Know the key accounting skills and competencies you need to thrive in today’s times.

Numerical prowess is critical to the accounting profession. But as technology makes entry-level tasks simpler and complex analysis easier, the combination of skills required from accountants is going beyond the basics.

Accountants of today need tech-savviness, along with business acumen and interpersonal skills, much more than their peers of the past.

If you’re an entry-level accountant looking to enhance future employability or an entrepreneur seeking to learn how to maintain your books and communicate financial performance to investors, you’ll benefit from understanding the most in-demand accounting skills in the present day. And if you’re planning to outsource accounting to a third party, you’ll know which exact skills to look for in the service provider.

In this article, we discuss nine of the most in-demand accounting skills—from basic to advanced. We also suggest some strategies to boost these skills, so you can kick-start your career and add value to your organization.

But first, let’s see what hiring managers value in accounting candidates these days.

Accounting skills companies seek in candidates

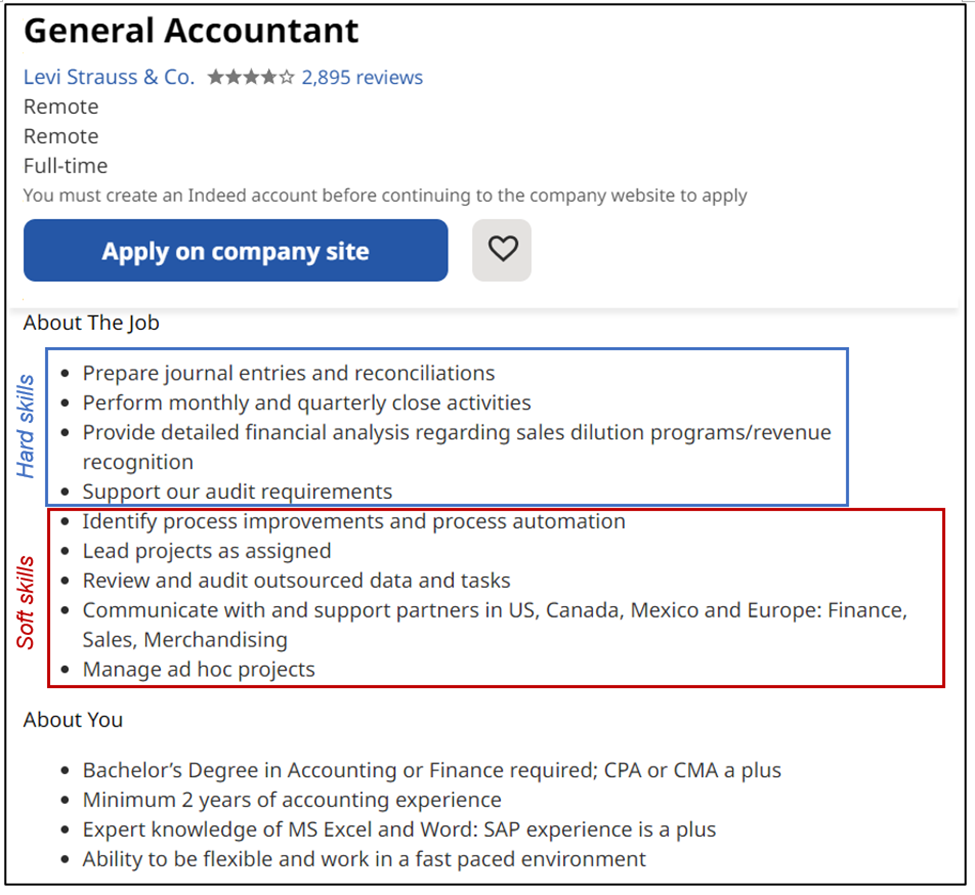

Here’s a job announcement for an accounting position at a popular retail brand.

Advertisement for a general accountant job (Source)

For starters, organizations value hard and soft skills equally today. As an accounting professional, you’re expected to not only be knowledgeable in financial concepts (see the blue box in the ad) but also have a high level of general business acumen to put the subject knowledge to work (see the red box). Additionally, working knowledge of accounting software is also desired in most accounting jobs.

Although the skills required could vary by job title, it’s a good idea to develop your soft skills along with technical expertise, as those can make all the difference in your career.

Here’s a comprehensive skill table that outlines the expertise accountants will always need.

