Learn how to retain employees with the right small-business retirement savings plan.

The COVID-19 pandemic has disrupted the financial plans of millions of people.

According to a 2020-21 survey by Age Wave and Edward Jones, one in three Americans are planning to postpone their retirement plans due to the pandemic, while 14 million have stopped monthly contributions to their retirement accounts altogether (as of March 2021). A whopping 70% say the pandemic has prompted them to prioritize long-term financial planning.

However, the Bureau of Labor Statistics reports that only 67% of private industry workers had access to employer-provided retirement plans in 2020. That means over 33% of workers don’t have employer support when it comes to retirement savings.

As a small business owner, you can do your part by establishing a retirement savings program to ensure your employees have financial security amid difficult times. In this article, we explain some popular retirement plans for small businesses as well as define the steps to set up a retirement package for your employees.

Retirement plan options for your small business

Here are some small business retirement plan options you can consider:

1. 401(k) plan

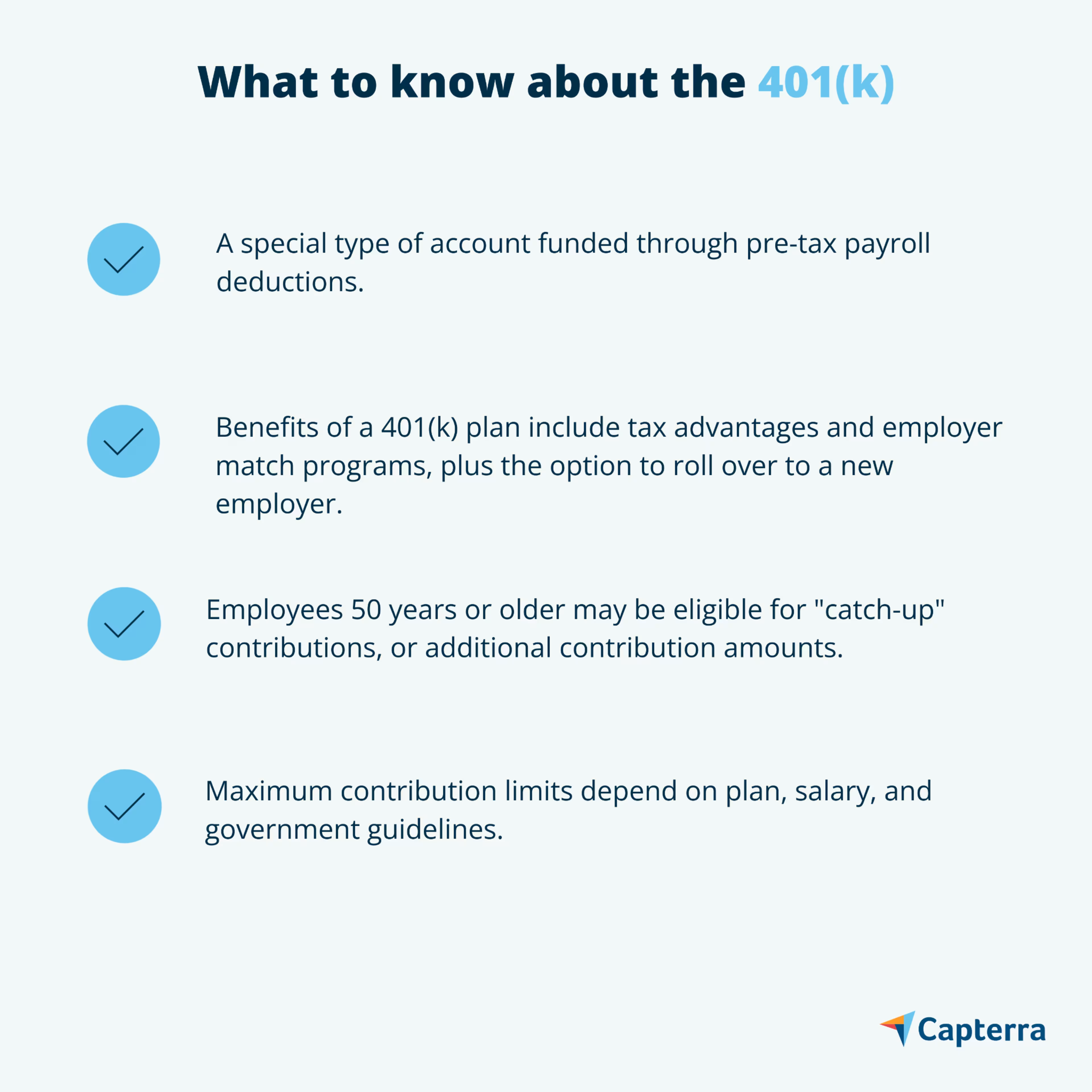

In a 401(k) plan, you as the employer place a percentage of a consenting employee’s paycheck into an investment account, where the retirement funds grow tax-free. Employees can choose how much they want to contribute and which funds they want to invest in. However, they are limited to the selection of investment tools your chosen plan provides.

