The year is 2019. The future is now. We've heard wind on Mars, dethroned Justin Bieber's “Baby" as the most disliked video on YouTube, and created burgers stuffed with macaroni and cheese.

Your future is now, too. It's time for you to take your small or midsize business (SMB) across the globe to the European Union. We've touched on what's waiting on the other side of the pond before, but there's still a lot more to learn.

Many SMBs lack the resources to research the size, scope, and operations of buyers in other countries. For those looking to expand internationally, this can severely hinder the efficacy of their marketing.

By researching the demographic data of French and German SMBs, companies in the United States can better know who they're marketing to, and how much money is available for them.

That's why Gartner Digital Markets asked 270 SMBs in France and 270 in Germany, as well as 700 in the United States, about their 2019-20 business software budgets and purchasing intentions (to read more about our methodology, click here).

France and Germany are both fiscally strong countries (ranking third and first, respectively, in the European Union) that have exhibited consistent adoption of myriad technologies. Looking at these countries' tech budgeting plans can provide a clear picture of the forefront of EU technological interests.

In this article, we'll take a look at what you can learn from comparing the SMBs in these two countries, which locations might be more receptive to international expansion, and what lessons you can take from your knowledge of American markets with you.

First, are you ready to expand?

Before you decide it's time to expand, you have to make sure you're ready. Answer these four questions to see if you are:

Do you have the infrastructure in place to expand?If not, focus on adapting your sales, production, and customer service team to meet much higher demand.

Do you have the financial resources in place to expand?If not, build your client base stateside. In fact, some of the tips in this article will still apply to you, so keep reading!

Do you have the language skills necessary to expand?If not, start by understanding the language and culture of the region you want to expand to.

Do you know how much money is available for you out there in the European Union?If not, keep reading!

Where is the money in France, Germany, and the U.S.?

Let's take a look at the following three graphs. For each of these countries—France, Germany, and the United States—we took the top three most-budgeted-for software types and broke them down by the size of the businesses investing in them in order to look at their rate of investment.

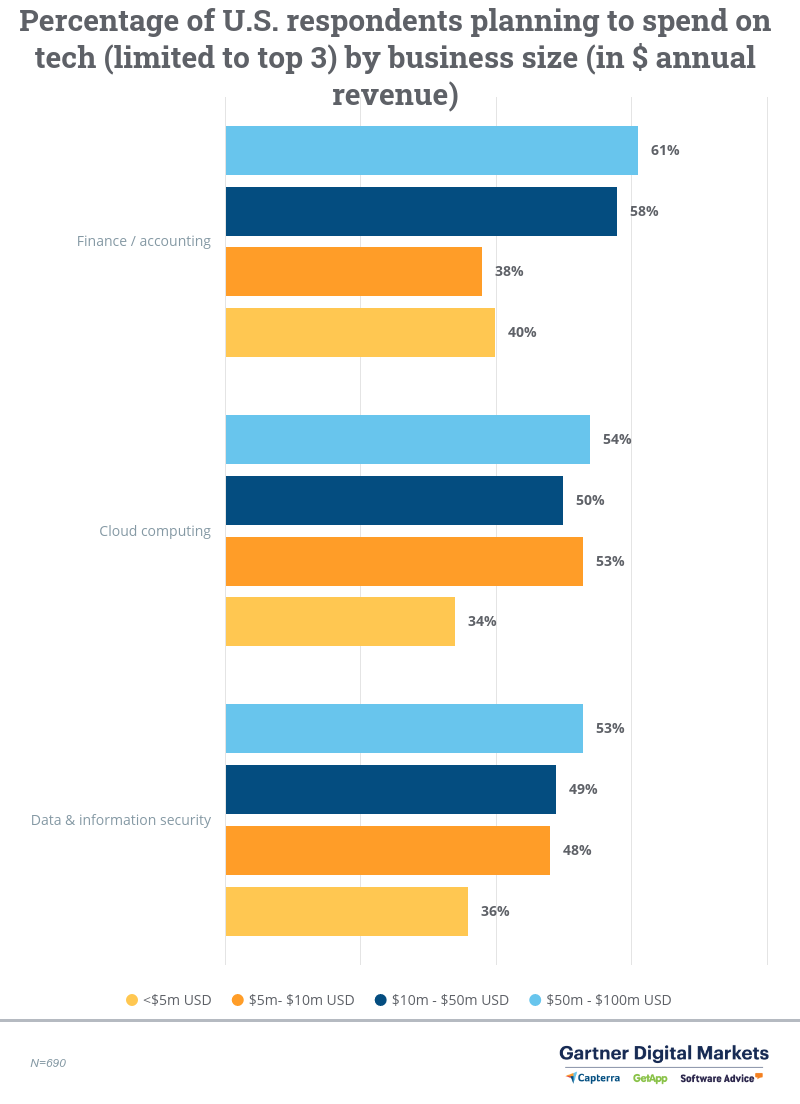

Figure 1: This graph shows the percentage of each U.S. business size surveyed that expressed interest in the various technologies.

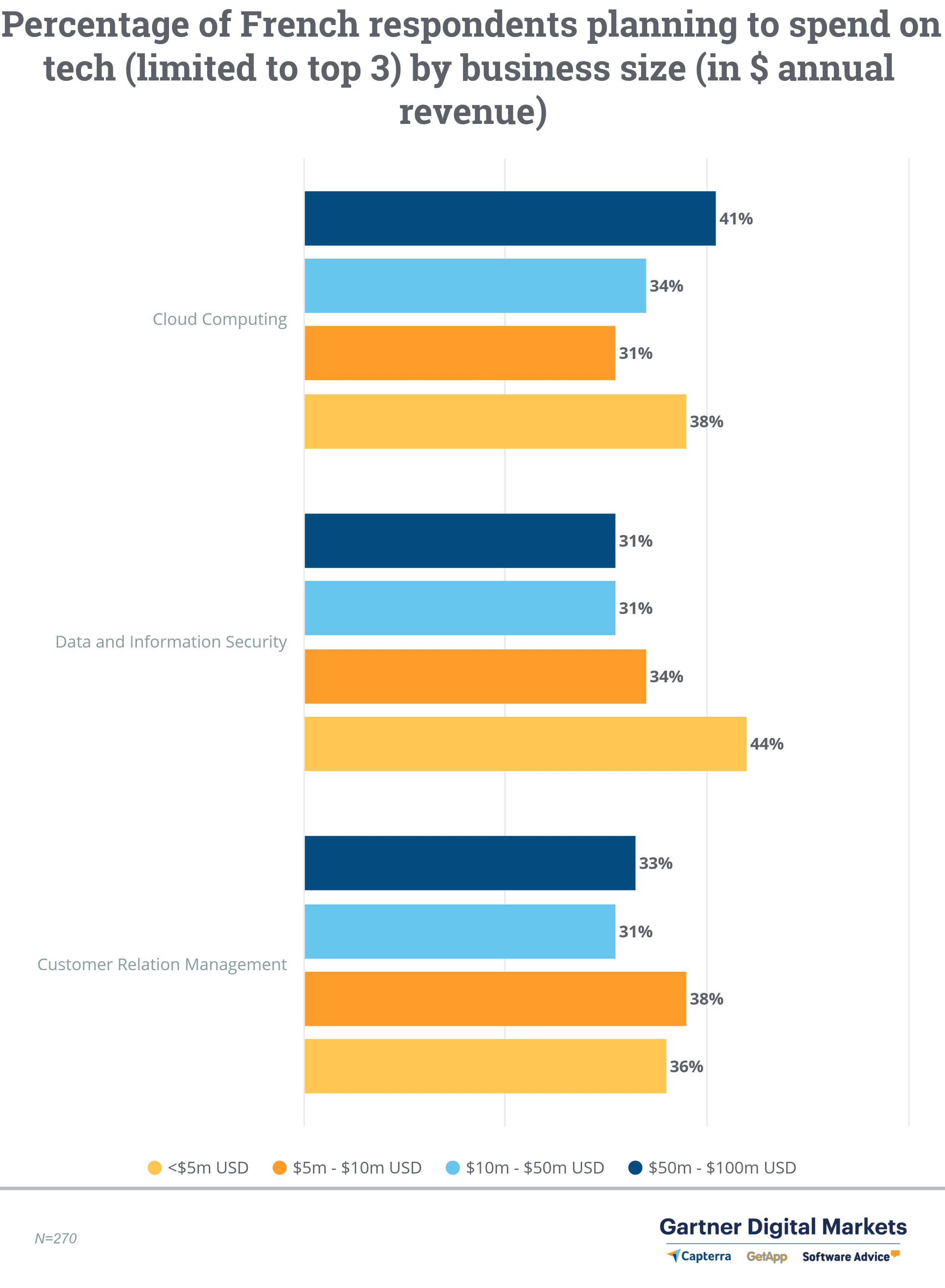

Figure 2: France's largest businesses seem much less likely to invest in popular software types. Read on to see why!

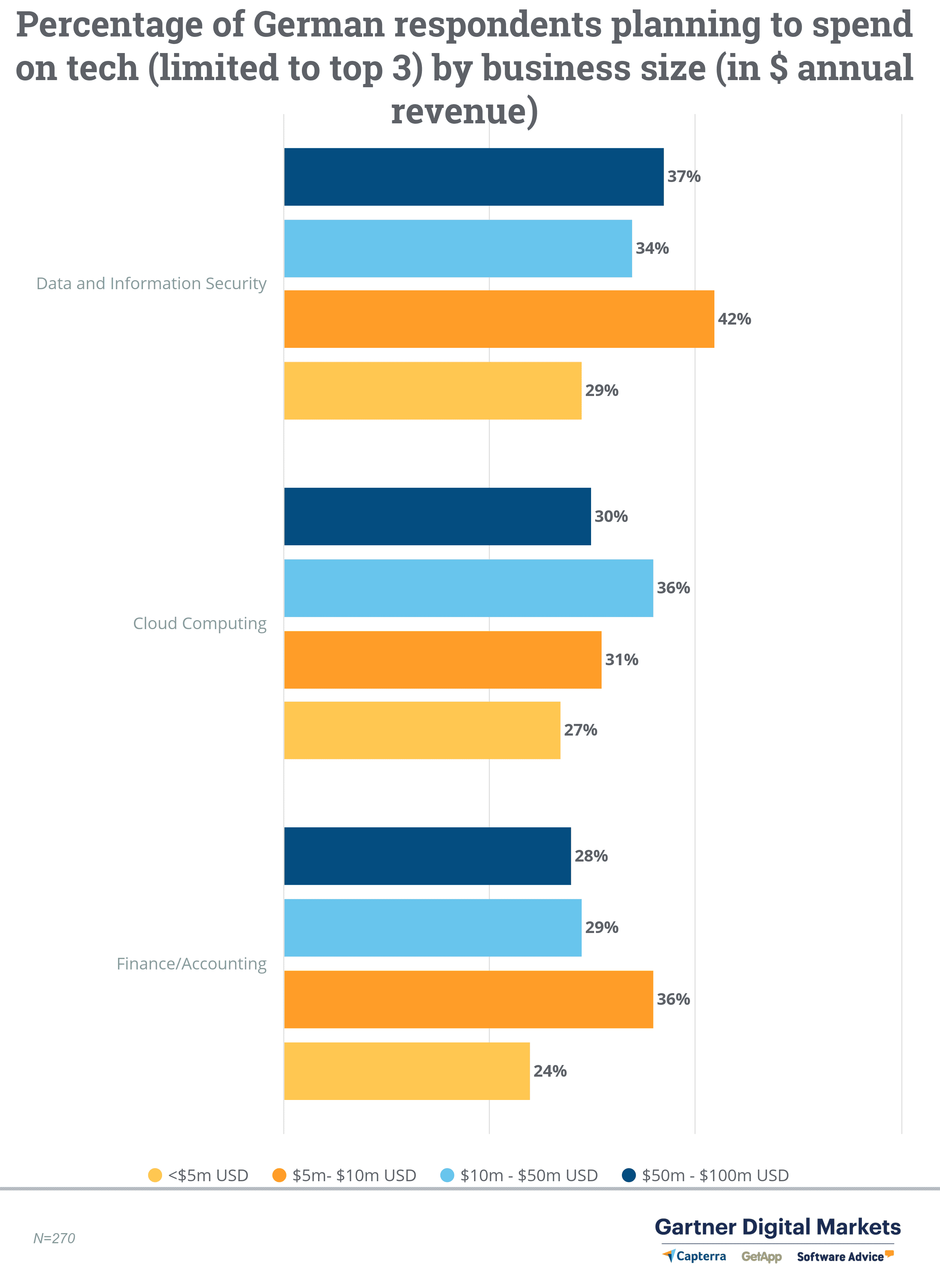

Figure 3: These graphs effectively demonstrate some of the differences between France, Germany, and the United States, as well as international corporate climates.

Why do these software types come out on top?

Data and information security software and cloud computing software both crack the top three in every country that we're looking at.

Cloud computing—including software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS)—has become a de facto means of operation, especially at companies that require large amounts of storage and coordination across several offices in multiple locations.

Pivoting to data and information security software, both France and Germany are members of the European Union, which has incredibly stringent GDPR compliance requirements. Any company that conducts business with a citizen of the European Union must meet these requirements or face hefty fines.

This also means that any U.S. companies that interact with European citizens and businesses must also meet GDPR security requirements. Between trade with the European Union, increasing worries about cybersecurity, and various other security regulations, companies in all three countries would naturally invest heavily in data and information security software.

The United States and Germany both have finance/accounting software rounding out their respective top threes, while France has invested more heavily in customer relations management software.

This is because the United States and Germany both operate under very similar roles in their respective places in the global market: at the forefront of trade, manufacturing, and transportation—all industries in which SMBs need a finance/accounting software suite in order to survive.

Interpreting the difference in rates of investment: 3 lessons

1. Large U.S. companies invest more frequently than French and German ones

Look at the rates of investment in Figures 1-3.

Save for those making less than $5 million per year, U.S.-based SMBs invest more frequently—in some cases almost twice as often—than their European counterparts.

While that does mean that there's generally more money to be had in the United States for software vendors in the top three categories, don't take that to mean you shouldn't look to expand abroad!

Those larger companies have some deep pockets, but that comes with some stiff competition as a plethora of other businesses try to swoop in and make those sales.

2. Smaller businesses are key to selling in France

If you're interested in selling your software in France, you should target smaller French businesses.

At every turn, France's businesses with less than $5 million in annual revenue outpace U.S. and German companies of similar sizes in terms of their investment rate.

Here's an example: 44% of French small businesses plan on investing in data and information security software, compared to 36% of SMBs in the United States and 29% in Germany.

France's accelerating rate of adoption

Let's look for a second at cloud computing. In France, up to 41% of companies with annual revenue between $50 million and $100 million have budgeted for cloud computing software. In Germany, that number drops to 30%.

One explanation for this difference is that France has begun adopting cloud computing at an accelerated rate (according to Statista, there's a projected 50% increase in usage from 2015). Even the larger companies, which have been the most reticent to adopting new technologies, are unable to avoid the need for cloud computing.

3. Sell your emergent tech to larger German SMBs

If you're in emergent technologies such as blockchain, virtual/augmented reality, the internet of things (IoT), and artificial intelligence, you should be targeting larger German SMBs.

German companies are either currently using or are planning on using emergent software and tech at an incredibly high rate. Companies valued between $10 million and $50 million and those valued at more than $100 million expect to be using IoT tech at rates of 54% and 66%, respectively, in the next two years.

That means that in order to access that massive market (which has very deep pockets), you have to begin your marketing campaigns early in the expansion process to increase your brand awareness.

Because it's emergent technology, appearing trustworthy and marketing your company as a knowledgeable source of information is crucial for success.

What can you do with all this information?

Depending on how ubiquitous or emerging your tech is, you've got to figure out how to scale both your price and production to match your target business size.

Knowing the financial landscape and interest in your targeted country will not only give you a stronger sense of how to market but also of how much you can expect to make and how long creating a stable international business could take.

Technological priorities shift based on both business size and geographic location, so here's what you're going to do next:

Figure out if you're ready to expand into Europe.

Study how the different countries and their tech needs compare to the United States and its needs

See what size businesses in your selected country are more likely to invest.

Target your marketing toward those companies with a stronger sense of how much money is out there.