Spoiler alert: No. But offering low-risk benefits can help you attract quality contractors.

Business owners and HR directors alike are aware that we’re currently in an employees’ market. HR analyst and industry expert, Josh Bersin, puts it like this:

There are more than 161 million people working and 15.7 million jobs open. This means that roughly one in 10 seats in your office are empty, and you’re competing with everyone else for staff.

Recruiting top talent has always been competitive, but the current talent shortage has amplified the struggle to fill open seats—and apparently, it’s not over yet. So, how can you, a business or HR leader, ensure that you have the people you need to deliver on business objectives?

Change your staffing strategy.

Contract workers can be a powerful addition to your workforce; for starters, they are quick to bring on board and require minimal training and oversight. But in order to become an attractive employer for contract workers, you need to create a culture and work experience where they feel valued.

Providing benefits (something that’s not usually done for contract workers) is one way to do this, but it does come with its own risks to consider. Below, we’ll explain why contract workers don’t typically receive employee benefits and provide ideas for ways to level up your contractor experience without the risk of incurring the costs of misclassification.

Ready to hire a staffing agency for your business needs? Browse our list of companies in the following areas:

The difference between full-time, contingent, and contract employees

You’ve got options when it comes to staffing your business. You can hire a full-time, permanent employee, or you can opt to bring on temporary help in the form of a contingent or contract worker. There are unique benefits associated with employing each of these workers, including how their payroll taxes and benefits are handled.

Make sure you understand the differences between each of these kinds of workers, because misclassification can lead to the Internal Revenue Service (IRS) declaring that you owe state and federal taxes.

It’s crucial to take the time to educate yourself on how to classify your employees, and the IRS is the best resource for help with that. We’ll provide just a brief overview of each type of employee below:

Full-time employee: Frequently referred to as a direct hire, these are workers who are employed by your organization. They are on your payroll, whether paid salary or hourly, and receive benefits such as paid time off (PTO) and health insurance.

Contingent employee: Contingent workers are temporary employees who may be hired to help with a specific project or season of work. In some cases, contingent workers are employed by a third-party staffing firm who partners with your organization. Otherwise, they might be on your payroll for the extent of their tenure with your team. They are typically paid hourly and provided equipment they need to work. Examples of contingent workers include freelancers and consultants.

Contract employee: Both contingent and contract workers are considered temporary employees. While distinguishing between the two can be difficult, one telltale sign that an employee is a contractor is if the employer does not withhold part of their compensation for taxes. For instance, independent contractors are considered self-employed, so if they provide their services to an organization, they receive a 1099 (instead of a W-2). They may be paid hourly or a flat fee, and they usually complete work on their own terms with their own equipment.

Thinking of hiring contingent workers? Check out this short video for an overview of the pros and cons first.

Related reading: Is Contingent Staffing Right For Your Organization?

Do contract employees get benefits?

Contract employees are usually not provided benefits by their employer.

Having covered the different types of employees, you now know that independent contractors are considered self-employed. As such, they are not eligible to receive tax-free benefits from the organization they’re working for.

For instance, if an organization decides to include an independent contractor in their benefit pension plan, they run the risk of losing the tax-exempt status of the plan. However, an independent contractor can receive health care benefits as long as they pay income taxes on the value of the benefit.

All of this to say, it’s rare that contract workers are provided benefits, but like most aspects of HR, there are exceptions.

Should you offer benefits to contract workers?

One of the primary reasons businesses opt for contract workers is to save money, so it’s completely acceptable to not offer benefits as a means of cutting expenses.