401(k)s are particularly attractive for employees because they come with company-sponsored contributions. For example, if an employee contributes $1,000 to their account, you can contribute 50% of the amount (i.e., $500), adding to their investment. If these contributions seem costly to you, note that they can be deducted from your company’s federal income tax.

There are two common types of 401(k) plans: traditional 401(k)s and Roth 401(k)s. Per Marcus’ guide to 401(k) plans, the main difference between the two plans is when tax benefits come into effect.

A traditional 401(k) lets employees deduct contributions from their taxable income; their earnings are taxed once they withdraw their retirement funds. A Roth 401(k) plan, on the other hand, takes contributions from employees’ post-tax income only. Since employees have already paid their dues, their capital gains aren’t taxed once withdrawn.

Things to know about traditional 401(k) plans (Source)

Marcus also notes that many 401(k)s come with a vesting schedule. For instance, some 401(k) plans may not allow employees to take employer contributions if they leave the company before an agreed-upon date. Such plans incentivize employees for their company loyalty, potentially reducing your small business’s turnover rate.

2. SIMPLE IRA

Savings Incentive Match Plans for Employees, or SIMPLE IRAs, were designed to simplify retirement savings plans for small businesses. SIMPLE IRAs have lower account management fees than 401(k) and IRA plans and also have fewer restrictions.

Overview of SIMPLE IRAs (Source)

The IRS notes that SIMPLE IRAs are available only to companies with 100 or fewer employees, so they’re perfect for small businesses.

In a SIMPLE IRA, you roll a fraction of each employee’s salary into their designated investment accounts. You’re also required to make contributions of up to 3% of your employee’s salary. Plus, you have the option to contribute even if your employees choose not to, and your contribution is tax-deductible—a win-win situation.

3. Payroll deduction IRA

If you can’t afford contributions to a 401(k) plan, you can set up a payroll deduction IRA. Similar to a 401(k), a payroll deduction IRA lets you take an employee-elected percentage off their monthly paycheck, which you then roll into a tax-advantaged investment account. Your employees can choose which assets they want to invest in. Unlike 401(k)s, in IRAs, employees aren’t limited to the assets chosen by your company’s provider.

Since employers make no contributions, establishing a payroll deduction IRA won’t get you any tax deductions. Your employees, however, can enjoy pre- and post-tax advantages. If they opt for a traditional IRA, their contribution can be deducted from their payable taxes, but their capital gains will be taxable. And if they opt for a Roth IRA, their contributions can only come from post-tax income, which makes capital gains tax-free.

Calculating employee benefits costs for your small business

To summarize, 401(k) plans and SIMPLE IRAs might be more expensive should you opt to match employee contributions, but these expenses can be deducted from your company’s taxable income. SIMPLE IRAs also come with lower provider costs. On the other hand, payroll deduction IRAs don’t require employer contributions but also offer no tax benefits.

As a small business owner, you should realize that attractive retirement packages help attract as well as retain top talent. This is particularly true for employer matching, which incentivizes employees to perform well and contribute to your company’s bottom line.

For starters, evaluate your company’s current financial situation to determine which plan you can afford. If retirement programs aren’t the only employee benefit you plan to offer, use our Employee Benefits Cost Calculator to get an estimate of your overall costs. Remember, no matter which retirement plan you choose, you’ll still be legally required to match Social Security and Medicare contributions from your employees’ paychecks.

3 steps to set up a retirement package

Follow these three steps to set up an employee retirement plan for your small business:

1. Look for a plan provider

To set up a 401(k) or IRA plan, you first need to find a plan provider—preferably one that specializes in employee retirement plans for small businesses. Financial institutions such as banks and brokerages offer these services. Most providers charge a fee for helping manage your employees’ assets, so it's best to look for providers with low service fees.

2. Make it official

Make things official by creating a written document that outlines the benefits, rights, and features your plan provides. If you choose to establish a 401(k) plan, you’re legally required to place the assets included in each employee’s plan under designated trust accounts. This helps ensure any deposits are only used by the participant and beneficiary of each trust account—meaning you and your employees. Thereafter, establish an organized recordkeeping system to track all the assets involved.

3. Share the details with your employees

Finally, share the plan details with all employees. Make sure they’re aware of all provider costs, such as annual and transfer fees. Should they decide to enroll in the plan, allow them to select the percentage of their paycheck they intend to contribute.

Exception for SIMPLE IRAs: The setup process is easier for SIMPLE IRAs. All you need to do is fill out either Form 5304-SIMPLE or Form 5305-SIMPLE. Fill out Form 5304 if you want to give your employees the freedom to choose which financial institution will host their IRA. On the other hand, if you want all employees to partner with a single company-selected provider so it’s easier to track investments, fill out FORM 5305 instead.

Retain talent and enjoy tax benefits with retirement planning plans

Every employee deserves a peaceful retirement. When you create retirement programs that incentivize saving for the future, you prove to your workers that they’re valuable to your company. Your employees are happier, which helps reduce your business’s turnover rate and makes you competitive in the job market. Not just that, you also benefit from making tax-deductible employer contributions.

Are you interested in becoming a guest writer for Capterra? Reach out to guestcontributors@gartner.com for details.