The Supreme Court's June 2018 ruling on eCommerce sales tax is causing small businesses a lot of consternation. And that consternation is well placed.

Sales tax in the eCommerce realm used to depend on whether you had a physical presence (or "nexus") in a state. If you didn't have a store, warehouse, distribution center, or thatch hut in a particular state, you didn't have to pay that state's sales tax.

South Dakota v. Wayfair changes that physical nexus rule. Now, if your sales reach a certain threshold in a state, you have to pay that state's sales tax. And to pay that state's sales tax, you'll have to first collect that tax from your customers.

Failure to adapt to the Supreme Court's eCommerce sales tax ruling could mean anything from lost sales to financial penalties.

If you are a small business that sells online, you should bite the bullet now and purchase sales tax software, which can help you avoid confusion, fines, and even legal penalties due to the new ruling.

Are you at risk?

Your small business is at risk from the eCommerce sales tax ruling ... once you pass a certain threshold of revenue or transactions.

One caveat: Not all states have laws that require you to collect sales taxes—yet.

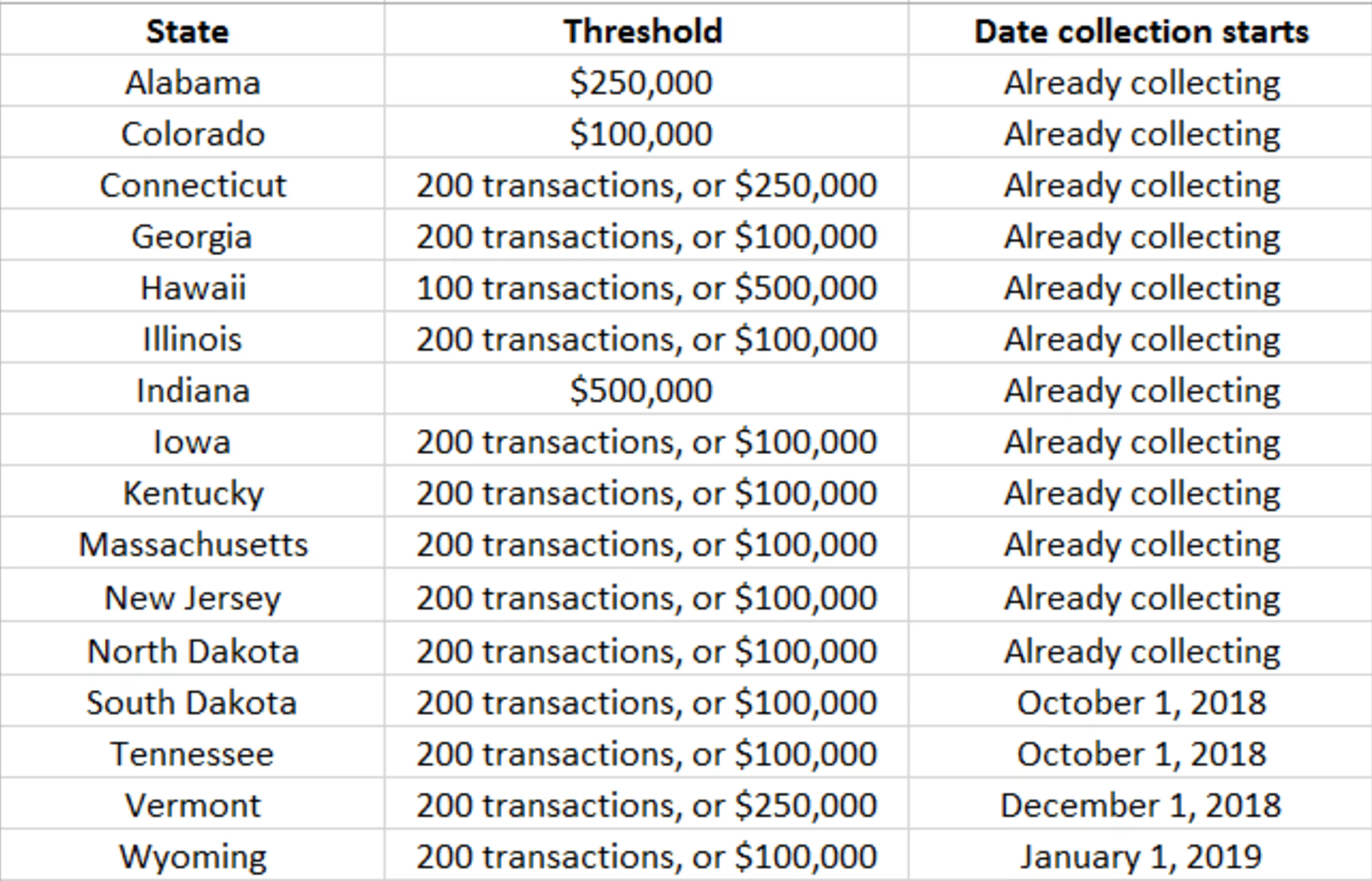

Currently, 16 states collect sales tax from online purchases (see the table in the next section).

