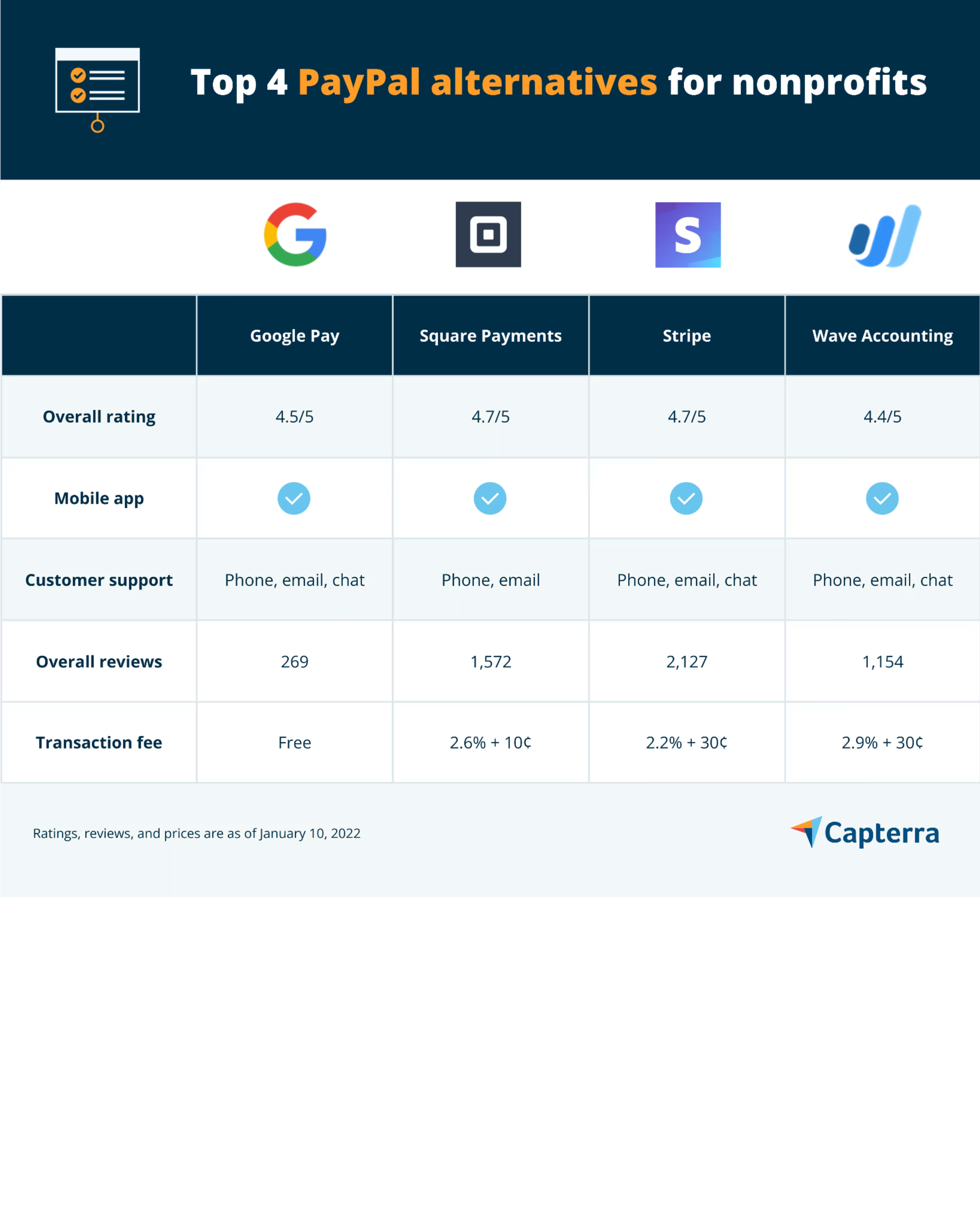

Four PayPal alternatives to help nonprofits manage payment processing.

