The pandemic had a profound impact on how small businesses compensate their employees. Due to employee demand, many of the payroll changes implemented during COVID are here to stay.

If you want to keep your best employees, you need to pay attention to what’s happening in the payroll industry.

According to Capterra’s 2022 Company Culture Survey[*], compensation is the top factor in job satisfaction. Companies that don’t have the ability to raise wages are scrambling for solutions.

You may not be in the position to give raises, but adopting these trends can help alleviate other financial woes for your workers—improving their employee experience and boosting retention rates in the process.

Read on to learn more about the payroll industry trends that may be impacting your business now.

Find the right payroll provider for your business in Capterra’s list of payroll service providers in the United States.

1. Financial wellness platforms ease workers’ money stress

Companies may be unable to raise pay, but through financial wellness platforms, they can at least provide tools to help workers better manage what they have.

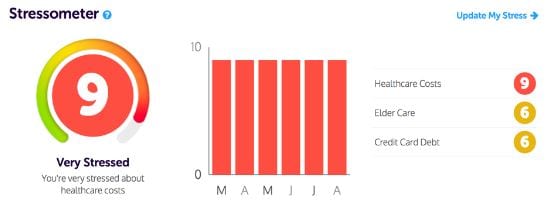

The Stressometer in Best Money Moves can diagnose areas of financial concern[2]

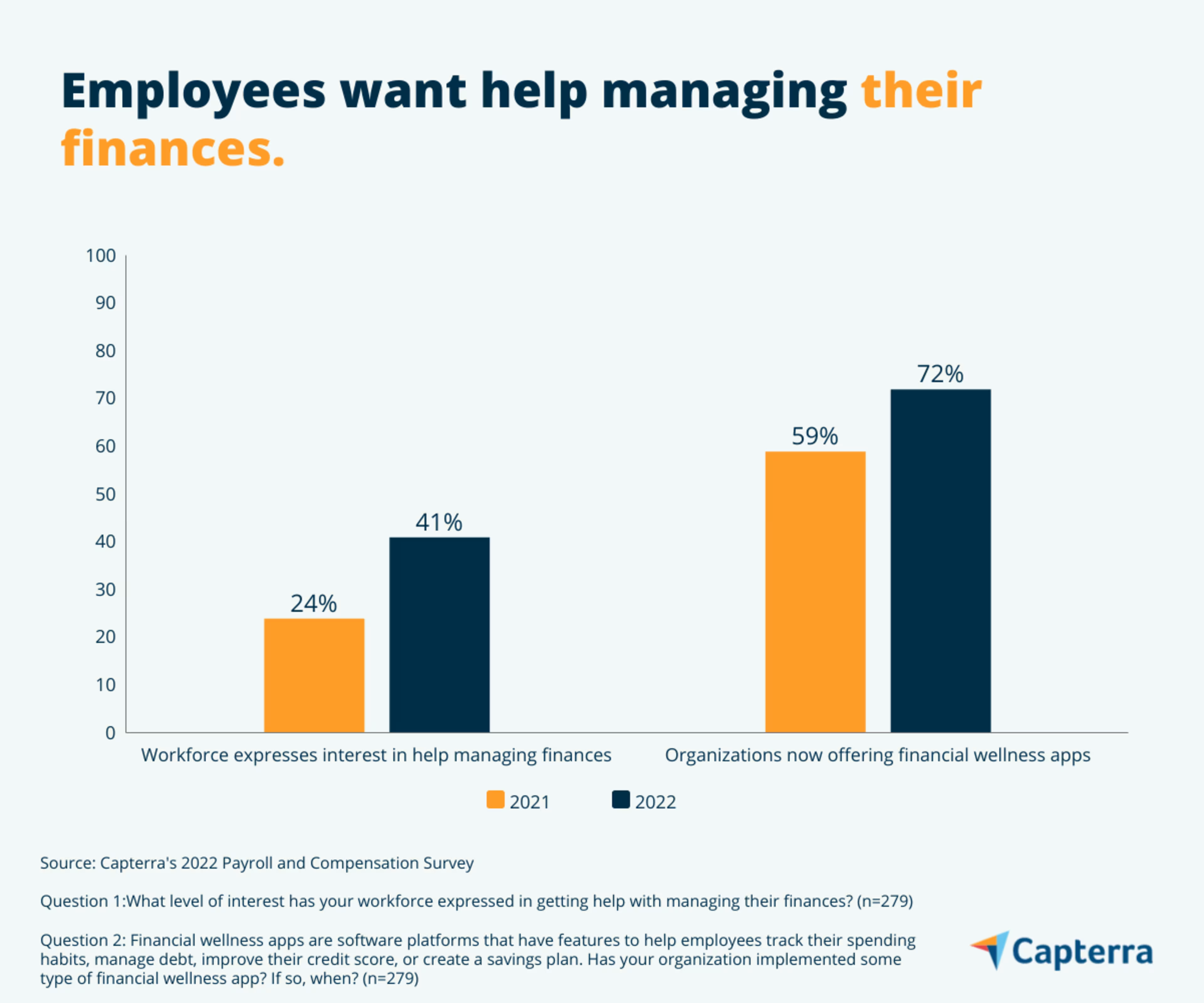

And employees increasingly want help managing their finances. According to Capterra’s 2022 Payroll and Compensation Survey[**], 41% of business leaders say their workforce has expressed significant interest in getting help with managing their finances, compared to just 24% in 2021.

As a result, 72% of organizations now offer a financial wellness app, compared to 59% in 2021.

Using these platforms, workers can identify financial areas that are causing them the most stress and receive advice on how to pay down large debts, build up retirement savings, or plan for a big purchase, such as a house or car. Some of these systems even allow workers to connect with a financial coach for further assistance.

CEOs and HR leaders can then monitor their workforce’s overall financial stress over time through dashboards and analytics, giving them insight into common stressors that they could address with other financial wellness tools.

The bottom line for small businesses

Financial stresses can impact job performance. This, in turn, can impact worker productivity, costing businesses $4.7 billion a week[3].

Small businesses may not have asked to take on the responsibility of advising employees on their finances, but now that they’re suffering the consequences, they need to take action.

If your current employee wellness program focuses only on physical wellness through perks, such as gym memberships or yoga classes, you need to expand your strategy to tackle financial wellness too. Implementing a financial wellness tool is a great first step.

2. Employees want to get paid more frequently

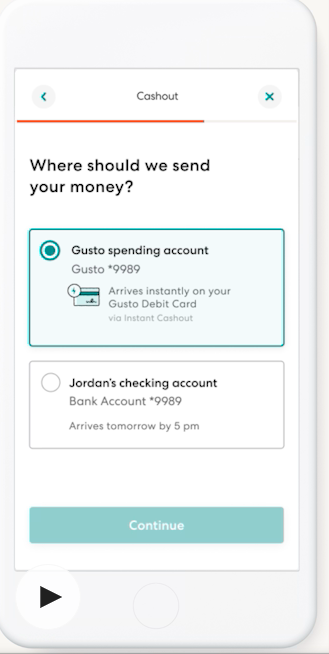

Employees with access to Gusto’s Cashout program can access money they’ve earned before payday[4]

It’s the beginning of the end for biweekly paydays that occur on the 1st or 15th of the month. Companies have stuck with the static payroll schedule for decades, and as a result, workers needing access to funds before their scheduled payday have suffered. Outside of expensive and predatory payday advance loans, workers have had very few options when emergencies strike.

Because of factors such as rising debt, cost of living increases, and the proliferation of unstable jobs in the gig economy, many U.S. workers have found themselves in uncertain financial situations.

More than 50% of workers live paycheck to paycheck in 2022[5], which is why forward-thinking companies and payroll providers are testing the idea of dropping the rigid two-week payroll schedule to offer workers much-needed flexibility regarding when they get paid.

Employees increasingly want on-demand pay, which means they can access the money they earn as they earn it, rather than having to wait for payday. Business leaders report that 47% percent of their workforce has expressed significant interest in receiving pay more frequently, which is nearly double the percentage in 2021 (24%).

And businesses are listening. The number of organizations offering on-demand pay jumped from 50% in 2021 to 71% in 2022. Apps such as Even, and new payroll software features such as Gusto‘s Flexible Pay and ADP’s Wisely Pay, make it easier for businesses, especially those with fewer employees, to adopt more flexible compensation options. These tools allow workers to choose which day of the week they get paid, receive a small pay advance with no interest or charges, or even get paid immediately for completed work in the case of 1099 contractor employees.

The bottom line for small businesses

It’s a surefire retention booster with employees that increasingly run into surprise expenses they can’t always cover and a perk that smaller companies with low headcounts have the flexibility to administer relatively easily.

And flexible pay doesn’t just benefit employees. It also gives employers the ability to spread their payroll expenses out over time, instead of having to scrape together the funds for those biweekly spikes on the 1st and 15th.

Unlike most technology trends, this is going to start from the bottom up: Startups and small businesses have much more agility to offer flexible pay to their employees than their enterprise counterparts.

