Tax season can be a scary time for unprepared businesses. These tips will make it as smooth as possible for this year and next.

Many small-business leaders find themselves consumed with endless paperwork and meetings with tax experts when the time for tax filing comes around. If you have a trusted tax accounting firm by your side, the scare of the tax season may be somewhat subdued. But even then, you may be anxious if you’re using every possible benefit to reduce tax obligations.

Focusing on a few strategies and contracting the right professionals to file your taxes can help you save all that’s possible.

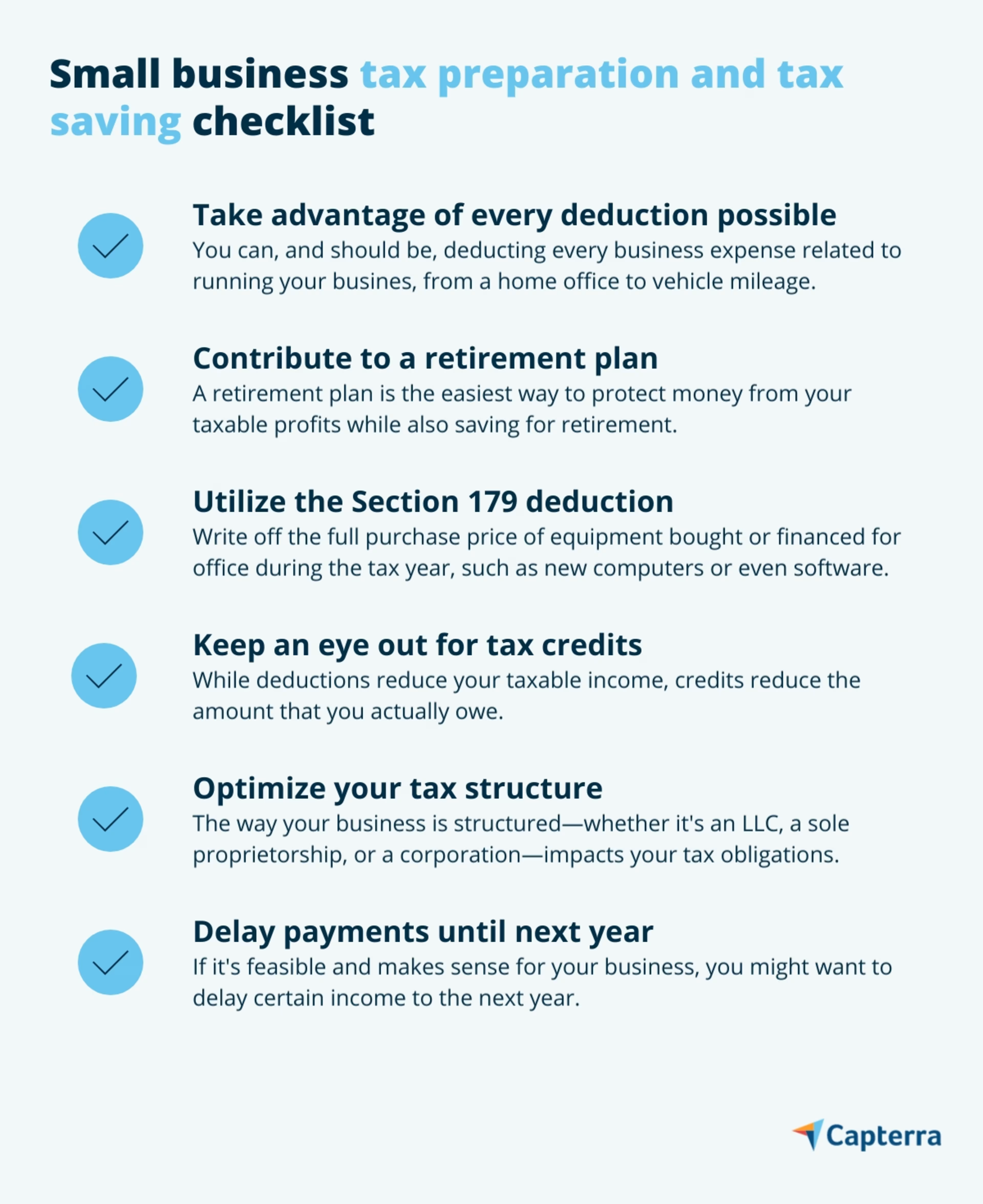

With the help of several seasoned CPAs and entrepreneurs, we get you six solid small business tax planning strategies. These will help you salvage benefits this tax season and make sure the next one goes even smoother.

Keep in mind that this is not a step-by-step manual on how to prepare or file your taxes. These tax planning tips are commonly availed benefits listed by different experts. We assume that you already know the basics:

All the income and expense information from your business.

All of the tax forms you need from the IRS (if your accounting software can't handle this part for you, it's time to upgrade).

Your deadlines for filing.[1]

If not, talk to a local tax expert to get everything in order. Discuss the potential for your business to avail these strategies with your accountant.

#1. Take advantage of every deduction possible

One of the best ways to reduce your overall tax bill is through small business tax deductions. But note that deductions are tricky—if you don't do them right you can get audited.

What are tax deductions?

Tax deductions, also known as tax write-offs, are like discounts on your income that reduce the amount of your income that is subject to taxes. They can potentially drop you into a lower tax bracket, resulting in less tax owed.

If you operate your business to turn a profit, each essential expense you incur can potentially lead to substantial tax savings. To know if an expense is tax-deductible, you should have a good understanding of what is considered a business expense in the eyes of the IRS. The expenses you deduct should:

be made for business (not personal),

be necessary, useful, and relevant in your industry, and

ordinary (commonly accepted in your industry).

Here's a list of nine small-business tax deductions to give you an idea of deductions you may be missing out on:

Home office deductions are something many small businesses miss out on. Even though employees can no longer deduct home office expenses[2], small business owners still can. If you have a dedicated space in your home used exclusively for your business, you can deduct expenses related to that portion of your home.

CPA Jeffrey S. Levine[3] says that fear of an audit prevents many small businesses from taking deductions that they deserve.

"Making incorrect assumptions, such as not deducting a home office or not realizing other items, such as health insurance may be deductible... the biggest danger in that is paying more tax than necessary."

Jeffrey S. Levine

CPA

Tax planning for this year

It’s always recommended to work with a tax professional to understand how these deductions apply to your specific situation.

One of the biggest advantages of working with a professional is finding deductions that you never knew existed. You can—and should—deduct every expense related to running your business: from a home office to mileage on your car to research and development costs. In fact, nearly half of small-business owners rely on full-time support from accounting firms to keep up with tax compliance.

Get help with small business tax breaks you are entitled to while staying compliant with the law.

#2. Contribute to a retirement plan

Multiple CPAs recommend tucking away any surplus cash into a simplified employee pension individual retirement account (SEP IRA).

“A business of any size, even self-employed, can establish a SEP," according to the IRS.

The easiest way to set up your SEP IRA is through your bank, insurance company, or other financial institution like an online investment firm.

"Retirement contributions are put in tax free and removed from your taxable profit. So, not only is setting up a retirement plan a great way to save for your own future, but it also helps you save on taxes in the present. Any small-business owner not doing this is missing out."

Stacy Caprio [4]

Small-business founder, Her.CEO

Savings incentive match plan for employees, or SIMPLE IRA is another retirement saving option for small businesses with fewer than 100 employees. In SEP IRA, employees can’t make contributions for themselves, but in SIMPLE IRA, both employees and employer can contribute and take tax benefits. Remember that:

Your contributions to your own retirement account should be reported on your personal tax return.

Your contributions to your employees’ accounts should be reported on your business’s tax return since your contributions to employee SEP-IRAs are a part of your business’s income.

Tax planning for this year

You can set up a SEP IRA any time, and you have up until the tax filing deadline (March 15 for S-corpsIn addition to these two, there are other retirement investing options, such as solo 401(k)s, available from IRA. Connect with a CPA to learn about the plan best for you.

#3. Utilize the Section 179 deduction

All businesses need equipment: whether it’s office furniture, supplies, vehicles, machinery, software, or other tangible items. You could purchase any number of these items throughout the year and may do so repeatedly. It allows a business to deduct the cost of qualifying purchases, making this a great time to invest in your business.

Recently, it was expanded to allow improvements made to nonresidential property, such as roofs and systems for heating, security, and fire protection.

Consulting an accounting expert at the beginning of the year will help you find ways to reduce your tax burden with wise business purchases and activities that yield deductions.

Tax planning for this year

Do an internal audit to determine which expenses you've missed out on in the past that you can take advantage of this year. To do so, keep track of everything throughout the year, and separate business expenses from personal ones. This is an area where expense tracking functionality (included in most accounting software) is incredibly helpful.

Share that information with a tax professional to find the tax benefits that may apply to you. They’ll ask questions about your business based on current tax provisions to position you favorably for all eligible deductions.

#4. Keep an eye out for tax credits

Tax credits are different from tax deductions. In fact, one expert we talked to says they're better than tax deductions:

"Tax credits reduce your potential taxes on a dollar-for-dollar basis while deductions reduce your taxable income so their net effect is savings equal to your tax rate. From a tax perspective, credits are more valuable than deductions."

Sarah Hancock [5]

Chief editor, Best Company

In other words, tax deductions lower your overall business income on which you’ll pay taxes, while tax credits directly reduce the amount of tax you owe on your business income. Common tax credits to look out for include:

Disabled access credit: For small businesses that make their business accessible to persons with disability.

Work opportunity tax credit (WOTC): For employers who hire individuals from certain targeted groups who have consistently faced significant barriers to employment.

Family and medical leave credit: For employers who provide paid family and medical leave to their employees.

Energy efficiency credits: For businesses that use renewable energy or promote energy efficiency.

Research and development (R&D) tax credit: For in-house and contract research expenses spent for the purpose of discovering information.

For a complete list of business tax credits for small businesses, check out this resource[6] from the IRS. Note that tax credits may also carry forward from prior years.

Tax planning for this year

Review the list of business tax credits and target those that make sense for your business and you aren't already taking advantage of.

Your tax software or tax advisor can walk you through the process of redeeming your earned tax credits when you file a tax return (assuming, for instance, you have earned the credit by purchasing an electric vehicle or providing childcare facilities).

#5. Optimize your tax structure

The choice of tax structure is one of the most important decisions you’ll make as an owner to optimize your tax dues.

Depending on your business structure, you have various tax filing options:

If you’re registered as a corporation, you can file taxes as an S-Corp or C-Corp (check the table for more).

If you’re an LLC, you can file taxes as an S-Corp, C-Corp, sole proprietor, or partnership.

Tax classifications | What they do |

Sole proprietorship or partnership | These businesses are considered “pass-through” entities. This means that business income passes through to the owners’ personal income tax returns where it’s taxed at individual income tax rates. |

S-corp | S-corp, or S corporations, are pass-through entities like sole proprietorships and partnerships. They allow businesses to avoid double taxation by passing corporate income, losses, deductions, and credits through to their shareholders. |

C-corp | C-corp, or C corporations, are subject to double taxation. First, a C-corp pays taxes on its profits at the corporate tax rate. Then, if the after-tax profits are distributed to shareholders as dividends, those dividends are taxed again on the shareholders’ personal tax returns. |

Elect the tax structure that can benefit you the most. For instance, if you own a sole proprietorship, partnership, or S-Corp, you can deduct up to 20% of your business income from tax computation under the qualified business income deduction (QBID) rule. On the other hand, income earned through a C-corporation route is not eligible for QBID deduction.

“Sometimes, remaining a sole proprietor for tax purposes—meaning that you simply report your business income on your personal tax return—is the most advantageous route. The extra administrative costs of having your business taxed as an S corporation may not outweigh the tax savings. This is why it's important that you get personalized tax advice from a qualified tax professional.”

Logan Allec [7]

CPA

Tax planning for this year

The choice of tax classification isn’t always straightforward. Most small businesses start off as sole proprietors or partnerships. But if you earn active income (say by selling stuff online, providing legal services, or having a store) and not passive (say earning real estate rentals) and getting upward of $40,000 in net profit, according to many CPAs, electing for an S-corporation status may be the best option to save taxes.

If you are confused about which tax structure you should file under, consult a tax professional and let them know what industry you’re in and your daily business activities.

#6. Delay payments until next year

If your business uses the cash accounting method (which most small businesses do), you recognize income when you receive it and expenses when you pay them. By delaying payments owed to you until after December 31st, you effectively push that income into the next tax year. This approach can lower your taxable income for the current year, thus reducing your tax liability.

When it’s the end of the year, there’s very little of what you can do to offset a big income coming your way. Deferring it to the next year will give you enough time to plan for taxes. Let’s say you're an independent service provider, and you're due to receive a significant $2 million commission near the end of the year. You could ask your client to hold off on paying you until after December 31st, deferring that income to the next tax year.

Keep in mind that this strategy won't reduce your overall tax obligation—it merely defers it. However, if you expect to be in a lower tax bracket next year, need more time to plan, or if you anticipate tax rates to drop, this could result in actual savings.

Tax planning for this year

Expecting a significant income toward the year’s end? Talk to a CPA or a tax professional to know if delaying those big payments to roll into the next year is a smart strategy for your specific situation.

They’ll also guide you through other ways to offset that sizeable income, say by making certain business-related purchases, contributing extra to your retirement account, or taking advantage of tax credits or deductions discussed above.

Good record-keeping is the key to effective tax planning

Ideally, tax planning is something that should be woven throughout your business lifecycle. Every time you make a sale, invest in new equipment, or even hire a new team member, you’re making a financial decision that has tax ramifications.

If you’ve gotten by somehow this year, the soundest advice we can offer when it comes to preparing and planning your small-business taxes is to use accounting software early, and often.

Accounting software, when paired with a good tax services provider, keeps all necessary records in one place, offers all the tax forms you'll need, and helps you take advantage of every possible deduction and credit.

Tax law is complicated and ever-changing, and small-business leaders need to be ready when tax time rolls around to make sure they're not paying the government more than they owe, or worse yet—unwittingly committing tax fraud.

“You could find yourself subject to penalties and interest from underpayment of taxes. This can come from either error in preparation of the return or failure to make the required estimated payment.”

Steve Hocheiser [8]

CPA

You may be thinking that you can save some money by doing your taxes yourself or skimping on accounting software, but isn't the peace of mind that comes from knowing your taxes were done accurately worth a modest investment?

Schedule a free tax consultation with a local accounting firm to see how they can help with your tax filing, bookkeeping, or payroll needs.

Note: This article is intended to inform our readers about business-related concerns in the United States. It is in no way intended to provide financial advice or to endorse a specific course of action. For advice on your specific situation, consult your accountant or financial consultant.