Offer an employee benefits package your future and current workers will love.

The benefits package your company offers does matter, and there's a high cost in terms of attracting and retaining talent if you get it wrong. According to Capterra’s recent survey, benefits are critical to employee retention: Most HR leaders (57%) say employee benefits are extremely important to retaining top talent. Among large businesses (1,001+ employees), that number jumps to 67%.*

But maybe you're a new or growing business with no idea where to begin when it comes to creating and offering a competitive employee benefits package.

Use this step-by-step guide to figure out the right benefits mix, estimate costs, and set up benefits administration so you can offer a competitive employee benefits package that job seekers and current team members alike will love.

What is compensation and benefits?

Compensation is the money you pay an employee for their work. This includes wages or salary, commissions, and annual bonuses. Benefits are the additional perks you offer employees, such as health insurance, equity and stock options, retirement plans, the flexibility to work from home, paid vacation days and reimbursement for tuition or other learning opportunities.

Competitive compensation and benefits packages offer a variety of financial and non-financial rewards.

5 types of compensation

Employees expect to be paid for their contributions to your company, and a competitive compensation package acknowledges this. Here are five types of compensation you might offer to your workers.

1. Base pay

Whether your employees are hourly or salaried, their base pay should be on par with your industry and the cost of living in your area, especially if workers are expected to live within a certain radius of the company.

If your base pay is not enough, employees may leave for a competitor or get side gigs to make ends meet.

2. Commissions

If your employees work in sales, incentivize them further by giving them a cut of what they sell.

3. Bonuses

Your company’s success is also your employees’ success. Appreciate their hard work by giving them bonuses.

4. Stock options

Offer your employees a stake in the company’s long-term success by giving them stock options.

5. Per diem for travel

If travel is required for the job, don’t make the employees pay for company business out of their own pockets. Offer an allowance for business trips that covers travel, meals, and housing.

5 types of benefits that can inspire your benefits package

Unlike compensation, the benefits you offer employees can be creative. Some of these benefits may have a financial value, such as insurance and stock options, while others may be giving time back to the employees, in the form of paid leave.

