Get a clear picture of your company’s financial health with these four financial statements.

Known as the basics of accounting, financial statements provide stakeholders the information they need to evaluate a company’s financial performance.

If you’re a business owner or finance officer, you may want to know which aspect of your operations is performing well and which needs improvement. If you’re an investor, you might be interested in determining if a company is healthy enough to be offered credit and can earn profit over the next few years.

Financial statements can help you make these critical business decisions. They are a means to record and report monetary transactions such as the sale or purchase of goods and infusion of money from creditors. They provide a snapshot of your business’s profitability and forecast where you’re headed.

In this article, we explain the different types of financial statements you should be creating for your business and what each says about your company’s financial health.

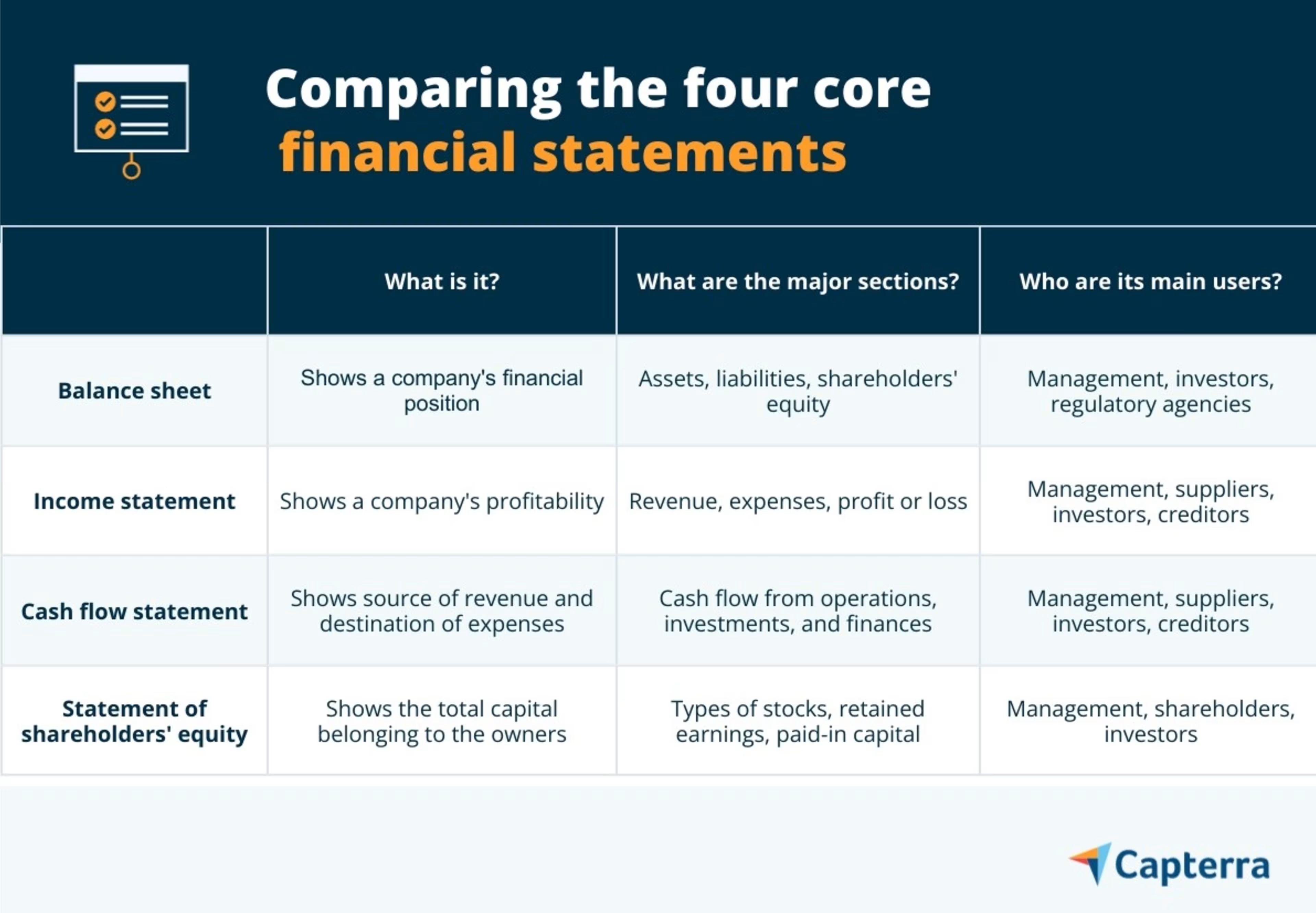

What are the four basic financial statements?

Each of the four basic financial statements offers unique insights, and when analyzed together, they answer some of the most important questions about your business’s operations: Where is the money in your company coming from or going to? How much do you own or owe? Are your earnings growing or shrinking?

Did you know?

If you have a publicly traded company, you are required by law to release financial statements in public for investors. And if you don’t, you still need to periodically file tax returns, which contain important financial information from these financial statements.

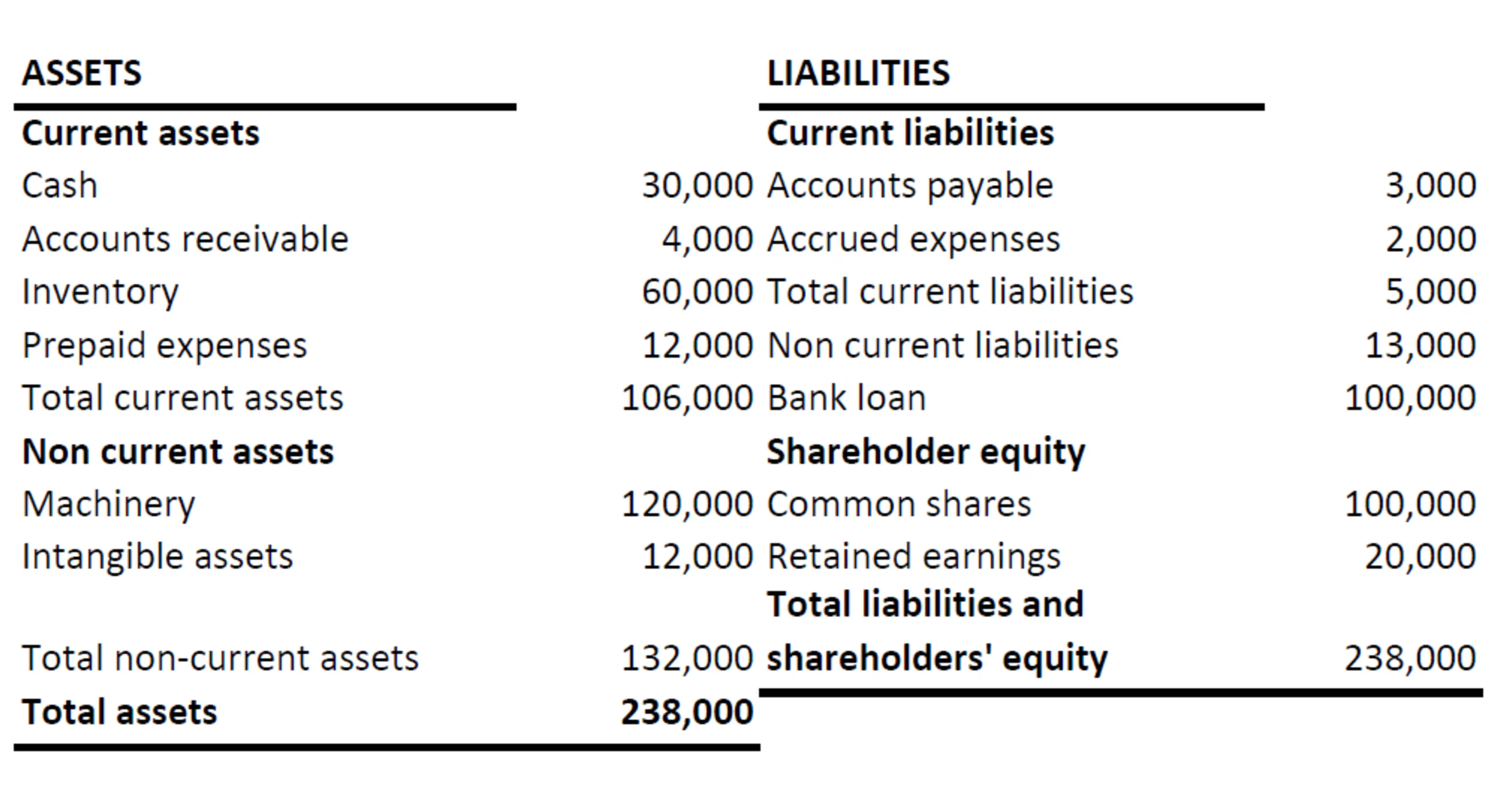

1. Balance sheet

Also called a statement of financial position, a balance sheet gives an eagle-eye view of a company’s financial position or worth at a given time.

A balance sheet shows assets (what you own—i.e., anything of economic value such as cash and property), liabilities (what you owe—i.e., economic benefits you owe to others such as loans and credit payments), and shareholders’ equity (the amount investors will be paid after the business is liquidated in case of bankruptcy or any such event) as of the reporting date.

Here are the components of a balance sheet:

Current assets: Assets that are expected to be consumed, sold, or converted into cash within a year. Examples include inventory and the money debtors owe to your business (accounts receivable).

Current liabilities: Obligations that are to be paid off within a year. Examples include the money your business owes to creditors (accounts payable) and unpaid debt (from the overall long-term debt) due in the next 12 months.

Noncurrent assets: Assets that cannot be converted into cash within a year and are typically used to run the business. Examples include machinery and furniture.

Noncurrent liabilities: Obligations such as pension benefits that will not be paid off within a year.

Shareholders’ equity: The amount investors will receive if the company is liquidated after clearing all debt obligations.

An illustrative example of a simplified balance sheet

Check out how to arrange your components to prepare a balance sheet that you can use for compliance purposes, as well as to assess your business performance.

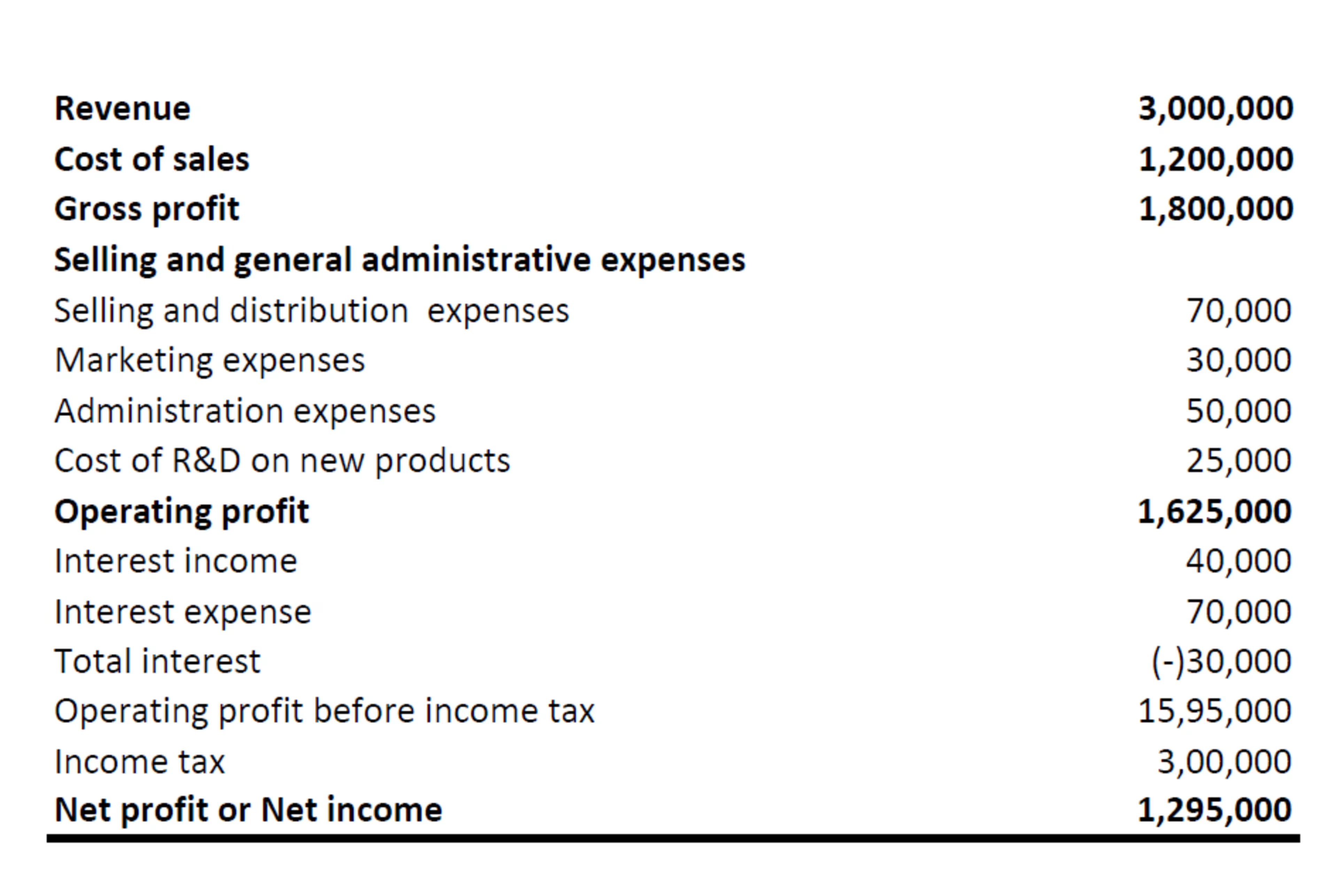

2. Income statement

Also known as a profit and loss (P&L) statement, an income statement shows your company’s earnings and expenses over a period—i.e., the bottom line of your company.

An income statement is considered the most important financial statement and is the first thing stakeholders, including investors, business owners, and departmental decision-makers, refer to, as it represents the operating results of your company.

Here are the components of an income statement:

Revenue: Income generated through the sale of goods and services from business operations, after deducting returns and allowances (such as discounts).

Expenses: Cost paid to produce the goods and services sold (called the cost of sales) and the expenses from running operations.

Profit: Profit that a company makes from business operations. It includes gross profit, operating profit, and net profit.

Gross profit vs. operating profit vs. net profit

Gross profit is the total income left after subtracting expenses directly related to the production of goods (such as raw materials, direct labor, and discounts) from the total revenue of the company.

Operating profit is the income left after deducting all the cost of doing business (including marketing and administrative expenses) from the gross profit.

Net profit is the income left after including both outgoing and incoming cash flows, such as the income from interest and expenses in taxes. It’s reflected at the bottom line of the income statement and is used to estimate a company's profitability.

An illustrative example of a simplified income statement

3. Cash flow statement

A cash flow statement reports where cash is being generated and used in your business. It shows if your business has enough cash on hand to pay for day-to-day expenses and asset purchases.

A cash flow statement shows the net increase or decrease in cash during a period. It also highlights your business’s ability to raise cash when needed.

A basic difference between an income statement and a cash flow statement is that the former determines if your company is making a profit, while the latter checks if your company is generating cash to fund expenses and stay operational.

Here are the components of a cash flow statement:

Operating activities: Cash flow from day-to-day operations to reconcile net income with the actual cash used for company operations.

Investing activities: Cash flow from or to noncurrent assets. An example is the sale or purchase of property or a piece of machinery.

Financing activities: Cash flow from financing activities—typically includes cash raised by issuing shares.

