Unsure of how to communicate financial information to business leaders without cryptic jargon? We’ve listed the key steps to deliver your insights with impact.

It’s the time of year when you sit down with your business leaders to present the numbers. You meet with elbow bumps and engage them in some small talk, mostly about the weather. Now, you have to get down to business: “How has the company performed?”

The challenge to communicating financial information is that it’s a foreign language for most. Few speak or understand the vocabulary of generally accepted accounting principles (GAAP) and financial reporting: accrual versus cash, assets and liabilities, and the commonly used (yet mind-boggling) debit versus credit.

Whether you’re a chief financial officer (CFO), an independent accountant, an entire finance department, or an outsourcing financial firm, you must learn how to translate financial details for non-accounting leaders. By seeking out ways to effectively deliver financial information to your stakeholders, you can give a business perspective that only finance can provide.

Here’s a six-step guide to better articulate financial insights to your leaders and some tools and tips that will help you along the way.

1. Determine the key data points relevant to you

Three reports commonly used for financial reporting are balance sheets, income statements, and cash flow statements. They provide a good starting point and a bird’s-eye view of the business, but when not simplified for leadership to understand, they aren’t enough for making decisions at the departmental or overall business level.

For business leaders bogged down by many day-to-day responsibilities, trying to spot major trends while studying the minutiae of report becomes difficult. This leads many business leads to selectively use the financial insights delivered to them.

A Gartner study reveals that about 90% of business managers fail to consider the financial implications of their decisions, and this oversight compromises over 3% of the net income for an average business (full research available for Gartner clients).

That, by no means, is a small number, for fast-growing, cash-strapped small to midsize businesses (SMBs) and may equate to losing the money for a new marketing campaign, hiring more resources, or investing in new technology.

So, the first step is to make your financial reports more meaningful and contributory for the leaders. Filter out the most important financial metrics that give them relevant information about their part of the business.

How does it work?

If the sales department wants to know if they should invest in digitalization, your financial insights should be able to help them make that decision.

Pro tips to select important financial indicators:

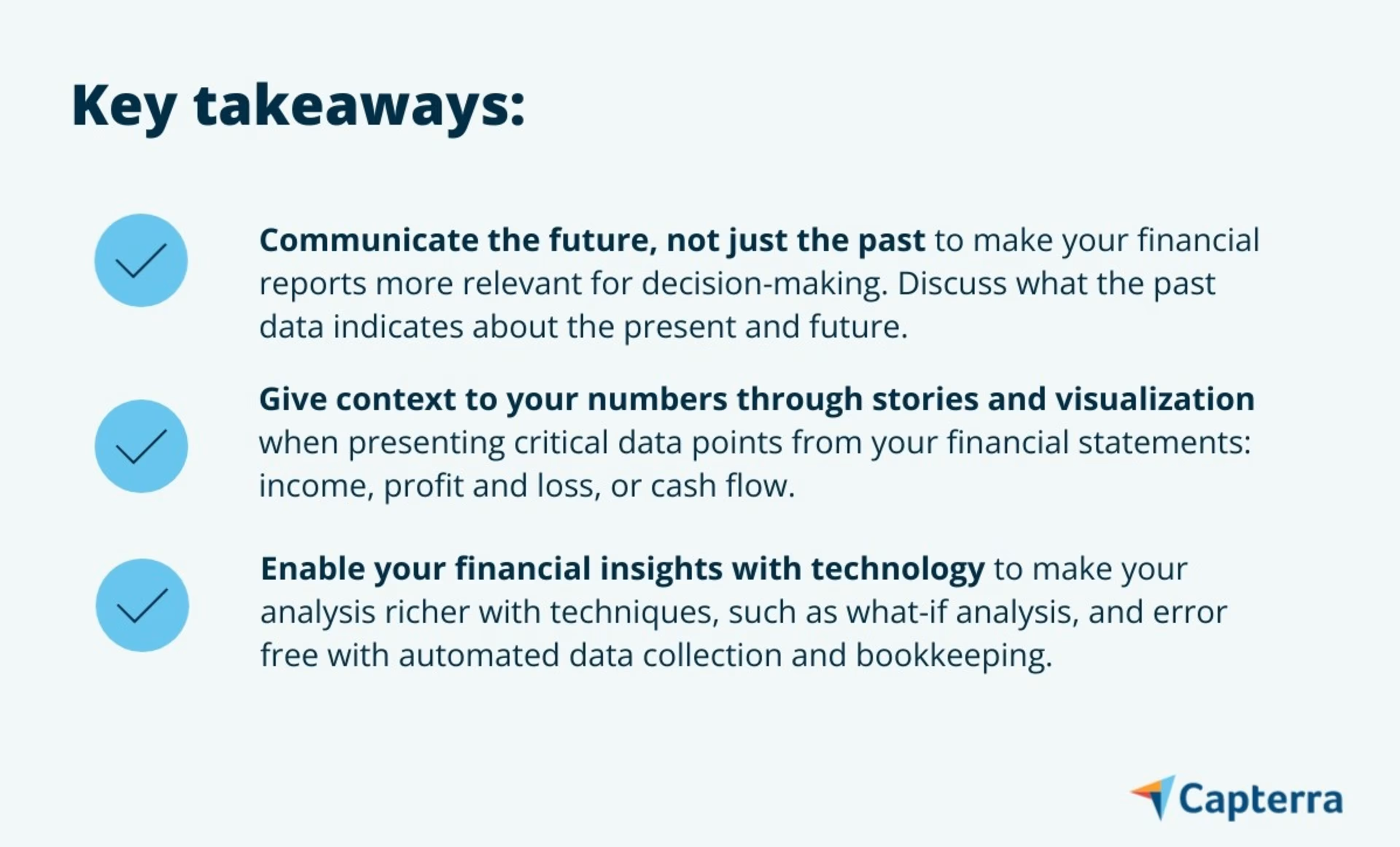

Financial reports are generally presented “after the fact.” Make them more forward-looking by unraveling which areas of the overall business or department are making money and growing, and which are shrinking.

Break your reports into trends, and ask “so what?” from your data until you reach reasoning that’s helpful for business leaders.

Talk to leaders about the important decisions they want to undertake in the coming quarter or year. Prepare your reports around those key priorities and highlight the challenges facing them.

Align your reports to your company’s objectives. To optimize profitability, for instance, conduct competitors’ analysis of their product price points, number of employees, and sales volume.

2. Dig into the stories behind your numbers

Stories can overcome the gap between financial results and business understanding. Pick stories to communicate the numbers on your financial statements.

Delivering your financial insights in the form of compelling stories will prompt discussion and enable decision-making. The challenge for you is to identify individual stories, which can inspire change and understanding at the company level.

How does it work?

Tell stories to explain important financial metrics, such as variance which tells whether you fell short or exceeded the expectations from the budget.

Pro tips to search for stories behind the numbers:

Partner with department leaders to better understand the “how’s” and “why’s” for their revenues and costs. Ask them to put you in touch with the right contact within their department. Be curious, ask good questions, and listen to what they have to say.

Use data visualization techniques to visualize the outliers, as well as the average values for your financial data, and investigate whether there are any good stories in them.

Once you select your stories, run them through department experts to avoid confirmation bias.

3. Eliminate unnecessary information from reports

Reduce unnecessary complexity from your financial reports to make them more useful for leaders.

Present data by following the principle of “less is more” to be succinct, but provide more information if it furthers understanding.

How does it work?

Let’s say that you wish to provide two sets of learning from your cash flow statement. One, by representing the differences between your budgeted and actual amount, and another, by comparing the business activities and investments of the present year with that of the previous year’s. Then it’s better to create two reports of cash flow statements, instead of one.

Pro tips to reduce needless information from financial reports:

Look at what type of information leaders have asked for in the past, and remove the unhelpful bits that are cluttering your message.

Provide final calculations within the report so the readers can focus more on studying the data than indulging in mental math.

Use comparative data points (from previous years or actual vs. budgeted) and percentage differences to make it easier for leaders to assess how good or bad the numbers are.

Do an “elevator test.” Imagine if you were in an elevator with your leader, and you had to convey your message clearly and briefly by the time it reaches the desired floor. Doing so will help you understand whether your information is overburdening or if it contains succinct central pointers.

4. Free up your time for analysis with technology

By improving how you communicate financial information, you empower decision-makers with proper tools to optimize operations and stay competitive. Accelerate the rate and quality of your analysis by investing in the right technology solution.

Manual financial reporting can bog down your operations with problems as small as version control, toggling between emails to send the right file, or even simply updating your financial data.

An effective software will free you from the tasks of manual accounting and bookkeeping and assist you in accurately tracking the trends to generate richer insights. Even better, most of the software offerings today provide data security solutions, which are vital for finance and accounting teams.

How does it work?

A good accounting and reporting software can help you tie a single number, say your profit of $1000, to a variety of relevant sources (your spreadsheet, a bar chart, and departmental income statement) lending an all-encompassing view for 360-degree analysis.

Pro tips to automate financial information reporting:

Invest in accounting software to free up your time for analysis and grab reports more easily and with more accuracy. Software will help you manage your routine tasks efficiently and add more value to the business. You can start with free accounting software solutions if you are new to financial automation. They are affordable and can give you full functionality at minimal to no costs.

If you outgrow the basic functionalities offered by free software, you will be well-served with in-suite financial reporting solutions with integrated accounting and budgeting processes, such as payroll, budgeting, etc.

Go a notch above by choosing cloud-based software solutions for better security and access to your data.

5. Organize your information for the presentation

If not planned well, even the best of analysis can be rendered worthless. Back your information with powerful dashboard presentations. You can instill a mix of data visualization and presentation skills with financial reporting software for effective communication.

A financial reporting software can allow you to custom format fields to track and showcase the most important insights to give better visibility into the workings of different departments.

How does it work?

Summarize insights most relevant to each business unit by creating customized dashboards for targeted stakeholders, from CEOs to department heads. Configure your dashboards to make them visually appealing and easy to understand. You can use data visualization, financial reporting software, or presentations to do that.

Pro tips to visualize information for financial reporting:

Visualize how you wish to present your analysis. Start with a blank paper, and sketch how you expect your data to look at the time of presenting.

Be specific. From the columns of data to the examples you want to include, draw them all when visualizing your information. Lastly, make sure your insights are adding value for leaders.

Invest in financial reporting software that can combine your financials in an easy-to-scan display, and show insights with interactive graphics and charts.

6. Follow up with leaders on what you missed

No one better understands the value of self auditing than finance and accounting teams.

Solicit reactions from leaders on how on point you were in providing financial insights that spoke to their needs. And if those insights helped them, it’s good to collect feedback on how.

These follow-ups will help you retain the good aspects of your financial reporting and correct the areas not adding value to decision-making. It will also help you choose more effective financial indicators for future reports.

How does it work?

Say a new player has entered the market, and you provided an analysis of how it will affect the company's top line. Upon contacting leaders, you may realize they would have benefited even more from an overall market analysis reflecting the new market share.

Pro tips to follow up with leaders:

Set one-on-one meetings with your CEO and department heads to seek their views on your reports. Have an honest and open conversation.

At this moment, don’t give clarifications or press your financial needs on them. Lend a listening ear to their needs. You can discuss the challenges that may have prevented you from addressing the issues they pointed out afterwards.

Performing routine accounting tasks in line with compliance guidelines is the basic minimum. It’s crucial that finance adds value by making sure the business leaders understand how their actions impact the bottom line.

Make your financial presentations something you and the leaders look forward to with the steps above.

Want to learn about hiring an accounting firm? Capterra’s list of the top accounting firms and their features will help you narrow your search. Learn more in our accounting firm hiring guide.