If you're a nutrition professional thinking about accepting insurance for the first time, you may feel daunted, frustrated, and confused. Should you even try?

Here's the good news: it doesn't have to be that difficult.

With a little guidance and persistence, you can create a process to accept insurance from clients.

In the guide below, you'll find everything you need to know to start taking insurance at your private practice. We'll cover it all, from the prerequisites for being an in-network provider through the legal requirements that come with accepting insurance.

Should you take insurance?

Insurance isn't a fit for all nutrition practices. Before deciding, seriously weigh your long-term goals and how insurance could impact your business.

Here are some pros and cons to accepting insurance to help you decide.

Pros of accepting insurance

Many practices see growth after taking insurance. Each insurance company has a large membership base, which gives you access to a large set of potential clients. Clients use insurance directories, like this one, to look up in-network nutrition and wellness professionals in their area. You want to be on that list.

Accepting insurance makes your services accessible to clients who may not otherwise be able to afford your care. This can be especially important if you practice in an area with lower incomes.

Clients increasingly expect their care providers to accept insurance. Clients may feel that a provider who works with an insurance company is more legitimate or reliable.

More plans than ever cover nutrition counseling. Many insurance plans cover a certain number of sessions per year. You may therefore get more business from insurance clients, because they are more likely to return for all the sessions they have covered. That means better client retention.

Working within an insurance network can expand your referrals. Referring providers in the insurance network—from PCPs to condition-specific specialists—can send many clients your way.

Cons of accepting insurance

Getting set up to accept insurance is time-consuming. The process includes getting an NPI number and legally registering your practice, then setting up a system for processing insurance billing. The process can take months.

The complexity can continue post-setup. Processing insurance claims requires: Filling out CMS 1500 forms correctly. Tracking which claims are processed and which ones you're waiting on. Potentially processing returned claims or follow-up paperwork

You may get paid more slowly, depending on how long it takes your payers to process your insurance claims.

Insurance companies set how much they're willing to reimburse, based on their own algorithms. Clients may not expect to pay more than what's covered by their insurance company. These two things, taken together, may limit how much you are able to charge for your services.

Keep in mind that some of these cons can be addressed with the help of technology. For example, the right software can significantly reduce the time to file claims, the frustrations, and the reimbursement lag time.

If you do decide that accepting insurance as payment is right for you, here's a short guide to getting it all set up.

How do you prepare to accept insurance?

First you need to apply with an insurance company. Your application process will go faster if you prepare correctly:

1. Get familiar with state licensure laws

Insurance companies work with providers who are licensed.

Sometimes exceptions are made. For example, health coaches who are employed by an in-network practice may have their services covered. However, if you run your own practice then you need to be licensed.

Licensure requirements vary from state to state.

Some states—like Colorado—don't require any specific education or credentials to practice as a nutritionist, nutrition advisor, or nutrition counselor. On the other hand, states like Florida require that you be licensed by the state if you perform nutrition counseling.

Whether or not a license is required, the specific licensure process itself varies from state to state. You can use this map to check the laws of your state.

2. File as an LLC or S-corp

Insurance companies take your legal filing status into consideration as a measure of how established your practice is and to evaluate their risk in working with you.

Filing as a business communicates your practice's stability, and your ability to consistently provide quality care to an adequate number of clients.

Legally filing your practice as an Limited Liability Corporation (LLC) or as a Subchapter Corporation (S-corp) creates legal boundaries between you and your business, which has an impact on two things: lawsuits and taxes.

Operating a business opens you up to litigation. If someone sues you—whether it's groundless or not—having filed as an LLC or S-Corp means they are suing your company, and the lawsuit can only go after your business assets, not your personal assets.

LLCs and S-corps may be similar in some ways. However, the impacts on company structure, tax filings, and reporting requirements are extensive.

To determine which is right for you, talk with an attorney and an accountant. If you don't have access to an attorney, services such as LegalZoom can help you. Furthermore, many states provide a filing agency to help you through the process.

3. Get liability insurance

When you start giving nutrition counseling, you open yourself to possible lawsuits. Liability insurance protects you from potentially-devastating legal costs, and is required by most insurance companies.

Again, it limits the financial sanctions you have to pay personally if your advice is in any way associated with negative outcomes. Your policy will cover attorneys' fees, court, arbitration and settlement costs, as well as punitive, compensatory and medical damages.

When choosing which liability insurance to buy, pick a plan by considering:

Which services you provide

How much coverage you need

Whether you need coverage for in-person care, virtual care, or both

The cost of different plans

Remember: You need liability coverage in each state you practice in, whether you practically physically and virtually.

You can find a starting list of liability insurance providers here.

4. Get your National Provider Identity (NPI) number

Also necessary before you apply to work with an insurance company is a unique identifier. An NPI number is a 10-digit identification code that identifies you when filing insurance claims.

The Health Insurance Portability and Accountability Act, or HIPAA requires that you have one, in order to identify your practice in insurance claims.

Your NPI is permanent and will be yours regardless of any job or location changes.

NPI applications are free, and the process is straightforward. Turnaround time is between one to twenty days, so make sure you file with enough time before you submit your application to be an insurance provider.

5. Decide which insurance companies you want to work with

It may be tempting to work with as many insurance companies as you can, given the pros listed above. And it's true that your licensure, legal filing, liability insurance, and NPI number will be needed by all of them—so you would reap more benefits from all that setup work.

However, the application process can be long, and you don't know how well insurance works for you until you do it. If you start by applying to just one or two insurance companies that are a good fit, this will allow you to evaluate what's working for your practice.

To determine which insurance companies are a fit for you, start with a list of possibilities. A good way to start your list is to reach out to clients, nutrition professional peers, and referral partners to see who they work with. You can also search the internet for the most popular insurance companies in your area.

With your list assembled, answer these seven questions about each company:

Does the insurance company cover nutritional care in its plans?

What qualifies a client for this coverage?

How is the extent of coverage determined? Is telehealth covered?

Is the nutrition coverage constant across insurance plans? If not, how does does the coverage change?

Is the insurance company currently accepting new providers?

Are your current qualifications enough to get credentialed by the insurance company?

How does their referral system work?

Once you've answered these questions and determined which companies you want to work with, you can begin the application process with a specific company.

This starts the journey of becoming an in-network provider.

How do you become an in-network provider?

Every insurance company has a different application process. However, generally, there are four main phases to becoming an in-network provider:

Applying

Credentialing

Contracting

Follow up

1. Apply to be an in-network provider

Applications are company-specific. Each one will have slight differences in the documents and forms you need to provide.

You can usually find a company's application and requirements online, such as these from Aetna and Anthem.

If you run into any difficulties, you can call the insurance company's provider line to get more information or specific application forms.

2. Get credentialed

Credentialing is the process of getting enrolled in an insurance company's preferred provider network. In this step, the insurance company verifies your education, training, experience, and competency. This gives insurance clients more peace of mind and puts you in a more limited set of providers.

To get credentialed, you need to register with the Council for Affordable Quality Healthcare.

Once you register with them, you'll need to complete their form, which is free. Along with basic identification questions it will ask for your affiliations, liability and malpractice insurance information, your malpractice history, and your work history and references.

With this one form, you can start the credentialing process with all the member companies. Just choose which ones you want when you complete the form.

Now, the credentialing process begins. It's slow.

It can take several months. CAQH will reach out to you every 90 days to attest that the information is still valid. Once the CAQH confirms your credentials, each member insurance company will consider you fully credentialed.

3. Start the contracting process

Once credentialing is complete, you are ready for contracting. This is the process in which you set your reimbursement rates and policies for seeing and filing claims for plan members.

Contracting varies wildly from company to company. It can take anywhere from one to six months.

While individual practices continue to have less ability to negotiate specific terms with managed care companies, these best practices will help you through the process.

One of the most important things you can do throughout all these steps is…

4. Follow up!

For every step, you will need to be persistent and follow up with the insurance company.

Document all tracking numbers and receipts for your forms and applications.