In 2017, state governments stood to have gained $13 billion overall if they had been allowed to collect sales tax from online retailers, according to a 2017 Government Accounting Office report.

So, if they don't already require a sales tax collection, they likely will in the future. You could take my word for it, but I'll defer to Ben Franklin's famous statement about how death and taxes are the only certainties in life.

What the eCommerce sales tax ruling means at the state level

In the 16 states that already collect sales tax from businesses, businesses have to meet a threshold before they have to start collecting sales tax from their customers.

Most thresholds are based on:

Revenue, and/or

Number of transactions

Revenue thresholds run from $100,000 to $500,000. Thresholds based on number of transactions start at 100.

State eCommerce sales tax thresholds (Source)

For example, once you sell more than $500,000 worth of goods or services online to the citizens of Massachusetts, you have to start collecting sales tax. Or, once you record 100 transactions with Massachusetts-based customers, you have to start collecting sales tax.

The 16 states listed above are, most likely, not the only ones that will take advantage of the Supreme Court's ruling. But what will the threshold be in other states?

In 11 of the 16 states that already have online sales tax laws, the threshold is $100,000.

Stephen Yarbrough, vice president of tax at Kruze Consulting, notes that the Supreme Court's ruling in South Dakota v. Wayfair, "hinted that the thresholds set by South Dakota [$100,000, or 200 transactions] are not a cutoff, so states can go lower."

"I imagine most states will immediately adopt the South Dakota thresholds going forward, but the court hinted that the availability of multistate tax software could eliminate the 'undue burden' of taxing out-of-state sales, so states could conceivably adopt even lower thresholds."

Stephen Yarbrough, Kruze Consulting

The likelihood is that many states will set that bar lower.

What will your small business need to do to comply?

The eCommerce sales tax ruling poses a profound challenge to many small businesses. There are nearly 10,000 tax jurisdictions in the United States, including local jurisdictions. That's a nearly impossible number for most small businesses to keep track of.

And the costs of keeping track extend far beyond simply collecting sales tax, says Vladimir Gendelman of Company Folders.

"In some jurisdictions, there is a tax on service, in some cases, none. In some cases, there's a tax on food, in others, none. Everyone has a tax on product," Gendelman says.

On top of that, Gendelman adds, "you might have [a rule or regulation] in a state or city that charges additional tax."

Tracking these variations is enough work that it can require a full-time employee. But even with a dedicated employee, Gendelman says, "Having a structure in place that allows you to track it all is pretty much impossible."

Struggling to fathom tax legislation isn't the only problem, however. If you fail to understand what taxes you should be collecting, you could leave money on the table. In one case, a pair of entrepreneurs who wanted to sell their startup had to reduce their sale price by $70,000 to make up for sales tax they hadn't collected from their customers.

Some states also charge interest and late fees on unremitted taxes. The average late fee penalty? 17.85%.

Sales tax legislation isn't just costly—it's also unpredictable. You can't be sure if you'll break a state's threshold in a given year.

"My thought is that in states where we might be borderline [to the threshold], if we get close in October or November, then we just stop selling in that state until the next year."

Vladimir Gendelman, Company Folders

Even that strategy, though, is complicated. "As of right now, I have no clue how I can keep up with being able to do that right," Gendelman adds.

Monitoring all 10,000 tax jurisdictions to see where and when you should stop selling, "is not a two or three thousand-dollar solution," he says.

It would require, again, at least one dedicated employee.

Sales tax software can help your business comply with the Supreme Court's ruling

OUR RECOMMENDATION: Unless you want to hire several accountants (median salary: $68,000) to look after thousands of sales tax jurisdictions, your best bet is to invest in a sales tax software program. These solutions can keep track of where, and how much, you'll have to pay.

Sales tax software helps you handle the confusion and risks that are South Dakota v. Wayfair's fallout.

"If you just sign up with Taxjar, or some other service," Stephen Yarbrough says, "there's no excuse not to collect sales tax."

The easy automation provided by sales tax software vendors removes the need to constantly check on whether New Jersey has different laws than New York.

Sales tax software is relatively cheap (especially compared to that $68,000 per year accountant's salary). A brief perusal of Capterra's sales tax software directory reveals a price range of $9 per month, $19 per month, and $50 per year.

Have you collected online sales taxes?

Has your small online retail business already been collecting sales taxes? If you've figured out ways to deal with new eCommerce sales taxes, I'd love to hear about it in the comments below.

Want to know other upcoming small business tech trends? Check out one of these great posts from the Capterra small business blog: