We tested consumer sentiment toward cashless payments during the pandemic and asked if small businesses are ready for continued change.

Cashless payments have been gaining traction in the U.S. for years. A GetApp survey published last December found that 24% of small business leaders surveyed used Venmo to process customer payments. That same quarter, Mastercard shared that 30% of all global card purchases were contactless.

In early 2020, the COVID-19 pandemic transformed cashless payments from optional to essential. A New York Times article about flying during the pandemic cited a new and unusual risk for passengers: not being able to purchase food with cash. The article recommended that readers use contactless payment options or download tools like Apple Pay as businesses around the world banned cash, citing a risk of virus transmission.

Current public health guidelines say that this risk is low. Still, the decrease of in-store transactions, coupled with stay-at-home orders, seems to have spurred an inflection point for cashless.

What are cashless payments?

Cashless payments use digital tools to sell and pay for services in lieu of cash. If you’ve ever paid your rent via bank transfer, bought groceries using Apple Pay, or stored your ID in a digital wallet, you’ve used cashless payments.

Contactless payments are one type of cashless payments. They are credit cards that use near-field communication (NFC) or radio frequency identification (RFID) technology to let readers wave their cards near readers to make payments. This distinction is important since many use “cashless” and “contactless” interchangeably.

The state of cashless payments amidst COVID-19

In light of the COVID-19 outbreak, Capterra wondered how this pandemic changed North America sentiment toward cashless payments. Did COVID-19 increase consumer demand for cashless payments? If so, were small and midsize (SMB) business leaders prepared to meet that demand?

To find answers, we ran two surveys in late May 2020. The first survey asked consumers in North America for their preferences regarding payment options and how those options affect their likelihood to buy from businesses. The second asked North American business leaders with 500 or fewer employees if they offer cashless payments, and why (or not not).

Let's take a look at survey results, and compare sentiment between both groups. If consumers show widespread preference for cashless payments—especially amidst a public health crisis—SMB leaders like you should know. Even if you’re already using cashless payments, this pandemic offers new opportunities to set yourself apart.

Key findings:

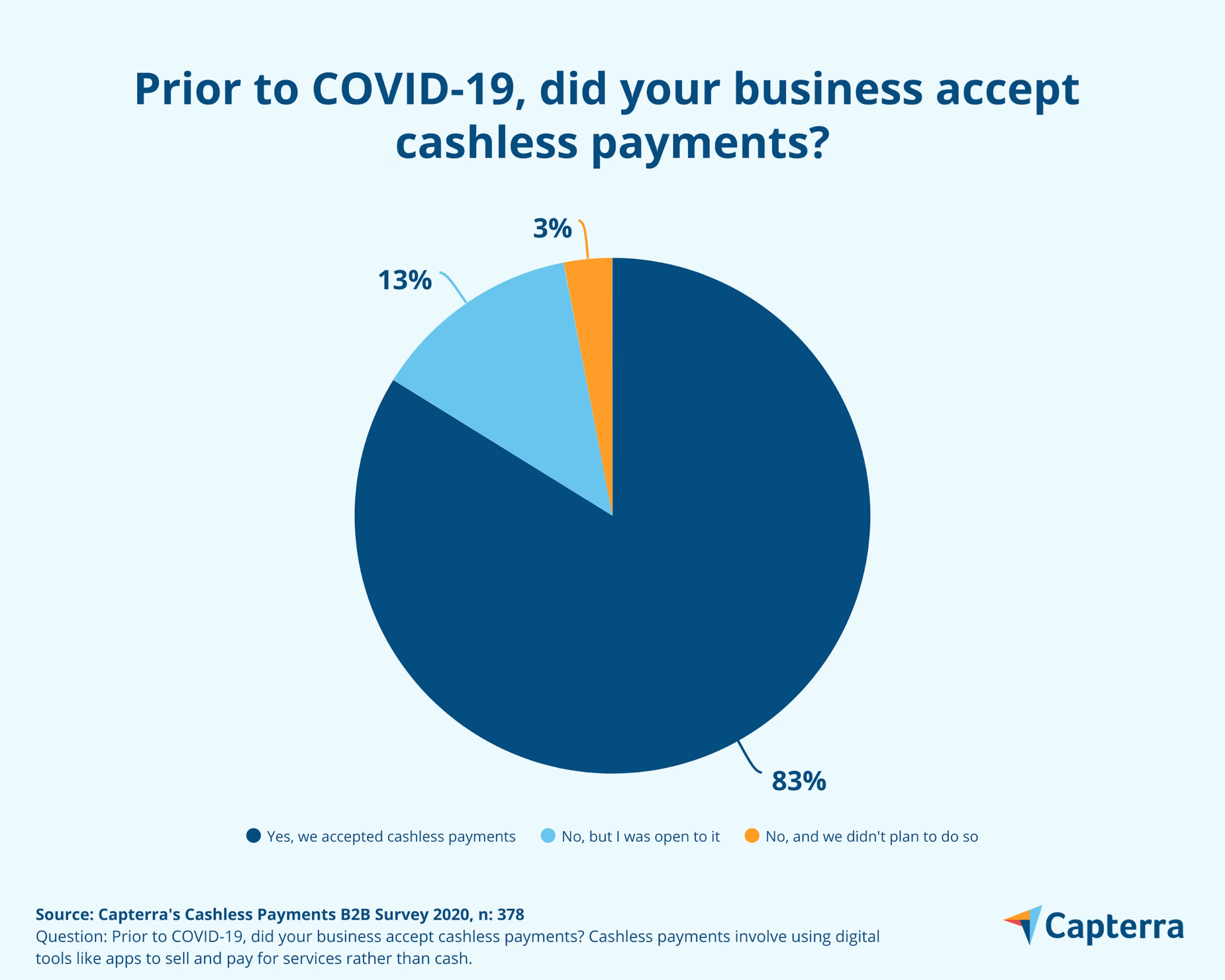

83% of North American small and midsize businesses (SMBs) accepted cashless payments pre-pandemic.

72% of consumers have paid for business services using cashless payments during the pandemic.

72% of consumers expect businesses to offer cashless payments as an option.

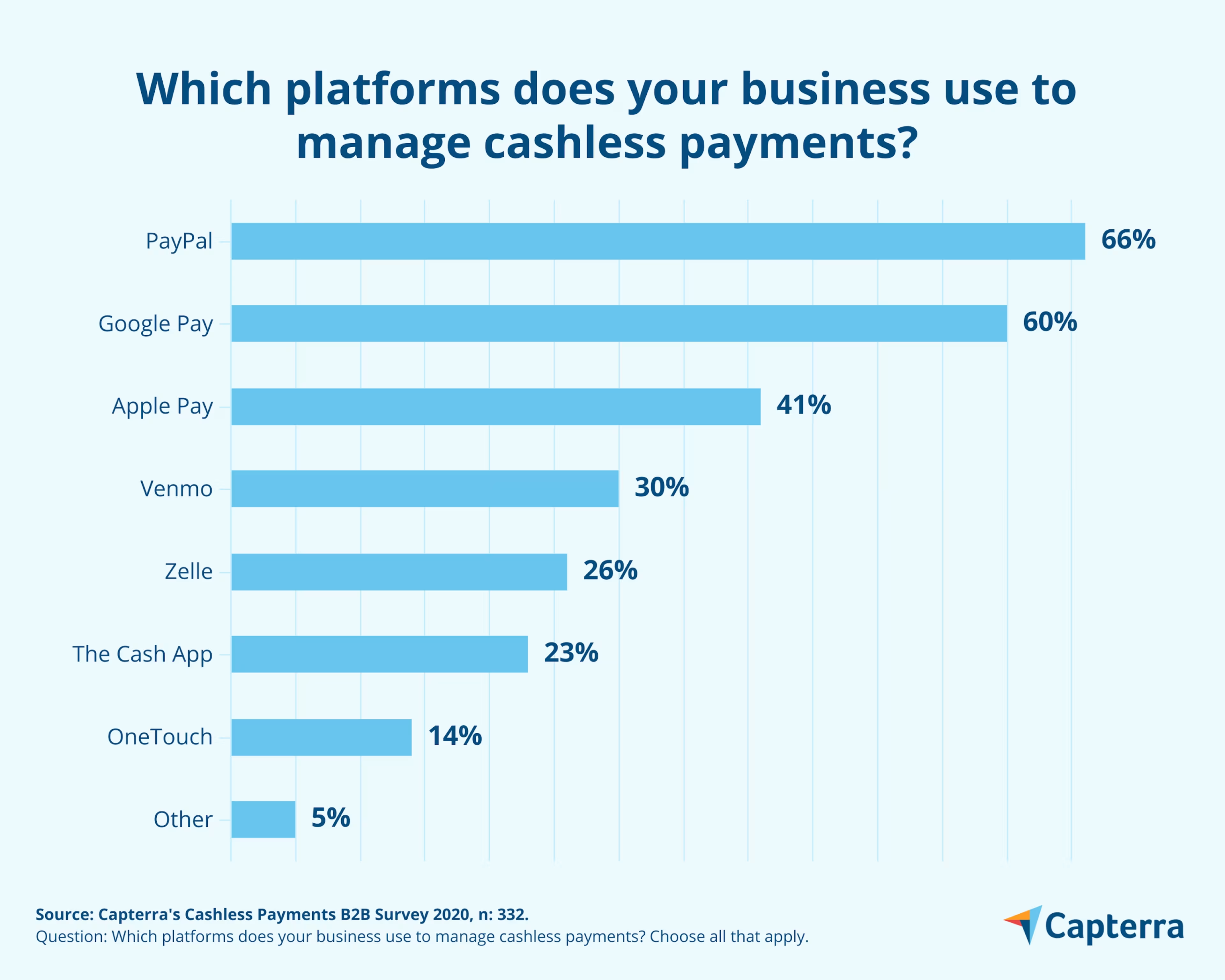

PayPal, Google Pay, and Apple Pay are the most popular cashless payment options.

Recommendation: North American SMBs are well-positioned to meet consumer demand for cashless payments. To survive the pandemic and thrive afterward, SMBs should budget for technologies that support contactless payments—a specific type of cashless payment that meets growing consumer demand for safety and hygiene.