Skills you need | What do the skills include? | Why do you need the skills? |

Hard skills | Knowledge of basic accounting principles (double-entry system and three golden rules of accounting) Ledger posting and trial balance preparation Financial statement preparation Proficiency in accounting software | To be well-versed in tasks that are critical for accounting To maintain proper records of everyday business transactions To stay compliant with regulatory standards |

Soft skills | Critical thinking Communication Leadership | To lead projects and manage teams To improve business processes |

Advanced skills | Analytical skills Digital skills | To apply statistical analysis to financial data To identify cash flow trends To automate accounting tasks |

1. Knowledge of accounting basics

Concepts such as the double-entry system and three golden accounting rules are the fundamentals of accounting. Without a foundation in these basics, you’ll find it difficult to practice as a bookkeeper or an accountant.

The double-entry system explains that every business transaction affects two accounts, which could be cash and liability, inventory and credit, or others depending on the nature of the transaction. For instance, let’s assume you borrow $15,000 from a bank. While you’ll make an entry in your cash account to record an increase of $15,000, your liability account will also increase by $15,000. This dual effect of a transaction is known as debit and credit in accounting. When one account gets debited, another has to be credited.

The three golden rules of accounting guide what gets credited and what gets debited in a transaction. For the uninitiated, it can be quite confusing to get this right initially. But the more time you spend practicing recording business transactions, the easier it’ll be to determine what to debit and credit in an accounting entry.

Here are the three golden rules of accounting for quick reference:

Debit the receiver, and credit the giver

Debit what comes in, and credit what goes out.

Debit expenses and losses, and credit income and gains.

Practicing is essential to develop a knack for basic accounting skills and internalizing them. The best way to practice is by creating journal entries. A journal is like a detailed personal diary that records all of your business’s transactions by date. The ability to make journal entries is a necessary skill for every bookkeeper and accountant. You can also refer to any school’s accounting curriculum for easy introduction to accounting and practice questions.

pro tip

As you practice recording information in a journal, we recommend using bookkeeping software, as most organizations use software programs to record data quickly and correctly. The software is intuitive in following the golden rules of accounting, as it learns from your historical entries to give auto-prompts about future entries.

2. Posting the ledger and preparing the trial balance

After business transactions are recorded in a journal, they are posted to a book that summarizes information from the journal and classifies it into separate accounts (called ledgers) such as cash account and liability account. Your efficiency as an accountant largely depends on how attentive and accurate you are in posting journal entries to ledger accounts.

At the end of every accounting period (monthly, quarterly, or yearly), accountants prepare a statement that lists the balances of all ledger accounts. This is called the trial balance. In accounting, it’s used as a barometer to check the accuracy of ledger posting, as the debit side should always match the credit side. If it doesn’t, it shows inaccuracy in journal entry and ledger posting. And it can be quite tedious to track the errors!

pro tip

Most accounting software tools offer a bank reconciliation feature, which matches cash records in your accounting book to the records of your bank account and flags any differences between these two sets of records. The software also helps in preparing the trial balance, spotting errors, and making modifications. Start with these free tools to practice your accounting skills.

3. Preparing financial statements

Basic bookkeeping ends and advanced accounting starts with the preparation of financial reports (also called financial statements), which show an overview of your company’s financial performance. How well were sales vis-a-vis costs? How much profit did your business make? Financial statements can answer many such similar questions.

The ability to close the books and prepare financial statements is a vital activity for an accountant. Balance sheet, income statement (also called profit and loss statement), and cash flow statement are the primary financial statements you should be able to create. They are interlinked with each other, and you should be able to articulate the correlation between them.

A key aspect of preparing financial statements is following the accounting and reporting standards that apply to your industry or geography and as demanded by regulatory authorities. Financial reports that abide with accounting standards ensure regulatory compliance as well as make comparing financial positions simpler. Two commonly used accounting principles are the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

pro tip

Use financial reporting software to put together financial statements that follow accounting principles and regulatory standards. The software automatically generates financial statements from the trial balance and leaves accountants with more time to analyze the statements and offer valuable insights as business advisors.

4. Proficiency in using accounting software

From recording information on floppy disks to maintaining records online on cloud-based accounting tools, the accounting profession has come a long way in using technology. Knowing how to use software has become a fundamentally essential skill in the field of accounting.

So, which accounting software is most in demand?