PayPal is an online payment processing tool used across industries. But despite its market-wide popularity, PayPal may not be the best option for nonprofit fundraising due to its high transaction fee.

If you're a donation manager handling funds for a nonprofit organization, you need a platform that lets you receive donations without spending a chunk on processing fees. A low transaction fee will allow your nonprofit to receive more donations from supporters.

Fortunately, there are quite a few PayPal alternatives for nonprofits like yours. These alternative tools can take care of payment transfers and don’t have any set-up fees or hidden transaction charges.

We asked users about the PayPal alternatives they considered when purchasing payment processing software for their nonprofit organization. Here are the four best PayPal alternatives (sorted alphabetically) they identified—all four tools offer dedicated features for nonprofits.

See the full list of PayPal alternatives.

1. Google Pay

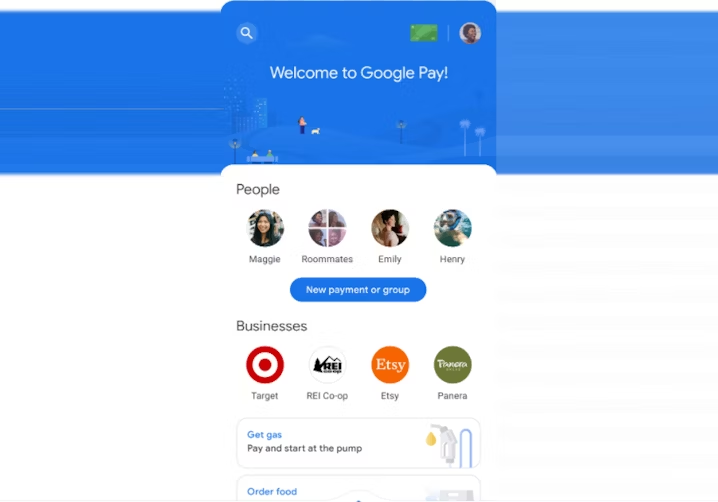

Google Pay is a payment gateway merchant that facilitates money transfers and payment checkouts for small businesses and nonprofit organizations. The software makes payment processing efficient by allowing your contributors to save their credit card information during an online donation.

You can integrate Google Pay into your nonprofit website for faster checkouts. You can also use the software to track the funds you receive and pull up weekly and monthly transaction reports.

If you’re an approved nonprofit organization with a valid 501(c)(3) status, you can integrate the Google Pay API to collect donations. However, you’ll need proper documentation to validate your nonprofit status on Google Pay.

Key Features

- Chat/messaging

- Transaction monitoring

Trial/Free Version

- Free Trial

- Free Version

Transaction fee

Device compatibility

Screenshots

Homepage in Google Pay

Here’s how Google Pay compares to PayPal

Both Google Pay and PayPal offer cloud-based applications that users can access from their mobile devices. Google Pay charges no fees on debit card transactions and bank transfers and also facilitates in-store transactions.

Platforms supported: Both are web-based tools, and both offer a mobile app for Android and iOS devices.

Typical customers: Both are used by freelancers and small businesses.

Customer support: Both offer phone, email, and chat support.

2. Square Payments

Square Payments is a payment processor tool for small businesses, nonprofits, and online fundraising organizations. It facilitates in-person and online payments besides allowing manual entry of transactions.

Square tracks your donations and automatically transfers the money collected from a fundraising campaign to your bank account. It offers a donor directory that you can access via your online Square dashboard. You can integrate Square with your website to accept donations and raise awareness for your cause.

The software is Payment Card Industry (PCI) compliant and keeps your donors’ online payment data secure. It also vets the legitimacy of donors through mandatory sign-ups and profile verification to protect your nonprofit from fraudulent or high-risk transactions.

