As your business grows, your accounting department should expand alongside.

Managing finances seems like smooth sailing when you first embark on your entrepreneurial journey. However, the landscape can shift dramatically as your company grows. Imagine launching a rowboat on a serene lake only to find yourself navigating choppy seas as you expand your route. The straightforward methods that work in calmer waters are no longer sufficient. It's crucial to establish an accounting department structure like that of a sturdy vessel capable of adapting to the evolving demands of your growing business.

Let's look at five essential small-business accounting tasks, how you should approach staffing for each role, and how to tell when you need help. And because your business can't run on human effort alone, we'll break down how accounting software can support your team.

What are the different ways to structure an accounting department?

Accounting software is a must-have for any small business. You also need a human alongside your tech solutions to double-check the numbers, analyze output, coordinate between non-integrated systems, and ensure your financials are in order. At a minimum, you need someone to run payroll, someone to pay vendors and send invoices, and someone to handle the books so they're balanced come tax time.

Accounting business structures will never look like a softball team roster. These aren't positions on a lineup card you need to fill; there are tasks your business must handle through a combination of roles and resources. You'll need to show discretion as an organizational leader and determine what that looks like for your business and the resources you have.

Use this article as a blueprint to build your accounting team structure, but don't forget to expect fluidity based on the size of your business (both in staff and volume of business) and the capabilities of your team.

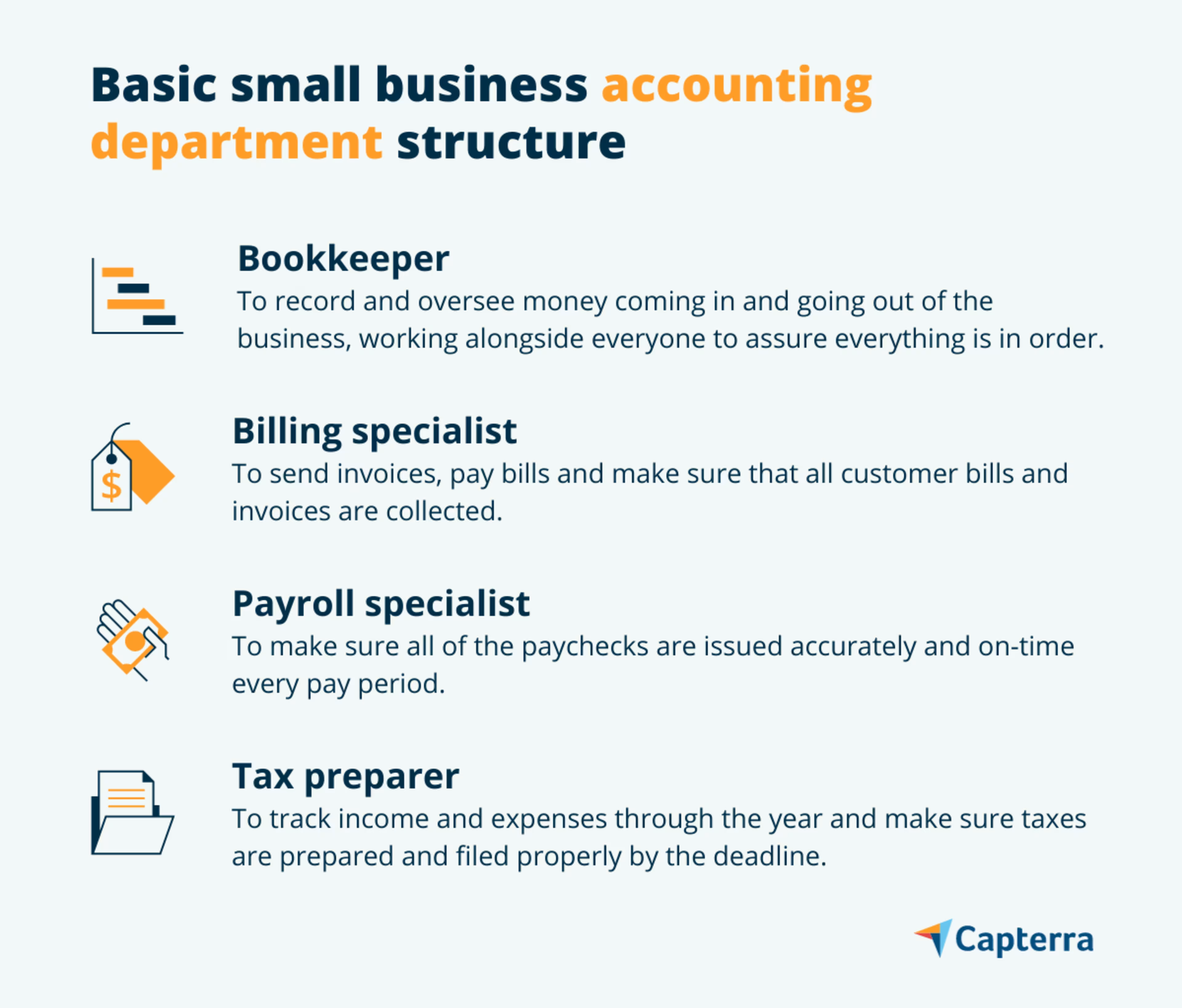

A basic small business accounting department structure

Now that we've outlined the essentials, let's look at a basic accounting structure for small businesses:

A setup like this will cover virtually every small business accounting need, but there is room for flexibility. If your business is small enough, you could have your bookkeeper also handle accounts payable/receivable. You might also decide that an outside firm for payroll dispersal makes more sense.

As a small-business leader, the important thing is to monitor growth and adapt as needed. (Don't wait until paychecks have been late for three straight cycles to get help.) On that same note, seeking professional support may be necessary—you don't know what you don't know. Getting your accounting right without burning yourself out is more important than saving a little money.

In-house vs. outsourced accounting

What's the best way to manage your business's accounting? It depends. You could create an in-house accounting department or outsource to an accountant or accounting agency. In addition, you benefit from either a centralized accounting system or a decentralized accounting system. In some cases, it may make sense to go with each option.

Centralized accounting

Centralized accounting means consolidating financial activities and processes into a single, dedicated department, including bookkeeping, payroll, and financial reporting. Centralization helps streamline communication and financial data supervision. This approach is common in companies that want tight control and standardization across all accounting processes.

Decentralized accounting

Decentralized accounting, on the other hand, spreads finance functions across different departments. Each department might have an accounting team with specific responsibilities. While this approach gives individual departments greater autonomy, it can lead to inconsistent practices, duplicated efforts, and trouble obtaining a comprehensive overview of the company's financial health.

Outsourced accounting

Outsourced accounting involves hiring external professionals or agencies to handle specific accounting functions, such as bookkeeping, tax preparation, and financial analysis. Companies often choose this route to access specialized expertise and ensure compliance while saving money and time for other essential tasks.

When does it make sense to go with each option?

Whether to go for in-house or outsourced accounting—or choose between centralized and decentralized systems—depends on various factors. Outsourcing may be a cost-effective solution if you have a small business with straightforward financial needs. For a larger corporation, you may prefer the strict control and standardization of an in-house centralized approach. Conversely, decentralized accounting may be best if your organization involves diverse operations but requires the consistency of meticulous management.

As per Capterra's 2023 Accounting Shortage Survey, more than two-thirds (71%) of organizations outsource some of their accounting and finance needs to outside firms. However, the downside to outsourcing is the risk of scope creep, which occurs when the project goals, deliverables, or requirements change after it’s already started. You also have less control, and teams aren't as accessible.

Many firms overcome this challenge by adopting accounting software. About 76% of businesses plan to invest more than $5,000 in software in the next year. The top types of accounting software they want to adopt include billing and invoicing software (46%), budgeting and forecasting software (42%), and accounts payable and accounts receivable software (41%). Although technology can't replace human expertise, it has become a more viable solution. This is especially true considering America's accountant shortage, which makes it difficult for small to midsize businesses to find and afford outsourced services. Ultimately, the final decision should align with your business's size, complexity, budget, objectives, culture, and technology.

Key roles and responsibilities of an accounting department

In the sections below, we'll look at five essential business accounting tasks, the skills needed to handle those tasks, and the red flags that signify you need reinforcements. There are different types of accounting, so it's essential to choose the best approach for your business.

1. Billing/invoicing

Why it's important: Cash flow problems are among the devastating financial mistakes that small businesses make. What does this have to do with billing? The longer it takes to bill your customers, the longer it takes for you to get paid.

You need to receive these payments before you can pay your employees and vendors. If you aren't paid accurately and on time, your business risks failure because of low cash flow.

Who should be doing it: You don't need a certified public accountant (CPA) to handle your billing and invoicing. Anyone who's good with numbers and has an eye for detail should be able to manage this task. In addition to accuracy, timeliness is crucial for billing. You want someone in your accounting department structure who is punctual and meets deadlines.

Signs you need help in this area:

Customers don't receive prompt invoices

Customers receive bills for the wrong amount

Customers don't pay the correct amount or on time

2. Payments/accounts payable automation

Why it's important: An Institute of Financial Operations and Leadership study found that 64% of accounts payable teams still input invoices manually, and 36% have no automation.[1]

Automation allows you to prioritize on-time vendor payments to avoid paying late fees or—worse—losing your vendors. For example, you want to be proactive and not wait until the local utility company turns off your electricity. Plus, using automated invoicing software reduces errors.

Who should be doing it: As with billing and invoicing, accuracy and timeliness are paramount for accounts payable. If your organization is on the small side, it's fine to have one person or a small team handle accounts payable and receivable (billing)—especially if you implement the right software.

Of course, your vendors should be trustworthy enough to bill you accurately—making the task of accounts payable less involved than invoicing. However, the role should go to someone in your accounting department who can double-check vendor numbers. You must ensure you aren't overbilled or charged for goods or services your company didn't receive.

Signs you need help in this area:

Vendors complain they aren't getting paid.

Your accounts payable employees continue to make late payments despite their best efforts.

Your accounts payable professionals work overtime to keep up.

3. Payroll

Why it's important: Employee self-service, direct deposit, and correct and timely employee paychecks are crucial tasks for every accounting department. You must ensure these tasks are features provided by your payroll software.

Who should be doing it: When your business is very small (two to three employees), you might get away with having your accounts payable and receivable team/staff member handle payroll. Once your company grows beyond that, you'll need an experienced payroll specialist or a third-party payroll service to do it for you.

What makes a good payroll specialist? In addition to being punctual and meticulous, your payroll person must work well with others to resolve inevitable issues. If you have an in-house payroll person, ensure they have the right payroll software to meet your needs.

Signs you need help in this area:

Employees routinely receive late paychecks.

Employees receive under- or overpayment because of clerical errors.

The employee responsible for payroll is overwhelmed and works overtime to get paychecks out on time.

Want to learn more before hiring a payroll service as part of your accounting structure? Capterra's list of top payroll firms and their offered services will help you narrow your search.

4. Bookkeeping

Why it's important: Balanced books are the true north of your business and should help you sleep peacefully as a small business owner. Good bookkeeping means you've paid all your bills, your customers have paid what they owe, and you've kept clean records showing your financials. While that may not sound terribly exciting, it's vital to your business's financial well-being. If your books are off, it means something has gone wrong.

Who should be doing it: In a way, every other task on this list ties into bookkeeping. You need someone who is well-rounded, precise, and works well with others. While billing is responsible for sending invoices, and accounts payable handles bill payments, your bookkeeper must record and keep track of all those transactions and balances. Your bookkeeper also works with accounting software almost constantly, so they must be proficient in whatever accounting program your business uses.

Signs you need help in this area:

Your books aren't balanced (there's money earned or money spent that remains unexplained).

You're missing necessary reports and receipts when tax time rolls around.

At the end of the year, you have to sift through personal expenses to locate business expenses.

5. Tax preparation

Why it's important: You must pay the government what you owe, but you also need to get credit for all qualified deductions. You don't want to pay more than necessary. You also need to get W2s out to your employees so they can file their taxes on time. If you don't think this is important, wait until the Internal Revenue Service (IRS) comes knocking with a long list of questions you can't answer.

Who should be doing it: A professional. Ideally, either a CPA on staff or an outside accounting firm that can represent your business to the IRS if necessary. While tax time comes once per year, it's folly to think you should only worry about it for a few days or weeks before the deadline.

To succeed, stay on top of expenses and income throughout the year, and record them properly in terms of their tax implications. These proactive measures make a huge difference when tax time comes. Your bookkeeper should work with whoever's in charge of tax preparation to ensure they have everything they need to thoroughly and accurately prepare your tax return.

Signs you need help in this area:

You're trying to do your business taxes and struggle to find the correct reports and forms.

You end up with a much higher refund or amount owed than the year before and can't explain why.

You get an audit notice from the IRS after you file your taxes, and you're not prepared to answer their questions.

Narrow your search for accounting firms with our list of companies in the following areas:

How to scale accounting function as your business grows

As your business grows, your accounting department structure should be able to adapt. This is easier said than done, but accounting software can help support your accounting team structure.

Automated invoicing

Say you have a client that orders 10 pounds of coffee every month. The first time they order, you fill out an invoice template with all their information. Then, you set it to send out the same day every month. If they want to increase or decrease their order, skip a month, or cancel, all your billing specialist has to do is go in and change the settings. But the rest of the time, this invoice goes out like clockwork.

Automated payments

Any good accounting software will remember a bill after you've paid it the first time, allowing your payments specialist to set up an automatic payment the next time that vendor submits a similar bill. Advanced features might include payment tracking, which lets you see when the vendor receives your payment. Another feature is automated approval, so you don't have to digitally sign a form every time your office manager orders more supplies.

Payroll

Payroll software is complex. In most cases, it's only a built-in feature for the biggest hitters in the accounting software space. Instead of looking for an accounting tool that also handles payroll, we recommend setting up your business payroll software the right way. Make life easier for your payroll specialist by automating direct deposit, taxes withheld, and other components.

Automated bookkeeping

Accounting software is bookkeeping software. Bookkeeping is baked into accounting software, keeping a clean record of all the money coming in and out of your business and flagging discrepancies. Automation allows your bookkeeper to act more as a gatekeeper for your accounting business structures. With automated bookkeeping, they can feed data into the software and double-check numbers rather than spend hours on tedious data entry and simple, repetitive math.

Tax preparation

Accounting software can't do your taxes for you, but it can record and organize the data and provide the necessary tax forms. When tax time comes around, you can click a few buttons to produce reports for your accountant instead of dumping a shoebox of receipts on their desk.

Need more business accounting tips?

This article looked at the core accounting department positions. However, you'll need to expand these teams and adjust your accounting structure for small businesses as your company grows. This might entail hiring a chief financial officer (CFO) and financial analysts to shift the focus from staying afloat to achieving growth.

You don't have to be an expert in every business area. Rather, you need to listen to those who know more than you. If your lead accountant tells you it's time to outsource your payroll, listen to them. Be sure to ask the right questions before hiring an accountant.

Creating your accounting department structure is one step toward helping your business grow. You'll also need to give your financial experts the tools they need to succeed.

Read some more tips about finances and accounting for your small business: