All businesses are suffering, but your digital business strategy will keep you afloat now—and help you thrive later.

Capterra surveyed more than 500 small-business leaders to learn about how businesses have been impacted by the unprecedented crisis posed by the novel coronavirus. [Learn more about our methodology.]

We focused on only small businesses with 250 employees or fewer and asked their leaders about:

Their financial outlook and plans for mitigating negative impacts

Their new software purchasing decisions

The business-model changes they’re working on

For this report, we'll be looking at responses from small-business leaders who own mostly or fully digital companies. The remaining respondents are brick-and-mortar business owners—if this is you, check out Software Advice’s brick-and-mortar business report here. We’ll be looking at brick-and-mortar business responses throughout this report for comparative analysis.

Key findings:

What is the short-term financial outlook and resulting plans for digital small businesses?Small businesses need financial help within six months; the smaller the small business, the deeper the cuts. [Read more]

Are digital businesses better positioned than their brick-and-mortar counterparts in this time of social distancing requirements?Digital revenue models fare better than brick-and-mortar because digital revenue is more robust. [Read more]

Which changes are temporary and which are permanent?Over half of the new software purchased for temporary use during the circumstances created by COVID-19 will actually be permanent tools by 2021. [Read more]

What business-model changes can a digital small business implement to stay afloat or even thrive in “the new normal”?More online offerings and new pricing models are key to survival. [Read more]

First, what is a digital business strategy?

A digital business strategy is a business model designed to engage, interact, and serve your customers primarily online by blurring the digital and physical worlds. Your store front is a website, customer service is provided via live chat, the dressing room is an AR experience, and your brand is built on social media platforms.

Digital acceleration is about implementing the latest technologies to streamline business processes, expand services and products, and increase revenue streams in innovative ways.

As we'll see in the next section, all businesses are impacted by the current crisis—but your digital business strategy may hold the key to survival and success. More on that later.

Small businesses need financial help within 6 months

While you hear about the success some businesses such as Zoom and 3M are having right now, we all know this represents a tiny sliver of reality.

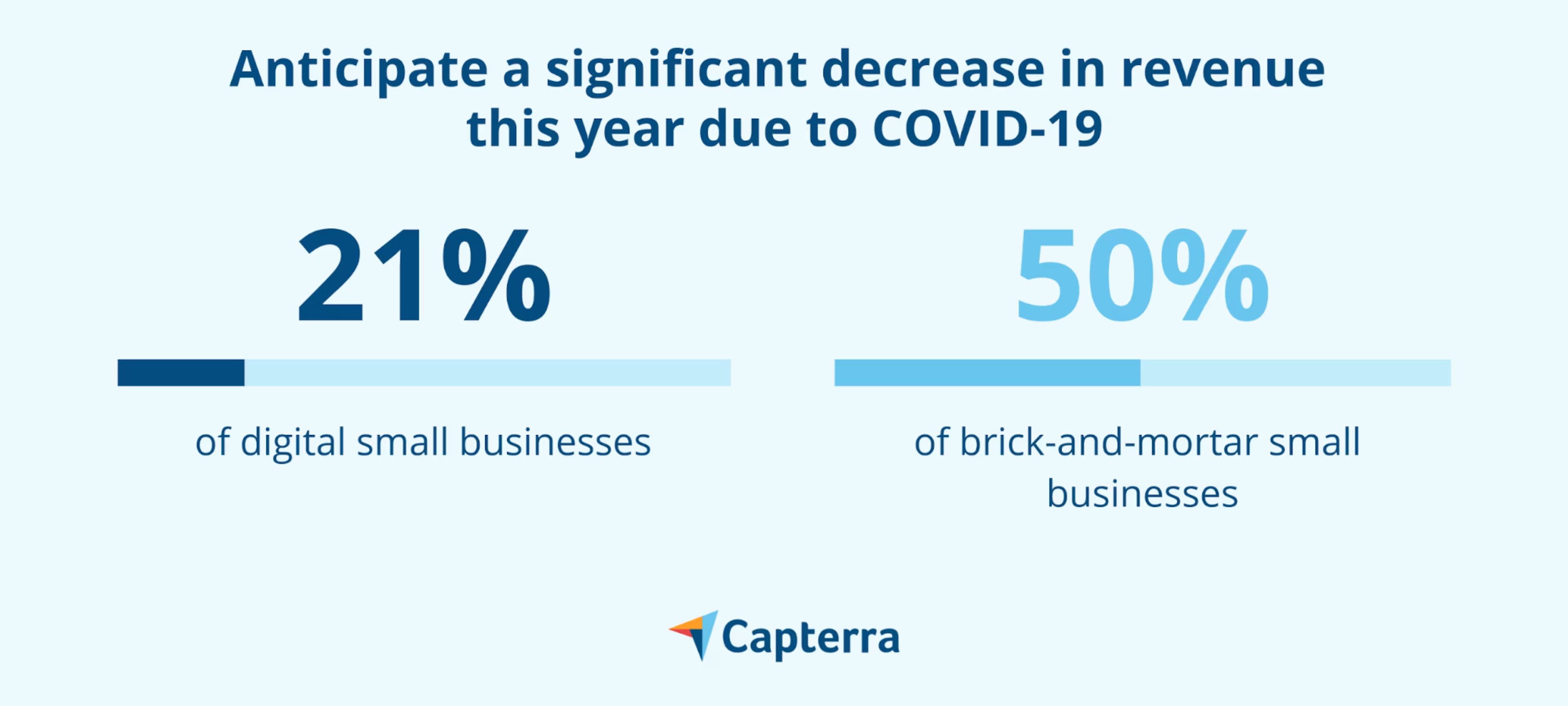

Some 70% of digital small businesses expect decreased revenue this year as a result of the COVID-19 crisis; the number rises when we add in brick-and-mortar small businesses. Given the unemployment rate—and your personal experience with local businesses, I’m sure—this number comes as no surprise.

