Consumers are willing to share data with your business—but increasingly, it must be on their terms. Learn what our data says you should do to optimize your first-party data collection efforts.

As a digital marketer, you must prepare for a decline in third-party cookies and the ever-increasing sophistication of digital consumers who demand value in exchange for their personal information. The clear answer to this dilemma is to ramp up the data you collect about your customers (i.e., first-party data) and do so in a way that is relevant to their needs.

In this piece, we’ll dive into the results of our recent First-Party Data Survey (check out our methodology here) and help you understand what makes consumers more or less likely to engage with your first-party data strategy—including an important factor that 84% of digital consumers say would make them more willing to share personal data with an online company.

What is first-party data, and why does the end of third-party cookies make it so important?

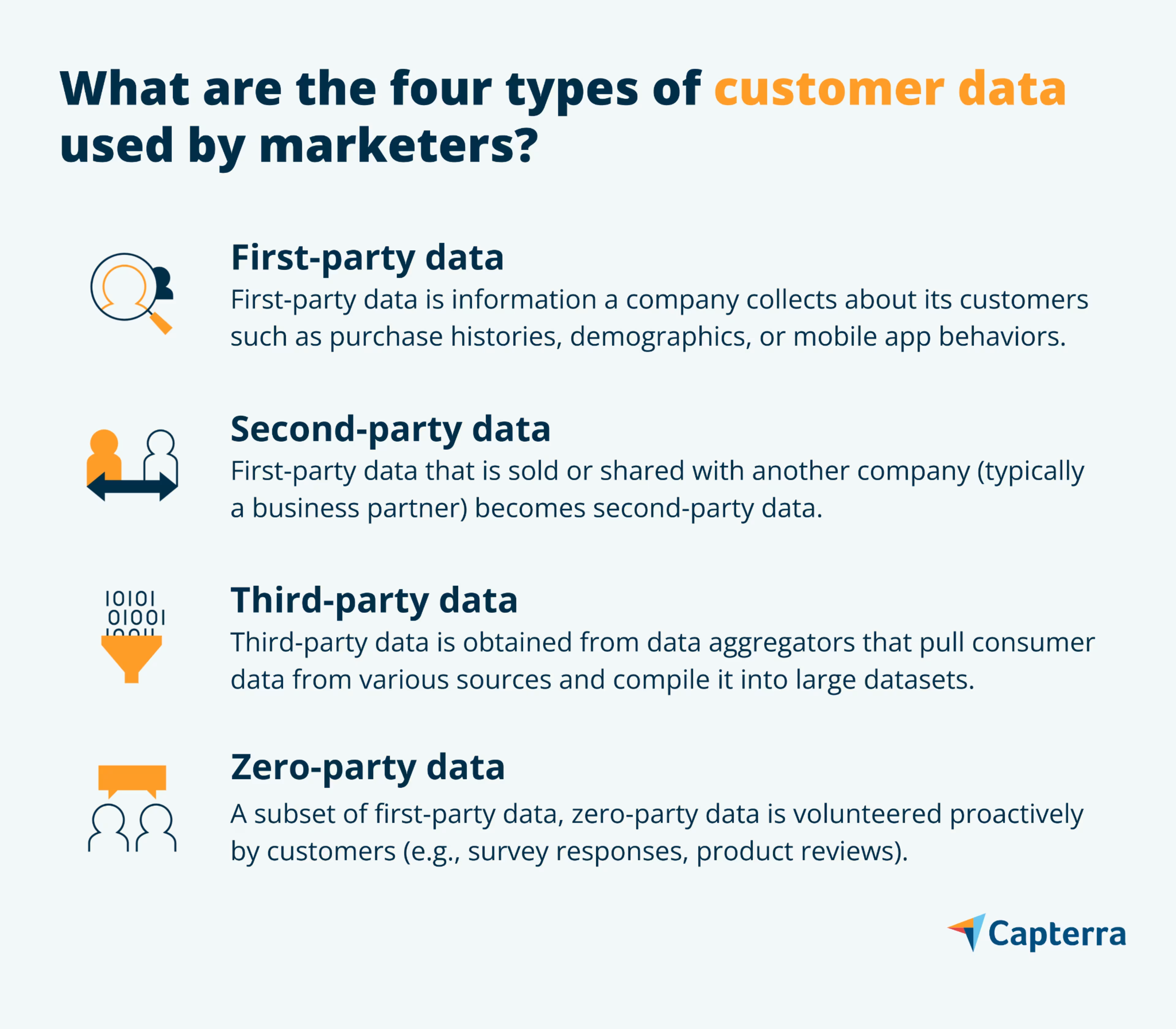

First-party data is the information you collect about your customers and visitors to your website or application. This might include purchase histories, demographic information, or mobile app behavior. A subset of first-party data known as zero-party data includes information customers provide intentionally such as survey responses. When a company collects first-party data and then sells or shares it with another company, it becomes second-party data.

Third-party data is that which is acquired from data brokers (or data aggregators) that collect data on web users from various sources and compile it into large datasets. Third-party cookies connect these datasets with your current and potential customers to help you target them with (hopefully) relevant advertisements. However, it’s not always clear where the third-party data comes from, whether it’s relevant to your audience, or if it’s in compliance with data privacy laws.