A smart choice is to learn the ins and outs of spreadsheets and a few common types of accounting software. Small businesses usually rely on standalone accounting software, while midsize and large firms opt for enterprise resource management (ERP) systems. Accounting is at the core of most ERP systems used by businesses to manage key operations such as sales, inventory, and customer relationships and thus the overlap between them.

pro tip

Gain expertise in using spreadsheets. As you learn to work through spreadsheets, focus on learning basic functions such as sum, average, if, and match; creating pivot tables; preparing charts; analyzing data; and presenting information to decision-makers.

5. Critical thinking

Critical thinking is the ability to have a deeper understanding of an issue and its underlying causes. It epitomizes the concept popularized by President Reagan—i.e., “Trust but verify.”

A healthy dose of skepticism about numbers can turn a good accountant into an excellent one.

It develops business acumen like nothing else. To cultivate this skill, develop a habit of asking pointed questions and finding alternative (and better) ways of doing things.

6. Communication

The art of communicating clearly and effectively is a highly sought skill in all professionals. But it’s even more vital in the profession of numbers. Accountants with good communication skills excel in storytelling and de-jargonizing the scary-looking accounting principles for non-accounting stakeholders.

A few ways to be a good communicator are to reduce the usage of jargon, speak succinctly, and actively listen to others.

7. Leadership

The ability to lead projects and manage teams becomes critical as one climbs the professional ladder. Leadership is about being adept at bringing people together, showing time and project management skills, and emerging as a problem-solver.

To gauge your leadership skills, assess how well you adapt to changes, inspire those around you, and innovate business processes. For finance managers, accounting practice management software is a project management tool designed to streamline communication and collaboration within accounting teams, especially if you are supporting remote work.

8. Analytical skills

Accounting in practice often ceases at the preparation of financial statements. Most organizations make financial reports to comply with regulatory standards, but if used properly, financial statements reveal a lot about a company.

With software there to cover the essential aspects of preparing financial reports, accountants are expected to use their time to analyze financial data and uncover insights and business trends.

Small accounting firms usually leverage budgeting software for this purpose, which is used for making sales and cost forecasts for the year ahead. Many midsize firms also use business intelligence software to integrate data from finance and other business units such as HR.

Get well-acquainted with analytical skills to become a future-ready accountant who can also function as a strategic partner offering intelligent insights to business leaders.

Further reading: How Data Analytics Is Changing the Way Accountants Work

9. Digital skills

Digital skills are the newest addition to the list of required accounting skills, and their demand has increased due to the prevalence of remote work. Note that the accounting job advertisement mentioned above is also a remote position.

Accountants today are expected to combine subject expertise, business knowledge, and technical expertise to determine where and how to best implement technology. As the finance domain gets digitalized, leaders need accountants who can break down manual processes into tasks that can be automated using technology.

Increased investment in financial technology to support remote work and digital business transformation is driving the need for digital skills among finance leaders, as per Gartner research (full report available for Gartner clients).

Thinking about hiring an accounting firm for your business needs? Browse our list of top accounting firms and learn more about their features in our hiring guide.

Tips to improve your accounting skills

The basic skill development box in accounting is usually ticked with formal education, say a college degree in finance or a related discipline. That said, anyone can develop good accounting skills and instincts through self-study, bookkeeping practice, and a little support from accounting software.

Here’s what you can do to take your skills in accounting a notch above:

Earn a certification to refine your hard skills. Hard skills such as creating journal entries and financial reports are clear, defined, and measurable qualities. Studying for a well-recognized certification, such as the Certified Public Accountant (CPA), will help you develop a baseline understanding of accounting, refine your hard skills, and bag high-level accounting jobs by asserting your competence.

Get trained on the job. If you know the basics of accounting, learn the ropes of the trade by taking up a job. Accounting, like any other profession, is a lot about practice. Take help from seniors to hone your concepts. Many organizations also provide skill development opportunities for entry-level bookkeeping professionals and accountants.

Demystify technology trends by getting familiar with them. Attend workshops, latest seminars, and other industry courses to stay current and develop digital competency in accounting. Follow industry leaders, talk to experts, and develop a self-education plan to know what aspects in accounting are and aren’t ready for automation.

Check out more Capterra blogs on finance and accounting to understand the key technologies and concepts you need, to ace the digital transformation of your accounting business.