You're a small-business leader with a few years of growing pains and success under your belt. Your coffee shop, graphic design firm, or [insert your business type here] is off to a great start, and you've seen a few consecutive profitable years.

You have some capital to reinvest in technology for your business now ... but where do you start?

A fleet of drones to monitor the parking lot? A 3D printer to produce chocolates and soaps shaped like your company logo? A supply of VR headsets to help employees relax at their desks?

Those are all whimsical ideas, but there's a more practical tech investment that you could, and should, be making: accounting software.

Though it may not be quite as fun as a new drone or virtual reality headset, the numbers are striking. Just take a look at these results from our 2018 survey of more than 700 U.S. small businesses:

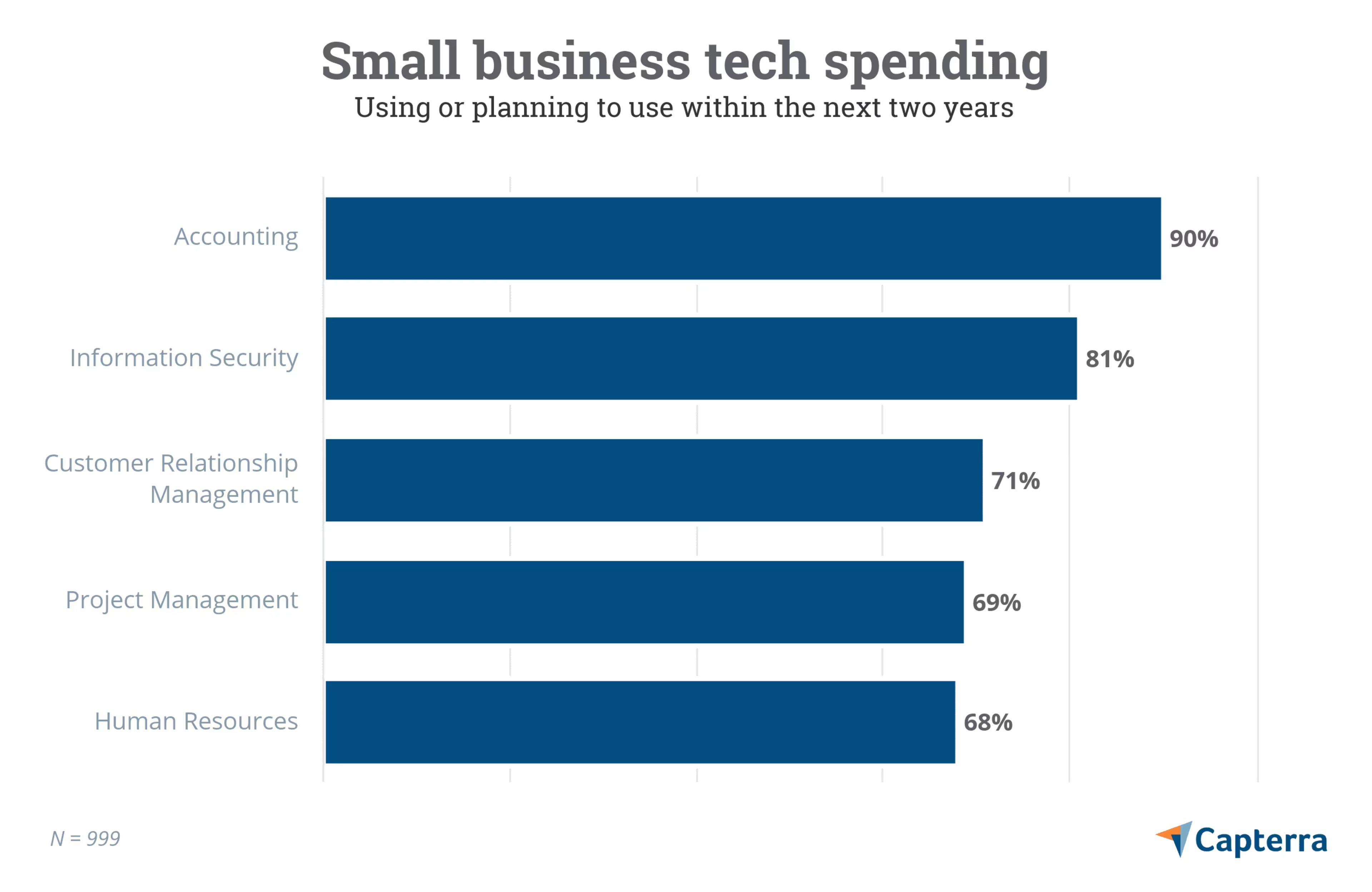

Results from 2018 survey

Out of the 700+ small businesses surveyed, about 90% (637) are either using accounting technology or planning to implement it within the next two years.

That's more than customer relationship management (71%), project management (69%), human resources (68%), and even information security technology (81%).

Only 20 of the small businesses surveyed (less than 3%) have no plans whatsoever to use accounting software.

More than 82% of surveyed businesses that use accounting software have already seen a significant impact on their business.

If I were among that 10% of businesses without accounting software and no immediate plans to implement it within the next two years, I'd be as nervous as a warrior standing on the battlefield with a sharpened stick while everyone else has automatic rifles.

It's true that you should never invest in a given technology just because other businesses are (I'm looking at you, coffee machines that cost more than new cars), but there's a clear trend worth paying attention to here.

Small businesses are investing more money in fintech (i.e., finance and accounting software) than any other new tech. They're using it to better manage their finances and grow their business by performing accounting duties more efficiently.

Unless you're a freelancer (and, in many cases, even if you are a freelancer), you need accounting technology to successfully run your business.

It's non-negotiable.

Fintech spending: What small businesses can expect

We know that small businesses are spending big on fintech in 2019, but why is that?

Let's take a look at some of the benefits small businesses will see after implementing accounting technology.

1. Less time spent on administrative tasks

One of the biggest advantages of accounting tech is that it makes routine, time-consuming processes—such as payroll and invoicing—more efficient. And I've never heard of a small-business owner who wouldn't prefer to have more time in their day.

A survey by GetApp found that 37% of small businesses save more than three hours per week by using accounting technology.

Maybe you already have some form of accounting software in place, but that doesn't mean you couldn't be using it more efficiently.

For example, Intuit research (as shared at QuickBooks Connect in November 2018) shows that each QuickBooks Online user saves about four hours per week by connecting at least one app. QuickBooks offers more than 600 integrations in everything from expense management to time tracking.

Imagine getting an entire workday back per week to spend time with your family, develop your business, knock out that ever-growing to-do list, or sleep?

2. Fewer mistakes due to human error

Receipts get lost, math gets fuzzy, and data gets entered into the wrong column on the spreadsheet.

You're even more likely to make mistakes when you haven't been getting enough sleep, and small-business owners are notorious for sacrificing sleep to spend a few more hours in the workshop.

So why not let accounting software run some of those formulas for you so you can focus your precious energy on growing your business?

Reconciling an account in QuickBooks (Source)

Take bank reconciliation as an example. This task takes place under the hood of your accounting software to ensure that the money you have in the bank matches what you have on record.

If you don't have accounting software, however, this laborious process involves a lot of number pulling and eye-squinting, making it very easy to miss something.

Accounting software can pull the relevant numbers for you, enabling you to compare them side-by-side with the bank's numbers and making it easy to find mistakes or signs of fraud. If your numbers don't match, accounting software will even help you find the source of the problem.

By connecting your bank accounts and payment processing platforms to your accounting software, you can perform an error-free bank reconciliation in mere minutes every month. Connecting these accounts to automatically import transactions saves significant time and reduces errors that come with manual data entry.

3. Easier tax filing

Tax season can be a nightmare for small-business leaders trying to handle it on their own. But accounting tech (along with a good accountant) can turn it into a breeze.

Filing taxes for your first summer job was relatively simple. You probably had a 1040-EZ form with just a few lines to fill with data that was easy to locate on your W-2.

As a small-business leader, you have way more than a few lines to fill and data to pull from all over the place (including expenses and deductions for everything from insurance premiums to equipment rental).

It's enough to keep you up at night.

The good news: If you've been using your accounting software properly all year, tracking expenses and recording all of your profits and losses, you can file your taxes easily because all of the information you need is all in one place. Most good accounting software even lets you e-file from within the platform.

Perhaps an even bigger advantage is that accounting software is up to date on changing tax rules and regulations, so that you don't have to read the entire 186-page Tax Cuts and Jobs Act to know what to keep track of.

4. Helpful financial reports

The thought of sifting through all of your invoices and sales slips to glean some kind of useful insight for your business might sound as pleasant as pulling your hair out one strand at a time. But accounting software does that work for you and delivers useful reports that you can use to grow your small business.

Even if you kept meticulous accounting records in a spreadsheet, you'd still have to take extra steps to pull an income statement or cash flow statement to see if your business is making money and how much cash you have to reinvest.

With accounting software, you can not only pull these statements with just a few clicks, but you can also easily run more advanced reports—such as sales by item and sales profitability by customer—to better see where your money is coming from and identify areas for growth.

QuickBooks Advanced Reporting (Source)

How are you investing in fintech?

Are you among the 83% of small businesses already using accounting tech to help your small-business operations run smoothly or among the 7% planning to implement it in the next two years? Please don't tell me you're among the 10% still doing things with a spreadsheet and a shoebox full of receipts and no immediate plans to join the rest of us in the 21st century.

(Although if you are, I would love to hear why and how you're managing to pull this off; share in the comments, email me at aconrad@capterra.com, or hit me up on Twitter @AndrewJosConrad.)

Wherever you fall, follow our accounting/finance tech blog, and read these articles to learn about the latest developments in finance and accounting technology:

What Small Business Leaders Should Know About the Future of Accounting Technology

5 Best Practices in Payroll Processing for Small Business Owners