Key Features

- ACH processing

- Billing and invoicing

- Contactless NFC

- Cryptocurrency processing

- Debit/credit processing

- Electronic signature

Trial/Free Version

- Free Trial

- Free Version

Transaction fee

Device compatibility

Screenshots

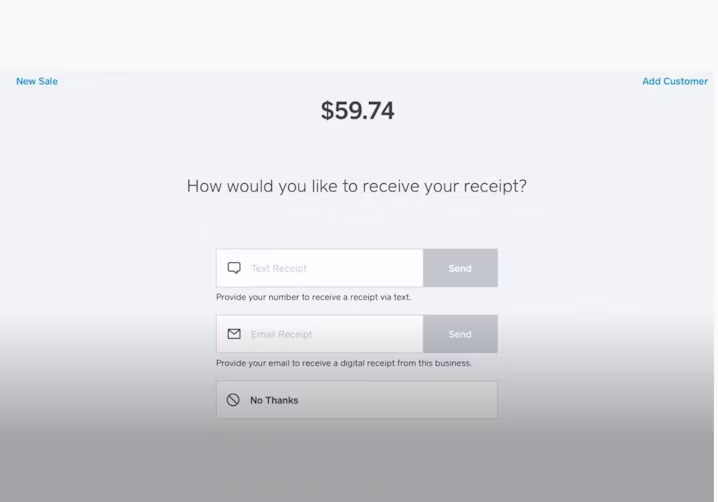

Making an online donation in Square Payments

Here's how Square Payments compares to PayPal

Due to the availability of Square POS systems, Square Payments is more suitable for in-person and online donations. Square also lets you send donation reminders to contributors through the Square Payments app and track their donations. PayPal, on the other hand, is a better fit for eCommerce businesses due to its mobile-optimized checkout process and easy shopping cart integrations.

Platforms supported: Both are web-based tools and have a mobile app for Android and iOS devices.

Typical customers: Both are used by freelancers and small businesses. PayPal is also used by large enterprises with international clients.

Customer support: Square Payments offers 24/7 phone and email support, while PayPal provides phone, email, and chat support.

3. Stripe

Stripe is a payment processing platform that facilitates online and in-person transactions. It supports mobile payments, helps prevent fraud through user profiling, and generates invoices against payments.

You can integrate Stripe into your nonprofit website for faster, seamless payment processing. You can use it to track donors’ card information and segregate low-risk and high-risk transactions to prevent fraud. You can also pull up custom reports to oversee the total donation you’ve received in a given period and to identify new prospective donors.

If your organization has a valid nonprofit status and processes at least 80% of payments as online giving, then you’re eligible for a discounted processing fee from Stripe.

Key Features

- ACH Payment processing

- Billing and invoicing

- Data security

- Mobile payments

- Online payments

- Payment fraud prevention

Trial/Free Version

- Free Trial

- Free Version

Transaction fee

Device compatibility

Screenshots

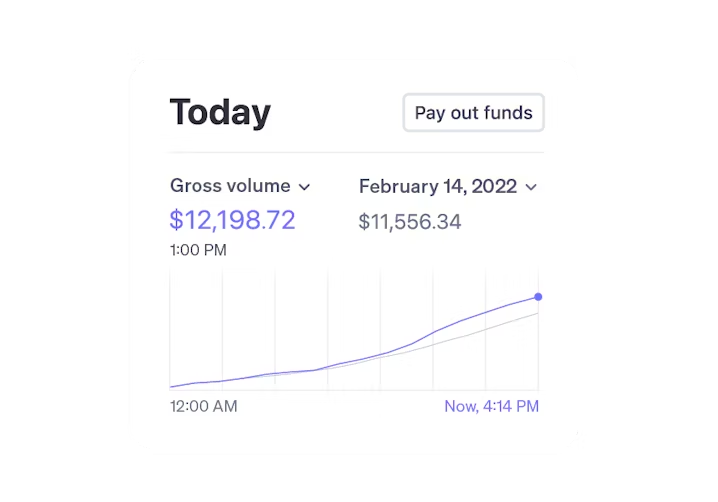

Managing users in Stripe

Here’s how Stripe compares to PayPal

Both Stripe and PayPal are cloud-based applications. However, Stripe is more customizable than PayPal. It lets you create a customized donation form to collect payments and change its layout and colors to match your website branding.

Platforms supported: Both are web-based tools and have a mobile app for Android and iOS devices.

Typical customers: Both are used by freelancers, small businesses, eCommerce platforms, and businesses with international clients.

Customer support: Both offer phone, email, and chat support.

4. Wave Accounting

Wave Accounting is an accounting and payment solution built for small businesses, nonprofits, and freelancers. It lets you collect and process payments, generate invoices, and create financial reports.

Wave helps manage your nonprofit organization's cash flow by tracking donors and automatically importing donations into its built-in bookkeeping tool. It also lets you track and categorize your transactions based on where the funds are coming from to offer insights into your financial health.

With Wave, you can create financial reports for any fiscal year and track the total donations you’ve received during that period. You can also share the reports with stakeholders who need to stay updated on your nonprofit’s financial metrics.

Key Features

- Access controls/permissions

- Accounts payable

- Accounts receivable

- Bank reconciliation

- Billing and invoicing

- Cash management

Trial/Free Version

- Free Trial

- Free Version

Transaction fee

Device compatibility

Screenshots

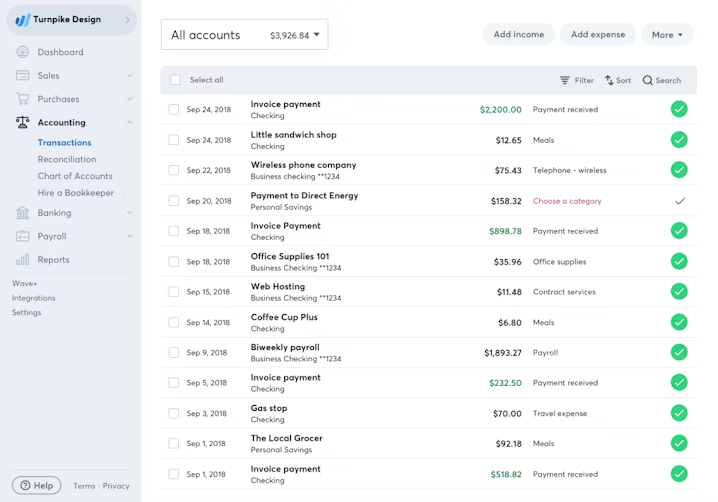

Managing transactions in Wave

Here's how Wave Accounting compares to PayPal

Both Wave Accounting and PayPal cater to freelancers and small businesses. However, Wave specializes in nonprofits and offers dedicated donor management, expense tracking, and bookkeeping modules. It also assists with payroll management.

Platforms supported: Both are web-based tools and have a mobile app for Android and iOS devices.

Typical customers: Both are used by freelancers, small businesses, eCommerce platforms, and businesses with international clients.

Customer support: Both offer phone, email, and chat support.

Assess all options to select the best PayPal alternative

While PayPal might not cut it for you, there are plenty of payment processing software options for your nonprofit needs.

If your donations are mostly peer-to-peer and you process multiple transactions every day, then Google Pay might be ideal for your organization, as it’s more adept at handling high-volume transactions. If you want to raise awareness for your cause among donors and make sure word gets out, then Square Payments might be the right choice due to its easy integration with social media platforms.

If your nonprofit organization has previously encountered fraudulent donors and wants to set up thorough donor profiling, then Stripe would be ideal, as it helps identify potential threats and high-risk transactions. And if you need detailed reporting of your donations and overall financials, then Wave Accounting would be suitable, as it lets you create custom reports.

Every payment gateway charges a transaction fee that varies depending on the type of transaction and payment method you use. Before investing, make sure to check which software charges the least transaction fee.

Narrow your search for accounting firms with our list of companies in the following areas: