Obviously, all businesses want to be successful. We could start with the usual clichés about business success—spend money to make money, get there firstest with the mostest—but those clichés don't tell you what you really need to know.

They don't tell you how to grow your business. They don't tell you what it takes to remain competitive in your market. They don't tell you how to increase profitability.

All businesses are concerned with profitability, but profitability is a different class of concern for smaller businesses. If large enterprises spend money and lose profitability, the result is usually some loss in shareholder value.

But a loss in profitability for a small business owner is more personal. It means a direct hit to retirement or maybe to a child's college fund or more immediate impacts such as meeting a monthly mortgage payment.

Arguably the most important decision small business leaders make is how to effectively spend their scarce funds to grow their business. The margin for error is small and the decision demands very careful consideration.

Spending money on business software is often not on the list of what you want to do. But these technology investments can be absolutely critical to competing in your market. It's important to know what companies like yours are buying and how much they're investing, or you risk falling behind.

The platitudes above certainly don't help to make these key budgeting decisions. Let's see if we can.

At Capterra, we recently surveyed more than 700 small and midsize businesses (SMBs) in the United States and asked them about their 2019 and 2020 purchasing intentions and budgets for business software. We found an overwhelming trend among our respondents.

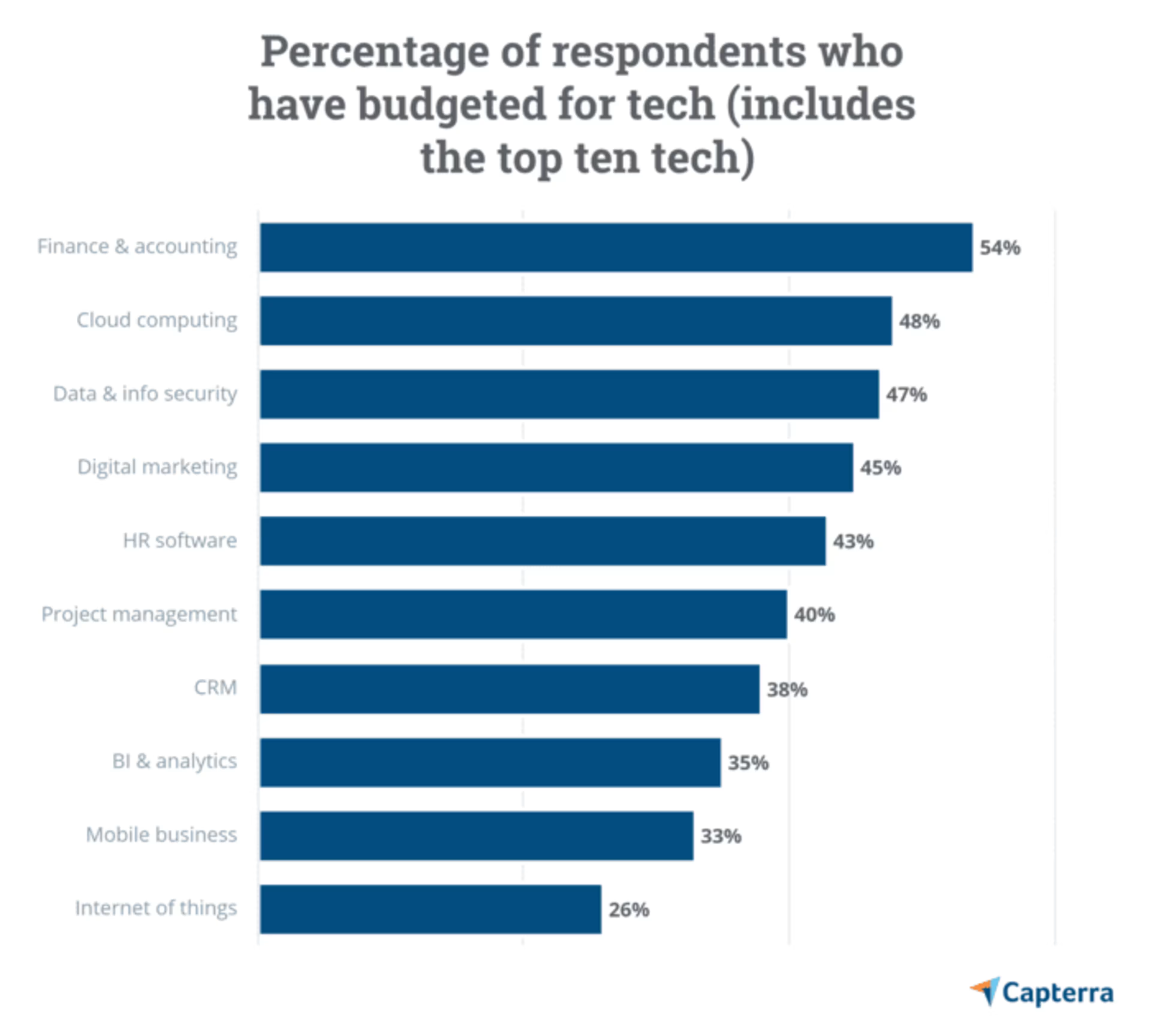

Across all small and midsize companies (from 2 to 249 employees) and all industries, SMBs are allocating budget to four business technologies: finance and accounting, cloud computing, data security, and digital marketing.

(See details on our survey)

Although the order of priority may shift with business size and industry, the businesses we surveyed consistently list these four technologies in their top tech budgeting priorities. And so, all small and midsize businesses should look to budget and spend on these technologies to remain competitive.

Figure 1

To help you make decisions about which tech to prioritize at your own small business, we will examine these four technologies more deeply, counting down from the fourth tech priority to the top tech priority, with an emphasis on spending and budget trends by size and industry.

Tech #4: Digital marketing is now crucial to acquiring new customers

Data highlight

Small businesses are realizing that all businesses are digital businesses—45.1% of SMB respondents plan to budget for digital marketing campaigns and tools within the next two years (see Figure 1).

The irreversible and escalating trend of online shopping (for personal and business consumers) is substantially impacting all businesses.

Almost every purchase now starts online … at least in the discovery stage. ROBO buying behavior (research online, buy offline) is gaining significant momentum, and recent studies show that up to 88% of buyers do online research before purchasing in a store.

Additionally, localization in internet search and advertising began a rapid acceleration in 2017.

If your business lacks a website or web presence, new customers simply won't find it. And a strong web experience can mean the difference between gaining a customer or merely a two-second scan and pass.

Digital marketing is especially important for small businesses that are up against competitors that already have strong name recognition. Digital marketing activity in the right places will grab attention you would otherwise miss. And a strong web presence can help your small business project the gravitas and capabilities often associated with much larger businesses.

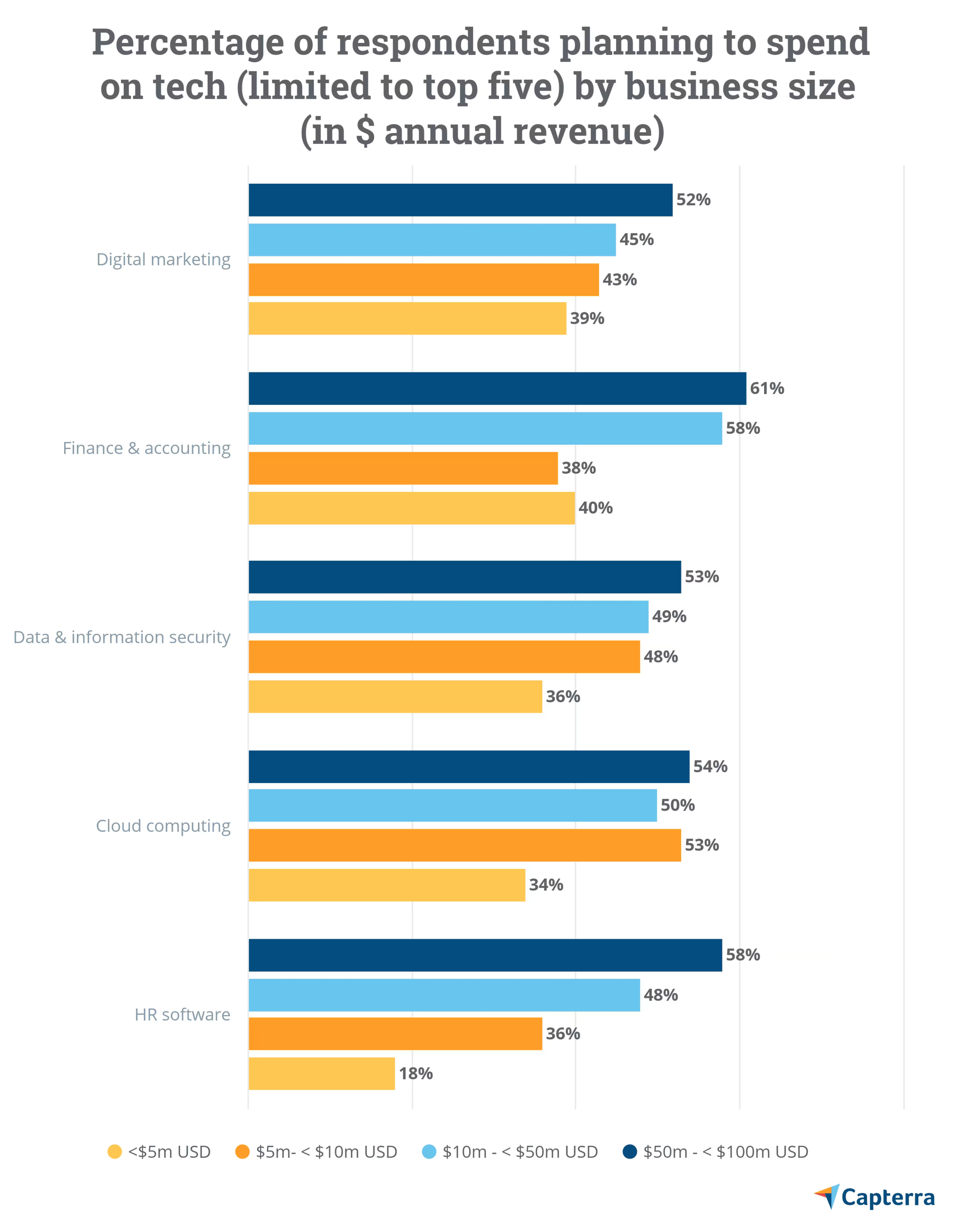

Figure 2

Data highlight

We find that digital marketing spend tracks with business size, indicating that you either need to spend more on digital marketing to grow or tend to spend more as you grow (see Figure 2).

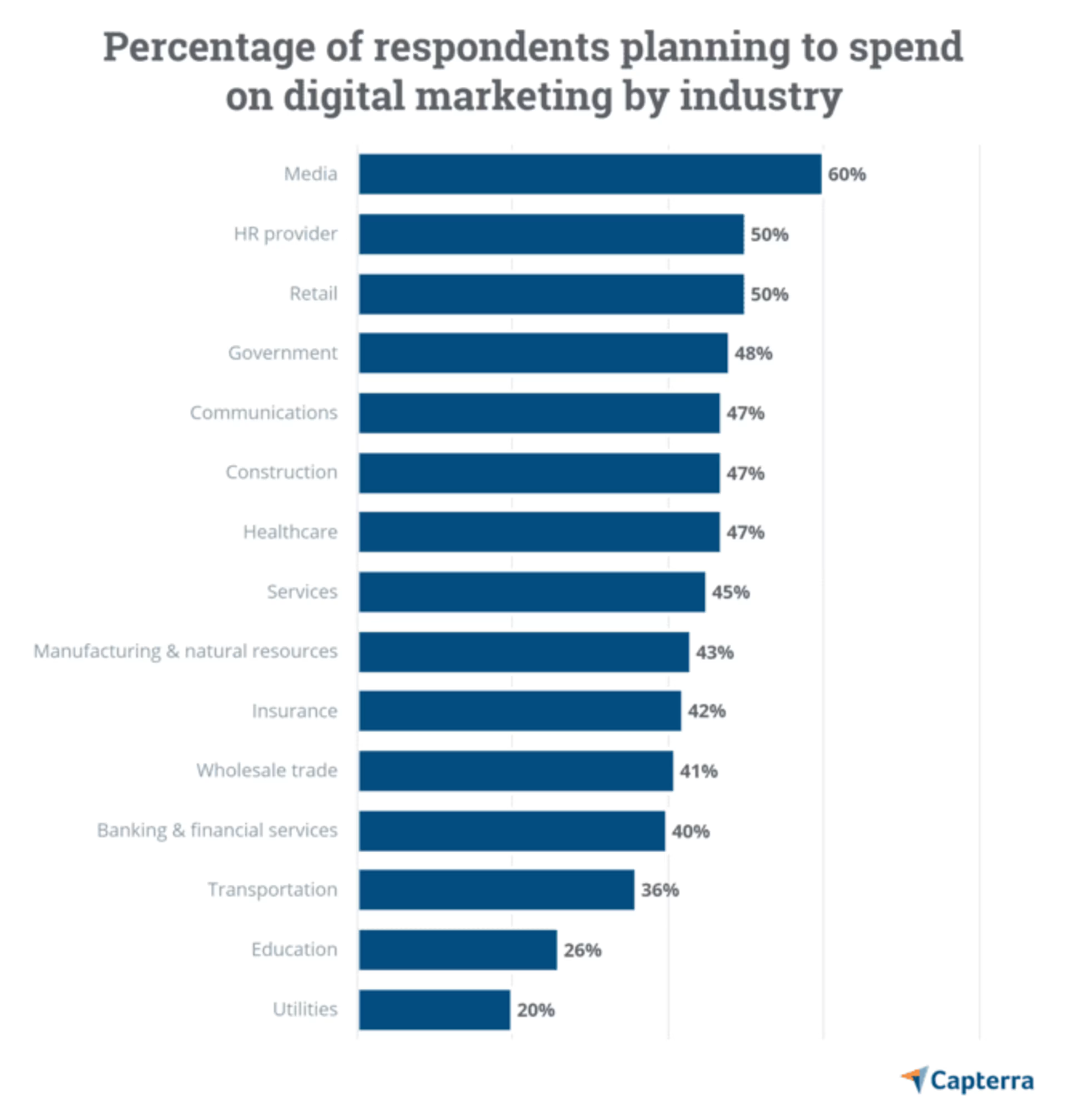

Figure 3

Data highlight

At 60% and 50%, media companies and retail businesses have the highest percentage of smaller businesses investing in digital marketing. Most industries are between 40% and 50% (see Figure 3).

Though the intention to spend on digital marketing is pretty consistent across business size and industry, the average spend can vary widely.

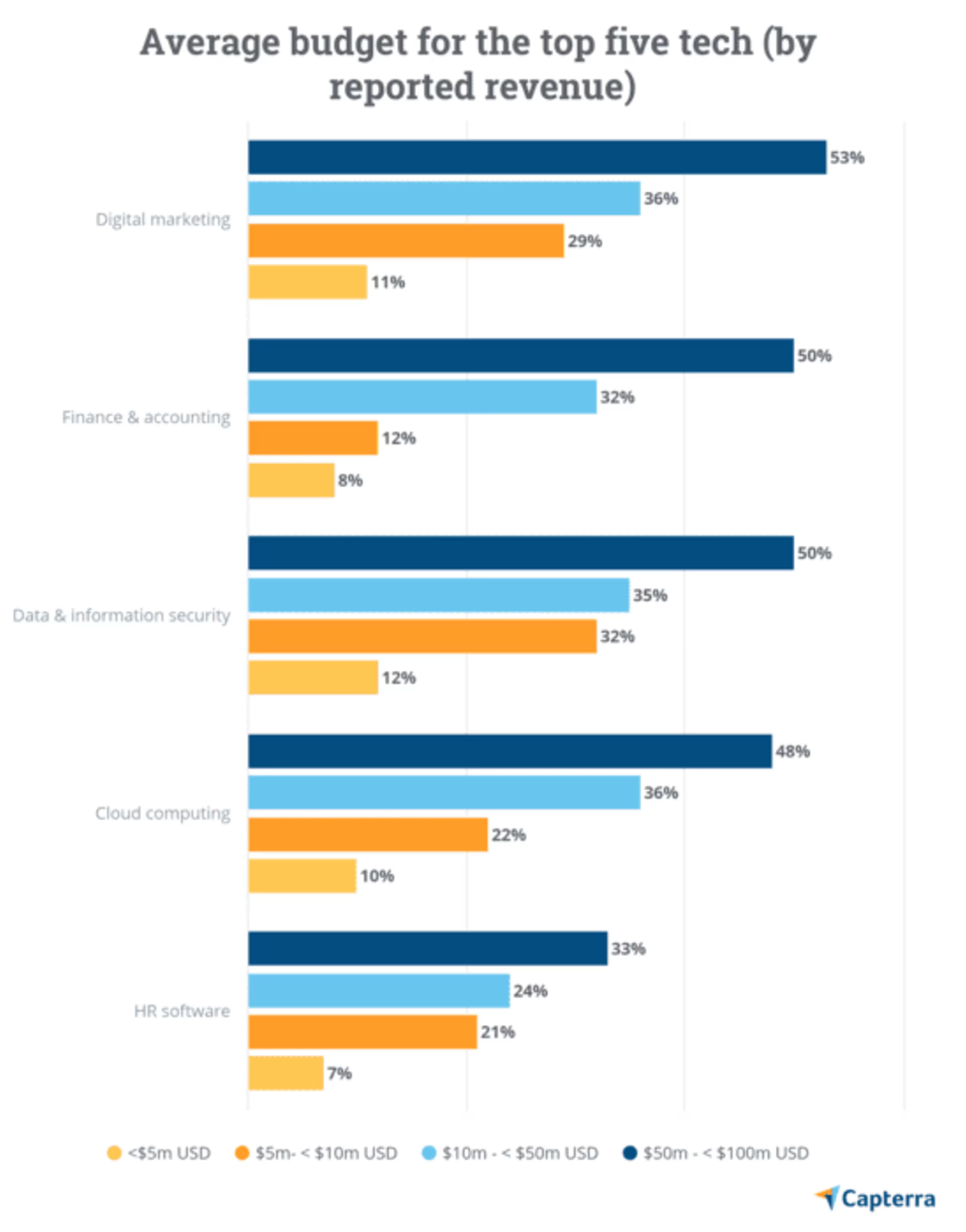

Figure 4

Data highlight:

The spread between businesses under $5 million in revenue and those between $50 million and $100 million is more than $40,000 (see Figure 4).

We also see significant variation in average spend by industry.

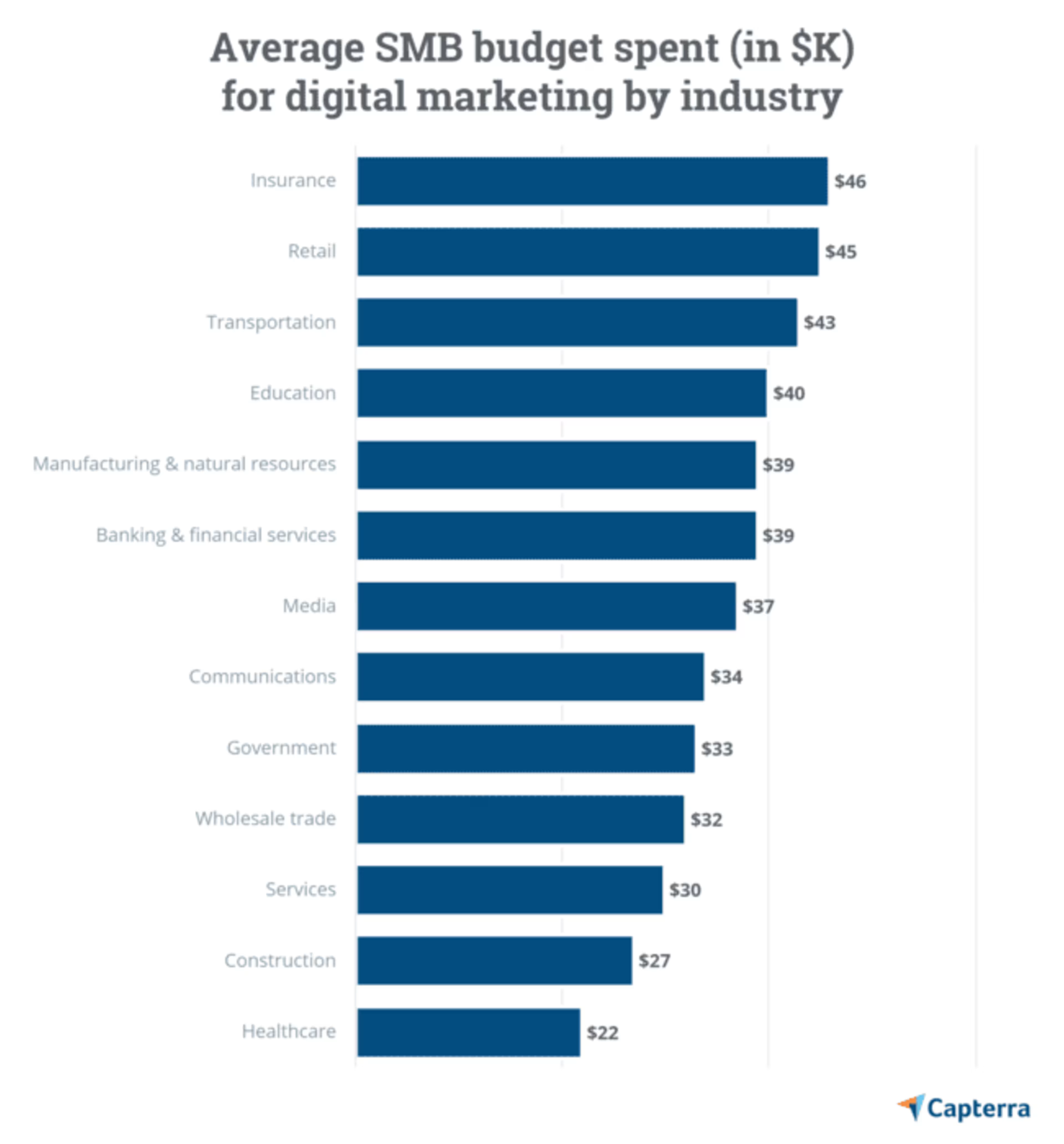

Figure 5

Data highlight

Though relatively fewer insurance firms (about 40%) are planning to spend on digital marketing, those that are building budgets have the highest average spend at $45,000 (see Figure 5).

Bottom-line recommendations:

If you plan on growing your small business, especially in the media and retail industries, you must budget for digital marketing spend to remain competitive.

If you are a smaller business in the media or retail industry, you should plan to spend between $10,000 and $25,000 on digital marketing over the next 12 to 24 months.

If you are a midsize business in the media or retail industry, you should plan to spend between $35,000 and $45,000 on digital marketing over the next 12 to 24 months.

If you are in another industry (especially insurance), you may gain competitive advantage with a digital marketing budget between $20,000 and $40,000.

Tech #3: Data and information security breaks into the mainstream

Data highlight

Over 47% of our respondents are budgeting for data security technology (see Figure 2).

Data and information security is now one of the top three hot technologies for small and midsize businesses.

This is important because government regulations and rules on privacy and data protection apply to smaller businesses as much as the behemoths.

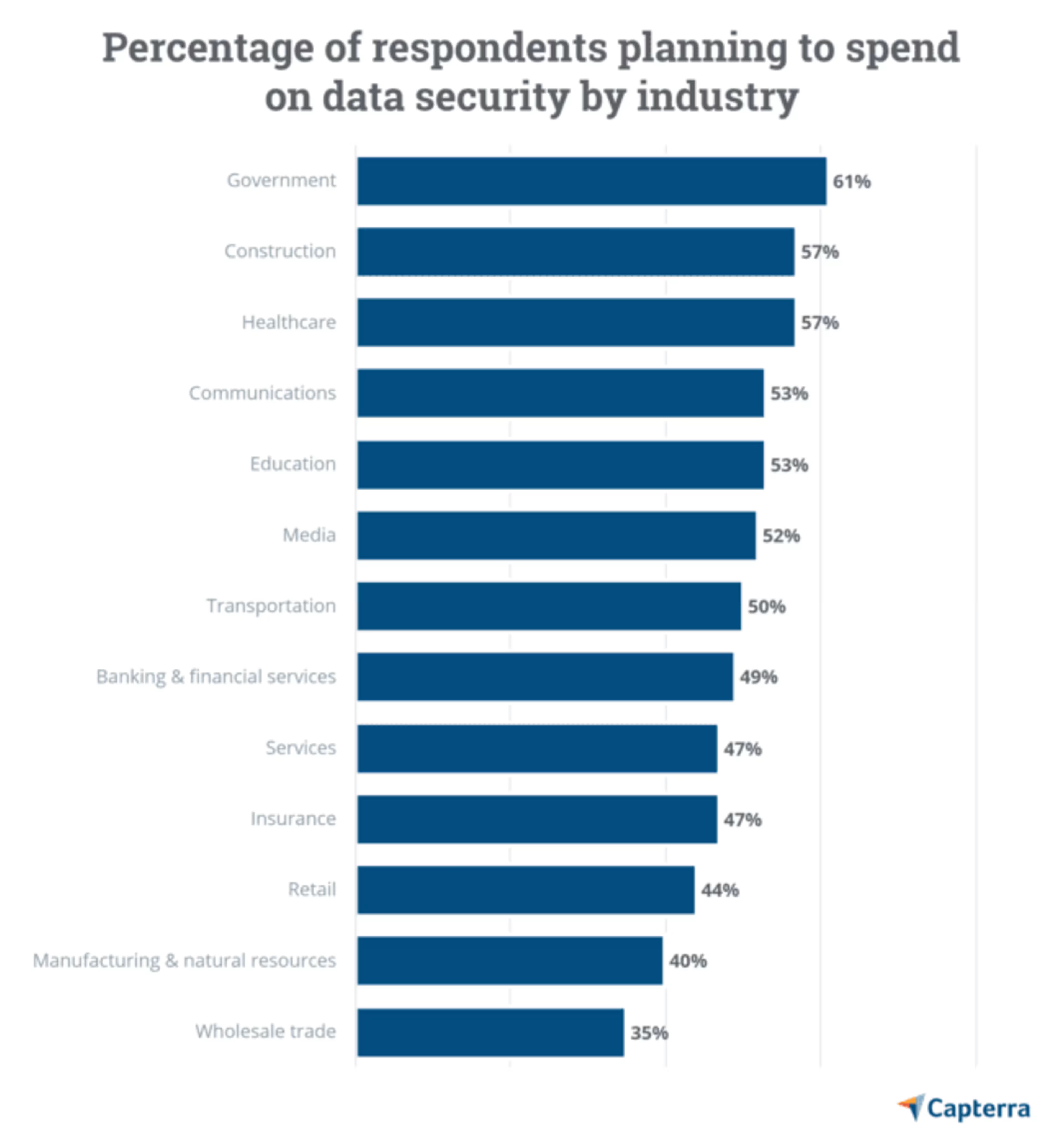

It is not surprising that with all the press that the General Data Protection Regulation (GDPR) has garnered lately that government tops the industry list for intention to purchase data security software at 61%.

Hacking is not reserved for big-name businesses either.

Research shows that cyberattacks can cost small businesses from $84,000 to $148,000 per incident and that 60% of SMBs that are hacked go out of business within six months of a breach.

Indeed, our research indicates that small and midsize businesses are recognizing the importance of data security.

Figure 6

Data highlight

The prevalence across industries is also noteworthy with our survey results showing over 40% of all industries but one budgeting for data security (see Figure 6).

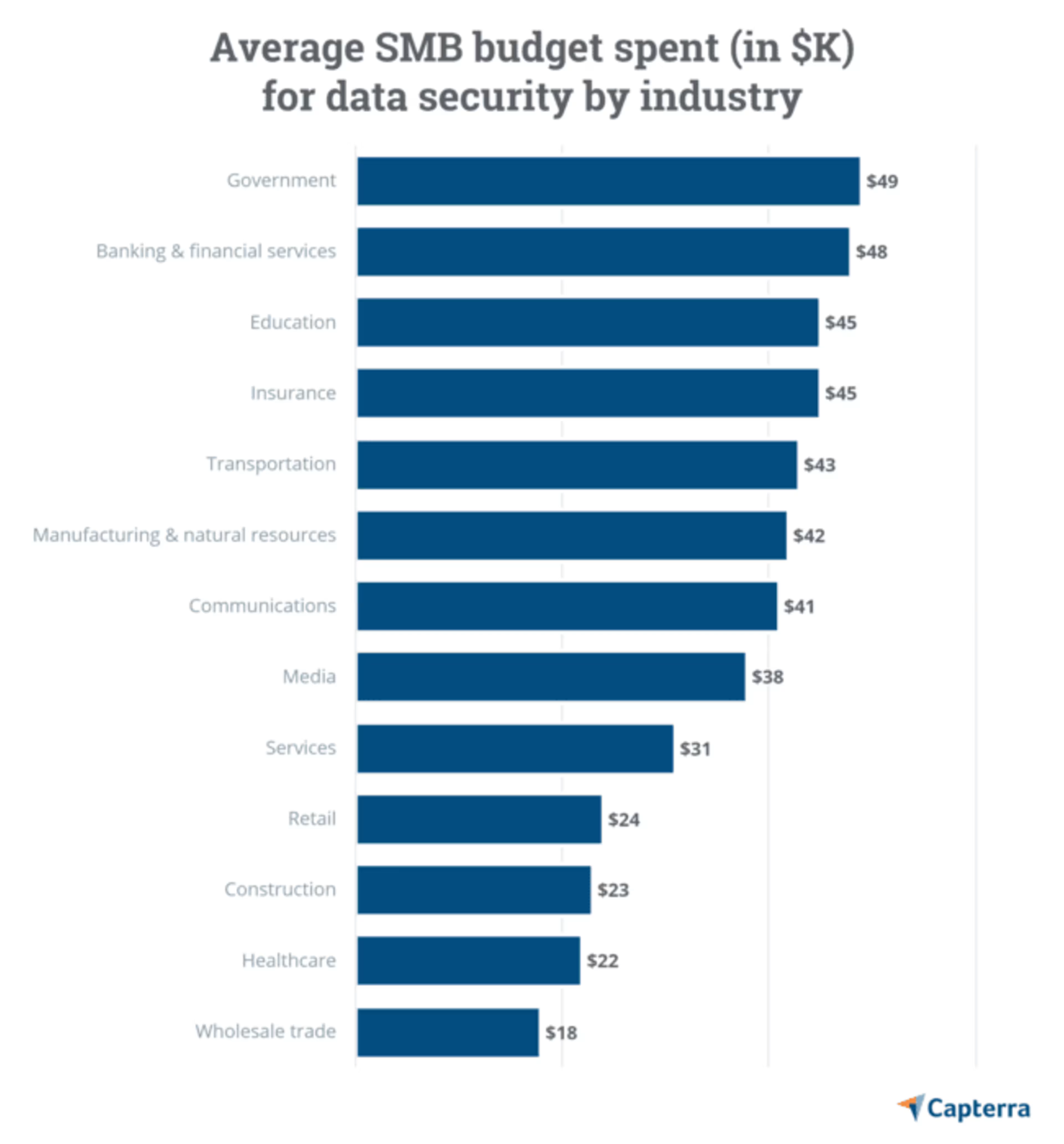

The average budget spend for data security seems to take a tiered shape for business size. This tracks with expectations as larger businesses with more data, more customers, and more employees will need more software licenses and greater functionality.

To put these budget numbers in perspective, the highest planned average spend on data and information security tech is still $34,000 less than the lowest cost estimate to recover from a cyberattack.

Figure 7

Data highlight

Government tops the industry list of the percentage of organizations with a budget for data security, and the average spend is $49,000 (see Figure 7).

Bottom-line recommendations:

If you are a government agency or work very closely with government agencies, you should plan on budgeting between $40,000 to $50,000 for data security in the next 12 to 24 months to keep up with your peers.

If you are in the education industry, anticipate a $40,000 spend to compete.

If you are in another industry, you may gain competitive advantage with a data security budget between $30,000 and $40,000.

In retail, construction, healthcare, and wholesale, the planned budget can be closer to $20,000 to keep up.

Tech #2: Cloud computing brings big power to small businesses

Cloud computing seems made for small businesses. It can deliver all the power of Amazon, Google, and Microsoft's computing infrastructure to the small business storefront. No big capital investment, pay-as-you-go pricing, no physical implementation… what's not to love?

With cloud-enabled Software as a Service (SaaS), small businesses can get access to robust business software and data storage technology without the costly upfront computing infrastructure investment.

It used to be a barrier to entry if you couldn't invest in and build your own computing infrastructure. Now, a self-built infrastructure can be more of a stodgy impediment to agility.

And so it's no surprise that small and midsize businesses are flocking to cloud software.

Data highlight

This year, cloud software is the second most prevalent technology with 47.8% of businesses surveyed budgeting for it (see Figure 1).

Nearly 50% of the businesses we surveyed that have $5 million to $100 million in revenue are budgeting for cloud computing. The rate for businesses under $5 million in revenue is much lower at 33.4% (see Figure 2).

However, that number may be higher since our research indicates that many of the smallest businesses are buying software without knowing that it is cloud software. They are buying information technology without the heavy feel of IT. That is part of the appeal of cloud computing.

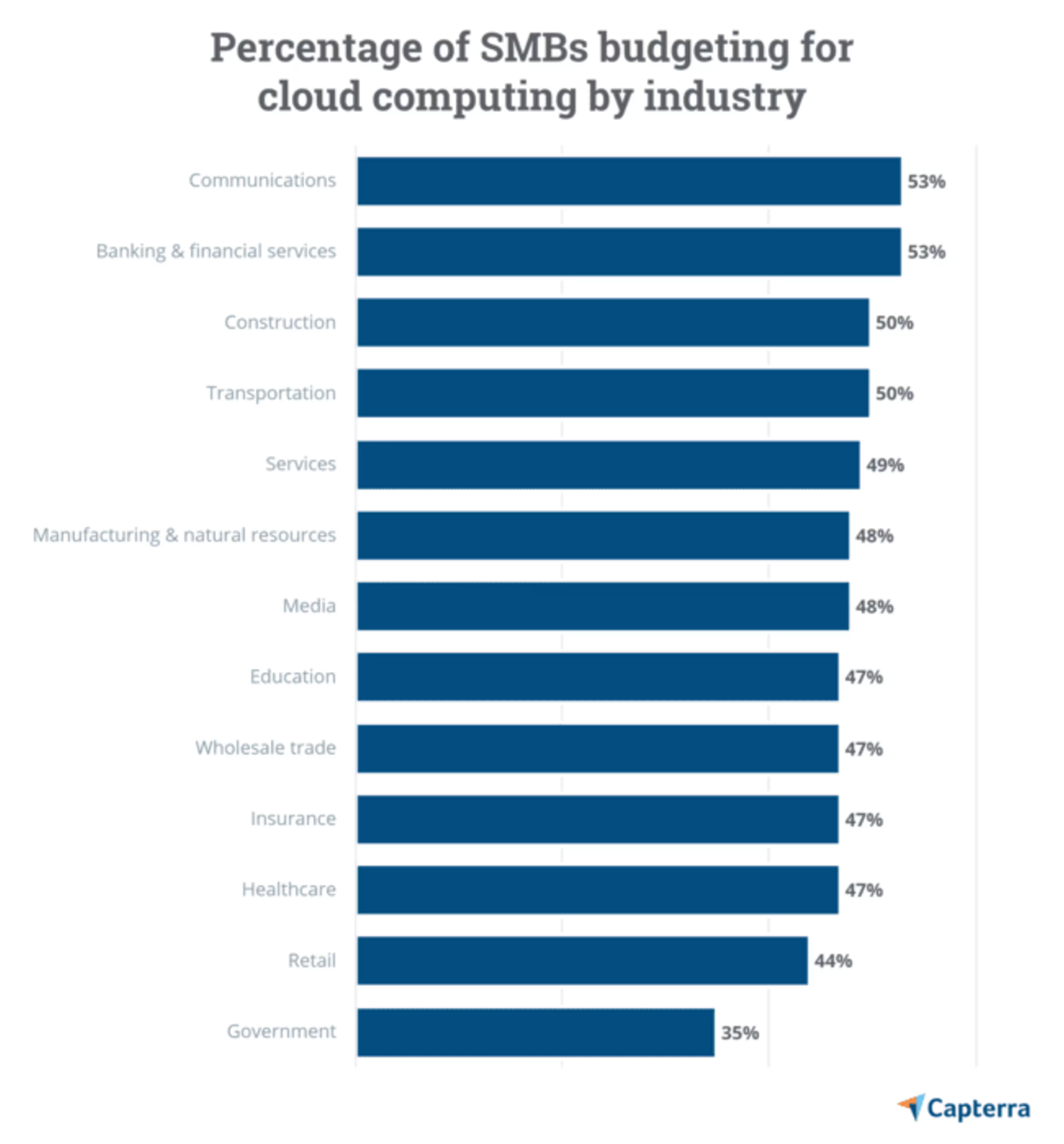

Figure 8

Data highlight

Between 45% and 55% of respondents from almost all industries indicate they have budget for cloud computing (see Figure 8).

Budgets may be consistently prevalent across business size and industry but the actual dollars in those budgets vary significantly. Smaller businesses have smaller budgets and they grow almost linearly with business size.

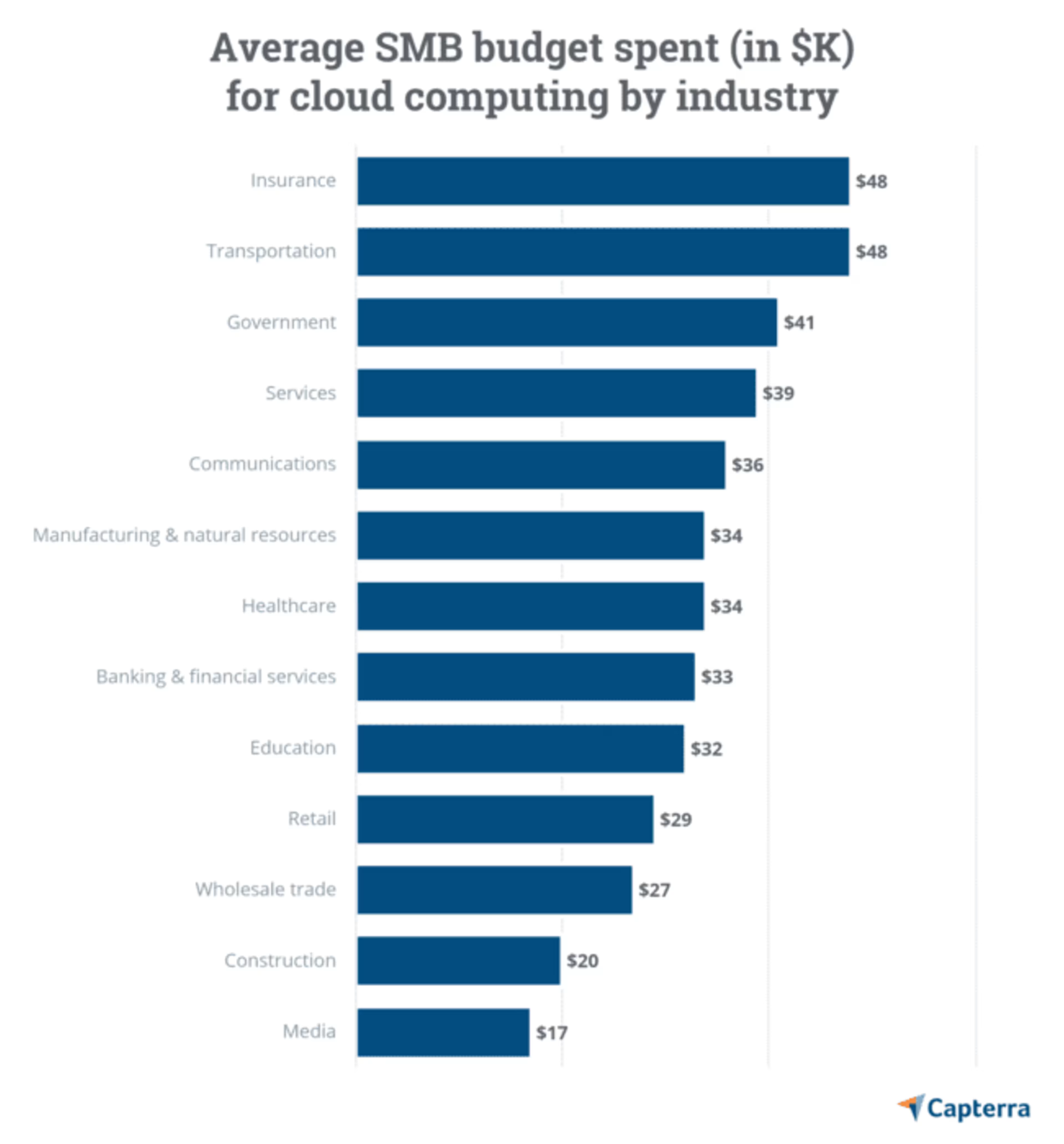

Figure 9

Data highlight

The insurance, transportation, and government industries all plan to spend over $40,000 on average for cloud computing (see Figure 9).

Bottom-line recommendations:

To remain competitive, small and midsize businesses in all industries should investigate how cloud computing can drive business value.

To keep pace with competition, insurance and transportation businesses should expect to budget between $40,000 and $50,000 in the next 12 to 24 months for cloud computing technology.

Businesses in the services, communications, manufacturing, healthcare, banking, and education sectors should consider budgeting between $30,000 and $40,000.

Tech #1: Finance and accounting software is an SMB staple

Data highlight

Finance and accounting software takes the number one spot with 53.6% of respondents budgeting for the technology (see Figure 1).

Remember the old saying that people get into business to deliver something of value, not to handle numbers? The rub is that running a successful business requires managing the numbers.

Stellar accounting practices are a hallmark of highly successful small businesses. Conversely, poor accounting practices cause cash flow problems, which are a primary reason for small business failure.

Few of us are born accountants. We need help. Accounts receivable, accounts payable, sales taxes, income taxes, reporting, and audits create a level of complexity that can derail your business if not handled properly.

Accounting software doesn't just make you more efficient, it helps keep you out of trouble.

If you can only invest in one technology in the coming two years, that technology should be finance and accounting software. Our survey indicates that small and midsize business recognize these facts (see Figure 1).

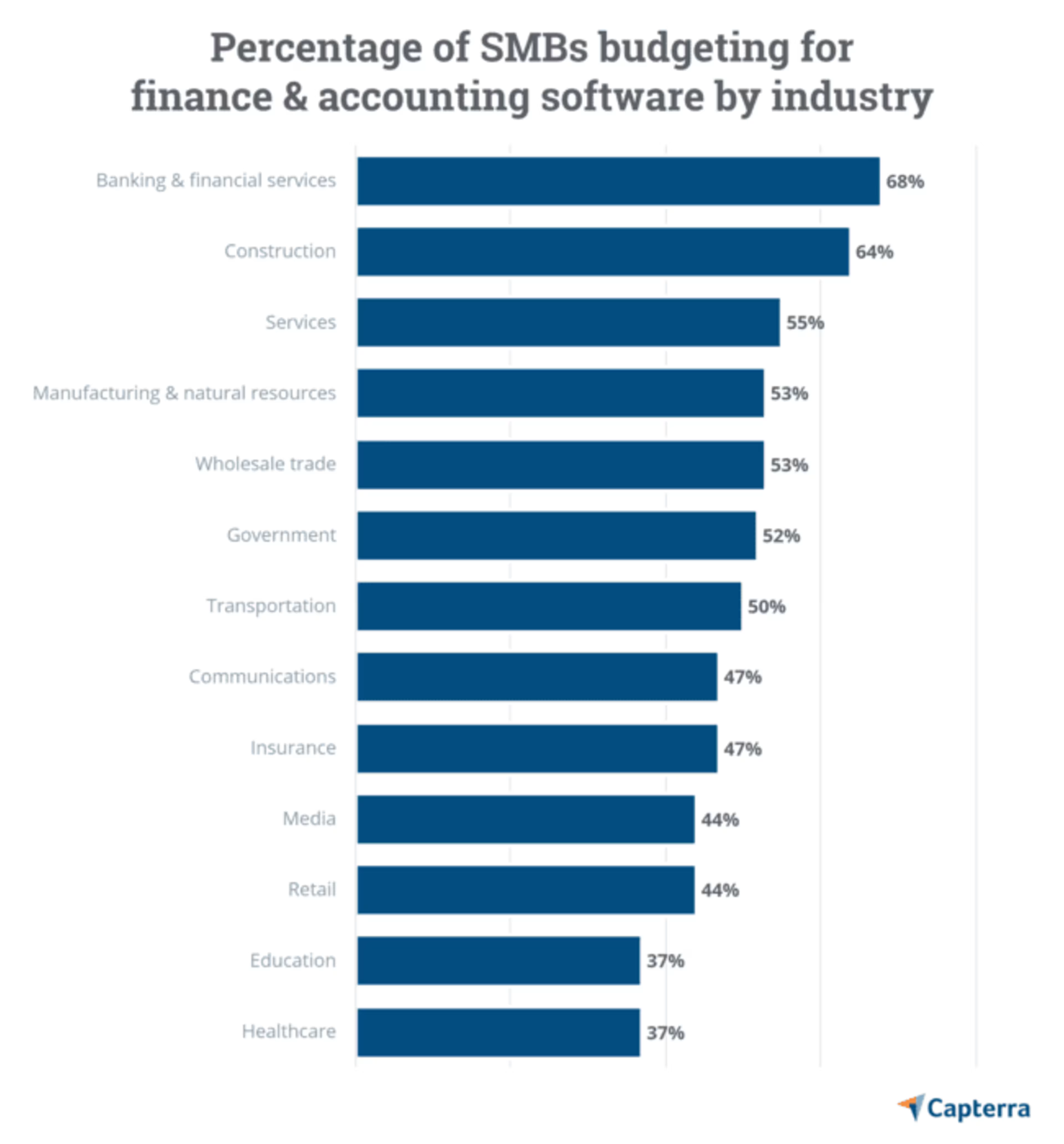

Figure 10

Data highlight

Banking and construction are standout industries with over 60% of businesses budgeting for finance and accounting software (see Figure 10).

There is surprising variation in spend by industry.

Average budget spend by industry doesn't track neatly with the percentages they have budgeted. For example, construction and services have relatively high percentages of respondents budgeting, but are on the lower end of spend with $27,310 and $25,820.

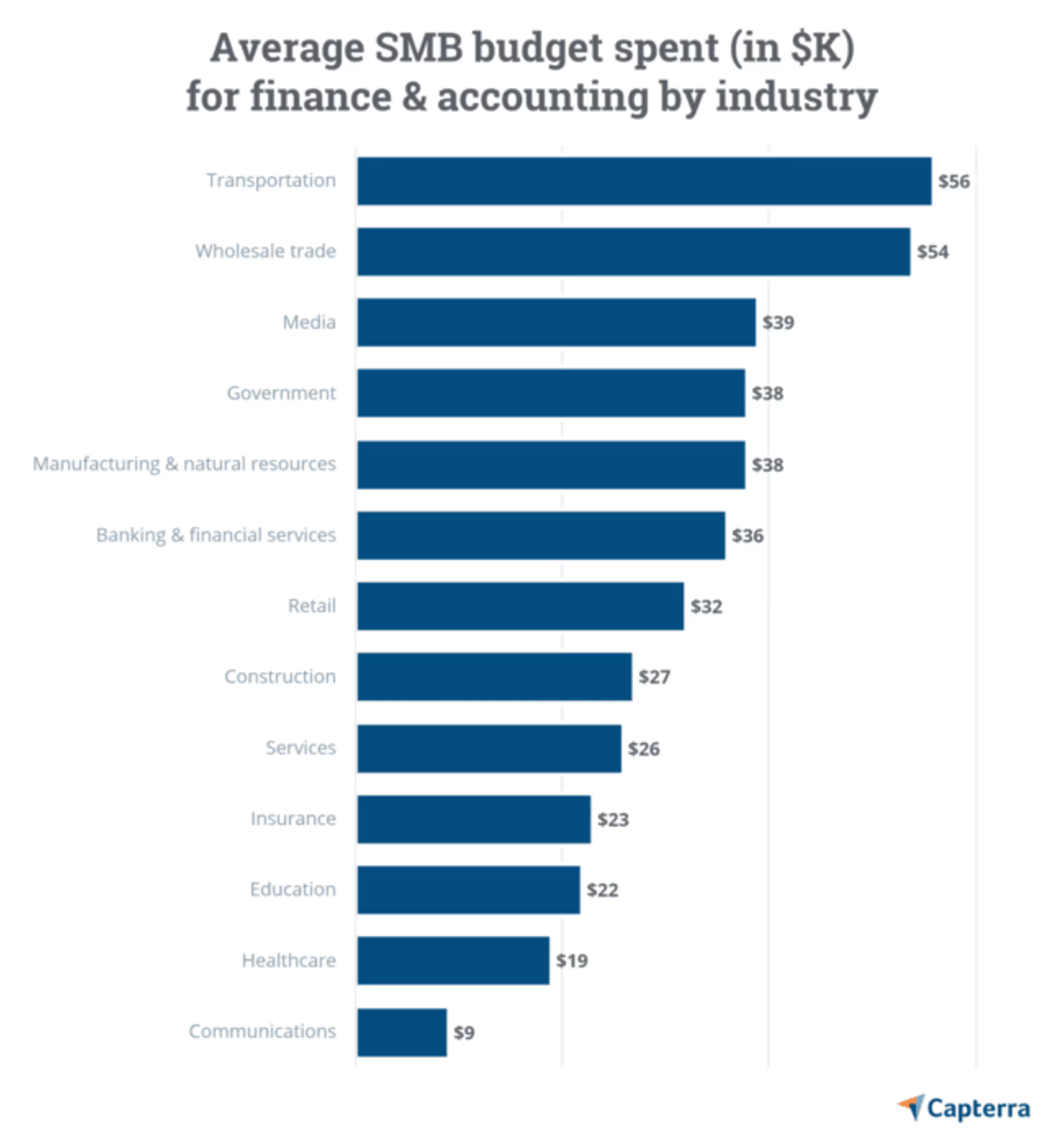

Figure 11

Data highlight

The transportation and wholesale industries have the greatest average spend at $56,330 and $53,850 respectively (see Figure 11).

Bottom-line recommendations:

Finance and accounting software is a staple technology for businesses of all sizes and should be one of the first technologies that small and midsize businesses adopt.

To keep pace with the competition, transportation and wholesale businesses should expect to budget between $50,000 and $55,000 for finance and accounting software in the next 12 to 24 months.

Businesses in media, government, manufacturing, banking, and retail should consider budgeting between $30,000 and $40,000 for finance and accounting tools in the next 12 to 24 months.

To keep up with peers, businesses in other industries should consider budgeting between $10,000 and $30,000 for finance and accounting software.

Learn from your competitors

We have used a lot of real estate here exploring which technologies small businesses are budgeting for and how much small and midsize businesses plan on spending on tech.

Why? Because in today's day and age, technology is critical to the success of any business.

And making decisions on where to spend scarce dollars on technology is a significant challenge for small business leaders. They must invest in technology and invest carefully. Being well informed on how other similar companies are investing in technology leads to better decisions.

Want to know which software programs your competitors are buying? Check out the user reviews in these Capterra software directories:

Campaign management for digital marketing

Data loss prevention software for data security

Accounting software for finance and accounting software

When you click on a vendor, you can read reviews to find out what other businesses want and need from their software. Reviews even list the reviewer's business size, so you can learn from other SMB's purchases.