The end of third-party cookies has been years in the making

The use of third-party cookies has become increasingly viewed as a privacy issue in recent years. In 2018, the E.U.'s pending ePrivacy regulation instigated a flurry of cookie consent notices across the internet. Then, in 2019, Mozilla moved to block third-party cookies by default in their Firefox browser—Apple’s Safari browser soon followed suit.

In 2020, Apple’s iOS 14 update changed device permissions from “opt-out” to “opt-in,” meaning that consumers must now intentionally choose to share their data, rather than having it shared by default. In 2024, Google is set to ban third-party cookies in Chrome (which comprises 65% of the browser market), a move widely viewed as the death knell for third-party cookies and crippling for an ad tech industry that is depended upon by most online businesses.

Your response, then, is to focus on a first-party data strategy. This is actually a good thing because first-party data is not only proprietary, it’s also more relevant to your business and its customers than third-party data ever was.

Looking for marketing analytics software to harness your marketing data, plan campaigns, and monitor performance? Check out our unbiased Marketing Analytics Shortlist to review the highest rated and most popular software for your business.

A full 86% of consumers feel forced into providing personal information online

One way to stand out is to recognize that digital consumers now overwhelmingly recognize data collection efforts for what they are and have grown cynical. Our research finds that 72% of consumers feel like online ads know too much about them, and 45% don’t think they can get through a typical day without their personal data being collected.