But there's still not enough awareness around just how dire the situation is right now.

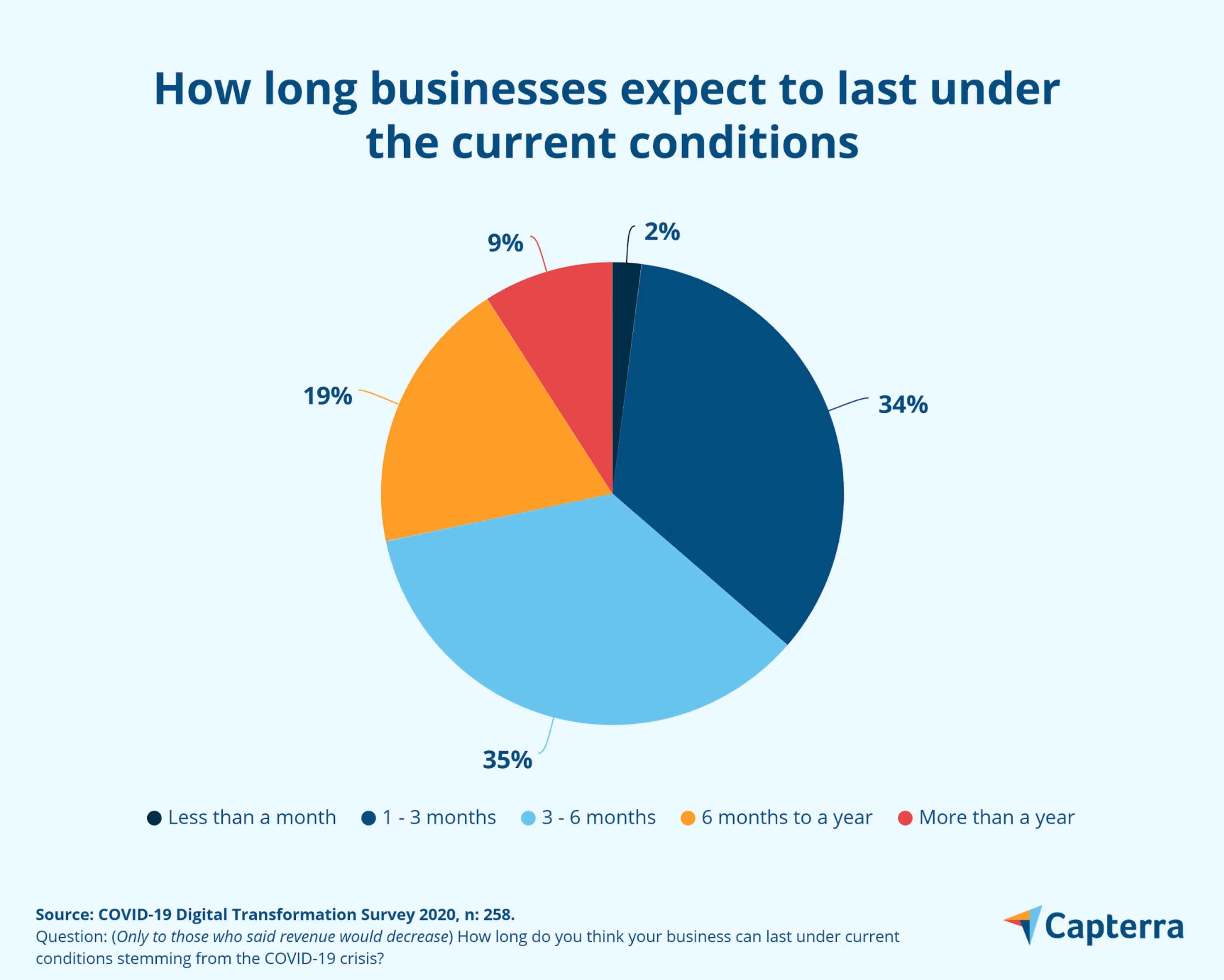

Let’s take a look at just how long small businesses expect to last as a result of this decrease in revenue and the short- and long-term state regulations around how businesses can operate. Here’s a breakdown of the responses in our survey:

It’s a very real possibility that by the time you’re reading this report, 2% of digital small businesses will have had to close down permanently.

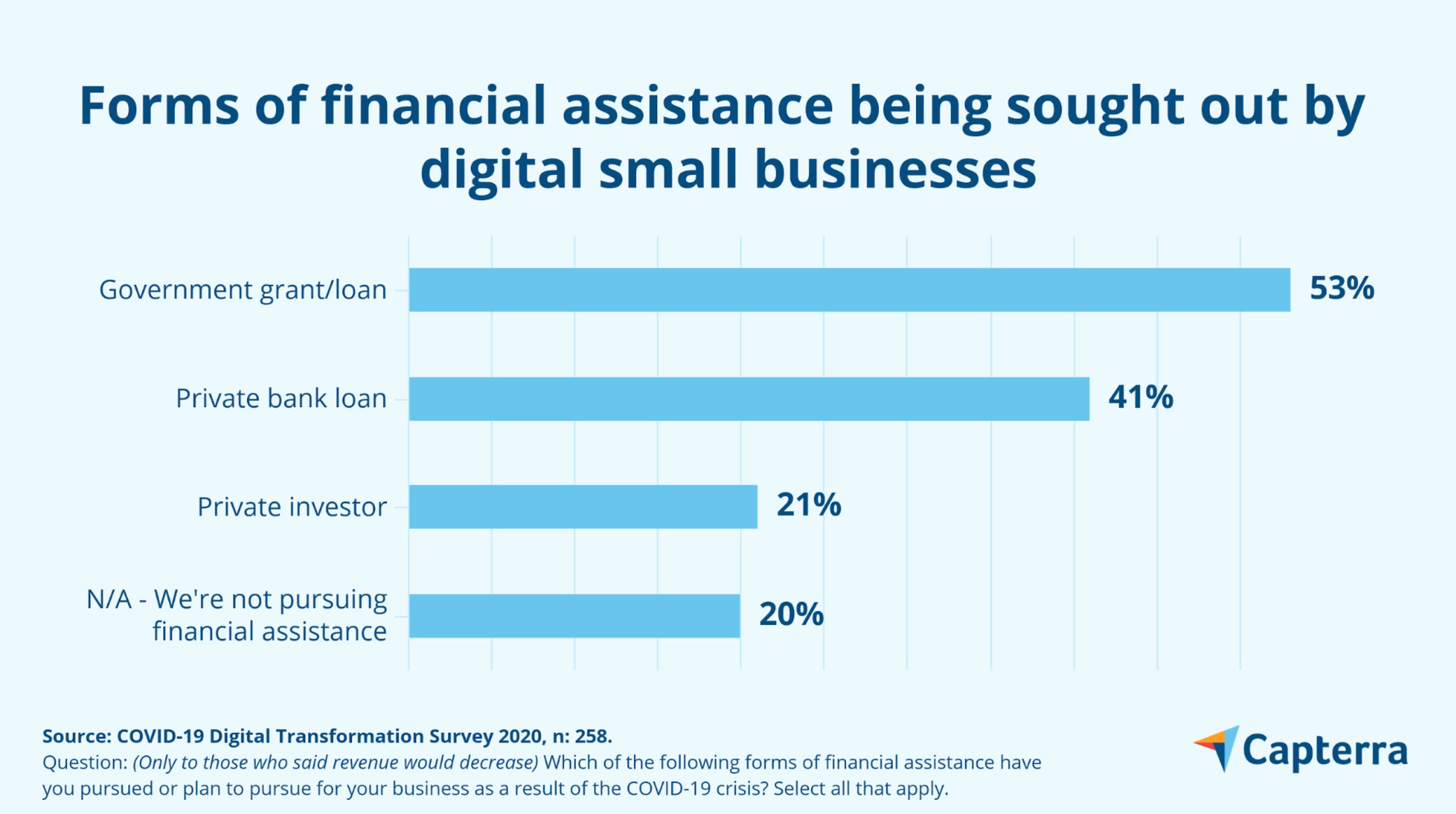

On the other hand, 28% of businesses in the chart above believe they'll last for 6 months and longer. When you consider that a similar percentage of respondents aren't looking to pursue financial assistance—as shown below—we can interpret that a significant proportion of your peers aren't expecting to see recovery until around that six-month mark.

The smaller the business, the deeper the cut

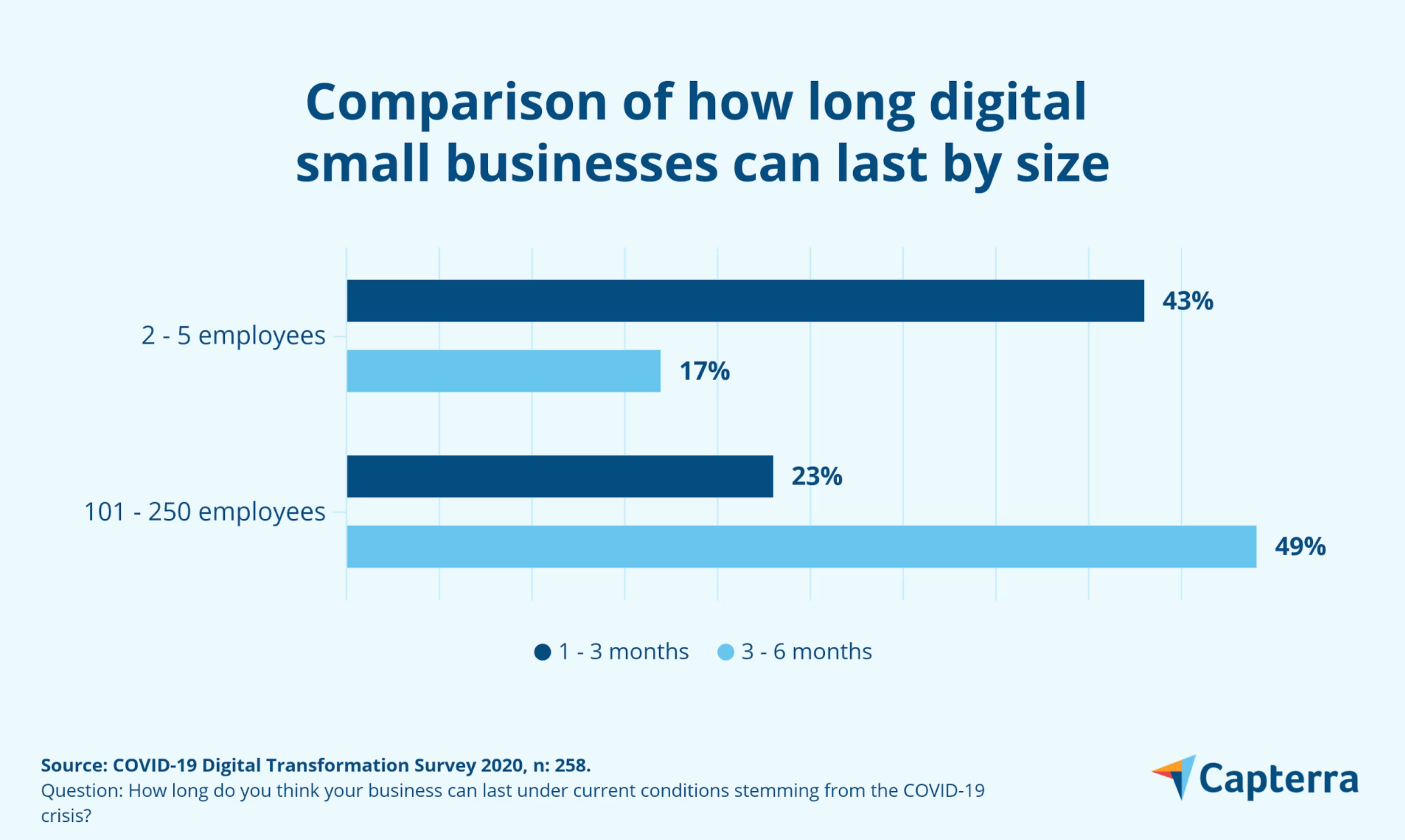

The threat of closure hovers over many small businesses. Unfortunately, very small businesses are perceiving that threat as soon as now.

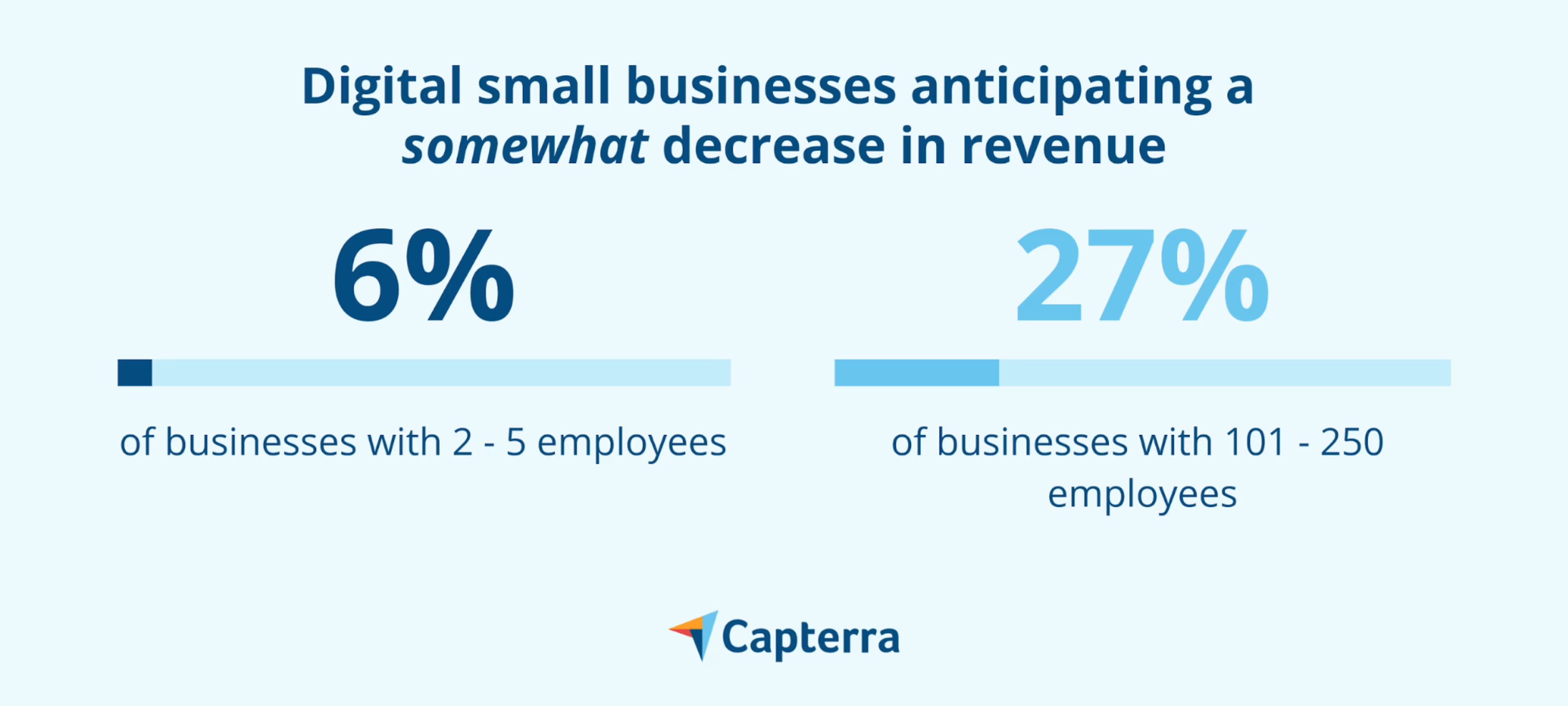

What we see in the charts below is that the smallest businesses, comprising two to five employees, are suffering considerably more than the businesses that are pushing the upper threshold of what qualifies as a small business. In each case, you’ll find the smallest of small businesses and the largest of small businesses on opposite ends of the data—and bigger businesses are always favored.

The difference between lasting three to six months versus one to three months is significant. Surviving for six months could mean sticking around long enough to receive loans or grants, or having enough time to make business-model changes that further digitize business operations to generate digital revenue.

Keep in mind that businesses with only a handful of employees are likely very new and still working to build a brand. This, coupled with keeping operations lean, may explain why we see these micro businesses of two to five employees struggling more than ones with a hundred or more employees.

This fact is further illustrated below, with twice the percentage of the smallest businesses expecting a significant decrease in revenue when compared to the largest of small businesses. Significant is the key word here.

And when we look at the data for a somewhat decrease in revenue, the numbers predictably swap. That's because recovering from a “somewhat decrease” should be less difficult than recovering from a significant one, and once again we see that larger small businesses are better positioned.

Digital revenue models fare better than brick-and-mortar counterparts

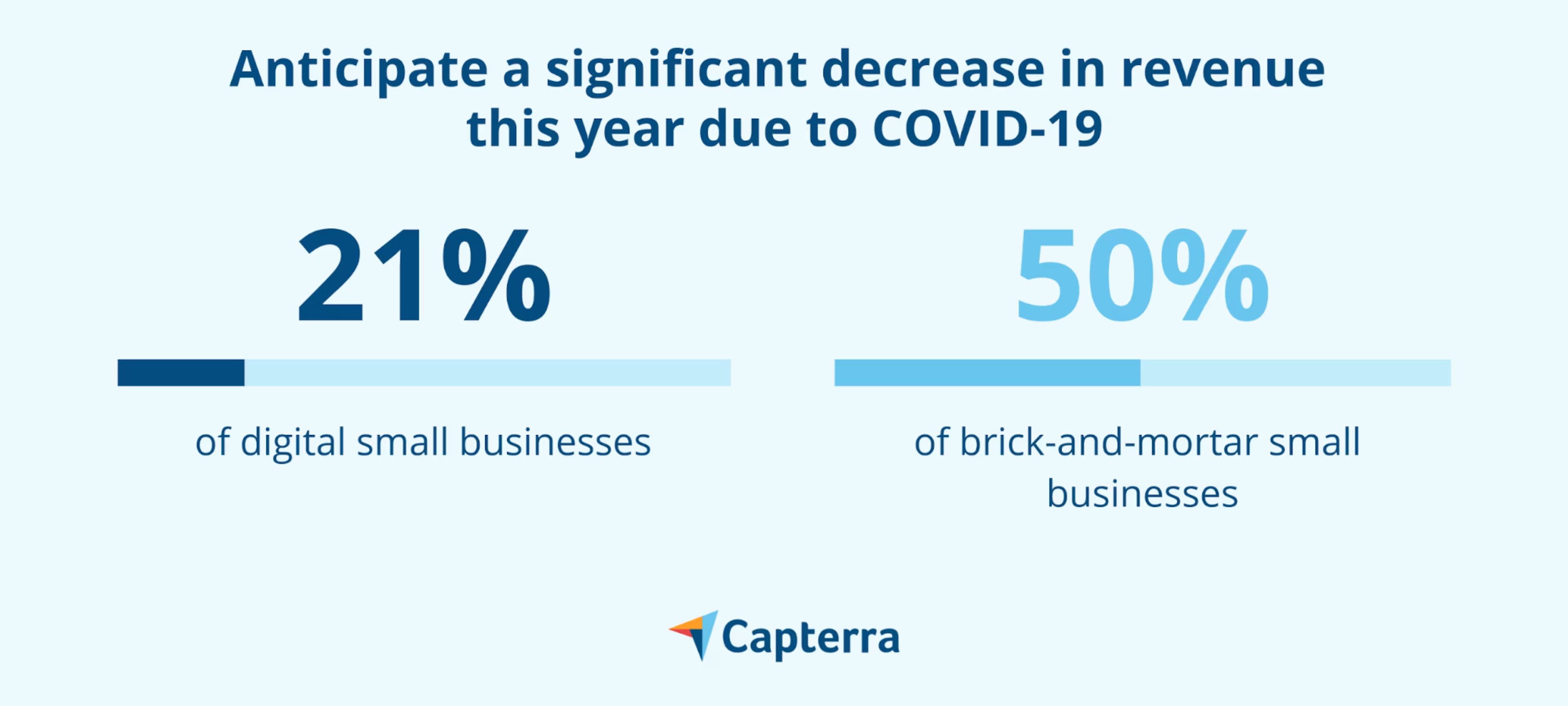

While this report focuses on digital businesses, let's take a moment to compare the revenue impact on both groups. Both types of businesses are clearly struggling, but digital businesses are expecting a less severe negative impact on their revenue.

It’s clear that the nature of the crisis, with social distancing forcing businesses to close their doors, is playing a key part in these numbers—but that’s not the whole story, and it’s short-sighted to think this impact goes away when state orders are lifted.

Digital-based revenue streams, such as the revenue generated via online shopping and digital services and products, were gaining popularity before this crisis hit and will continue to be the way customers want to consume even after we have a good handle on this pandemic.

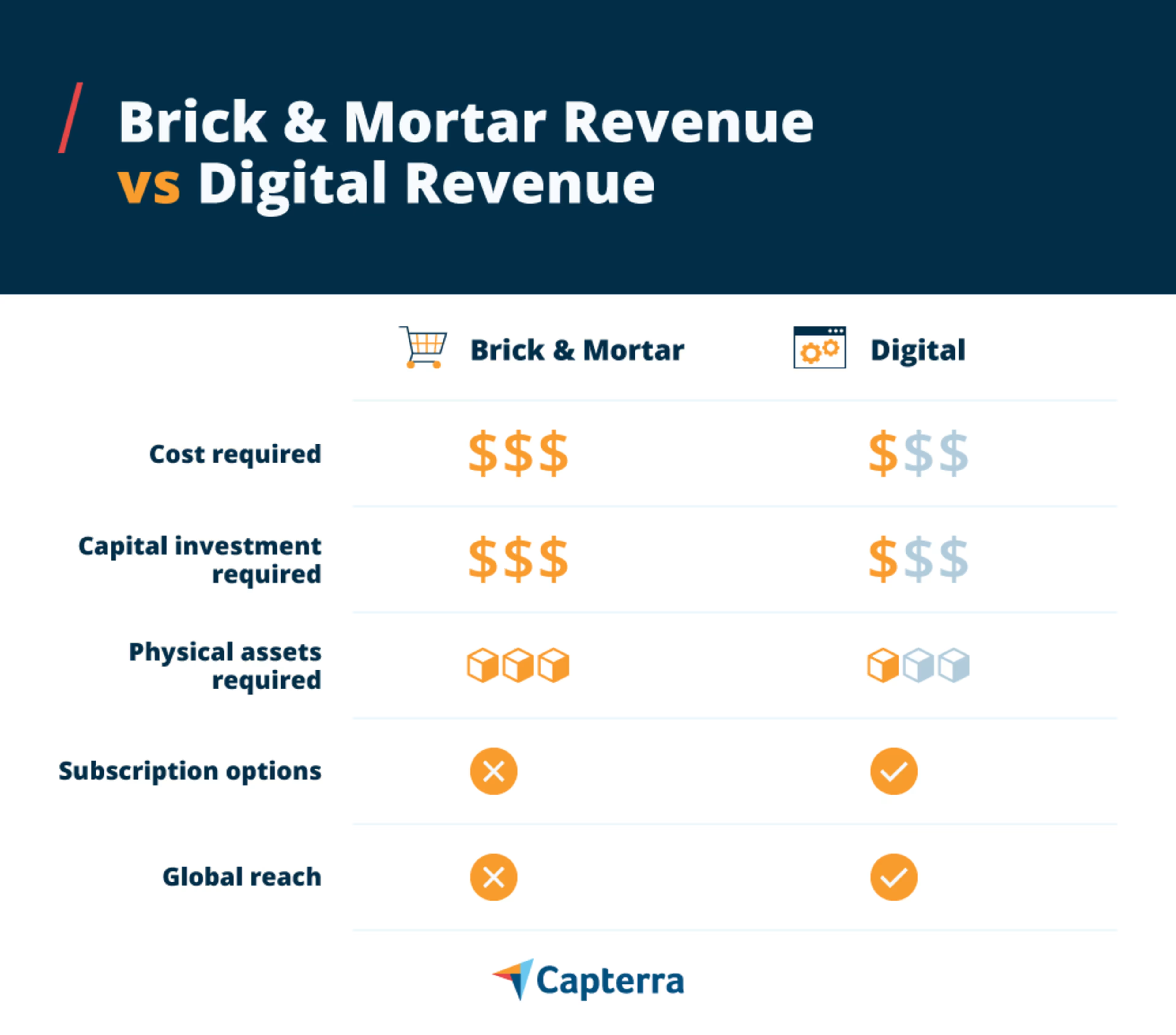

Let’s dive into the strengths of digital revenue streams over brick-and-mortar ones.

Prediction: Digital revenue streams and digital business-model changes will become more permanent than expected

Our survey found that, across the board, small-business leaders expect that business-model changes and software purchases will be temporary. But, as we stated in the beginning of this report, we predict that over half of these changes will become permanent by 2021.

This prediction is the culmination of the data analysis shared above, combined with the following key factors:

Businesses were already largely moving to digital business models prior to the COVID-19 pandemic. This shift has just been forced to happen over months, instead of the years previously expected.

Employees and customers will get accustomed to new business processes and offerings and won’t want to see them fade away within months.

Software purchases and implementations have been forced to happen much sooner than planned for 50% of surveyed businesses—even though revenue is down for 70%. Businesses won’t want to eliminate these purchases once revenue starts to increase because they already had plans to buy them.

Digital revenue streams are relatively lower risk than the revenue generated by brick-and-mortar operating models.

The last factor listed above is key: the digital acceleration of your business model in order to add more digital revenue streams is one of the best things you can be working on in order to stay alive now and remain competitive in the future.

Ready to digitize your business?

Download our 2020 guide to digitizing your business with software.

Digital revenue, simply put, is more crisis-proof. This is because it draws from a larger pool of customers at a lower cost to your business; it can also sustain itself without requiring repeat customer action needed, as is the case with subscription-based pricing models.

This point is driven home by the graphic below, which is adapted from Gartner’s 6 Methods to Earn New Digital Revenue report for enterprises (full report available to clients only):

Gartner recommends that their enterprise clients digitalize a product or service, as “digitalized offerings can complement traditional, nonconnected offerings in an enterprise’s product mix.” This is also true for small businesses of any size.

Now, there's no denying that it's painful to make drastic changes to a business model while your business is under duress. But this is limiting small-business leaders’ abilities to fully understand quite how profitable these changes could be even after we have a COVID-19 vaccine.

The importance and permanence of new software is another element of change that businesses are underestimating. Let’s get into the details on this next.

Small businesses are underestimating their future dependence on new software purchases

With 65% of small-business leaders being forced to buy new software, it’s clear that software is the key to adapting to the current crisis. In fact, some areas of digital small businesses that didn’t previously require software may now need it in order to perform their job functions.

Diving into the parts of the business that now require software show that almost half of digital small businesses’ customer support and accounting departments are driving this change, at 45% and 43% respectively. Marketing comes in third at 38%.

This number coincides with the 62% of digital small businesses that are planning to spend somewhat or significantly more on technology this year. This means that even if the purchase of software for these business areas was planned prior to the COVID-19 pandemic, nearly all are spending more money to do so than expected.

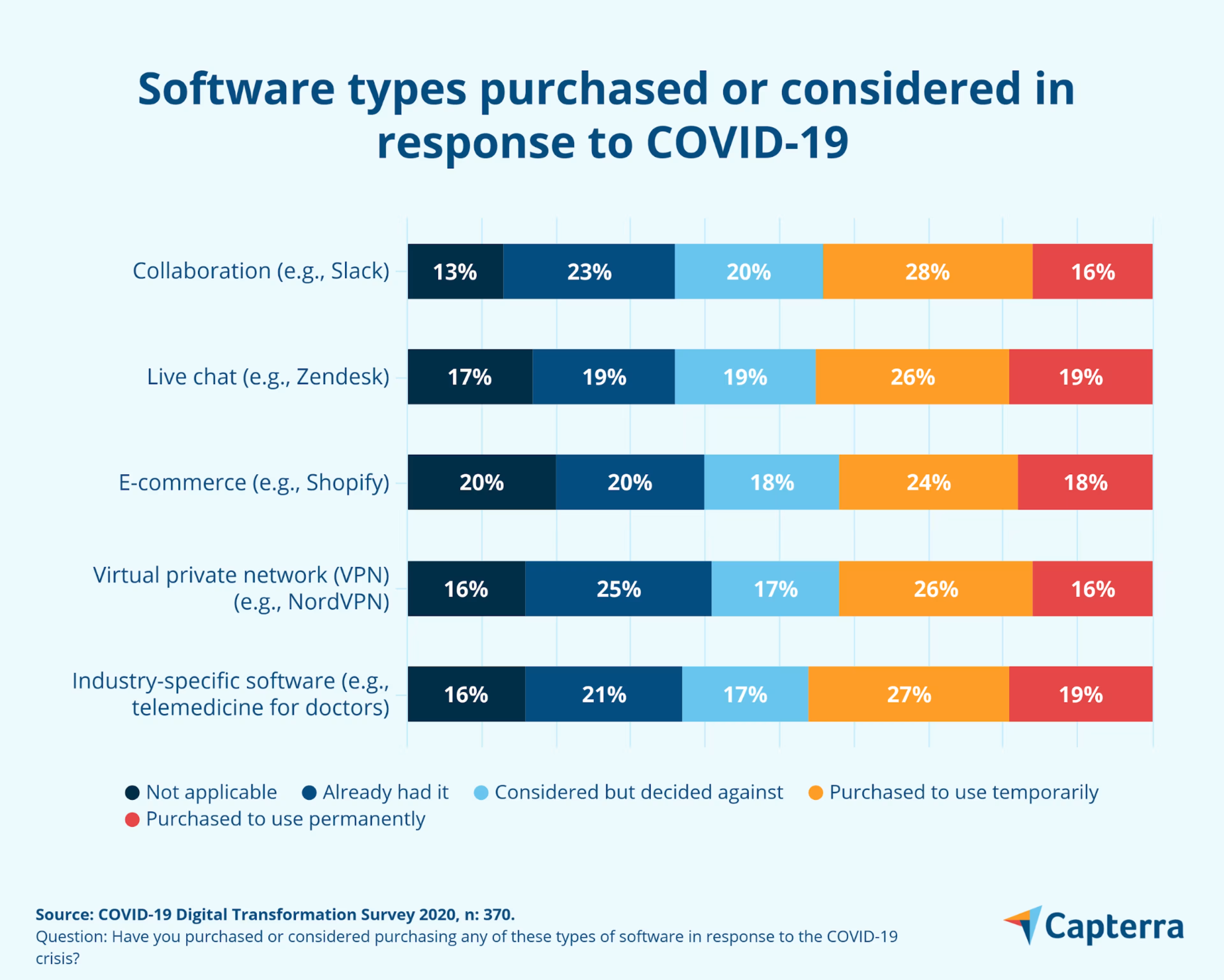

Let’s take a look at specifically what types of software small businesses are considering or purchasing. In the below chart, you’ll see that for each type of software, most respondents stated that they were making a temporary software purchase.

But current and predicted circumstances suggest that the use of new software, such as collaboration, VPN, and live chat, won’t be temporary. Let’s consider three reasons why these might turn out to be permanent purchases:

Your team will likely become dependent on the collaboration tool you implement even after they can return to the office.

Many workers either won’t be returning to the office at all or will do so only part-time. Therefore, a VPN will be required for employees to continue to work remotely and maintain secure internet connections.

Pair the fact that younger generations prefer live chats for customer service interactions and the real possibility of all your customers getting accustomed to live chat while social distancing, and it’s likely that you’ll be keeping this software permanently.

So don’t be married to the idea that you’ll be ditching software anytime soon. Not only is the new normal going to be around longer than many are thinking, some experts even say it’ll last years. But also—and perhaps most importantly—your employees and customers may want to keep some of the changes they’ve seen during this disruption.

Key business-model changes for surviving crisis conditions

When a crisis hits, agility can determine whether businesses sink or swim. Yet, surprisingly, 42% of respondents state that changing their product or service lineup is either not applicable or they decided against it.

This sheds light on a major opportunity small businesses aren’t exploring. To stay afloat now and succeed when things stabilize, small businesses must implement a stronger digital business strategy and embrace changes such as online offerings and new, digital products.

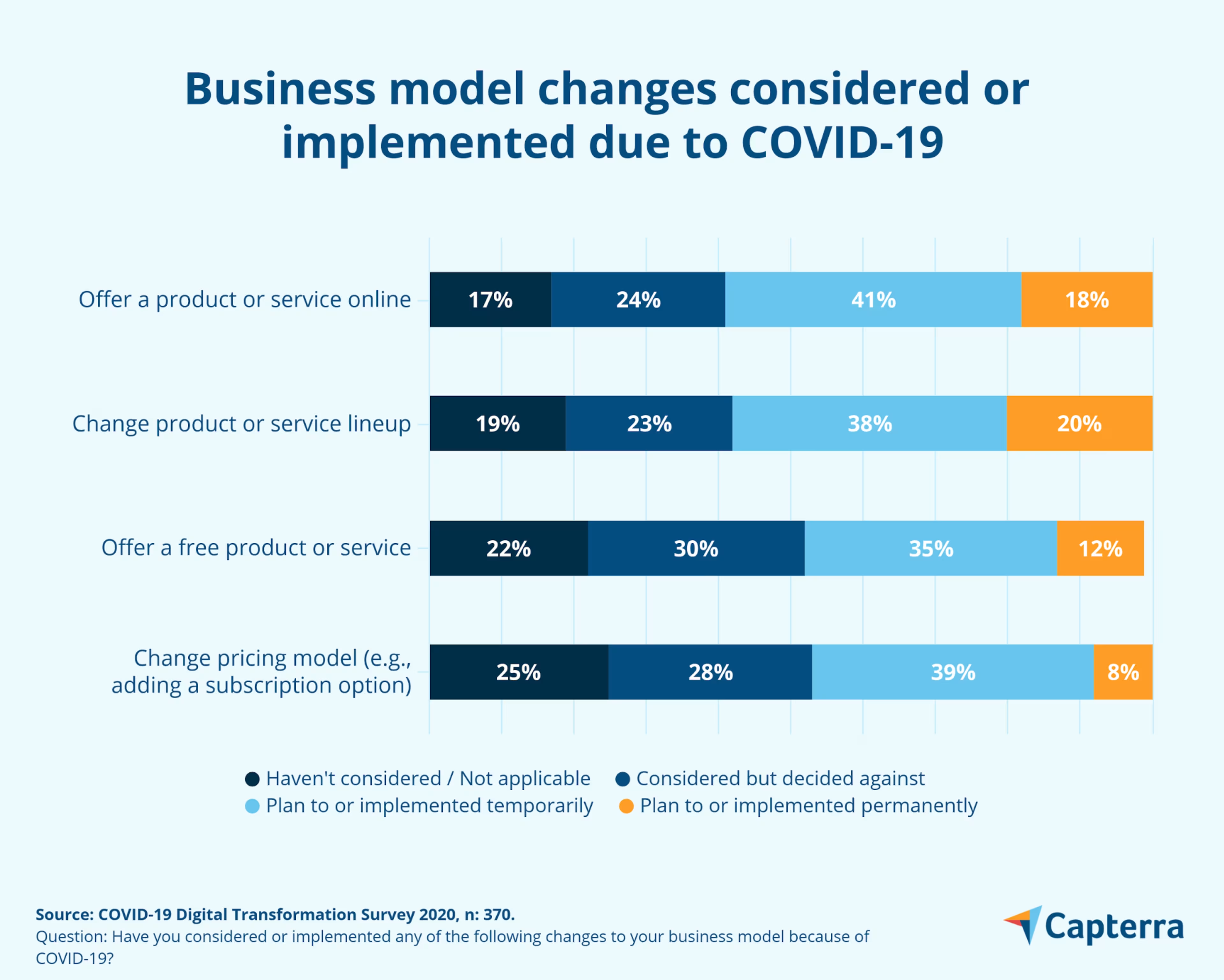

So what are businesses changing and what else have they decided against changing? Below is a breakdown of how business leaders are adapting in response to this pandemic.

Our analysis of this data follows the same line of thinking as the software purchase and use prediction: small businesses are underestimating the staying power of the changes they’re making.

Customers grow accustomed to and even take for granted new offerings from their favorite companies. Once the option’s been offered, many will be disappointed to see it go away.

Throughout this report we have shared insights from the actions being taken by other small-business owners in order to accelerate and augment their digital business models. We’re a small-business ally, and we hope that you find this information useful. Our mission is to help you find the right software for your business needs and arm you with the research and data you need to inform the tough business decisions we know you face every day.

Please, be safe. Stay well. Be kind to each other. And we’ll get through this and rebuild the small businesses of America together.