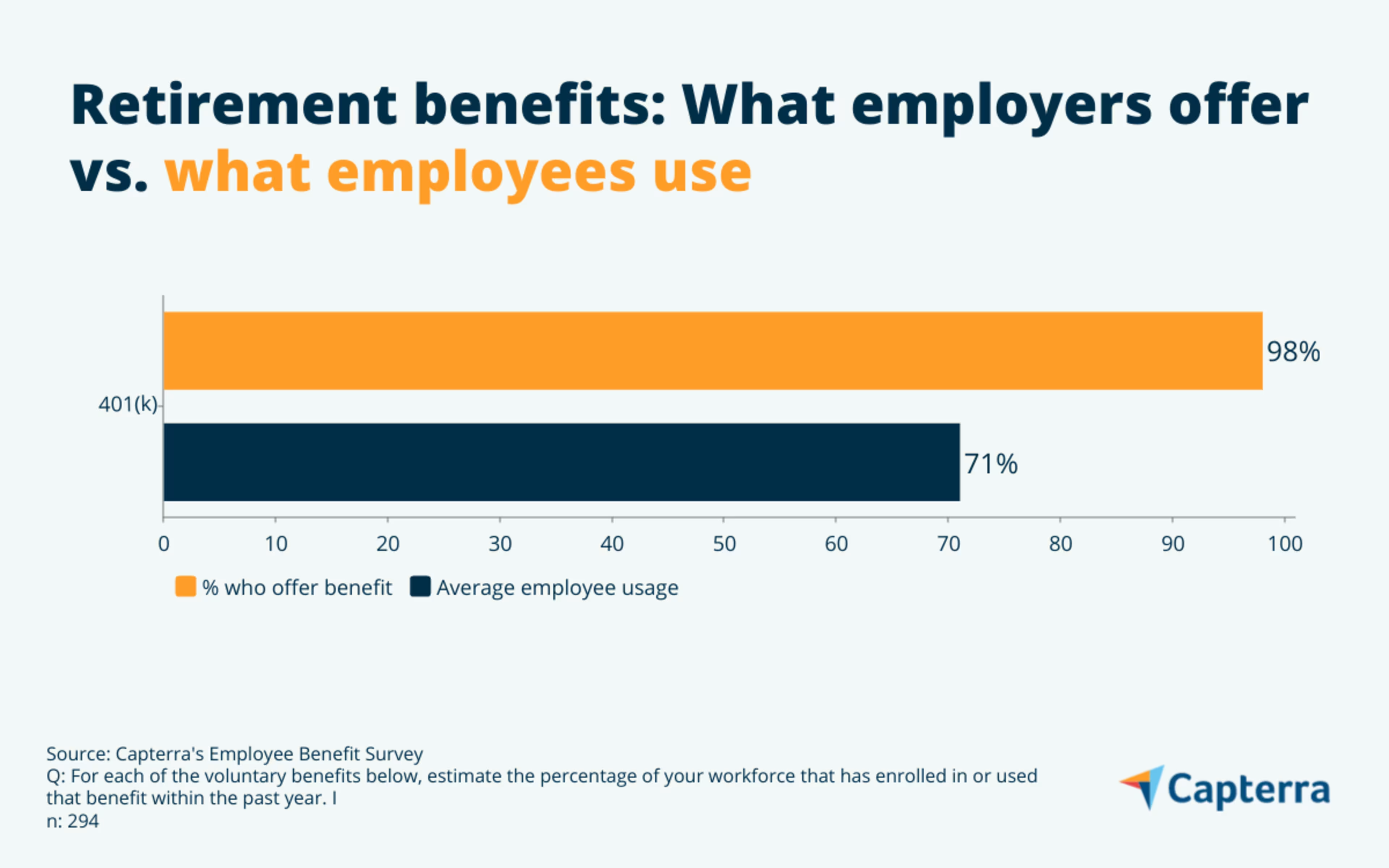

Retirement benefits (401k)

By offering employees a 401(k) and matching their contribution, you help them save for their future. According to our research, this is the most common benefit employers offer, and the one employees use the most.