Consumer sentiment toward cashless payments

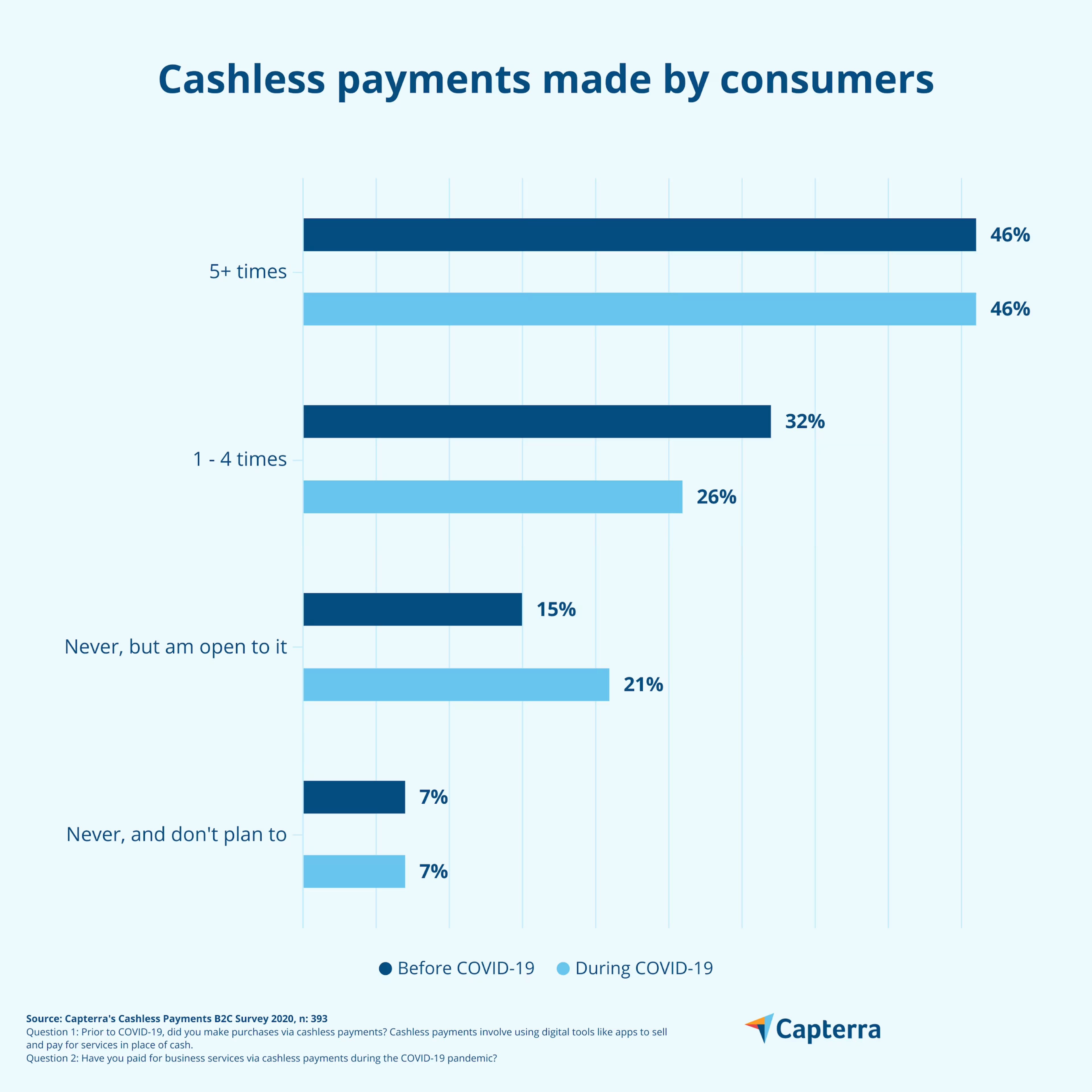

Consumer respondents were well acquainted with cashless payments before COVID-19 hit: Nearly half (46%) said they use cashless methods to buy services regularly, and a further one in three (32%) said they did so occasionally.

During stay-at-home orders that lasted between two and three months, North American consumers had fewer opportunities to use cash. Governments ordered non-essential businesses to close brick-and-mortar stores. If these businesses wanted to keep operating, they needed to sell using eCommerce platforms that accept cashless payments.

For essential businesses that stayed open, some brands such as Whole Foods Market chose to decrease the use of cash. Capterra’s research found that this confluence of events increased consumer openness toward cashless payments during the pandemic.

Capterra used two separate questions to ask consumers how often they used cashless payments before and during COVID-19. The most and least enthusiastic respondents did not change their spending preferences before or during the crisis, suggesting that the pandemic had no fundamental impact on those who felt strongly about cashless payments either way.

However, we noticed some changes in the middle. The number of respondents who used cashless payments on occasion decreased by six percentage points during the pandemic. Conversely, the number of respondents who said they are open to using cashless payments increased by six percentage points.

Our data on consumer behavior during COVID-19 shows that 93% of respondents are at least open to using cashless payments, if not using them already. From paying fitness trainers for virtual sessions via Venmo to ordering takeout through the UberEats app, the current moment has made fundamental changes to the ways consumers pay for services.

Can North American SMBs meet consumer demand?

The vast majority of Capterra’s B2B survey respondents accepted cashless payments pre-COVID. In fact, SMB leaders were even more likely than consumers to have actively used cashless payments pre-pandemic.

It’s good news that businesses were ready to meet demand. According to our B2C survey, consumers hold businesses to a high standard when it comes to offering cashless payments: 72% told us they expect businesses to offer cashless as a choice.

That number aligns with the combined 72% of consumers who have paid for services using cashless payments regularly (46%) or on occasion (26%). So, if you’re a small business owner, you can anticipate approximately three in four customers to expect and use cashless payments.

Luckily, there are a variety of cashless options to choose from. And, far from being limited to one option, business leaders can use multiple.

PayPal is the cashless payment method of choice for most SMB leaders: Two in three use it. Google Pay came in second, with six in 10 respondents using it. Use of specific tools dropped drastically from there, with 41% of respondents using Apple Pay.

SMBs’ reliance on PayPal checks out. The first day of May 2020 saw the site’s most active day of transactions ever, eclipsing Black Friday and Cyber Monday last year. Marcy Campbell, PayPal’s vice president and general manager of North America and Australia, said she thinks the pandemic will turn several physical stores into “showrooms” that consumers visit before purchasing products online. She added that the most successful businesses will show consumers how they’re putting their health first, largely through tech that minimizes person-to-person contact.

Likewise, it’s good that six out of 10 SMBs use Google Pay. According to reports, Google plans to add merchant buttons that will allow users to sell products and services inside the app. This product update would let online and brick-and-mortar sellers accept customer payments without leaving Google Pay.

Google hasn’t shared its timeline yet, but these proposed features are already available for some users abroad. India’s version of Google Pay lets users order food, hail rides, and more within the app. The fact that Google shipped such features in global markets before the U.S. speaks to North America’s historical focus on cash.

Preparing your business for the post-pandemic world

Capterra’s research confirmed that North American SMBs are well-positioned to meet consumer demand for cashless payments. SMB leaders were more likely than consumers to use cashless payments pre-pandemic, and most leaders in our survey accept payments via several cashless options.

These conclusions are not as obvious as one might suspect; the U.S.still lags behind its global peers in cashless payment adoption.

As of last autumn, Sweden, China, and the UK led the world in cashless payment usage. Meanwhile, several U.S. states banned cashless commerce, and more than 70% of Americans used cash for at least some purchases. By contrast, only two percent of all Swedish transactions used cash.

It’s impossible to know the final outcome of the COVID-19 pandemic, but we do know that consumers have safety on their minds. About two-thirds (63%) of Gartner Consumer Community respondents agree that they would like to continue some changes they’ve made due to the pandemic, even when the crisis has concluded (full research available to Gartner clients).

The most popular positive shift? Increased attention to personal hygiene and cleanliness in public spaces. So, it’s not surprising that in an April 2020 survey of 17,000 consumers in 19 countries, 82% said contactless payments are “the cleaner way to pay.”

This is where your own SMB comes in: Investing in the hardware and software needed to support contactless payments will set your business apart from peers. 31 million Americans tapped a Visa or contactless card in March 2020, and use of contactless payments in the U.S. has grown 150% since March 2019.

Steps you should take

To confirm that your business can meet growing demand for contactless payments, start by reviewing your current cashless options. Then, consider which additional choices you can offer consumers, all the way up to contactless payments. Each step below will keep your business ready for today’s demand and tomorrow’s future.

1. Make sure that your cashless payment gateways are PCI-compliant

When cashless payments started taking off in 2006, a group of industry leaders united to form the Payment Card Industry Security Standards Council (PCI SSC). The PCI offers best practice guidelines that keep customer and business data safe as it flows throughout the cashless payments ecosystem.

If your business accepts cards, you’re expected to uphold PCI standards already. This comes with three key responsibilities:

Ensuring that customers’ credit card details are securely stored and transmitted

Providing consistent security through encryption, security testing, and more

Conducting annual audits of your security controls

Many point-of-sale (POS) software systems offer features to help users manage PCI compliance. As one example, Stripe allows users to type card details into fields that originate from their PCI DSS-validated servers. If your business uses a POS system and you’re not sure which features it offers to track PCI compliance, ask your account representative to show you.

2. Research payment options that don’t require merchant accounts

Some of the most popular online payment systems don’t require merchant accountsIf you run a brick-and-mortar store, Square lets you attach a magstripe, chip, or Bluetooth card reader to your laptop, smartphone, or tablet. This makes it ideal for food trucks, retail shops, and other in-person consumer interactions.

Keep in mind that while you don’t need merchant accounts to start using these tools, you’ll gain access to more features if you’re willing to upgrade. For example, PayPal’s business plan allows up to 200 employees limited access to your account and faster follow-ups from customer service. Ultimately, you should choose a payment option that serves your business in both the short and long term.

3. Budget for contactless payments technology

If your bases are covered with PCI compliance and online payment systems, consider adding contactless payments to the mix as an investment in your business' future.

In a TSYS survey, 80% of respondents prefer paying with debit or credit cards (54% and 26%, respectively.) Now, consider that as of March 2020, 71% of U.S.-based in-person transactions occurred at locations that support contactless payments, up from 62% the year before.

The U.S. is already far behind global markets in its adoption of contactless cards. In the years ahead, they will try to play catch-up.

To accept contactless payments at your own small business, you’ll need the right hardware. Contactless cards and mobile wallets both use near field communication (NFC), so you’ll need to buy an NFC-enabled reader.

That said, the merchant accounts for some POS systems offer plug-in readers for existing card readers. If you’re already shopping for POS software, you can make this feature a core part of your search.