If you're a small business accountant—or a small business leader forced into moonlighting as an accountant to keep your employees paid and the heat running—you've probably heard of Wave.

Launched in Toronto in 2009, Wave has become a go-to free accounting app for small businesses, with more than 3.5 million users.

If you're a small business leader just starting out, there's a good chance Wave will make your shortlist of accounting tools to consider, and with good reason. The company has been in business for almost a decade and generates overwhelmingly positive reviews for its easy interface.

Reimagining Wave (Source)

You also don't have to determine how it will fit into your operating budget, because it's free. Wave has truly carved itself a niche in the marketplace by offering its product—a fairly robust small business accounting tool—for free, making it a great option for freelancers, solopreneurs, and very small teams.

Of course, Wave has to make money somehow to stay in business. Initially, the cloud-based app included advertisements, but they discontinued those about two years ago. Now, Wave gets transaction-based revenue from two integrated apps: Payments by Wave and Payroll by Wave.

By the time your new business has grown to the point that you need to accept payments and run payroll, you'll need to find room in the budget for those features in Wave or an alternative way. But there's an even more important reason to consider Wave alternatives when creating a software shortlist: Wave lacks an audit trail, which could leave your business vulnerable to fraud.

In this article, we'll look at several Wave alternatives that, while not free, offer an audit history to better protect your growing business from fraud.

Why you should consider Wave alternatives

As of now, Wave's workaround for a lack of audit history is to allow users to add notes to transactions manually when they make changes. But this does nothing to prevent fraud. If a larcenous employee wanted to go into Wave and work the numbers to hide embezzlement, they could just do so without leaving a note, and there would be nothing to stop them.

The Hiscox Embezzlement Study found that SMBs, which are particularly vulnerable because of a lack of resources to devote to fraud prevention, represent almost 70% of embezzlement cases, and the average embezzlement case costs businesses more than $350,000.

In other words, you can't afford to use an accounting solution that doesn't protect you against fraud.

Another criticism that users have reported is that Wave accounting can be slow at times. Accuracy is much more important than speed in small business accounting, but it is a factor when you're waiting for an earnings report to load at 8 p.m. and you still haven't had dinner and just want to get home to your family.

Budget-friendly Wave alternatives with audit trail

With those factors in mind, I went looking for a handful of easy-to-use accounting tools that, like Wave, are cloud-based (so you have access to your accounting information at the office, in the field, and at home) and include strong mobile-app support.

Unlike Wave, these tools will cost you a monthly fee. But remember, Wave is a unicorn in the industry. And these tools will offer you valuable features that Wave doesn't in its free package.

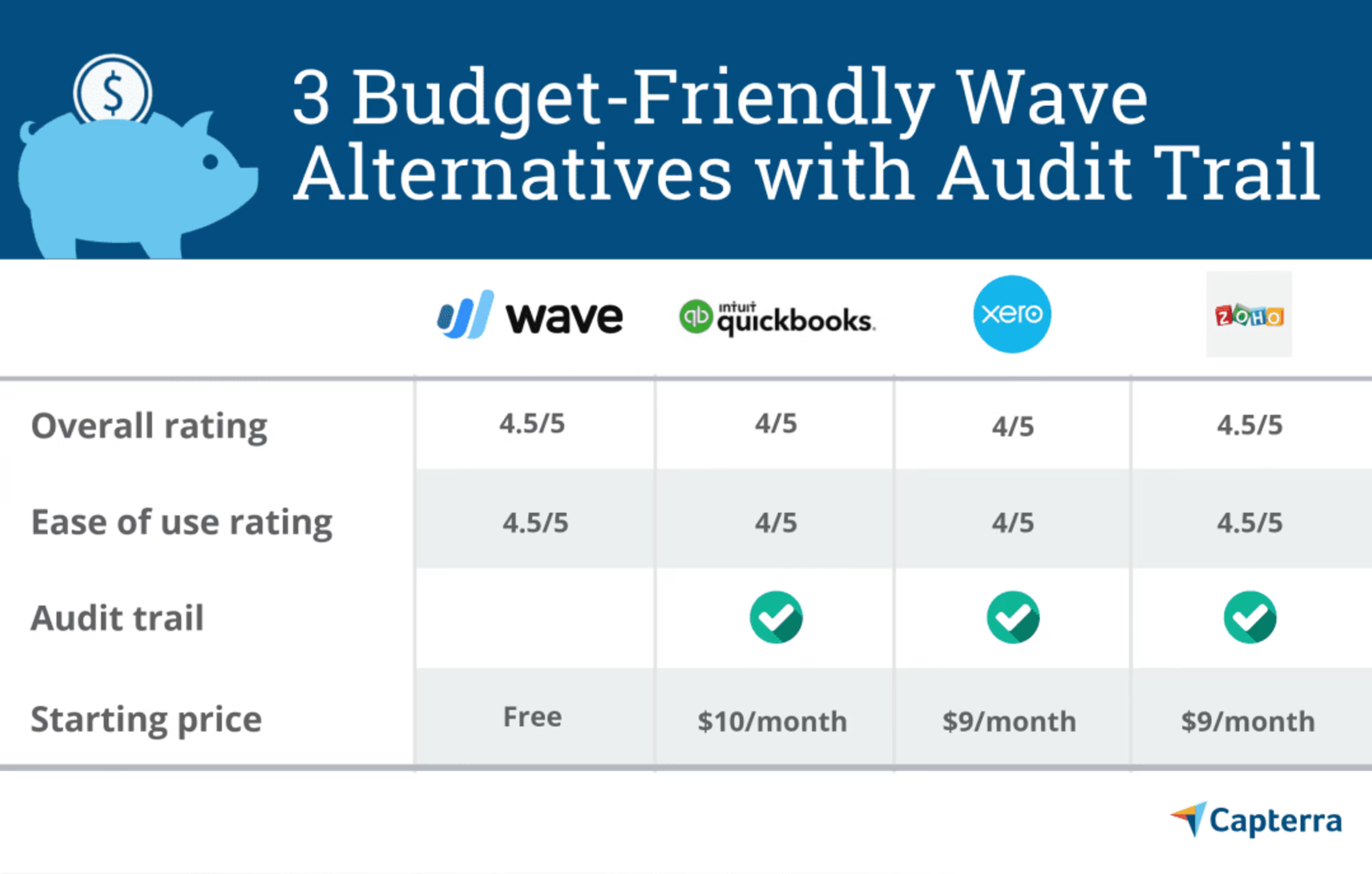

To meet small business accounting needs as closely as possible, as well as addressing the most important features that Wave lacks, I picked alternatives based on the following criteria:

Tools that start at $10 or less per month, since budget is a factor if you're considering Wave, a free tool.

Tools that include an audit trail feature to prevent fraud by allowing you and your accountants to monitor all of your company's financial transactions.

Tools that have an overall and ease of use rating of at least 4/5 based on 200 or more user reviews in Capterra's accounting software directory.

Here are the products I found that meet that criteria, listed in alphabetical order.

1. QuickBooks Online: The industry standard that grows with your business

QuickBooks Online overview (Source)

Overall rating: 4/5Ease of use rating: 4/5Reviews: 2,480+

If you haven't heard of QuickBooks, you're in for a treat. QuickBooks is essentially to small business accounting software what Coca-Cola is to soft drinks and Kleenex is to facial tissue.

One of the biggest advantages to using QuickBooks Online is you're getting a tool that has been refined over decades (Intuit has been operating out of California since 1983), has a user-support community of millions of other small business leaders, and integrates with hundreds of other apps.

So does QuickBooks Online have audit trail? You bet it does.

Pros

Industry standard accounting solution

Hundreds of integrations to adapt to your system

Includes every accounting feature a small business could possibly need

Cons

Price can escalate quickly as your business grows.

Multitude of features and integrations might be overwhelming for very small businesses.

Monthly price doubles after three months.

Simple Start: $10 per month ($20 per month after three months) for one user.

Essentials: $17 per month ($35 per month after three months) for three users. Adds bill management and time tracking.

Plus: $30 per month ($60 per month after three months) for 5+ users. Adds project management, inventory, and more.

Payroll starts at $18 per month ($35 per month after three months) plus $4 per employee, per month on all plans.

2. Xero: A relative newcomer that's rapidly gaining traction

Introduction to Xero (Source)

Overall rating: 4/5Ease of use rating: 4/5Reviews: 1,440+

If there's a Pepsi to QuickBooks Online's Coca-Cola, it's got to be Xero.

A relative newcomer, Xero was launched in New Zealand in 2006 and has been growing rapidly over the past decade, expanding from 50,000 customers to more than a million in 180 countries between 2011 and 2016.

It has all the standard accounting features, more than 700 integrations, and even its own conference—Xerocon—to rival QuickBooks Connect.

For audit history, Xero has you covered with an Assurance Dashboard that monitors errors and any suspicious activity all in one place.

Pros

Users have found setting up and getting started in Xero to be a cinch.

The interface has been lauded by reviewers as one of the sleekest and most user-friendly in the market.

The software is extremely customizable with more than 700 integrations.

Cons

While the community support is strong, Xero does not offer phone support in any capacity.

The starter plan is limited to only five invoices, five bills, and 20 bank transactions per month.

Pricing more than triples once you grow out of the starter plan.

Early: $9 per month for five invoices, five bills, and 20 bank transactions.

Growing: $30 per month for unlimited invoices, bills, and bank transactions.

Established: $60 per month adds multi-currency, expense management, and management.

Full service payroll through Gusto starts at $39 per month, plus $6 per employee, per month.

3. Zoho Books: Great value for less than $10

Introduction to Zoho Books (Source)

Overall rating: 4.5/5Ease of use rating: 4.5/5Reviews: 300+

California-based Zoho has been in business for more than 20 years and offers a full suite of cloud-based business software products, from CRM to project management.

Zoho Books, their accounting solution, offers the full range of accounting features, from expense management to invoicing, and it's targeted at SMBs, with a $9/month starting price.

More importantly, Zoho Books keeps complete audit trails for every transaction.

Pros

Simple, clutter-free interface

Less than $10 per month.

Users praise Zoho Books' customer support

Cons

Payroll requires a separate app

Most useful when integrated with Zoho CRM

Lacks a budgeting module

Basic plan: $9 per month or $90 per year for 50 contacts and two users.

Standard plan: $19 per month or $19 per year for 500 contacts and three users. Adds recurring bills and other features.

Professional plan: $29 per month or $290 per year for unlimited contacts and ten users. Adds custom domain, inventory, and other features.

The road to small business accounting success

Whether you settle on Wave after all, or one of these alternatives with an audit trail, you're off to a great start because you're not just winging it with a spreadsheet or piles of coffee-stained receipts and notebooks.

The good news about the alternatives listed above is that you really can't go wrong with any of them, or Wave for that matter. You just need to determine how important an audit trail is to your small business, and which features in the paid options your business can't do without.

Hopefully this guide has given you a clearer picture of what the different options offer, and what you would have to function without in the Wave free version.

Have you used Wave or any of these alternatives? If so, let me know what you think in the comments, or hit me up at @AndrewJosConrad.