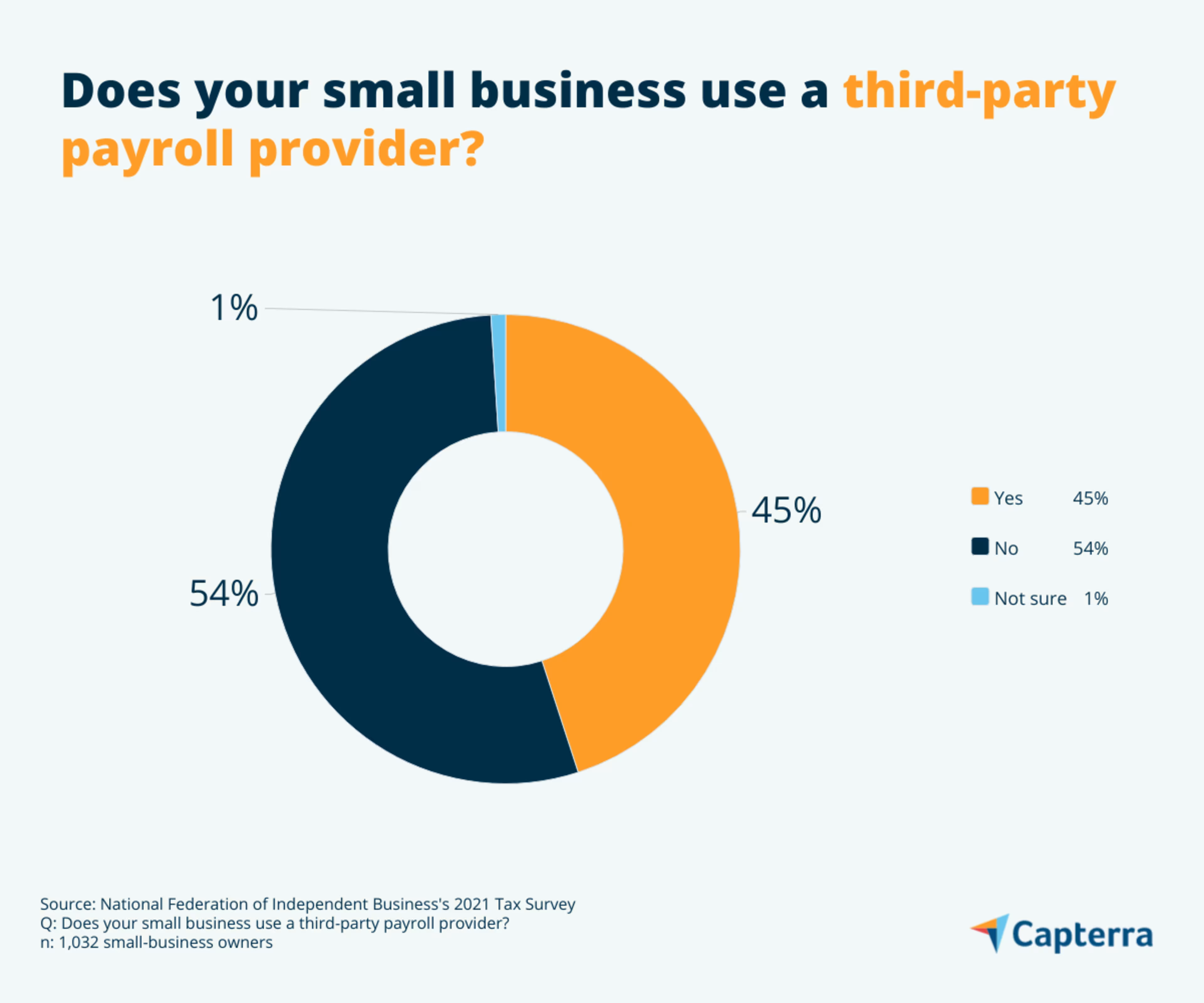

If you own a small business and don’t have the budget to outsource to a payroll service provider, you’re not alone. According to the National Federation of Independent Business’s 2021 Tax Survey[1], 54% of small businesses do not use a third-party payroll service provider.

While managing the payroll process internally is possible, it comes with its fair share of challenges. In this article, we will cover steps you should take when setting up payroll for your small business, how to mitigate common challenges, and how small-business payroll software can help reduce the most burdensome aspects of payroll processing.

