Your relationship with your customers is valuable. But can you put a number on that value?

I was an English major in college, which means that most math terrifies me.

What is customer lifetime value?

Customer lifetime value is how much money a customer generates for your company over the course of your relationship.

It starts off looking simple and easy: 1 + 1 = 2. But then you find out that the sum of all natural numbers is -1/12, and you realize that most math is much harder and more complex than you thought it was.

When it comes to calculating customer lifetime value (CLV), the math can be similarly tricky.

But you shouldn't avoid it. Calculating CLV is crucial to your business. In fact, 38% of CMOs use CLV as a key performance indicator in their marketing strategy (making it the third most-used metric after customer experience and channel marketing spend + ROI).

Before we get into the specifics of how to start calculating, let's talk a bit about why it's such an important marker of success.

Why calculating customer lifetime value matters

Not all customers are the same. Some move quicker through the sales funnel, some are more resistant to churn, and some are stronger brand ambassadors.

You've already got a pretty good idea of your ideal buyer persona, but you might be wrong. Buyer personas are supposed to be living documents, after all.

One way you can tell if your persona needs updating is through calculating customer lifetime value. You might find that, though you've been targeting healthcare professionals with your marketing, construction workers have a higher CLV. This would mean you need to shift your focus (something you wouldn't know without CLV calculations).

CLV is also a good way for the savvy marketer to justify their budget by showing just how much revenue your expenditures generate for the company.

The math for calculating your CLV

So, how do you actually figure all of this out? Get out your calculators, folks.

When you're first starting out, there's a simple equation you can use:

CLV = (Average cost of customer's purchase * Average number of purchases they make) - Cost of acquisition

But where do you get this data?

If you've appropriately invested in CRM software, the first two pieces of data should be easy enough to track down.

As for the cost of acquisition, this requires a bit more math. Essentially, you take the entire cost of your sales and marketing initiatives over a given period of time and then divide that by the number of customer acquisitions you made during that same period.

Now the equation looks more like this:

CLV = (Average cost of customer's purchase * Average number of purchases they make) - (Cost of sales & marketing during acquisition period / Number of customers acquired)

Already the math is getting more complex. Let's take a look at a few examples based on the first formula:

Customer A:

(Average cost of customer's purchase: $40 / month * Average number of purchases they make: 20 months of purchases) - Cost of acquisition: $200 = CLV: $600

Customer B:

(Average cost of customer's purchase: $800 / month * Average number of purchases they make: 6 months of purchases) - Cost of acquisition: $1,000 = CLV: $3,800

If we're only using these data points, Customer B is far and away the more valuable customer.

But there's a lot more at play here, which could be why only 58% of companies say they have faith in their CLV model (full text available to Gartner clients).

It might be that Customer B has a higher CLV, but without more data points, we won't know for sure. Let's look at the other factors that could impact that final number.

5 other factors to consider and how they fit in

Some of these factors will increase CLV and some will decrease it, so at the end of this section, we'll look at the revised equation.

As you identify each of the new factors that contribute to the equation, identify whether it's an investment or a profit. That will dictate where it goes within the equation.

Here are a few of the additional factors you should consider:

1. Likelihood to become a brand ambassador

Brand ambassadors lower your overall cost of acquisition. If you can convert a customer into a brand ambassador, their overall CLV will go up.

They will drive up the cost of your sales and marketing efforts (as you should provide small financial incentives to keep the relationship strong), but will generate a lot more customers (every social media post from an ambassador reaches an average of 150 people).

To figure this out, look at the number of customers that fit the profile of your target customer and see how many became brand ambassadors, then determine the impact those had (i.e., how much money you spent on them and how many customers they brought in).

2. Likelihood to upgrade

The likelihood of a customer to upgrade is something that can be rolled into the average purchase cost in our original formula, but it shouldn't be for the sake of knowing who to target.

That likelihood of an upgrade means that some customers who seem low value at first will probably become much higher value down the line.

It could be a result of their company growing in size or needing more functionality than your base model offers. This all means that a customer's (company's) maturity is another component to consider regarding their likelihood to upgrade.

3. Likelihood to leave impactful reviews

This one is interesting. Impactful reviews, in this case, are reviews that drive you to change your business practices or product.

It will drive up production costs, which you'll now have to factor into your calculations. But it will also ultimately drive up number of clients, number of purchases, and the size of those purchases.

4. Cost of onboarding

Different-sized companies will ultimately require different levels of onboarding. This impacts your cost of acquisition, as both newer and larger companies require a lot more money in terms of resources for onboarding.

Try to figure out the average cost of onboarding per user for customers that fit the same profile.

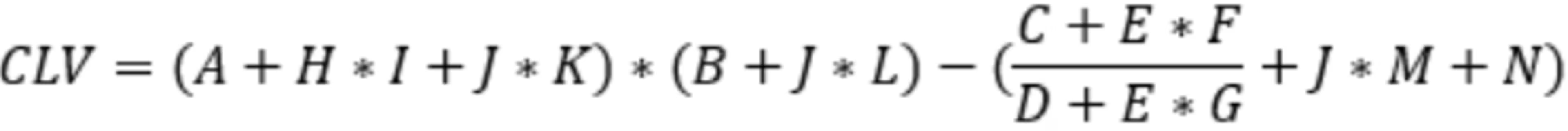

Your adjusted equation for calculating customer lifetime value

Are you ready for the new version of our CLV formula?

One quick warning: It'll look intimidating, and it'll still be incomplete. The latter stands because there will be plenty of other factors that your unique business will want to take into consideration.

A=Average cost of purchase

B=Average number of purchases

C=Cost of marketing / sales during a specified time period

D=Number of customers acquired during that same period

E=Likelihood of becoming a brand ambassador

F=Cost of brand ambassador relationship

G=Customers brought in by brand ambassador

H=Likelihood to upgrade

I=Average cost of upgrade

J=Likelihood to leave impactful review

K=Cost of purchase after changes from review

L=Number of purchases after changes from review

M=Cost of changes from review

N=Cost of onboarding

Look at that. It's beautiful and complicated, and requires you toPlease Excuse My Dear Aunt S**ally. It'll take a while to process it all, so take your time and practice before moving on to our next steps.

Using your CLV for marketing strategies

Your goal, now that you have a general understanding of each customer's lifetime value, is to use this information to dictate your marketing strategies. This includes which personas you target, as well as where you allocate the majority of your resources.

You want to do everything in your power to maximize each customer's CLV. To do that, you should implement an intent-based marketing strategy.