Use the four types of accounting analytics for maximum efficiency.

Accounting is more than just balancing books or filing tax returns. Over the years, software has helped automate many manual accounting processes, allowing professionals to take a more analytical role.

However, the shortage of skilled professionals remains a considerable challenge for accounting to become a more analytical role. This is where data analytics come in. With a little bit of knowledge and the right tools, your business can harness the power of data-driven insights.

If you're an accountant or auditor stuck with back-end spreadsheets and calculations, it's time to look deeper into your numbers. This guide explains the four different types of analytics for accounting and how you can use each for maximum efficiency and profitability.

What is data analytics in accounting?

Combining accounting and data analytics is the practice of taking a 360-degree view of a problem or situation. One collects, examines, and organizes all related data to extract meaningful information.

Accounting professionals deal with volumes of data every day—cash receipts, checks, bank statements, invoices, and more—to produce financial statements. Data analytics in accounting helps them dig into the financial statements to make predictions, and recommend corrective actions for misclassifications, duplicate entries, and data entry errors.

Types of data analysis used in accounting

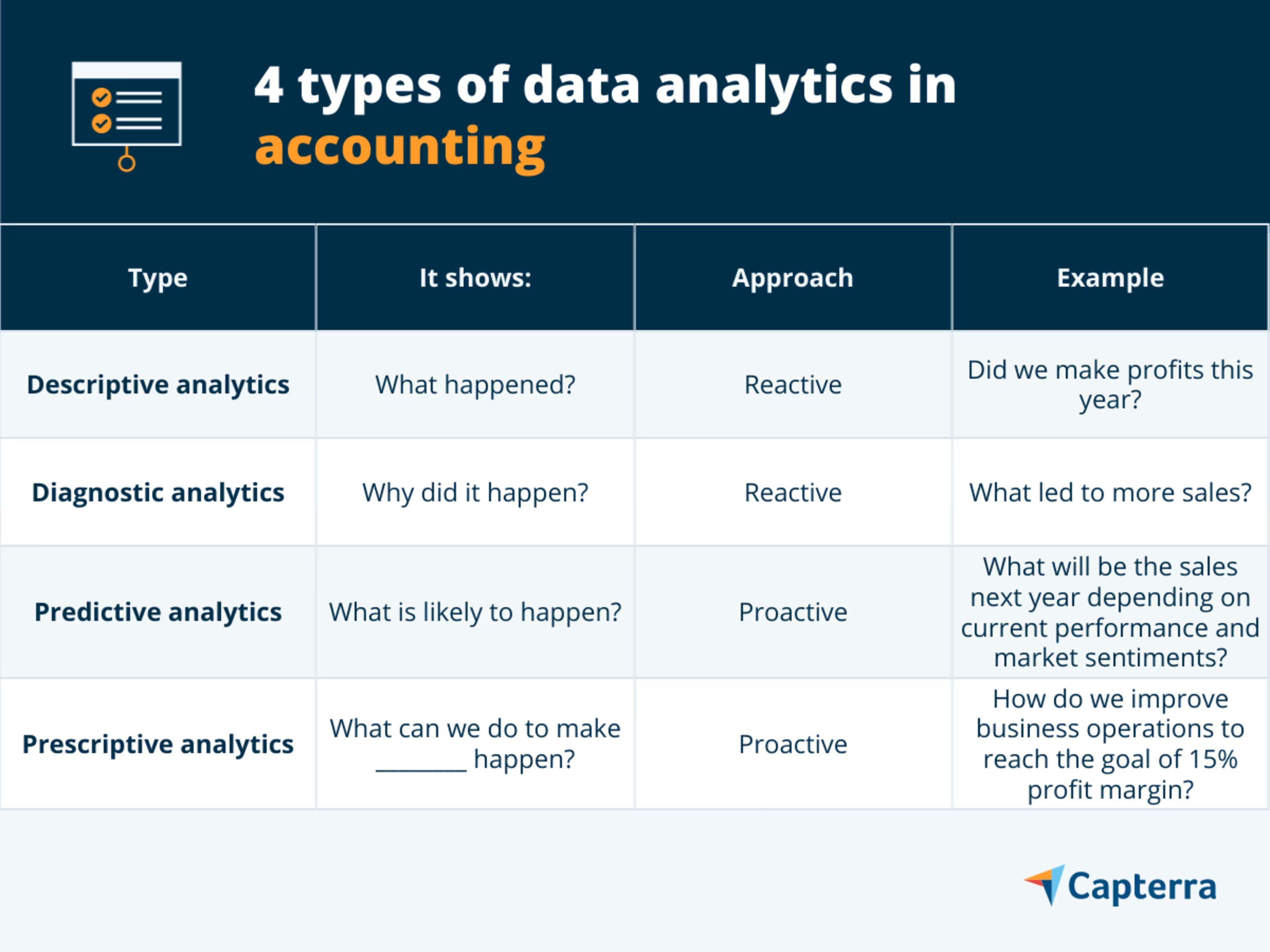

The four main types of accounting data analytics are descriptive analytics, diagnostic analytics, predictive analytics, and prescriptive analytics. Each approach reveals a different facet of a company's financial activity. Here are some examples to see the value of all four types:

Descriptive analytics

Descriptive analytics illustrate what happened within a given period. For instance, descriptive analytics will show your company's revenue, how many new customers you gained, or which region accounted for the highest revenue. Descriptive analytics are always focused on past events rather than current trends or future predictions.

The main benefit of descriptive analytics is that it helps visualize trends. Instead of relying on raw numbers, dashboards powered by descriptive analytics will help you see trends.

Diagnostic analytics

Diagnostic analytics also focus on historical data, but instead of answering the question of "what happened?", this type of analytics answers "why did it happen?". For example, diagnostic analytics help explain why revenue went up or down in the previous quarter or why your company gained or lost customers.

This type of analytics provides context and enables you to make better business decisions. With descriptive analytics, diagnostic analytics help you plan for the future by understanding the past.

Predictive analytics

A more advanced type of analysis, predictive analytics, uses historical data to determine what will likely happen in the future. Predictive analytics are essential in determining credit risk and identifying anomalies that indicate financial fraud.

With predictive analytics, you get a glimpse into future possibilities. This allows for better preparation and business planning.

Prescriptive analytics

Prescriptive analytics build on the insights gleaned in predictive analytics and guide you toward recommended actions to take. If predictive analytics, for example, forecasted an increase in customer demand for a specific product, prescriptive analytics might tell you how many extra units to produce.

You can look at prescriptive analytics as a merger of the three other types of analytics. This approach not only looks at what happened, why, and what will happen, but it also guides your company to make data-driven business decisions.

Examples of successful data analytics applications in accounting

Need help remembering which types of accounting data analytics are which? Refer to this table for a reminder of all four types of data analytics in accounting.

How accountants can use data analytics

Entry-level accounting jobs, such as collecting and logging records of business transactions, have already been partially or fully automated. Analytics are now helping accountants perform more complex tasks, such as inspecting financial records for fraud and analyzing annual financial statements. Here are some of the other valuable ways accountants can use data analytics:

Behaviors are easier to understand

Accounting analytics tools enhance understanding of the behaviors that motivate financial decisions. For instance, auditors can analyze complete financial records instead of picking up small data samples—this results in easier identification of outliers, lesser margin for errors, and more corrective recommendations.

Plan for business improvements

With strong predictive models analyzing a region's regulatory environment, market mood, and financial risks, tax accountants can more accurately forecast market movements and make practical prescriptions, resulting in tax-saving and profitable investment recommendations.

Build business plans

By improving cost estimation, accounting data analytics makes budgets more accurate and relevant. Real-time data analysis also allows accounting professionals to revise budgets more frequently.

Evaluate performance

By increasing the pace of data processing, analytics allows accountants to crunch data on demand to prepare financial statements, which summarize business transactions into profit and loss and other such reports. Generally, these statements are prepared once every three, six, or 12 months, but by then, they lose relevance for many stakeholders (business units, investors, etc.).

Maximize profits

Descriptive analytics help identify the products or services responsible for generating revenue. Diagnostic analytics offer insight into why customers responded so well. With this knowledge, businesses can focus their efforts on generating more revenue and maximizing profits. Data analytics can also pinpoint cost-cutting opportunities, further boosting the bottom line.

Mitigate risk

Data analytics help accountants better predict future risks such as bankruptcy, fraud, and misstatements in financial reports. Accounting firms can use predictive analytics to analyze risk areas, better gauge the possibility of specific risks, and take preemptive remediation steps.

What are the key data analytics tools used by accountants?

An accounting data analyst uses data analysis software to sift through and make sense of large data volumes. Data analytics software tools help organize large data sets, identify relationships between complex data points, and generate reports to enable trend analysis.

With these tools, you can easily spot patterns and outliers, and they usually require low- to no-coding skills and even offer user-friendly drag-and-drop interfaces. In addition, self-service analytics tools make it easier to dig into data and trace patterns without complex programming knowledge.

Getting data-driven insight from accounting analytics

Before the growth of data analytics, financial accounting was limited to the descriptive interpretation of financial statements, including summaries of everyday business transactions. Some practitioners would go deeper to explore the "whys" of the data—say, why the revenue was low this year. However, it was a highly manual process, and the success depended on internal relationships and one's ability to extract information from other departments.

There's a clear shift in accountants' responsibilities from administrative tasks to reasoning in the analytics domain. They move from stacking and storing data to using it to filter relevant insights (descriptive and diagnostic analytics) and interpreting the results to attain larger business goals (predictive and prescriptive analytics). Still, the problem remains that many SMBs don't have a trained accounting data analyst on staff. With the descriptions of all four types of accounting data analytics and the right tools, you too can gain data-driven insights.