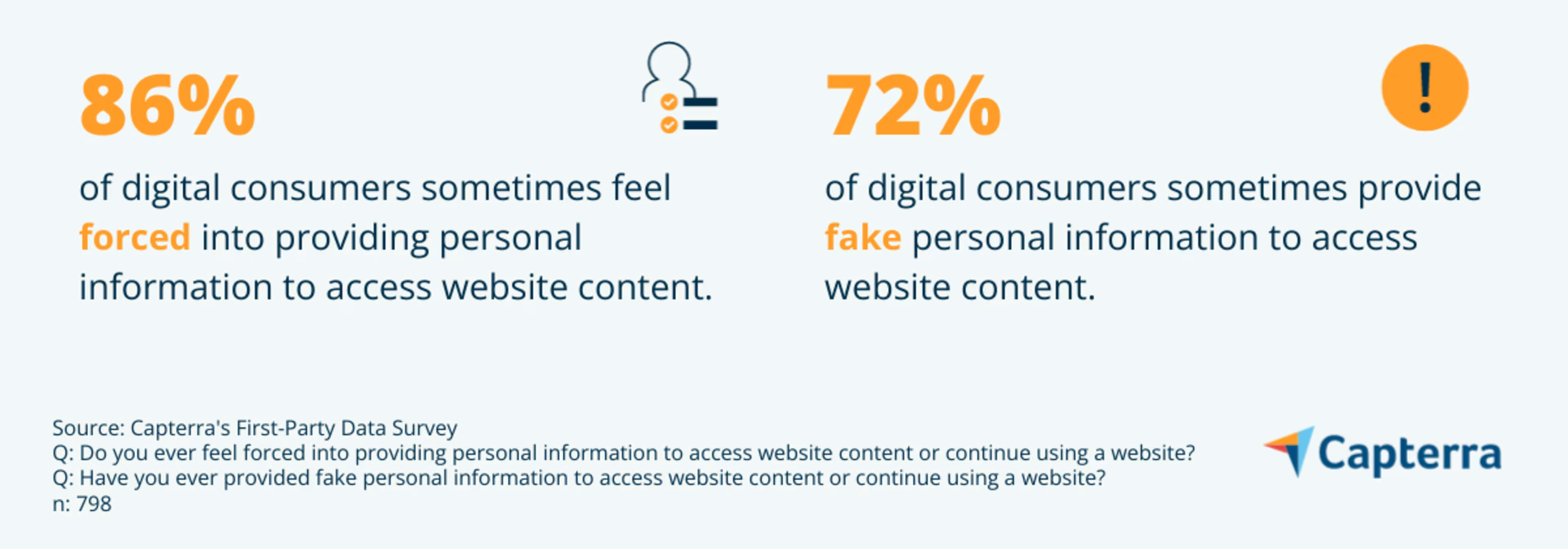

Our research also finds that 86% of digital consumers feel forced into providing personal information to access website content at least some of the time. This causes blowback in multiple ways.

Forcing someone to do something is obviously a bad way to begin any relationship. But making matters worse, 72% of our respondents say they sometimes provide fake personal information to access website content. So not only are you starting off on the wrong foot, you’re often getting bad information that results in misleading data that can put you on the wrong path.

If they knew what personal data was being collected and why, 84% of consumers would be more willing to share it

Now that companies such as Apple are moving to an opt-in model for their devices, you need to incentivize consumers to share their data by offering exactly what they’re looking for. And in 2022, that means transparency.

Our survey finds that 84% of digital consumers would be more willing to share their personal information if they knew what was being collected and why. This is the reason some companies now include an explanatory statement when asking for data, such as “Don’t worry, we’ll only use this information to improve your shopping experience. We promise never to sell your data to anyone else. You can withdraw your participation at any time.”

This is known as obtaining informed consent which is a foundation of ethical research and is now increasingly included as part of marketing research (it’s the purpose of those ever-present cookie notices). And if your company is subject to data privacy laws such as HIPAA, the General Data Protection Regulation (GDPR), or the California Consumer Privacy Act (CCPA), informed consent is typically required and must be specifically worded.

Read our report to learn what you need to know about emerging data privacy laws: US Data Privacy Laws You Need to Know

Tailor your first-party data collection strategy for different types of consumers

While nearly all consumers want to know why their data is being collected, preferences about how it is collected vary extensively. Through our research, we’ve identified three distinct digital consumers based on online shopping frequency and examined the data collection methods that appeal to each of them.

1. The very online consumer

The very online consumer shops online and consumes digital content on a daily basis. This segment represents 28% of digital consumers and skews younger (60% are 18-35 years of age). Here are a few key findings about very online consumers:

Just more than half use a laptop as their primary device (51%), a full quarter (26%) use their mobile phone, and only 21% rely on a desktop computer.