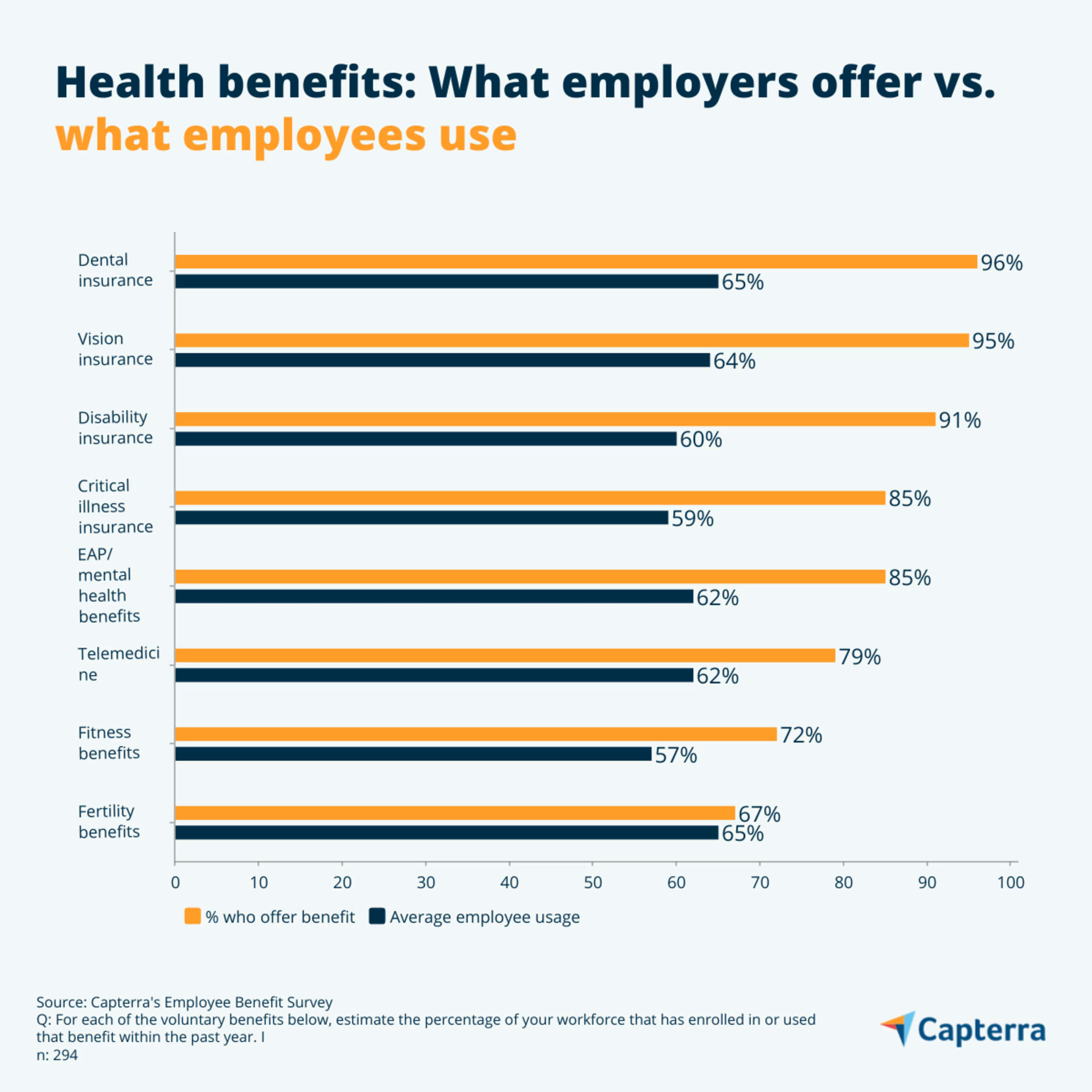

Health benefits

Health benefits may include health insurance and preventative measures, such as discounted or fully-paid gym memberships.

Your health insurance benefits may be all-inclusive or you may give employees the choice to opt in to certain types, such as dental and vision. Other types, such as disability and critical life insurance, could be automatically offered to employees as needed.

You could also consider offering medical insurance for procedures or treatments not always covered by health insurance, such as fertility treatments.