Create a follow-up calendar. Every few weeks, call the insurance company to check your status. This will help push the process forward and keep you from getting lost in the crowd.

If you're rejected at any point, get a clear answer as to why. Adjust. Then apply again.

Once you're in-network, how do you get reimbursed?

Once you're an in-network provider, you'll need to learn the forms to submit to get reimbursed by the insurance company you work with.

For reimbursement: Intake forms

Before you see a client who wants to pay with insurance, you'll need to get their information. This form does not need to be submitted to your insurance company, but the information on it is necessary to fill in the insurance forms.

An intake form gathers information such as:

Name and address

Contact information

Insurance plan and number, so you know which services will be covered

Goals and reasons for seeing you (optional)

Health history, medications, etc. (optional)

Any other information that will help you

For reimbursement: CMS 1500 forms

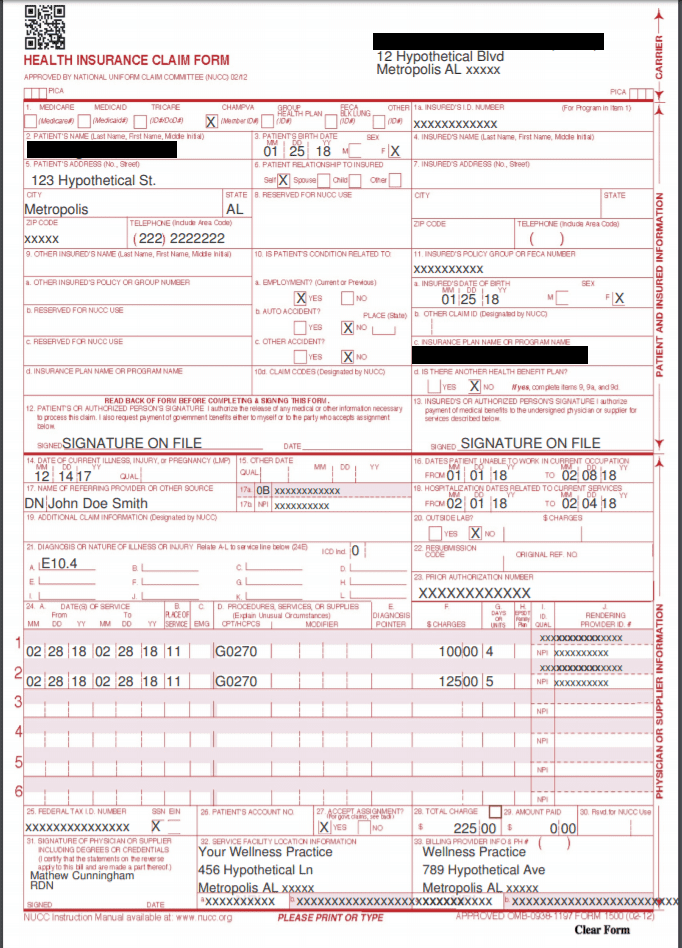

A CMS 1500 is the insurance claim form for non-institutionalized healthcare providers. That includes nutrition and wellness private practices. These forms are submitted by dietitians to insurance companies to get reimbursed for their services.

CMS 1500 form

On each CMS 1500, you will need to fill in:

Client info: This includes basics like name, birth date, gender, address, relationship to the insured, and billing information.

Referral info: If the client was referred by another provider, you'll need that provider's name and NPI number.

Provider and practice info: This is your information, including your NPI number, In-Network Provider ID, and any other information required by the specific company. You must include your location NPI and address.

Policy info: This includes the insured client's ID number, policy or group number, plan name, and FECA number.

Diagnosis info: This includes all appropriate CPT and ICD-10 codes. This is an insurance categorization system, which standardizes your reason for seeing the client and the treatments you provide. These are especially important. The wrong codes can not only cause claims to be denied, but can also cause insurance companies to demand the return of past claims.

This is a lot of information and can be especially time consuming if you see a lot of clients, see clients for different specialties or areas, or in different locations, or work with different referring providers.

To save time, look for software that make it easy to process and track CMS 1500 forms, such as a practice management platform.

For compliance: HIPAA privacy notice

The goal of HIPAA is to ensure that all personal health information (PHI) is protected consistently and securely by all health professionals. PHI is any health information that is linked with uniquely identifying information, such as a name or a social security number.

As a healthcare provider, you need to be HIPAA-compliant, or you will face consequences. There are two main categories of HIPAA violations: "reasonable cause" and "willful neglect."

The penalties for reasonable cause violations range from $100 to $50,000 per incident. These violations mean that you were taking reasonable precautions and didn't know there was a breech.

The penalties for willful neglect violations range from $10,000 to $50,000 per incident and possible criminal charges.

The HIPAA privacy notice explains to clients how you protect your their personal information and indicates that you won't share their information without explicit approval. To be compliant, you need to provide each client with this form.

You can find a sample HIPAA Privacy Notice here.

For insurance networks that require referrals: PCP referral form

Many insurance companies require that a client get a referral from a primary care physician (PCP) before seeing a specialist, such as a dietitian. Having each client's PCP complete this form streamlines the reimbursement process for you.

For insurance networks that require referrals: PCP follow-up form

If another provider referred a client, sending a summary of your visit back to them is the best practice. This form is basically a modified chart note. This insures continuity of care between providers and also helps you get more future referrals.

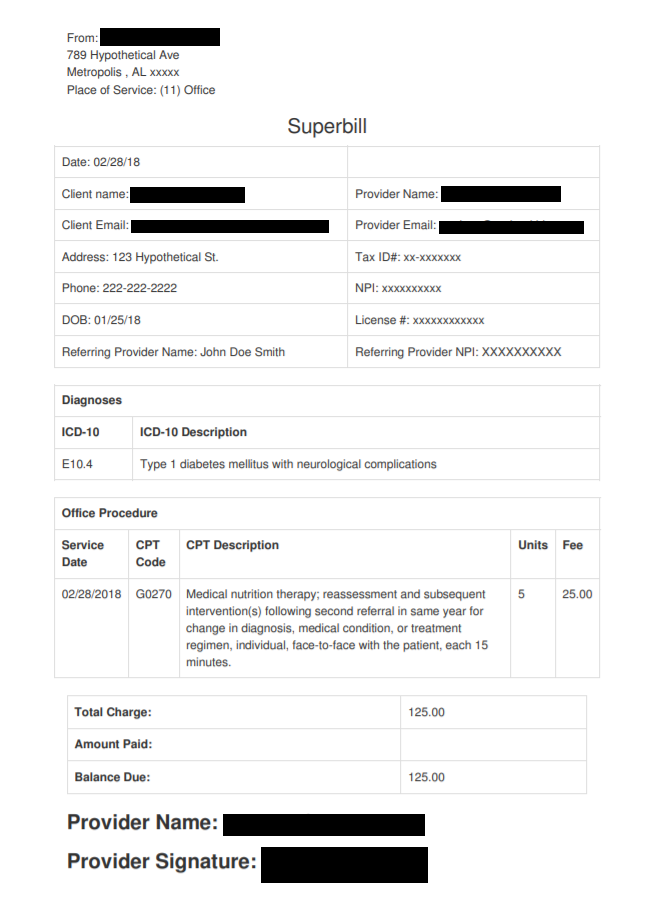

For out-of-network clients: Superbill

If you're seeing a client for whom you are out-of-network, you should offer them a superbill.

A superbill is a detailed receipt of the services you provided, in a specific format. It includes all the information an insurance company needs to file a claim.

Superbill

Clients submit superbills to their own insurance companies for a chance to get reimbursed. Like a CMS 1500 form, a superbill lists your information and NPI, along with the ICD-10 and CPT codes indicating what treatments were provided.

Feel overwhelmed?

Don't!

While it's a lot to take in at first, the road to accepting insurance is one that's been traveled many times—and that has many benefits.

Reach out to a peer or mentor who accepts insurance and has been through the credentialing process. Their experience will be invaluable in helping you through the process.

If you know taking insurance is right for your practice, don't give up. The process may be long, but the rewards will be worth it.