If you’re unsure if you should make the switch, survey your employees to find out if this is something that would be valuable to them.

3. Pay transparency is becoming the norm

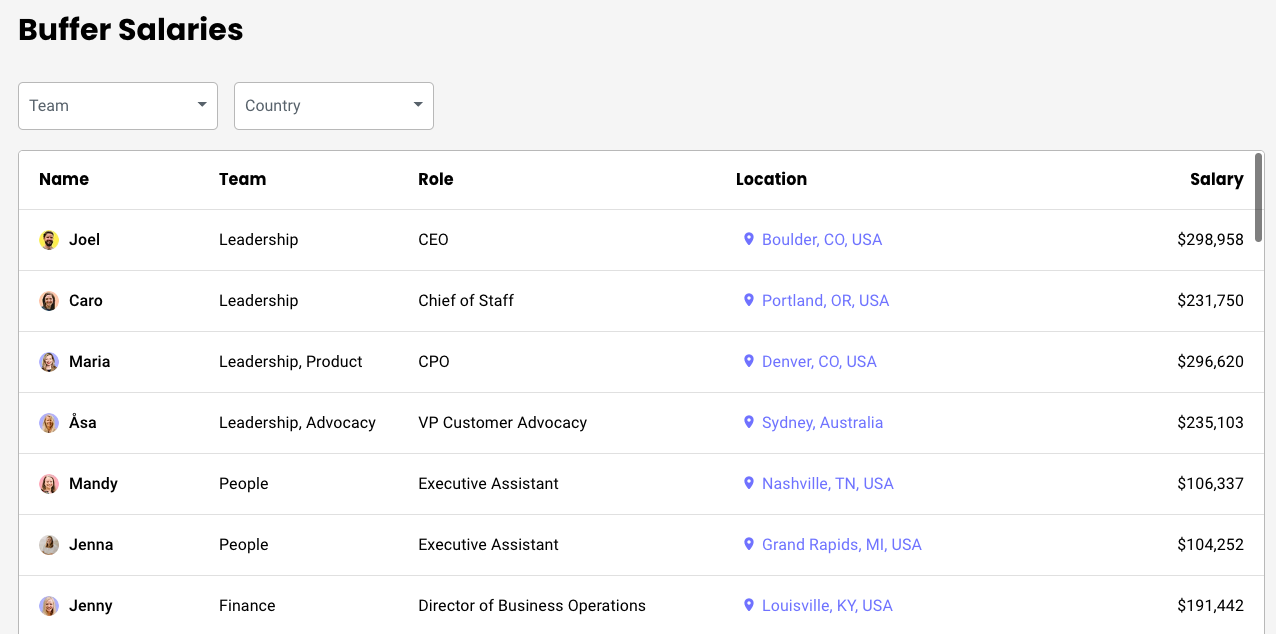

Buffer lists the salaries of every employee on their website[6]

Pay transparency can mean one of two things: (1) It allows potential hires to see either the exact salary of a posting or a salary range or (2) it makes the salaries of current employees public.

Companies such as Buffer, Whole Foods, CareHere, and Hired have decided to list every worker’s pay publicly—from the CEO all the way down to the newly-hired intern—in an effort to prove they’re offering fair and equal pay.

This payroll trend has produced both intended results (such as reducing the pay gap for women and minorities) and unintended consequences (when workers learn they make less than their peers, their productivity suffers).

And demand for pay transparency has increased: 63% of businesses report that interest in pay transparency has increased compared to before the pandemic. As a result, 62% of businesses say they post an exact salary on job postings for potential hires.

The bottom line for small businesses

Of course, there’s a very real downside to pay transparency: If you don’t offer competitive or equal pay to all your workers, they find out, get angry, and quit.

Before you adopt pay transparency, make sure to benchmark the compensation for all of your roles to ensure it’s not only in line with the skills and experience requirements of the position, but also comparable to other rates from competitors in your area. You also want to ensure you’re not discriminating pay based on gender or race.

Since this can be difficult to do by hand, you should consider investing in compensation management software to automate a bulk of this research and analysis.

Listen to your employees

When it comes to their pay, people want certainty, not surprises. But that doesn’t mean the payroll process is static—far from it. Payroll trends are determined by employee demands. When was the last time you took a pulse on what your employees need or want in terms of compensation?

As these trends show, there are plenty of levers that small businesses can pull besides raising wages to give workers more support, more flexibility, and more transparency regarding their pay.

If you’re ready to drag your payroll process out of the past and into the future, but don’t have the system to support it, head to our payroll software directory page to find the best options for your business.

Note: The applications mentioned in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.