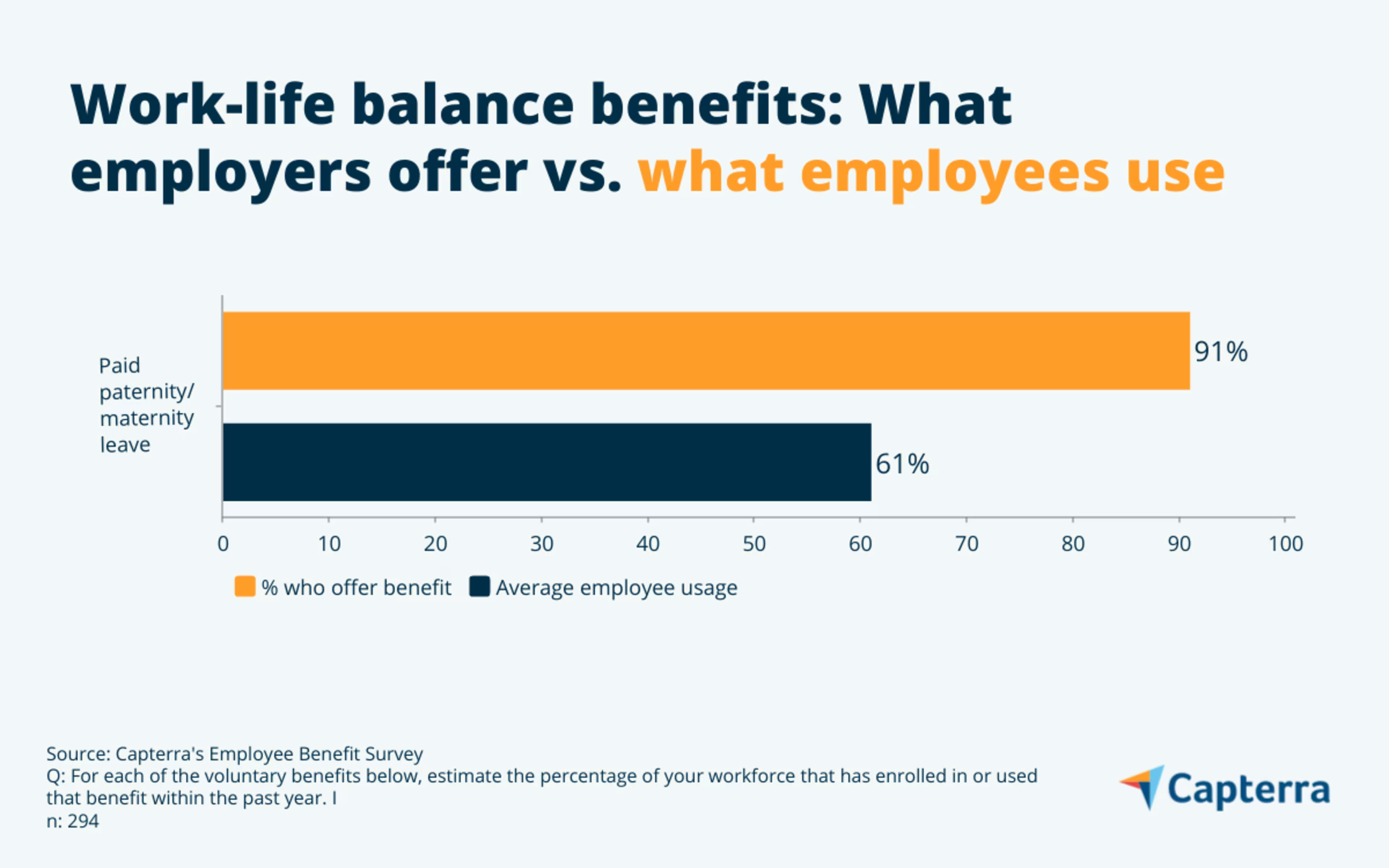

Work-life balance benefits

Another way to reward employees is by giving their time back to them. This could be saving them time from their commute by offering a hybrid work model and allowing them to work from home some days.

This could also mean giving them paid time off for vacations, paid sick days, and paid paternity and maternity leave. By giving them paid time off, you give them time to reset, heal, prevent burnout, and spend time with their families.

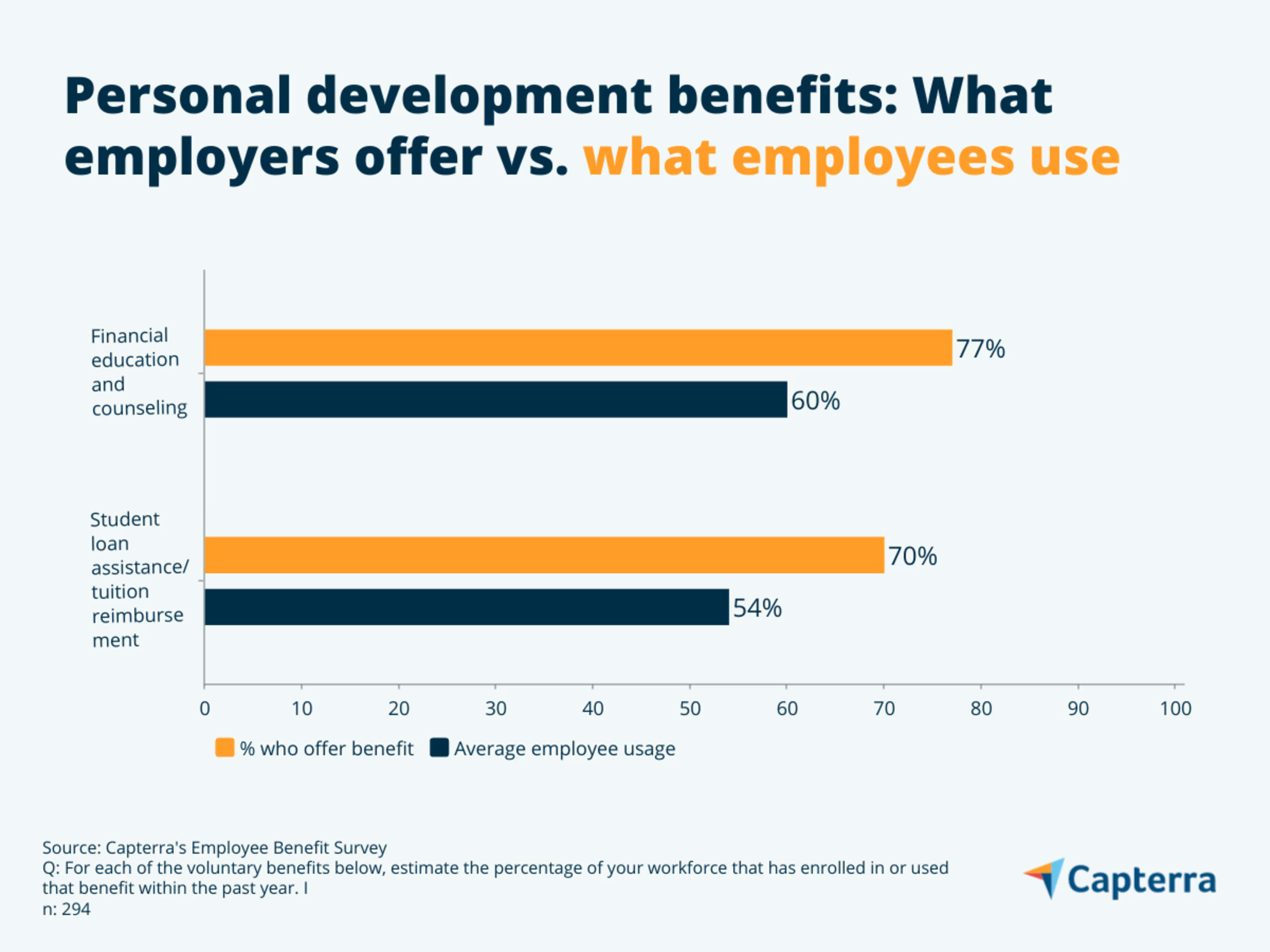

Personal development benefits

Some benefits could be investments in professional development opportunities your employees have already taken or would like to take in the future. These could include financial literacy counseling, student loan assistance or tuition reimbursement benefits.

