Bookkeeping software helps accounting teams manage company finances.

As a small business owner or an accounting manager at a small business, do you often get bombarded with invoices and financial paperwork that you are just not able to handle? Maybe your team is short-staffed or the work volume is simply too much to manage.

If such challenges seem familiar, it's time to invest in bookkeeping software. A bookkeeping solution automates the process of tracking and organizing your invoices and financial data. It improves data accuracy for your small business; simplifies routine tasks such as matching invoices with the right customers; and generates reports to analyze income statements, balance sheets, and the overall cash flow.

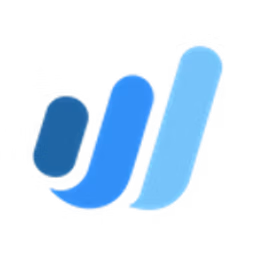

To help you make the right software choice, we’ve listed the five best bookkeeping software based on two parameters: user ratings and popularity. Each parameter is weighed and scaled to a value between 1 and 50.

User ratings: This parameter considers the overall user ratings of products based on reviews written in the last 24 months. Users rate products on a scale of 1 (lowest) to 5 (highest).

Popularity: This parameter considers the average monthly search volume for a standardized set of keywords for each product, as derived by a proprietary search methodology, as well as the position of the vendor’s domain on the search engine results page (SERP) for each keyword. It’s a measure of user interest and relevance used as a proxy for popularity.

Note: Products are listed in descending order of their total scores—i.e., summation of user ratings and popularity scores. If two or more products have the same score, they are listed alphabetically. (Read how we selected these products.)

1. Xero: Integrates with bank accounts to track finances

User rating: 48/50

Popularity score: 50/50

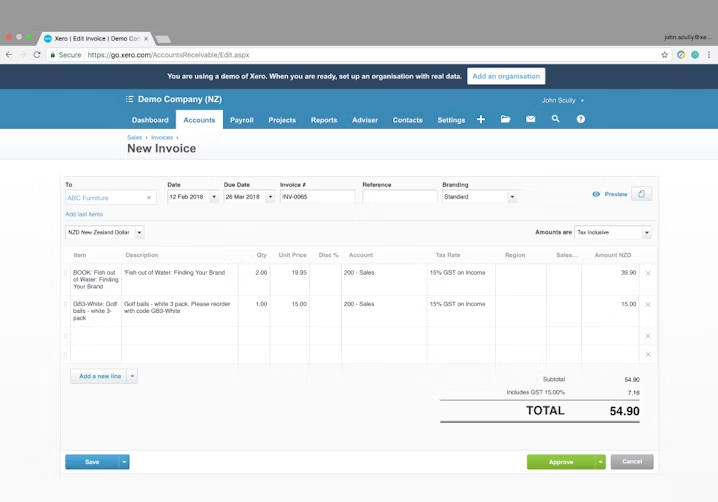

Xero is an accounting software solution for small businesses and startups.

It helps you maintain a general ledger, track accounts payable and cash flow, capture costs to submit and reimburse expense claims, accept payments, and manage unlimited invoices.

You can connect your bank account with Xero and set up bank feeds and expense tracking to track every business transaction and keep your finances up to date. The software also lets you create quotes for projects and send them to your clients.

With accounting reports, you can present financial data to stakeholders, track the taxes you paid in a fiscal year, and create drill-down reports that measure specific KPIs for your small business.

Xero offers chat and email support. It is a web-based tool and also has a mobile app for Android and iOS devices.

Key Features

- 401(k) tracking

- Accounts receivable

- Accrual accounting

- ACH payment processing

- Approval workflow

- Asset accounting

Trial/Free Version

- Free Trial

- Free Version

Starting price

Device compatibility

Screenshots

Invoicing in Xero

2. Wave Accounting: Provides expense categorization

User rating: 48/50

Popularity score: 47/50

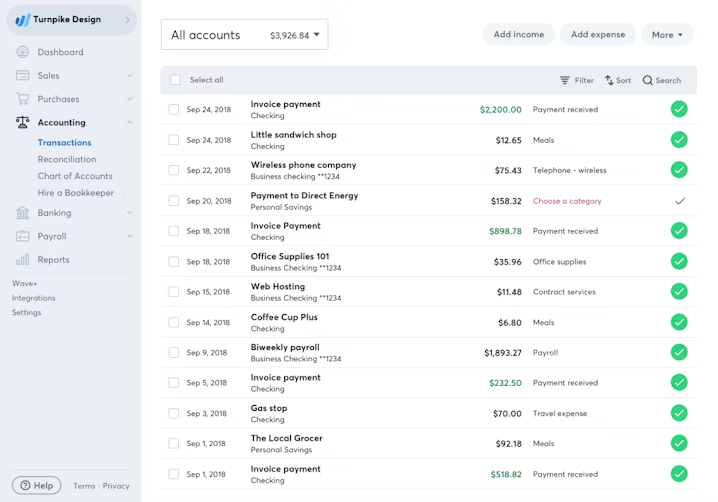

Wave Accounting is a money management and accounting tool for small business owners.

It lets you create and send invoices to your clients and set up recurring invoices and automatic credit card payments for repeat customers. It also automatically stores the invoice and payment details of each transaction you make.

You can view the payment history for new and long-standing customers and send personalized customer communication based on the payment status. You can use the built-in bookkeeping and expense tracking feature to track different income sources. You can also categorize expenses into different accounts to identify how much you’re spending on each expense account.

Wave accounting offers chat and email support. It is a web-based tool and also has a mobile app for Android and iOS devices.

Key Features

- Accounts payable

- Accounts receivable

- Bank reconciliation

- Billing and invoicing

- Cash management

- Expense tracking

Trial/Free Version

- Free Trial

- Free Version

Starting price

Device compatibility

Screenshots

Managing transactions in Wave Accounting

3. QuickBooks Desktop Enterprise: Offers financial budgeting and forecasting

User rating: 49/50

Popularity score: 34/50

QuickBooks Desktop Enterprise is desktop-based business accounting software for small firms.

It lets you simultaneously reclassify multiple transactions, fix incorrectly recorded sales tax payments, and clear undeposited fund accounts. It also stores your clients’ information, such as their bank account data, and assigns a unique customer ID to every client.

You can create custom financial reports with the sales information categorized under class, customer, item, or date. With built-in budgeting and forecasting, you can revise existing budgets and use profit and loss data to create a budget plan for the next year.

QuickBooks Desktop Enterprise offers chat, email, and phone support. It is a web-based tool and also has a desktop application for Windows and Linux.

Key Features

- Access control/permissions

- Accounting

- Activity dashboard

- Approval process control

- Backorder management

- Bid management

Trial/Free Version

- Free Trial

- Free Version

Starting price

Device compatibility

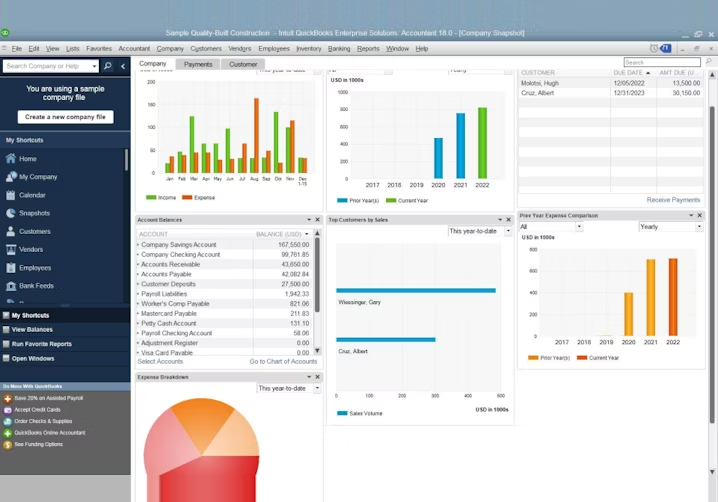

Screenshots

Reporting dashboard in QuickBooks Desktop Enterprise

4. Veryfi Receipts OCR & Expenses: Automatically captures data from receipts

User rating: 50/50

Popularity score: 29/50

Veryfi Receipts OCR & Expenses is a small business accounting and bookkeeping tool.

It helps automate routine bookkeeping tasks such as data entry, expense tracking, invoice categorization, inventory tracking, and bank reconciliation. It offers a built-in OCR and machine learning engine that reads unstructured receipts and invoices for customer details, such as account numbers and addresses, and turns them into structured data.

The software also offers an AI-based turnkey data extractor that captures data such as the vendor name, invoice date, line items, tax line breakdowns, and bank information from receipts in real time. This feature eliminates data entry burdens for your accounting team and helps process payments faster.

Veryfi offers chat, email, and phone support. It is a web-based tool and also has a mobile app for Android and iOS devices.

Key Features

- Accounts payable

- Activity tracking

- Bank reconciliation

- Budgeting/forecasting

- Cost estimation

- Expense tracking

Trial/Free Version

- Free Trial

- Free Version

Starting price

Device compatibility

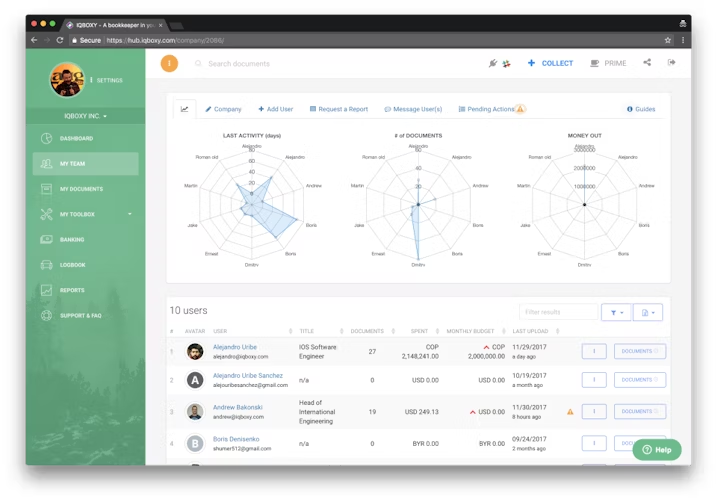

Screenshots

Team management in Veryfi

5. Sage Business Cloud Accounting: Tracks due dates for renewals

User rating: 47/50

Popularity score: 21/50

Sage Business Cloud Accounting is an accounting solution for small businesses.

It automates account receivable functions such as creating and sending invoices and recording and tracking payments. It tracks how much money your customers owe to you. If your services are subscription-based, the software also tracks due dates for renewals.

The software can connect with your bank account and automatically create a bank feed that tracks every account transaction. It also matches the transaction data to your invoices, payment receipts, and purchases.

You can create financial reports showcasing your small business’s performance, specifically profit and loss data, sales figures, and opening and closing balances. You can also share these reports with your teammates or other stakeholders.

Sage Accounting offers chat, email, and phone support. It is a web-based tool and also has a mobile app for Android and iOS devices.

Key Features

- Accounts payable

- ACH payment processing

- Bank reconciliation

- Cash management

- Check processing

- Fixed asset management

Trial/Free Version

- Free Trial

- Free Version

Starting price

Device compatibility

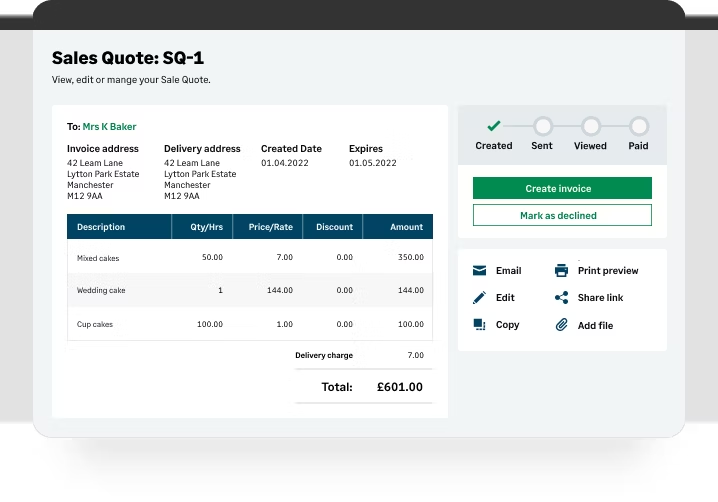

Screenshots

Sales quotes in Sage Business Cloud Accounting

How to choose the best bookkeeping software for your business

Here are some considerations to keep in mind when choosing bookkeeping software for your accounting firm:

Check whether the software creates easy-to-read and shareable reports. An ideal bookkeeping solution should let you create intuitive reports that showcase profit and loss data, working capital, cash flow, etc. You should also be able to share the reports with your team and clients. Ensure your shortlisted accounting solution has this functionality and doesn't make report creation too complicated.

Analyze how secure the software is. Accounting teams work with sensitive data, and the bookkeeping software you pick should be able to safeguard the financial records and client data it stores. Ask vendors whether their small business accounting software has features such as two-factor authorization and SSL encryption to ensure data protection.

Assess whether the software caters to small businesses. Some solutions are built keeping enterprise businesses in mind, while others are built solely for small businesses. When shortlisting bookkeeping software options, check for reviews from your industry and look at a solution's existing customer base to identify your best fit.

Searching for an accounting firm to hire for your business? We’ve got you covered. Check out our list of companies in the following areas:

Common questions to ask vendors when choosing bookkeeping software

As a small business owner, you should ask vendors the following questions when evaluating bookkeeping tools:

Does your software integrate with third-party applications?

The accounting tool you select should work well with your existing software systems, such as customer relationship management (CRM), payment processing, and eCommerce.

Does your software align with my firm's accounting method?

Your accounting team might use the cash-based accounting or accrual-based accounting method. The shortlisted software should seamlessly align with your accounting method to simplify the task of tracking and organizing financial records.

What kind of staff training and customer support do you provide?

Bookkeeping software shouldn't be too complicated to use. The software you buy should come with training and product support to ease your team into using the new tool. Also, check what kind of customer support the vendor offers.

How did we choose these products? We didn’t—you did

To find your ideal software match, you need information you can trust—so you can save time, stay on budget, and focus more energy on growing your business. It’s why we vet and verify all our user reviews and recommend only the tools endorsed by people like you.

In other words, our product recommendations are never bought or sold, or based on the opinion of a single individual—they’re chosen by your peers, reflecting the views and experiences of our independent base of software reviewers.