3 steps to get payroll up and running smoothly at your small business

Payroll setup is ultimately a mix of personnel management and tax form navigation. Some parts of setting up payroll[2] might seem obvious, while others might not be as intuitive. Here are three basic steps to take to lay the groundwork for payroll management.

1. Get the right paperwork from your employees

A smooth payroll system depends on getting the right paperwork from your employees for tax preparation: Paperwork and payroll go hand-in-hand. To get the right paperwork from your employees, you first have to know what kind of employee they are.

This is where things can get tricky.

Challenge: Identifying your employees correctly to avoid misclassification.

When onboarding employees, it is important to know what kind of employee they will be. Will they be considered full-time employees or contracted employees? This matters because it will determine how you pay them and do your payroll taxes.

Sometimes, employee misclassification is done on purpose so the company can avoid paying for overtime or workers’ compensation. This can result in fines for your business.

More often, however, employee misclassification is an accident.

How to avoid it:

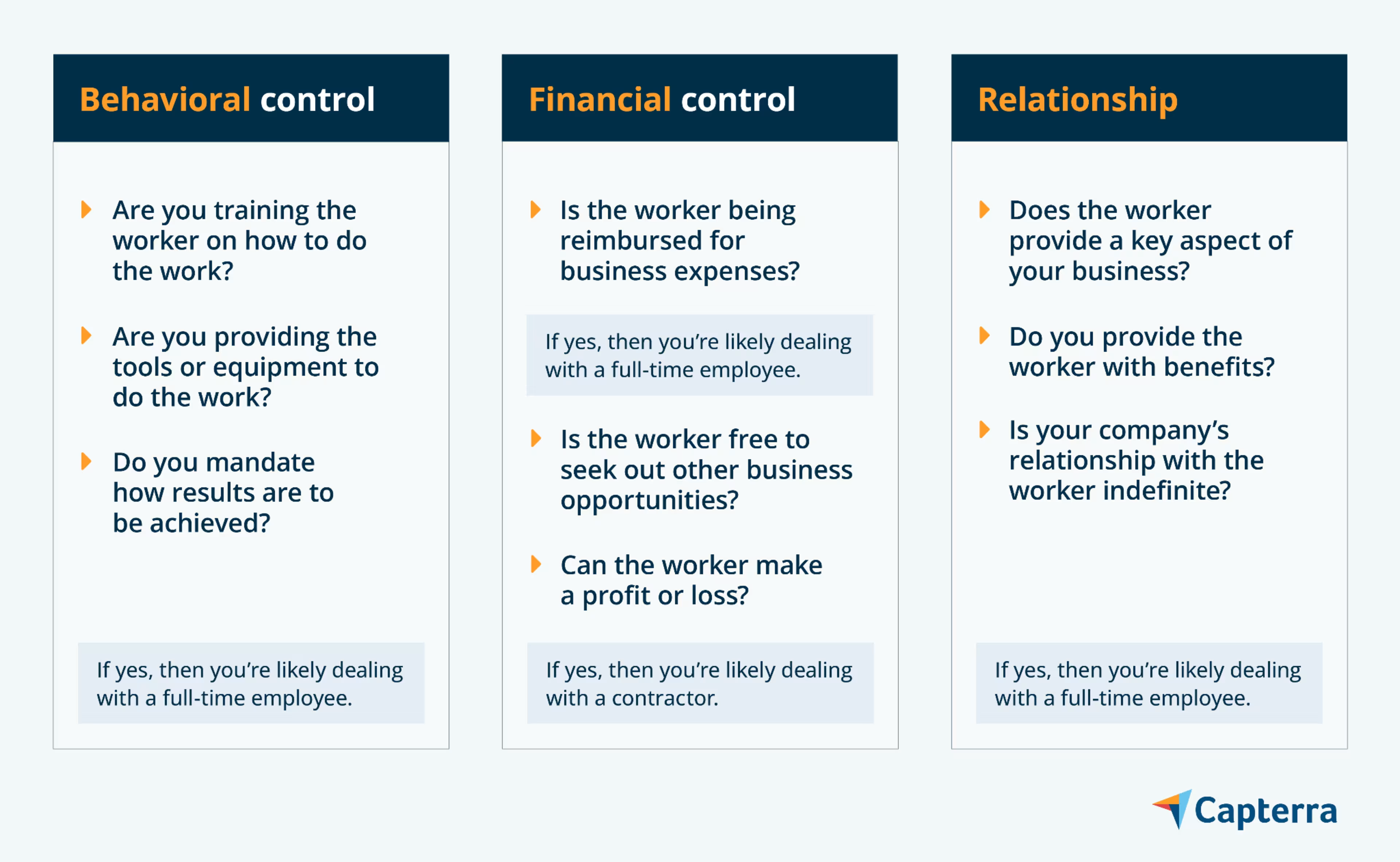

The IRS suggests asking yourself, “how much control as a business do I have over the worker?” As a general rule of thumb, more control over a worker means they are more a full employee than a contractor.

If you tell the person where and how to do their work, if you continue to retain them after a specific job is done, and if you give them benefits, you’re probably dealing with an employee and not a contractor.

If the person comes and goes based on the job, can do the work in any manner they see fit, and is responsible for their own benefits, then they are probably a contractor. If you’re still unsure, consult your legal counsel or submit Form SS-8 to the IRS to get their determination.

2. Document your pay policies

Consider talking with a lawyer or enlisting the help of a legal website to document pay agreements and policies.

As a small-business owner, everyone you hire should have a clear understanding of how much they’re being paid, when they’re being paid, how they’re being paid (e.g., direct deposit, cash, or check), and the employee benefits that come with the job. Like most legal documents, it is better to have documented pay policies and not need them than need them and not have them.

You should have a copy of this, along with details about employment terms, policies, and other human resource issues, signed and stored somewhere safe.

Challenge: Keeping documents protected and in compliance with data privacy laws

If you have a mix of employees, contractors, and employees from multiple states, you’ll have a lot of documents and forms to keep track of and store.

Since these documents contain sensitive and personal data (such as social security numbers), you’ll want to make sure they are stored safely—physical documents in a locked filing cabinet and digital documents in a secured software system.

This is important because you want employees to trust you with their information and also, it is the law. Failure to comply with the United States’ Fair and Accurate Credit Transactions Act (FACT Act)[3] and the Fair Credit Reporting Act (FCRA)[4] or the European Union’s GDPR can result in major penalties.

How to avoid it:

To keep digital files, policies, and your employees’ personal data safe, consider investing in document management software with features that are designed to keep documents secure and help you ensure compliance with data privacy laws relevant to your employees.

These features include centralized location for all departments to store data, reduce interdepartmental silos, automate repetitive tasks, and simplify document scanning, storage, retrieval, and archival processes.

3. Invest in software to help you manage the payroll process

Nothing will reduce employee morale faster than a late paycheck or two. Payroll software can help streamline the payroll process, minimize the possibility of error, safely store payroll records, and make paying payroll taxes way easier.

If you have a combination of full-time employees, contractors, and employees in multiple states, payroll software can help offload some of the stress by keeping records organized and secure and automating calculations and deposits. Of course, this depends on choosing the best payroll software for your business needs.

Challenge: Choosing payroll software

Having a streamlined payroll process can also give your business room to grow. In a payroll case study, VYRL, a startup, reported that investing in a payroll system allowed them to pay their employees and contractors faster, organize their documents, and gave them the ability to offer more competitive employee benefits packages. This ultimately helped them to start growing their business.

But shopping for a payroll system can be challenging with so many options out there. It can easily become overwhelming comparing different systems and features. You might think to yourself, “am I making the right decision?” and worry that you chose incorrectly.

How to avoid it:

When shopping for payroll software (or really, any type of software), make sure you always keep your original problem in mind to help you prioritize what features are important to you.

Some important features of payroll software to keep in mind include:

Direct deposit

Tax filing (payroll tax, Medicare tax, etc.)

Compliance management

Employee self-service (ESS)

Accounting and time-tracking integrations

Keep in mind that payroll software offers a range of features, from basic payroll functions to more complex. It never hurts to “try on” software by taking advantage of trial offers to make sure it is a good fit for your company and doing dry runs of the system before officially launching.

Offload the stress of payroll

Payroll can easily become overwhelming with all of its moving parts and high stakes. But having the right documentation from the beginning, a secure and organized document storage system for payroll records, and the right software for your business can make the process way easier.