Find out if your small business is eligible for the SBA's program to keep payroll running during the pandemic.

As the COVID-19 outbreak forces millions of Americans to social distance and self-quarantine, small businesses are bearing the economic brunt. A survey by the Chamber of Commerce states that 54% of small businesses either have already closed or may temporarily close by mid-April.

Amid such circumstances, even minimal financial aid can help small businesses weather the crisis and keep their payroll running. This is exactly where the Paycheck Protection Program—part of the Coronavirus Aid, Relief and Economic Security (CARES) Act—comes in. Congress passed the economic stimulus measures March 27.

We've prepared this article to help you, small-business owners and managers, learn more about the Paycheck Protection Program and take full advantage of the benefits available to you.

What is the Paycheck Protection Program?

The Paycheck Protection Program is a forgivable disaster loan that is a part of the U.S. federal government’s financial relief package for the COVID-19 crisis. Managed by the Small Business Administration (SBA), its aim is to offer small businesses the financial support to keep their payroll running through the economic downturn of the crisis.

Loans obtained through the Paycheck Protection Program can also be used to pay mortgage interest, other debt, rent, and utilities as long as those expenses originated before February 15, 2020.

Approximately 1.03 million loans for small businesses have already been approved (as of April 13), and about 70% of them are for $150,000 or under. Each eligible small business is entitled to loans totaling 2.5x its average monthly payroll costs (capped at $100,000/yr. for each employee), up to $10 million.

The loan has a maturity of two years, an interest rate of 1%, and does not require any collateral or personal guarantee. Business can apply for the program through June 30.

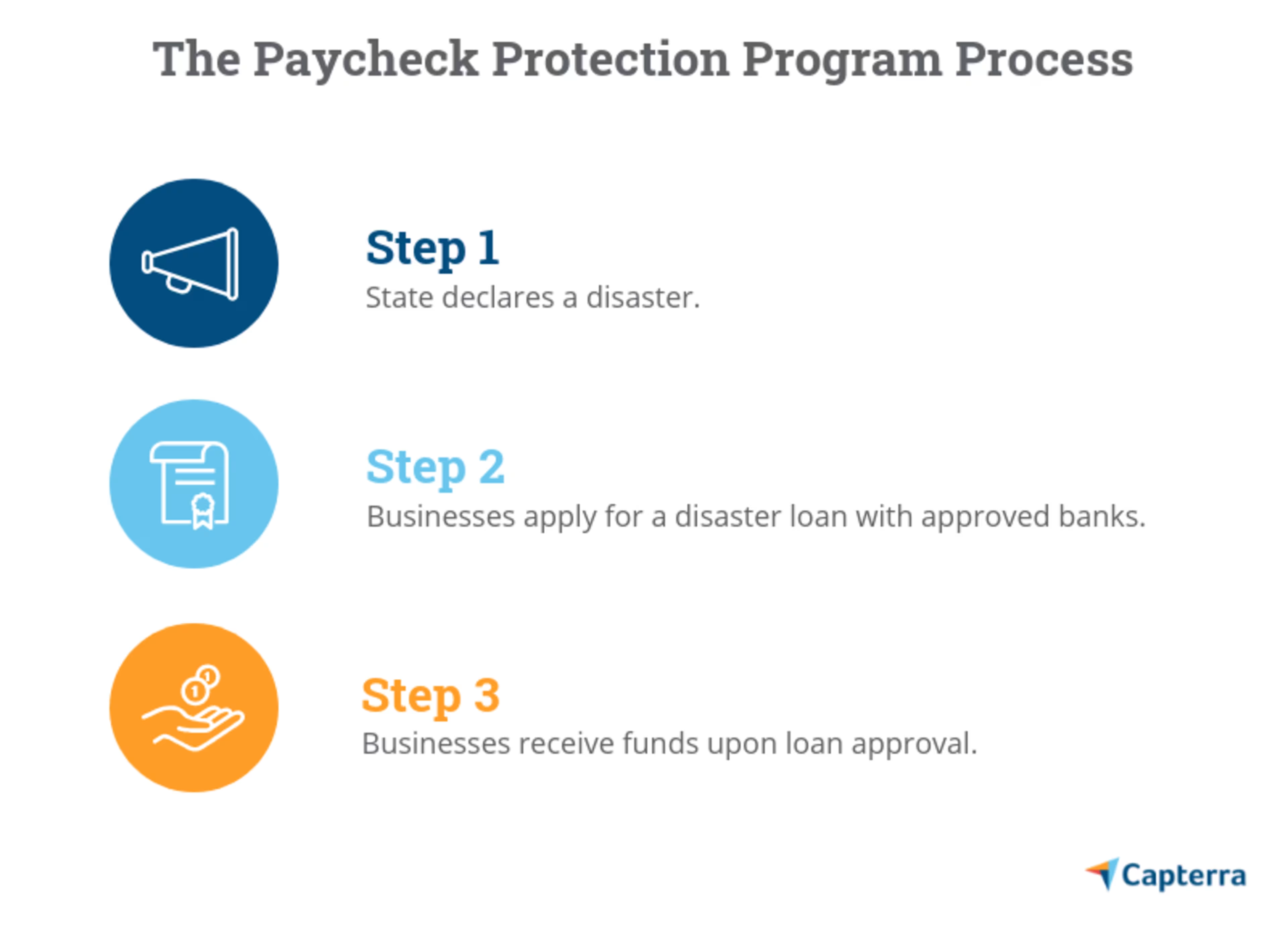

How does the Paycheck Protection Program work?

The Paycheck Protection Program is a federal disaster loan that becomes available only when a state declares a disaster. As of March 22, all 50 U.S. states have filed and received approvals on their disaster declaration requests with respect to the COVID-19 outbreak. This makes the disaster loan available to small businesses across the United States.

Who is eligible for the Paycheck Protection Program?

The disaster loan under Paycheck Protection Program is available to a variety of entities, including small businesses, sole proprietorships, independent contractors, and self-employed individuals.

To be eligible for the loan, the applicant must meet the criteria for a small business, as laid out by the SBA for each industry. For instance, a toy manufacturer with 500 employees and a musical instrument manufacturer with 1,000 employees would both qualify as small despite the difference in their number of employees. Additionally, the included employees must be based in the United States.

More information on eligibility can be found here.

How to apply for the Paycheck Protection Program

It is important to remember that the SBA does not provide the money itself. Instead, it backs your loan with a guarantee, and a financial institution (your lender) actually disburses the money.

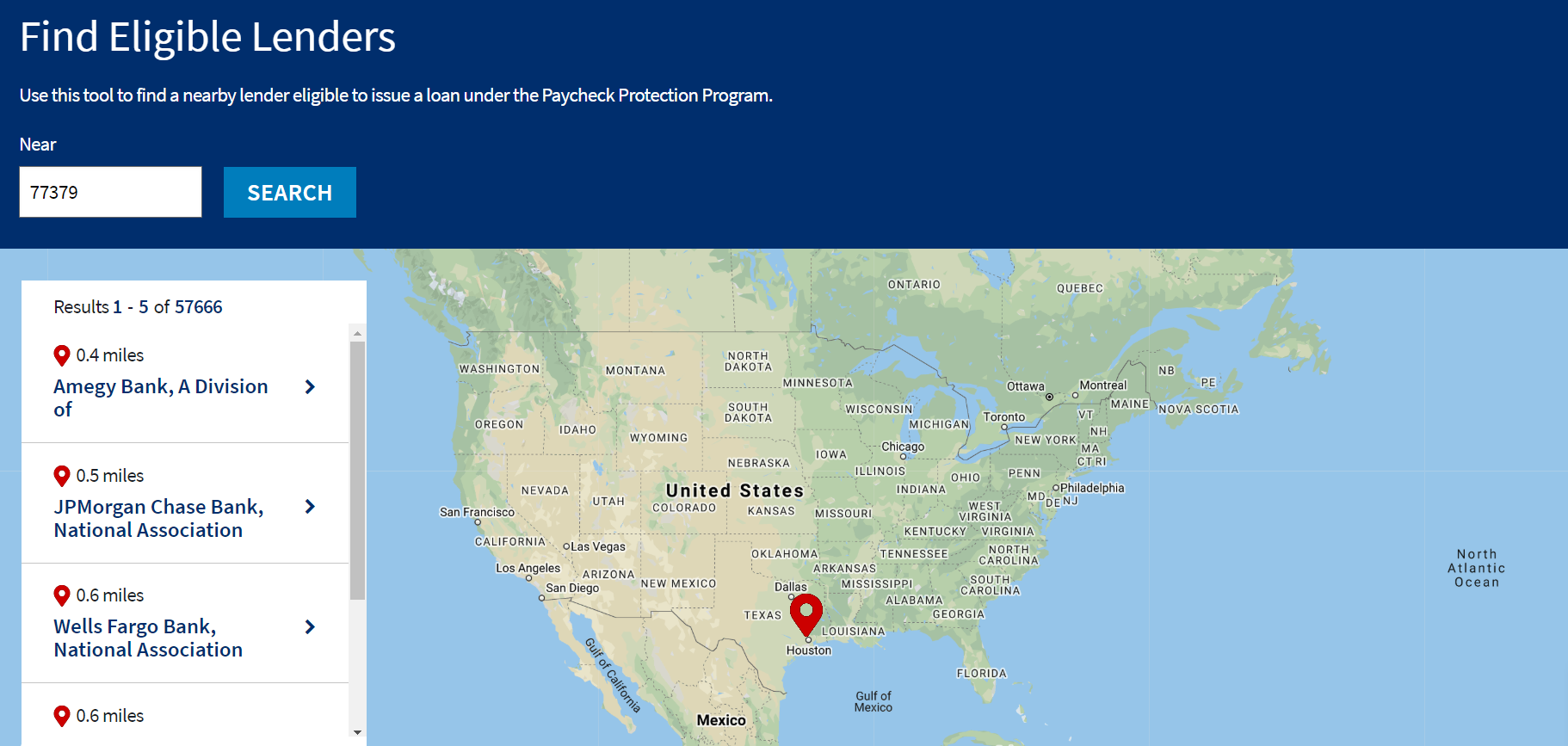

So, the first thing you need to do is find a lender. Visit this SBA page to locate an eligible lender within or near your postal code.

Finding a lender on SBA’s website (Source)

Given that the loans are facilitated through a multitude of lenders, each lender is designing the process per its own operating structure. For instance, Silicon Valley Bank is allowing online applications, but Ameris Bank is instructing businesses to get in touch with bank personnel for the process.

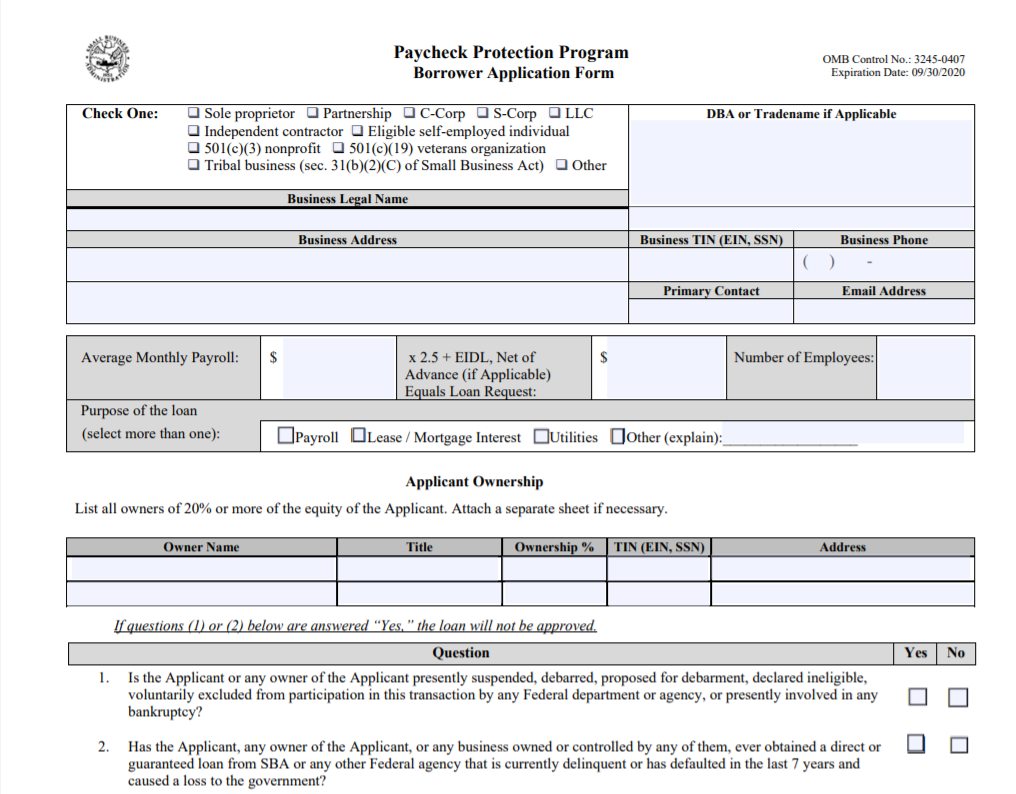

Regardless, there is a standardized application that needs to be filled out by everyone applying for the loan. It is available on the Treasury Department’s website.

Application for Paycheck Protection Program (Source)

When submitting in person, this application will typically need to be printed and filled out by hand. When submitting online, this application will typically need to be printed, filled out, and signed by hand and then scanned in as a digital file to be uploaded to the lender’s platform.

Other FAQs regarding the Paycheck Protection Program

Here are the FAQs we came across during our secondary research:

What documents do I need?

The documents required to complete the loan application will vary depending on state, lender, and the type of business. However, the following documents are typically required:

Payroll processing records

Payroll tax filing records

Payroll tax forms for the last year (Forms 941, 940, and W-3)

Form 1099-MISC records

Income and expenses from a sole proprietorship

What counts as monthly payroll costs?

Any money spent by your business on employee salaries; wages; vacation, parental, family, medical, and sick leave; and health benefits count as payroll costs.

Payroll costs don’t include federal employment taxes imposed or withheld between February 15, 2020, and June 30, 2020, or income taxes withheld from employees during the same time.

Do I have to pay back the Paycheck Protection Program loan?

The biggest highlight of this disaster loan is that it is forgivable. The government can decide to write off the entire loan as long as it is spent within eight weeks of the loan’s signing date and at least 75% of the forgiven amount has been used for payroll.

Are there any additional conditions for loan forgiveness?

Yes, to be eligible for loan forgiveness under the Paycheck Protection Program you must:

Maintain an average number of full-time monthly employees at or above the number from the year before the disaster hit.

Not reduce wages by more than 25% compared to the year before the disaster hit.

Small businesses that don’t meet the above-mentioned conditions can still be eligible for loan forgiveness, but the percentage of the loan forgiven will be reduced on a case-by-case basis.

How is the Paycheck Protection Program different from the SBA’s disaster loan, the EIDL?

SBA also offers another disaster loan called the Economic Injury Disaster Loan (EIDL). Though both the initiatives are similar, there are some key differences between them.

The EIDL may require collateral for loan amounts over $25,000, whereas the Paycheck Protection Program does not.

The EIDL typically requires businesses to not have access to credit from anywhere other than the SBA. On the other hand, Paycheck Protection Program aid can be sought even with credit available otherwise.

The EIDL is focused on covering operational expenses whereas the Paycheck Protection Program is focused on keeping payroll running.

The EIDL requires repayment and cannot be forgiven. However, loans under the Paycheck Protection Program can be completely forgiven if conditions laid out by the SBA for the use of funds are met.

Can I apply for both the EIDL and the Paycheck Protection Program?

Yes, businesses can apply and receive aid from both programs. However, they don’t each serve the same purpose.

As a result, a business is required to provide valid distinct reasons to apply for each of the loans and show proof of the use of funds. That being said, it would be tough to get approval on both the loan requests.

More coronavirus business resources

In addition to information about the SBA’s disaster loans, Capterra has a resource center to answer all your questions about remote work and how to keep your business running during the time of coronavirus.