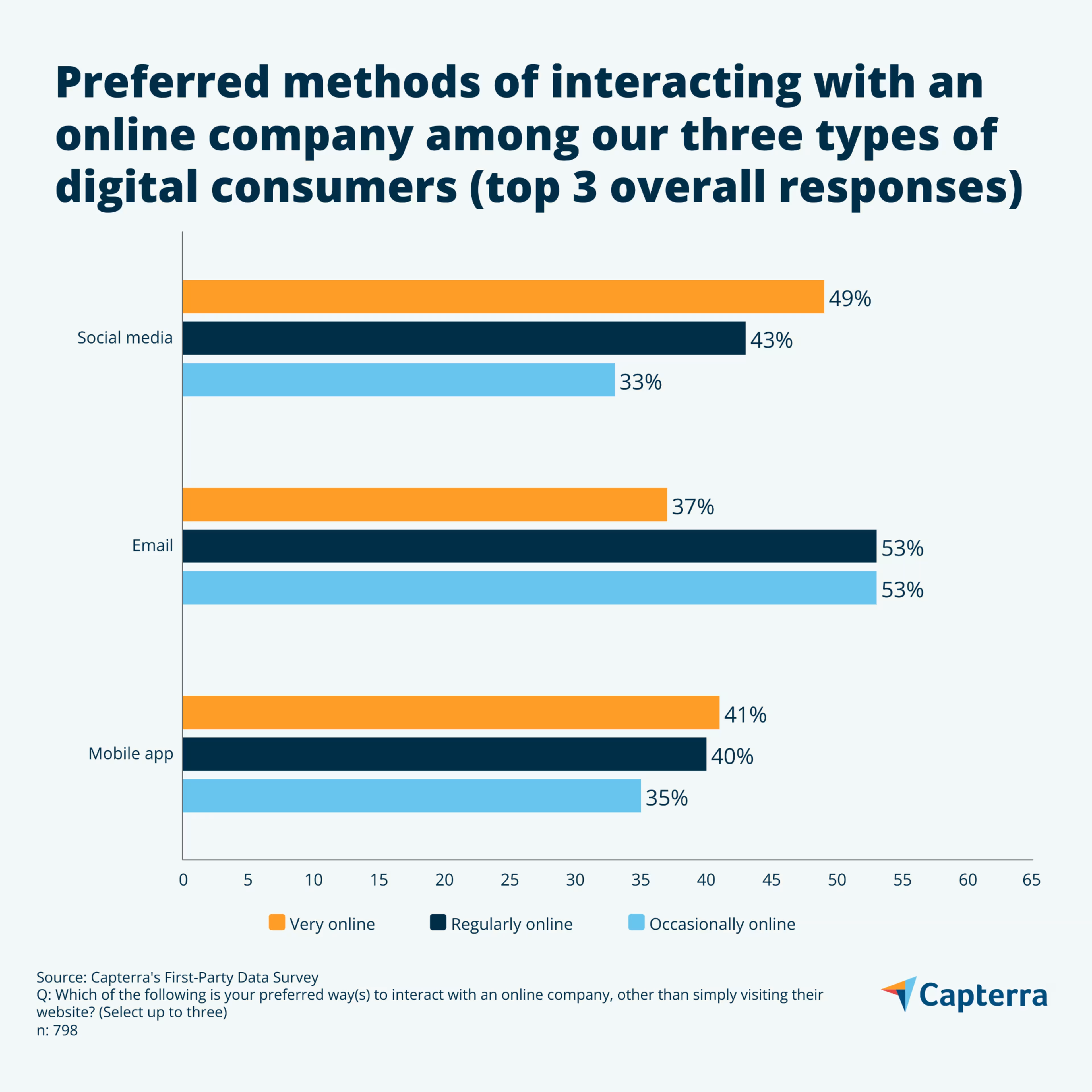

Prefer to interact with online companies via social media (49%).

A full 73% are willing to provide demographic information (e.g., age, income, gender) in exchange for more relevant product offers compared to only 46% of the other consumers in our survey.

Are least likely to provide personal information in exchange for access to video content, such as a webinar (16%).

Favor creating a new customer account using their email or a social media profile (45%) over selecting a new username and password (23%).

Seek out privacy-focused companies at least some of the time (88%).

Summary: Generally younger people who value privacy, prefer to interact with brands via social media, and are willing to exchange personal information for relevant product recommendations.

2. The regularly online consumer

The regularly online consumer shops online and consumes digital content at least once a week. This segment represents 51% of digital consumers and is concentrated between 26 and 45 years of age (72%). Here are a few key findings about regularly online consumers:

Their default device is spread fairly evenly among laptop (40%), mobile phone (30%), and desktop computer (27%).

Prefer to interact with online companies via email (53%).

Are most willing of our three groups to exchange demographic information for useful discounts or coupons (65%) and for personalized content recommendations (35%).

Are most likely of our consumer segments to provide personal information in exchange for coupons (55%) and for access to video content such as a webinar (22%).

Summary: Typically young to middle-aged people who are looking for discounts, prefer to interact with brands through email, and are looking for personalized content recommendations.

3. The occasionally online consumer

The occasionally online consumer shops online and consumes digital content on at least a monthly basis. This group represents 20% of digital consumers and skews a bit older (60% are at least 36 years of age). Here are a few key findings about occasionally online consumers:

Favor a laptop as their primary device (47%), desktop as number two (28%), and only 22% rely on their mobile phone.

Prefer to interact with online companies via email (53%), exactly the same percentage as regularly online consumers.

Are most likely to say they’re not interested in exchanging demographic information for any reason (22%).

Two in three (66%) say they are willing to provide personal information to register for a new customer/user account.

Favor selecting a new username and password to create a new customer account (46%) over using an email account (27%) or social media profile (11%).

Are least likely to provide financial information (e.g., income) with 68% considering it very sensitive—for comparison, only 48% of very online consumers feel the same way.

Summary: Middle-aged to older adults who are generally reluctant to share personal information but may be inclined to do so in exchange for discounts.

Here’s what consumers think about common data collection methods

Let’s take a look at what our three consumer segments think about some of the most common ways companies such as yours gather first-party data, and which methods are preferred in the collecting of that data.

Questionnaires

One in four (26%) very online consumers say that completing a questionnaire is a preferred method of interacting with an online company, compared to only 10% of both regular and occasional online consumers. This means that questionnaires should be saved only for your most active customers.

- Best for: Very online consumers

Contests/Sweepstakes

Contests are relatively unpopular with all three consumer types but scored best with occasionally online consumers. These consumers are also most willing to exchange personal information for coupons and discounts (65%). The theme here is that occasionally online consumers are looking for deals when they actually do shop online.

- Best for: Occasionally online consumers

Emails

Regularly online consumers are most receptive to email marketing with 20% saying they would be most likely to engage with promotional emails compared to 15% of very online and 16% of occasionally online consumers.

One thing most digital consumers do not appreciate is email tracking. Three in four (76%) say they would opt out of email tracking if given the option. The best way to stop email tracking is to disable images in emails, which 41% of our respondents say they do already. Ultimately, email tracking is a touchy area with digital consumers, so tread lightly.

- Best for: Regularly online consumers

Surveys

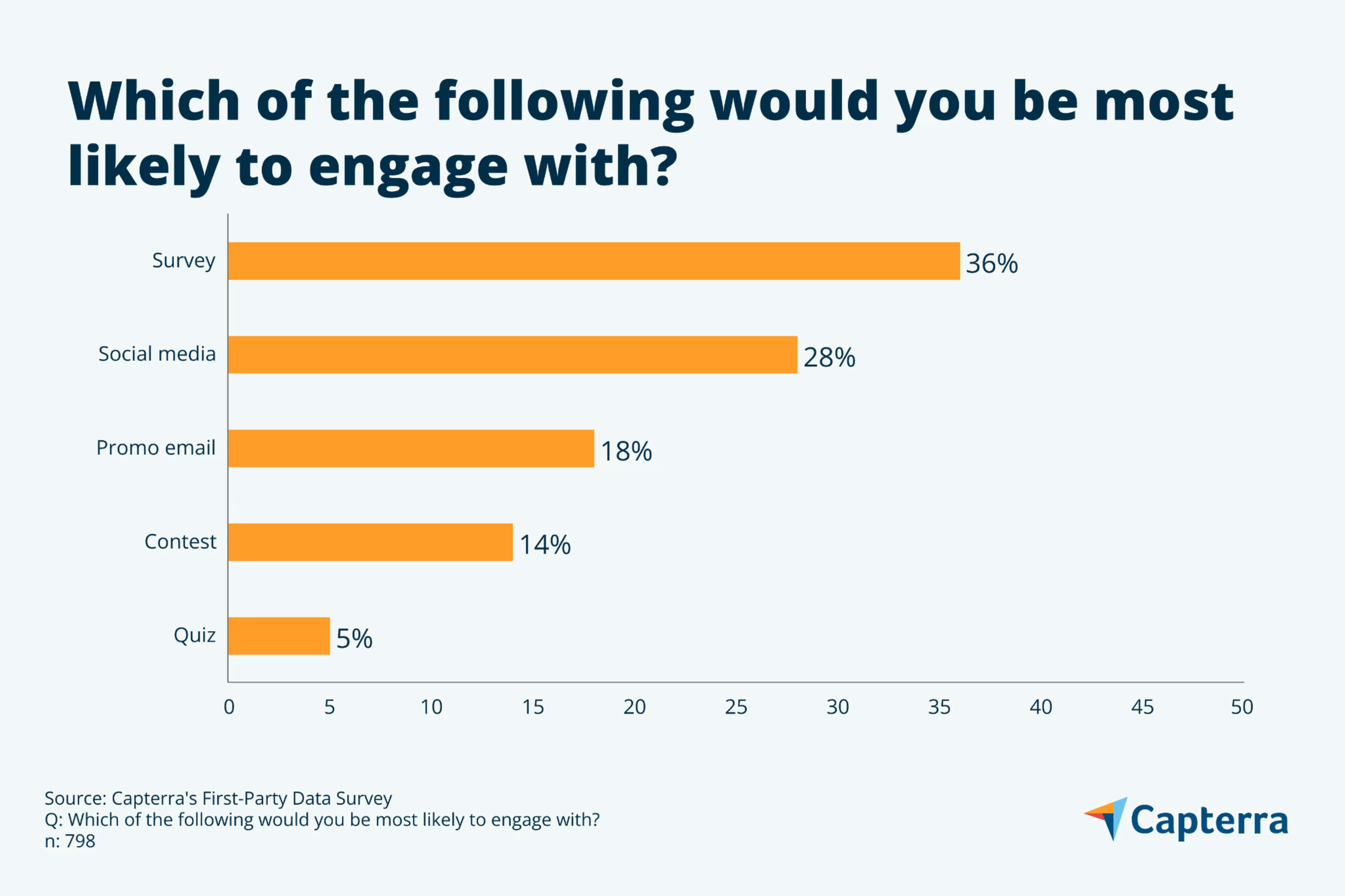

We provided a list of methods that companies use to collect first-party data, including surveys, quizzes, contests, social media posts, and promotional emails. The winner by far is surveys, which are the top choice of all three consumer groups. One thing is clear—consumers do not want to take a quiz, which scored at 5% or lower with all of our groups. Below is a chart showing results from all respondents.

- Best for: All consumer types

Location tracking

We found significant differences in attitudes toward location tracking among our three segments. Very online consumers are most likely to always have location tracking turned on (37%), regularly online consumers are most likely to turn location tracking on and off depending on which app they’re using (55%), and occasionally online consumers are most likely to leave location tracking turned off (31%).

Among all respondents, checking delivery area is the top reason to provide location data (68%), followed by checking local inventory (50%), and obtaining directions to a retail location (42%).

- Best for: Very online consumers

A parting statistic: 87% of digital consumers would stop doing business with a company they feel does not value their privacy

At the end of the day, the most important thing is that your marketing research must be conducted out in the open with as much transparency as possible. This will ensure your data is accurate and actionable while respecting the privacy of your customers who in turn will respect and engage with your business.

Looking for ways to organize and leverage your first-party data? Check out our catalog of Customer Data Management Platforms to find the right software for your business.