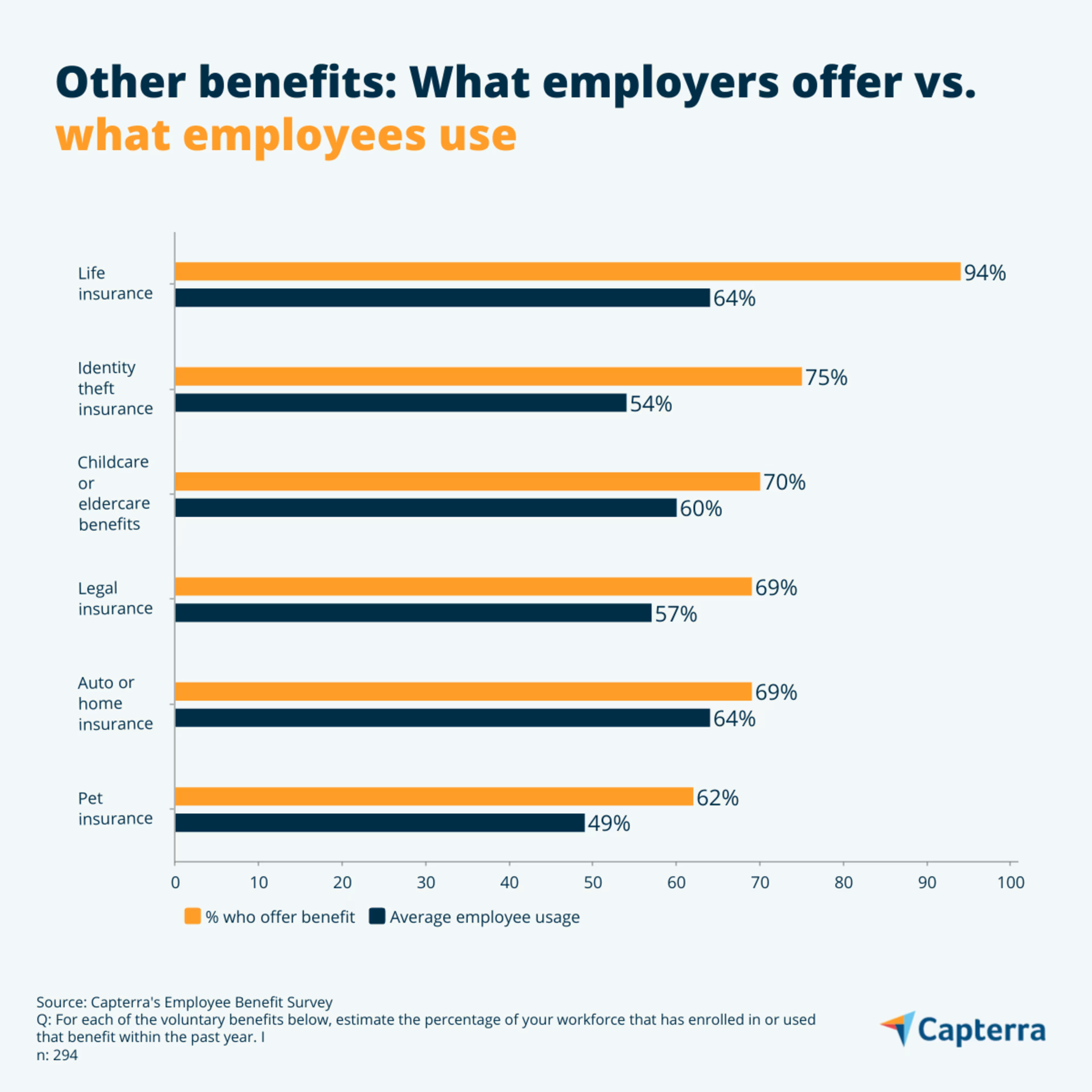

Benefits that give employees peace of mind

Some benefits could just give employees an extra sense of security in their lives, such as identity theft insurance, life insurance, legal insurance, home and car insurance, and pet insurance.

You could also offer childcare and eldercare benefits to employees with children or who are taking care of their grandparents or aging parents. This could take off some of the stress your employees face outside of work and improve their quality of life, which could also help them focus during the workday.

How to create a competitive compensation and benefits package

A compensation and benefits package is like a puzzle. How do you figure out the pieces?

Here are four steps to build a competitive compensation and benefits package. And remember: Periodically re-evaluate your package to make sure what you’re offering your talent stays competitive.

Step #1: Figure out which benefits you need to offer

There may be benefits that you have no choice but to offer, as per U.S. law. Figuring out what these benefits are is the first step when creating any employee benefits package.

Benefits requirements based on size

Depending on how many employees you have, you may be required to offer certain benefits.

For example, according to the “employer mandate" of the Affordable Care Act (ACA), companies with 50 or more “full-time equivalent" (FTE) employees—defined as those who work at least 30 hours a week averaged over the course of a month—must offer health insurance or pay a per-employee penalty.[1]

Your FTE calculation includes hours for part-time employees, so do the math to see if you qualify now or may qualify soon based on your growth hiring goals. HealthCare.gov offers a handy calculator for this on its website.[2]

It's a similar situation when it comes to the Family and Medical Leave Act (FMLA).[3] Under the FMLA, companies with 50 or more employees for 20 or more weeks in the current or previous calendar year must offer 12 weeks of unpaid FMLA leave to eligible employees. Employees are eligible for FMLA if they:

Have worked for your company for at least one year.

Have completed at least 1,250 hours of work for you during the 12-month period prior to their FMLA leave.

Work at a location where you employ at least 50 people within a 75-mile radius.

Benefits requirements based on location

You may also be on the hook for offering certain benefits depending on your location.

Some U.S. states require businesses to offer paid sick leave, paid family leave, or both.

Even if your state doesn't require paid sick leave, your city or county still might. The National Partnership for Women & Families offers a great guide[4] on these laws (just jump to page 11).

On the other end of the spectrum, every state but Texas requires most employers to provide workers' compensation insurance. The National Federation of Independent Business (NFIB) breaks down all of the details.[5]

Yes, there are exceptions

Is that everything? Not quite. There're also necessary payroll deductions for things such as social security and unemployment insurance. Talk to your payroll provider if you have questions about this.

Making matters even more complicated, there are exceptions to a lot of these requirements. Best practice is to always talk to your legal counsel to ensure you're in compliance.

Step #2: Decide which benefits you want to offer

With required benefits out of the way, it's time to focus on the additional benefits you want to offer to entice job seekers and retain workers. The options here are as limitless as your imagination, ranging from your usual benefit suspects, such as paid time off (PTO) and 401(k) retirement plans, to really unique ideas such as paying off student debt or a company music room.

However, don't rely solely on data from what other companies are doing. Figure out which benefits to offer by:

Surveying your own workers. Asking your own employees about which benefit offerings they want most will give you targeted insight into how to round out your employee benefits package.

Adding benefits that align with your company's mission or values. Did you know that employees at Jack Daniel's get a free bottle of whiskey every month?[6] Besides being a fun benefit, it also brings workers closer to the product they make every day. Anytime you can align benefits with what your company does or how it should act, do so.

Paying attention to long-term savings. Helping your employees can help you as well. What about letting employees work from home, which can help you conserve office space, while saving them a commute? Don't forget how you can benefit from benefits too.

Whatever you decide, think big. At this stage, it's better to be overly ambitious and cut things during the budgeting phase than to leave options off the table when brainstorming.

Step #3: Create a budget and estimate costs

Now, it's time to get down to brass tacks and figure out what you can actually afford to offer in your employee benefits package. Luckily, you don't have to start from scratch; there are a ton of online resources to help you estimate.

For starters, the Bureau of Labor Statistics (BLS) releases their “Employer Costs for Employee Compensation" report every quarter detailing how much, on average, U.S. businesses are spending on benefits.[7] As an example, in June 2023, U.S. employers spent $12.06 per hour worked on benefits. The BLS breaks this data down further by type of benefit, industry, business size, and even geographic area to give you more relevant estimates.

The BLS also releases an annual report called “Employee Benefits in the United States" that not only provides data on the benefits employees have access to, but also the ones they actually use (find the stat called “take-up rate").[8] This info can help you predict participation rates with your voluntary benefits and estimate how much employees will contribute to help cover costs.

These resources can aid your benefits budgeting efforts too:

The International Foundation for Employee Benefit Plans (IFEBP) has a ton of resources and research results, such as data that presents benefits costs as a percentage of total payroll costs.[9]

The Kaiser Family Foundation (KFF) runs an annual survey that breaks down key costs related to employer-sponsored health coverage.[10]

In the benefits section of their website, the Society for Human Resource Management (SHRM) offers beginners guides to benefits, up-to-date information on important benefits laws, and interesting benefits trends data (including cost-related trends).[11]

If a benefit appears to be too expensive, you may have options to lower the cost. Newly created Association Retirement Plans (ARPs), for example, allow small businesses to partner up to gain the ability to offer employee retirement plans.[12]

Once you've estimated your budget and the costs of different benefits options, you can pick and choose the benefits you want in your employee benefits package.

Step #4: Evaluate and select benefits providers

You now have an employee benefits package. Unfortunately, there's still one more step. To turn your employee benefits package into a reality for your workers, you need help from a benefits provider: A company that takes on the responsibility of providing and administering employee benefits.

When it comes to benefits providers, you (generally) have the five following options. Let's look at these options in more detail and weigh the pros and cons of each.

1. Benefits administration software

Sold standalone or as part of a more comprehensive HR software suite, benefits administration software allows companies to manage and administer employee benefits themselves. The software can walk employees through enrollment, track participation rates and costs, and generate reports for compliance purposes.

The types of benefits such software vendors can administer vary, as does how they actually offer benefits. Some vendors partner with licensed benefits brokers, while others are actually licensed benefits brokers themselves. It's a subtle difference, but one that can impact your options and costs.

Pros | Cons |

|---|---|

Gives you the most control over benefits administration | Vendors that are brokers themselves may not be available in all states |

Can integrate with your payroll software to automate deductions | Requires in-house personnel to manage |

Want to learn more about the top benefits-administration software options?

2. Professional employer organizations (PEOs)

Imagine an HR department as an entire company, and you'll start to understand the concept behind PEOs. With PEOs, companies can outsource all of their HR needs—including benefits administration—for a fee.

Typically used by small businesses that lack dedicated HR personnel, a major benefit of PEOs is what is called “co-employment." In a co-employment relationship, your PEO becomes the employer of record. That means if something goes wrong, your PEO is liable. The government can go after the PEO, and your employees can sue the PEO too.

Pros | Cons |

|---|---|

Lifts the burden of administration | Cost-prohibitive for organizations with 100+ employees |

Reduces liability | Employees have to work with an outside company to make changes |

3. Insurance agencies or brokerages

Instead of going through a third party like the first two options above, you can choose to work directly with insurance companies through their partnered agencies and brokerages.

It's important to understand the difference between an agent and a broker though:

An agent works on behalf of the insurance company, while a broker works on your behalf.

Within the agency network, you also have independent agents that work on behalf of multiple insurance companies and captive agents that only work for one.

Make sure you understand your broker or agent's relationship with insurance companies first to avoid getting a bad deal or funneled into limited benefits options.

Pros | Cons |

|---|---|

Can negotiate better rates | Have to negotiate and manage relationships with multiple vendors |

Gives you the most options | May use proprietary software that's hard to learn and use |

4. Small Business Health Options Program (SHOP)

Set up through the ACA, SHOP is the government-backed program that allows small businesses with 50 or fewer FTE employees to offer health and dental insurance.[13] For many companies of this size, SHOP is the only affordable way to offer these benefits.

Pros | Cons |

|---|---|

Affordable | Only an option for small businesses, and in certain areas |

Potential tax credits | Doesn't cover a ton of benefits |

5. Niche providers

“Niche providers" is a catch-all here for alternative organizations that may offer benefits administration services, such as banks and credit unions, and/or companies that can help you with atypical benefits, such as tuition reimbursement or commuter benefits.

Pros | Cons |

|---|---|

Allows you to offer niche benefits you couldn't administer otherwise | Inefficient and costly to use a niche provider for a single benefit |

Did you catch all of that?

Here's a summary of what we just covered about the different types of benefits providers. Weigh your options carefully to select the best mix of providers that will offer the benefits you want at the lowest cost, with minimal administration headaches.

Type of provider | Benefits offered | Pros | Cons |

|---|---|---|---|

Benefits administration software | Varies | + Control + Integration with payroll | - Might not be available in your state yet - Requires in-house personnel |

Professional employer organizations (PEOs) | Varies | + Easy to administer + Reduces liability | - Too expensive for 100+ employee companies - Employees have to work with outside org |

Insurance companies, agencies, or brokers | Varies | + Can negotiate better rates + Most options | - Managing relationships with multiple vendors - Proprietary software that's hard to learn and use |

Small Business Health Options Program (SHOP) | Health and dental insurance | + Affordable + Potential tax credits | - Only for small businesses - Doesn't cover a ton of benefits |

Niche providers | Varies | + Only means to offer certain benefits | - Inefficient and costly |

Attract and retain employees with competitive compensation and benefits

Your employee benefits package has never been more important. Organizations across the country are dealing with a myriad of talent management issues, from hiring shortages and worker skills gaps, to job hoppers and employee burnout.

It's tough sledding out there. But a great employee benefits package has the potential to solve these problems by attracting the best job seekers and giving workers the help they need to stay and thrive.

NOTE: This article is intended to inform our readers about business-related concerns in the United States. It is in no way intended to provide legal advice or to endorse a specific course of action. For advice on your specific situation, consult your legal counsel.