Being a property manager or landlord is stressful. There's so many things that need to be taken care of, from finding the right tenants, to maintaining building integrity and safety, to making sure all the paperwork is filled. The list can seem never-ending.

One of the best ways to lower your stress is to have good landlord insurance.

The right type of insurance ensures that you are fully covered in case of any property damage or accidents that may—and often do—occur.

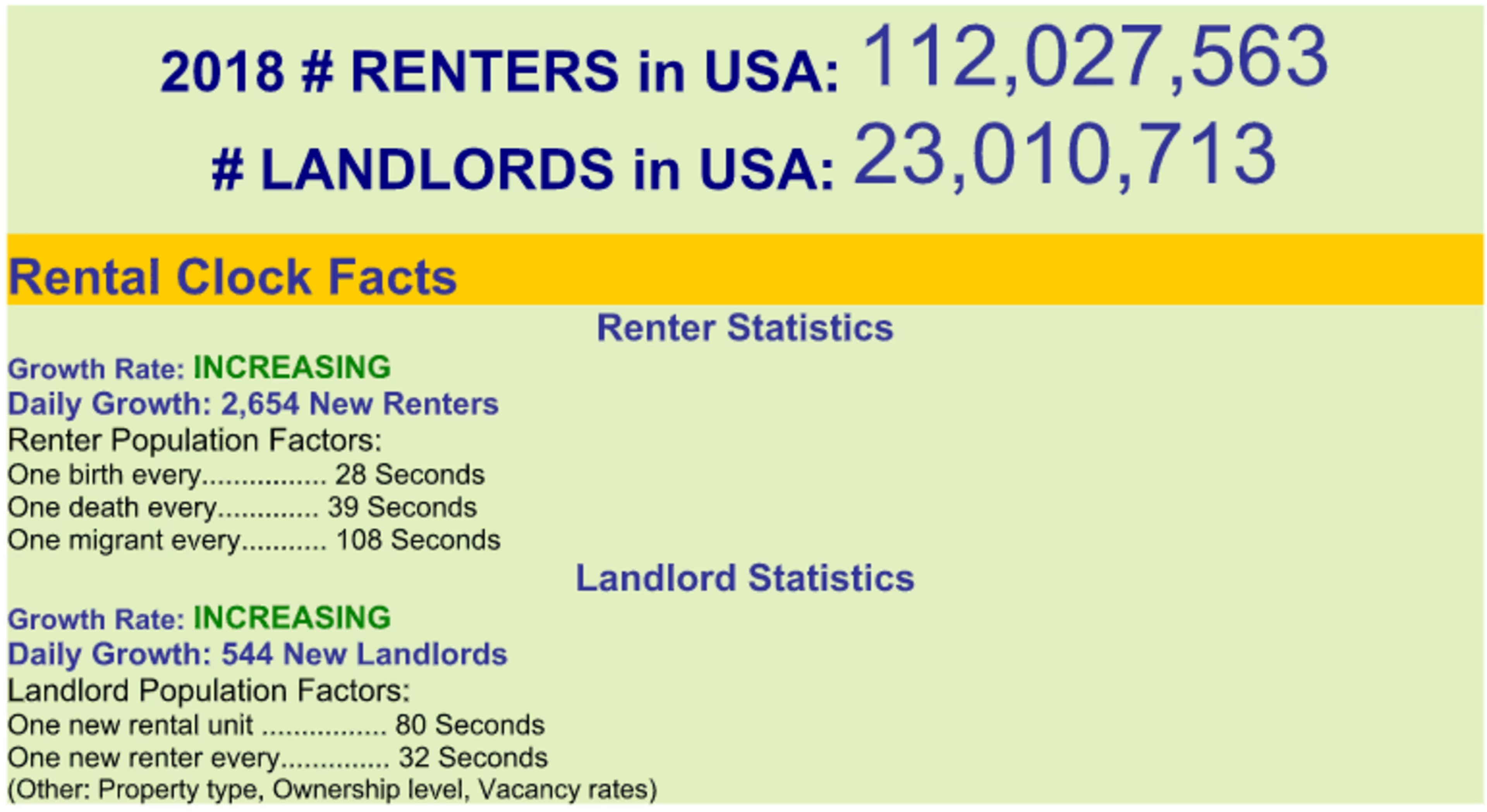

According to the Rental Protection Agency, the rate of new renters and landlords is increasing by the day.

More renters at your properties mean more profits, but also increased potential for expensive incidents that you could be on the hook for. Having landlord insurance will cover your property from damages and shelter you from possible liability expenses.

Here's what you absolutely must know before purchasing your own landlord insurance, or changing the terms of the insurance you currently have.

Types of landlord insurance

There are three main types of landlord insurance that you can purchase: dwelling property (DP) 1, 2, and 3.

DP-1: The cheapest and most basic form of coverage covers the most common perils such as fire and lightning, explosion, windstorm and hail, riots and civil unrest, and smoke damage.

One thing to note is that this type of coverage only covers actual cash value. This means that it takes current market value of the damaged property, which depreciates in value every year. So if you bought a fridge for $600, in a few years it would only be covered for around $400.

DP-2: This covers everything mentioned in DP-1 while adding more comprehensive peril protection. It often includes burglary, ice and snow, broken glass, falling objects, electrical damage, frozen pipes, cracking or breaking pipes, accidental overflow of water, and collapse of part of building.

With this type of coverage, you get the option to add replacement cost. This means that your insurer will replace the damaged property to its full extent, no matter what. This comes with a higher monthly premium cost, but you will be assured that the damage is repaired to what it was before.

DP-3: The third option is the most expensive but covers all possible perils. You get the option to cover the loss of rent if your tenant is unable to pay because of one of the perils described.

But to understand landlord insurance more deeply, you need to understand the different categories of coverage.

Categories of landlord insurance coverage

1. Property damage

If one of the perils described earlier does occur on the property you manage, landlord insurance will cover the cost to fix the damage.

This includes the structure, owned furniture, appliances, and other major parts of the property. Note that it doesn't cover the tenant's possessions and belongings. That coverage comes through renters insurance.

We recommend that you require your tenants to purchase renters insurance.

2. Liability coverage

If one of your tenants or tenant's guests is injured on your property, liability will cover all the incurred expenses that follow. This coverage comes in handy if your tenant gets injured and claims negligence on your part to maintain a safe property, and then decides to sue. It covers all lawyer's fees and medical expenses.

3. Loss of income

Loss of income insurance is exactly what it sounds like: it covers the loss of rent payments if your tenant is forced to move out because of one of the perils described earlier. Take a look at guaranteed income insurance as well, which will help prevent any loss of income if a tenant is unable or refuses to pay rent.

Who should purchase landlord insurance?

So does landlord insurance make sense for you?

If you're a property owner who rents a home or building to others that is not partially owner-occupied, then the answer is yes, says Gordon B. Coyle, president and CEO of insurance and risk management company The Coyle Group of New York, an insurance and risk management company.

"Typically, three to five family homes are written on a personal insurance dwelling fire [DP] package, while multi-unit apartment buildings are written on a commercial package policy," Coyle says.

One of the biggest considerations as a landlord is to decide how much you want to limit your coverage. With more coverage, you have to contend with higher premium costs. You can balance out the premium costs by adding a larger deductible (amount you pay to get a claim filed if something does happen).

However, if an accident or damage does occur, you will have to pay much more out of pocket to have your insurance kick in and pay for the claim.

How to save money

There's a few ways you can save some green on landlord insurance if you're worried about the expense.

You can bundle your policies. If you have other forms of insurance, grouping them together under one company will give you a discount. For example, put your landlord, homeowner, auto, and life policies under the same carrier.

Install safety features that will lower the risk of dangerous incidents. Having a safer property will appeal to your insuring company as it takes on less risk with a lower chance to have to pay out claims. You can install surveillance cameras or updated smoke and burglar alarms, to name a few options.

Look for discounts when you shop. Some groups that are eligible for discounts include military veterans and first-time landlords. You can ask your current insurer what they offer as well.

Make sure you compare quotes between insurers, as they can vary widely. You may think that being loyal to your insurer will bring you discounts, but it often works the other way around. Shopping around will send signals to insurance companies that you are a smart consumer. How will you know you are getting the best rates unless you know rates from a range of insurance companies?

What advice do you have for people seeking landlord insurance?

If you're a long-time landlord, you've probably gone through the experience of searching for landlord insurance. Let us know in the comments below what you struggled with the most, and share any tips you have for first-time landlords—or even for seasoned veterans.

Also, do you know of any real estate management software that helped you manage your landlord insurance? We'd love to hear your recommendations.