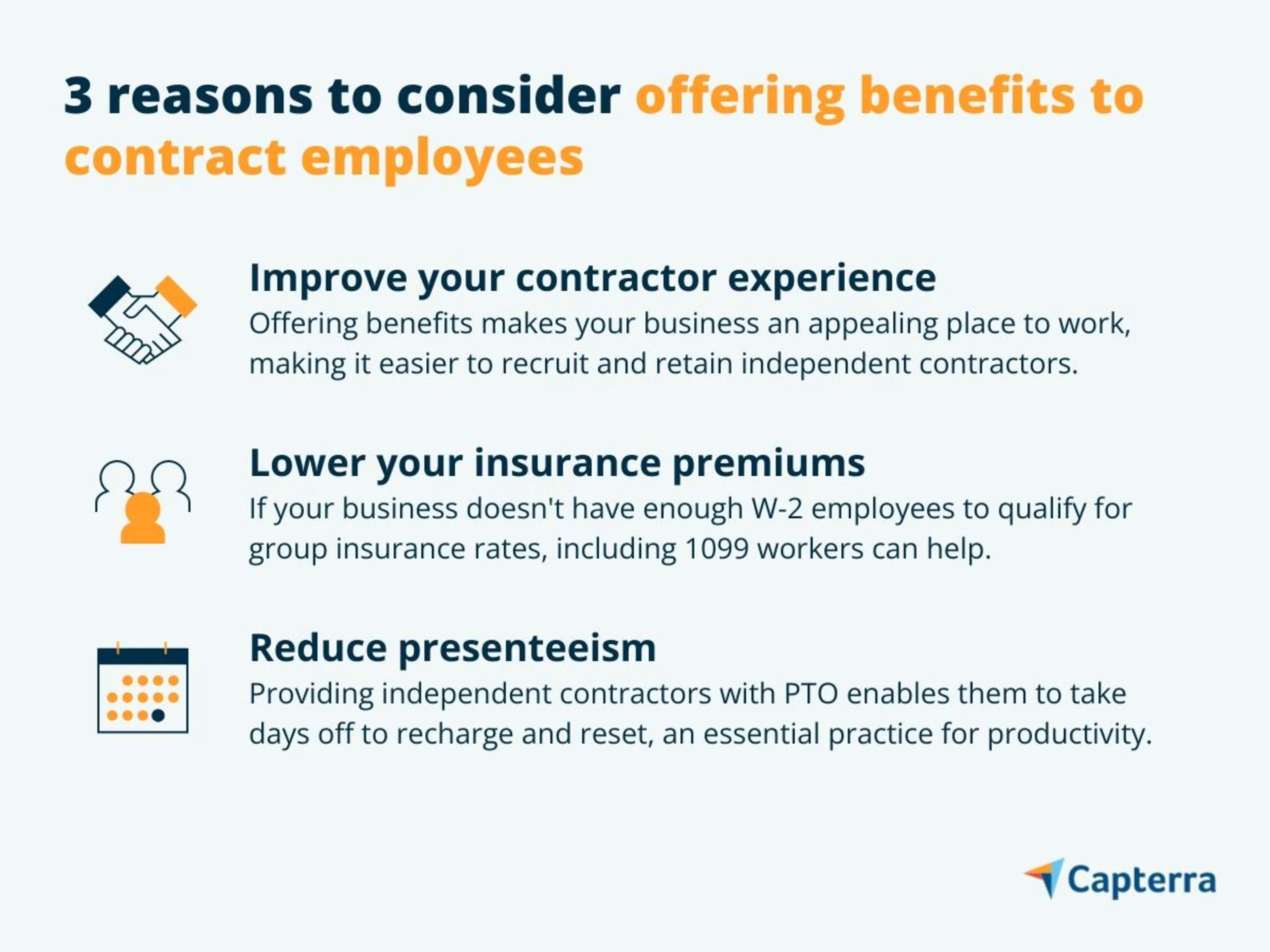

That said, there are some advantages to providing independent contractors with benefits, including creating a better contractor experience and reducing your insurance premiums.

Examples of benefits to consider offering contract employees

If you’re considering offering benefits to your contract job workers, let us start with a word of caution: Every perk you provide them with can affect the relationship's balance and increase the risk of them being classified as a direct employee—even if the employment contract makes it clear they are an independent contractor.

With that in mind, here are some examples of low-stakes benefits you can provide to contract hires:

Health-care stipends: Of all the benefits gig workers miss out on, health insurance is the most essential. However, it’s dicey to include contract workers in your health plan, so it’s best to avoid it. One thing you can do is provide a stipend to temporary workers with the intent for it to be used on any health-related expenses they incur.

Emergency relief fund: A crisis’s impact is only magnified by a lack of insurance coverage. Setting up an employee assistance fund (EAF) or emergency relief fund can make a big difference for those in a contract position who find themselves or their loved ones in an emergency situation.

- Education and development opportunities: Usually, access to development programs is reserved for full-time employees. But investing in your independent contractors’ career aspirations isn’t just one more reason for them to want to work with your business—it’s also a strategy that can lead to them becoming a boomerang employeeA boomerang employee is an employee who leaves a company they work for, but then later returns to work for the company once again.in the future.

For more guidance on the type of benefits that are approved for independent contractors, check out the Society for Human Resources Management (SHRM)’s What Benefits Can Companies Offer Gig Workers?

TLDR: Contract workers can be a great asset to your organization, and creating a work environment where they know they are valued will improve your retention and recruitment efforts. However, offering benefits puts you at risk of misclassification, so tread carefully when doing so. Check out our tools and tips below for our final recommendations for creating a positive contractor experience at your business.

Capterra Tools and Tips

Educate yourself on how to correctly classify employees. The financial consequences of misclassifying an employee can be detrimental to your bottom line. If you plan on hiring contingent or contract employees, take time to understand how the IRS distinguishes between different types of employees.

Pay contract workers more. The safest way to ensure independent contractors are both well-taken care of and classified correctly is to opt out of providing benefits and pay them a higher wage or rate.

Ask for your contract workers’ opinions. If you do decide to offer benefits to contract workers, don’t guess what they want, ask them. Doing so provides information you can use, and it also sends the message that they are important to your company.

If you liked this content, there’s more to explore. Visit our talent management blog for the latest HR research and findings our team has uncovered.