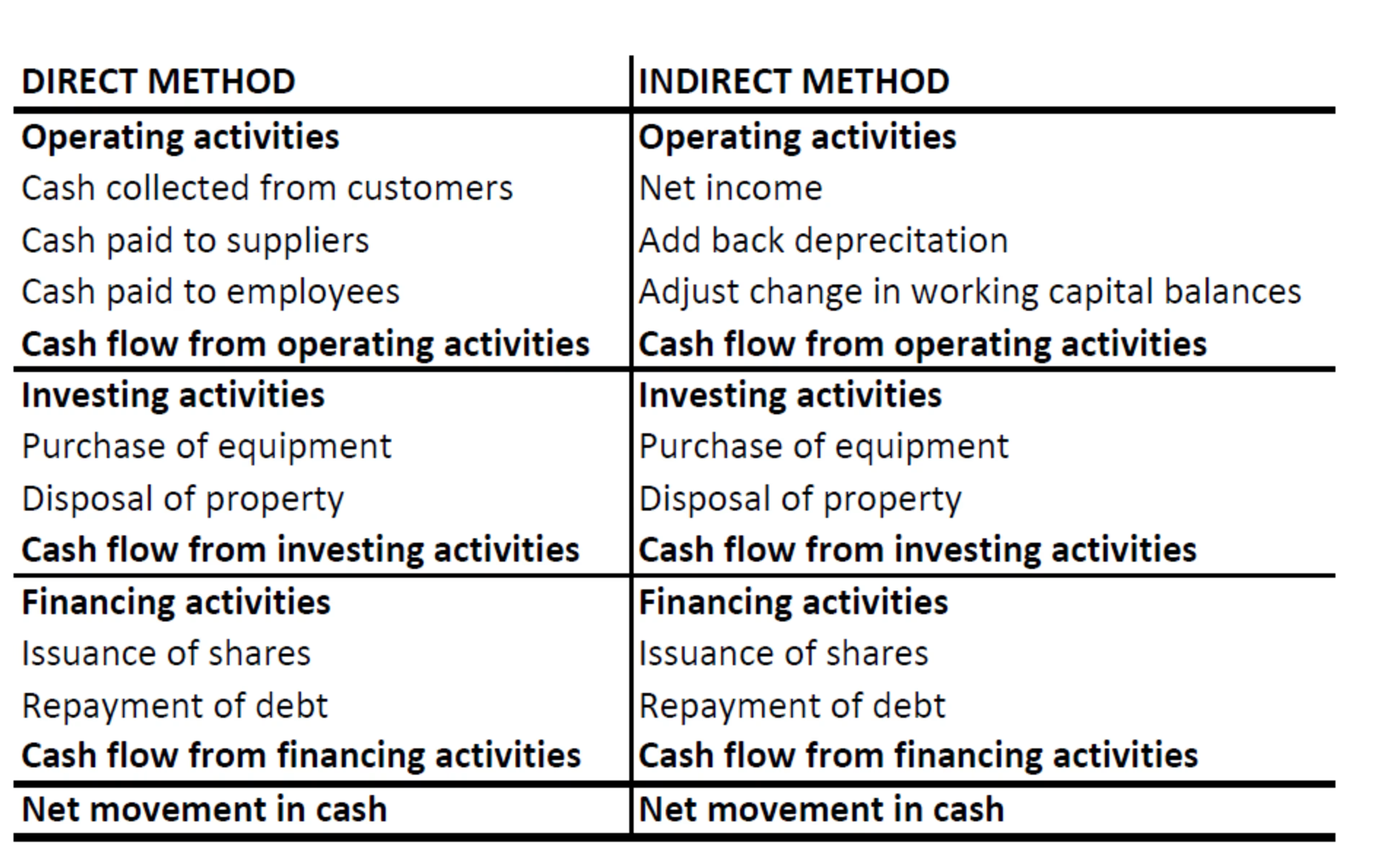

Ways to prepare a cash flow statement

There are two ways to prepare a cash flow statement: direct and indirect. The direct method begins with cash transactions, and the indirect method starts with net income (from the income statement). If you use the indirect method, then noncash expenses where actual money doesn’t change hands, such as depreciation, will have to be adjusted.

Irrespective of the way you choose, divide your cash flow statement into three parts based on operating, investing, and financing activities, and then add cash flow to each part as shown in the example below.

Two methods of preparing a cash flow statement

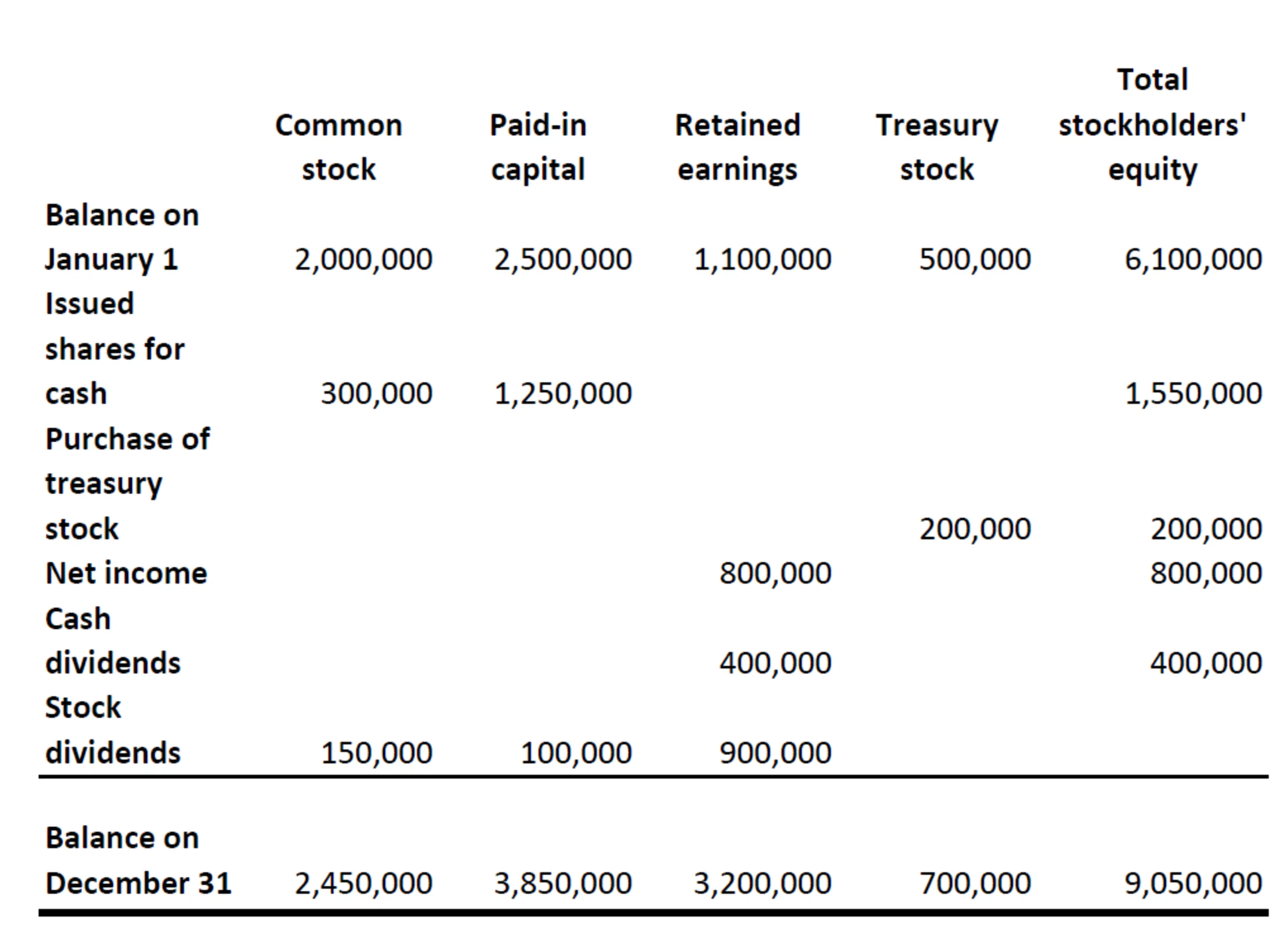

4. Statement of shareholders’ equity

A statement of shareholders’ equity details the changes in owners’ investment from the start to the end of an accounting period—a time frame usually covering an entire year. However, an accounting period can also be shorter (quarterly or half-yearly) depending on a business’s accounting practices.

A statement of shareholders’ equity is typically issued as part of the balance sheet. While the balance sheet provides a snapshot of your company’s assets, liabilities, and shareholders’ equity as on the reporting date, the statement of shareholders’ equity shows the value of your business after all investors/owners are paid out. It also shows how stockholders’ investments have fared over time and is used by owners to make decisions on the future issuances of shares.

Here are the components of a statement of shareholders’ equity:

Common stock: Company stocks that entitle shareholders to the issuance of dividends or profits and voting rights.

Preferred stock: Company stocks for which profits are paid out to shareholders before common stock dividends.

Additional paid-in capital: Additional amount paid by investors over the par value or face value of the shares of stock.

Retained earnings: Total earnings that are retained as income and reinvested in the business after paying out dividends to shareholders.

Treasury stock: Company stocks that are repurchased from investors to avoid hostile takeover or to boost stock price.

Illustrative example of a statement of shareholders’ equity

Tips and tools for preparing financial statements

Make the preparation and analysis of financial statements more effective by embracing technology for your financial operations. Here are some software tools for effective financial management:

Use bookkeeping software to automate bookkeeping processes and fetch error-free records for creating financial statements.

Automate simple finance operations, including billing, accounts payable, and accounts receivable, to reap huge returns in accounting.

Get a high-level view of financial statements with financial reporting software. Customize financial reports and set up informative dashboards with key metrics.

If you’re still using spreadsheets to handle your accounting work, explore these free accounting software options to get started.