Remember when having a camera in your phone seemed like magic? These days, phone-based camera technology is the norm.

In Gartner Hype Cycle terms, the tech has successfully traversed a curve, moving from the Innovation Trigger to the Plateau of Productivity. A good phone manufacturer could use the technology's position on the Hype Cycle to better understand how it should invest and approach customers.

The Hype Cycle—described in detail below—allows businesses to determine when a technology is just being hyped, and when it is a must have. Invest too early and you risk overpaying for under performance. Invest too late and you'll be behind the competition.

For businesses with a financial focus, there's nothing more likely to stir emotion than bringing up blockchain technology. The backbone of bitcoin has proven to be an incredibly flexible bit of technology, giving us ways to exchange cash and manage smart contracts.

On the other hand, it's still nascent technology. Instead of the tried and true accounting software we normally cover, today we're diving into something that hasn't yet solidified its place in the business world.

Let's take a look at Gartner's blockchain technologies Hype Cycle, and focus in on how a few cycle points apply to small and medium sized businesses. You'll learn how to interpret each tool, and gain a few recommendations based on the tech's current state.

What is the Gartner Hype Cycle?

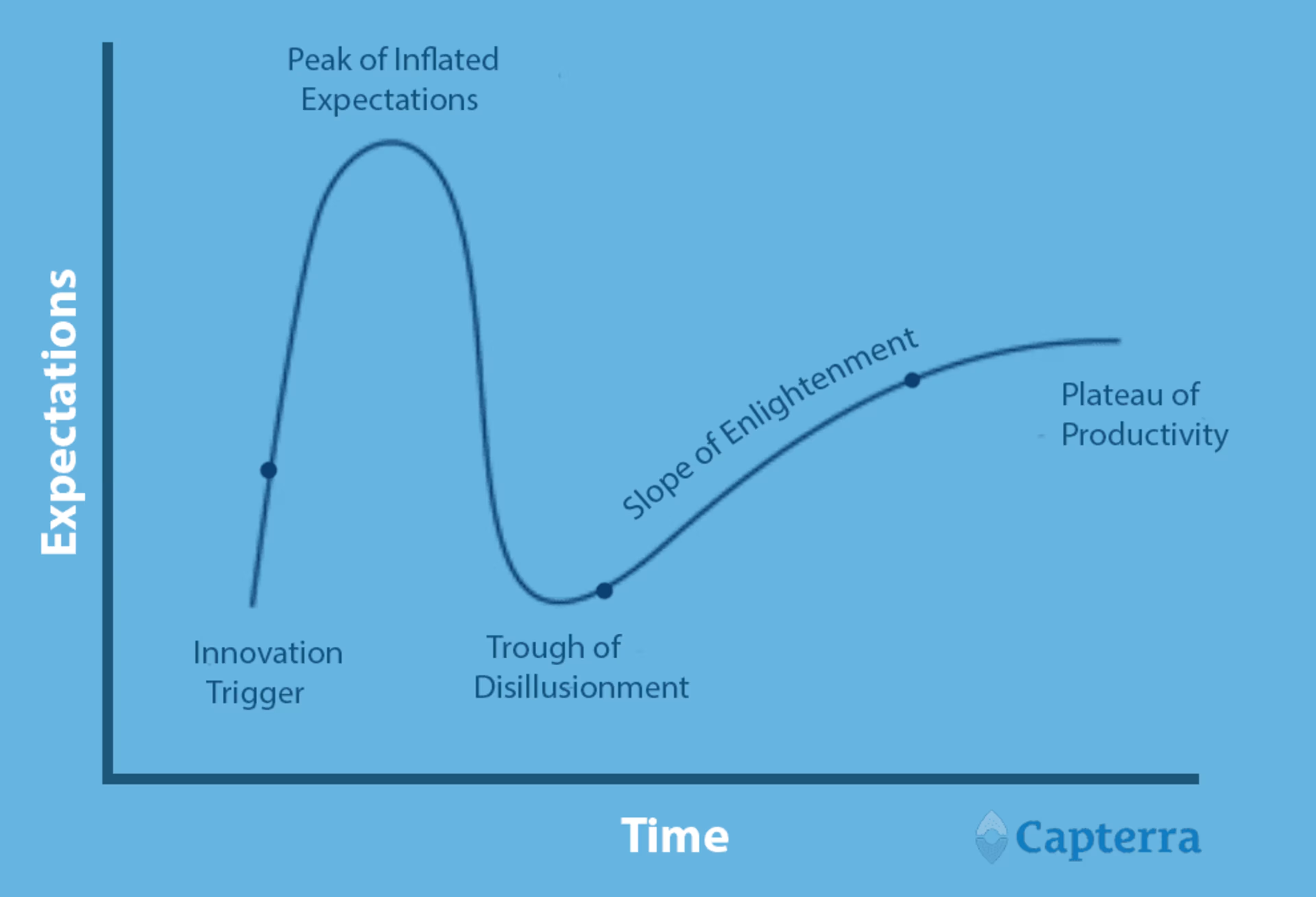

The Hype Cycle is a visual representation of the rise and fall of a product's expectations over time. There's a pattern to hype, wherein a product or idea starts out relatively unknown, quickly becomes the next hot thing, and disappoints by not being the Greatest Idea Ever before eventually finding its home in business reality.

The Gartner Hype Cycle.

The Hype Cycle is divided into five stages that products or services pass through:

Innovation Trigger. An event that moves new technology into the public's mind.

Peak of Inflated Expectations. At some point, all new ideas hit a point at which they simply can't live up to the hype. We find out about the potential to talk to our TVs for things like changing the channel and suddenly we're talking about how voice controls will let us to speak to anchors live, on-air.

Trough of Disillusionment. After our expectations peak, the product enters the mainstream and we discover its actual limits. This the point at which a lot of folks will write a technology or product off. Once we discover that something isn't magic, we start to think that it's a fraud.

Slope of Enlightenment. Of course, it's not usually a fraud. It's often just a normal product with limitations. In this stage, early adopters are discovering what the product actually does and what it's good for. We also determine the product's realistic value.

Plateau of Productivity. At the end of the Hype Cycle, we discover a product's final place in the market. This can take years to fully play out, but eventually every offering settles down. Hype is relatively flat, and acceptance and implementation skyrocket. As big businesses and everyday consumers see that something is safe to use and properly priced, they'll jump on board.

Why should finance workers care?

Anyone working in finance should understand what's coming down the financial tech pipeline. The blockchain Hype Cycle can help you get a better handle on what's real and what's not in a field that is still heavily developing.

Not only are financial technologies placed within one of the five segments outlined above, but each is also given a “Time to Plateau" estimate. While the Hype Cycle is fairly universal, the time it takes something to traverse the cycle varies.

This kind of information is especially useful for financial managers and accountants who work under excitable CEO or founders. You know who I'm talking about, the type of person that rushed to buy Google Goggles and lined up to get an iPhone X even though they only upgraded their iPhone 8 the month before.

While the Hype Cycle can keep tech chasers in check, it can also help you nudge overly conservative managers down the tech path. These are the folks still running Windows XP because they don't want to risk changing anything.

Let's examine three points along the cycle to see why they're where they are and what, if anything, your business should be doing about them.

Innovation Trigger—Quantum Computing

With a lead time of over 10 years until it reaches the Plateau of Productivity, quantum computing is still very much an idea, not a practice. Even so, the threat of quantum computing is one the blockchain world has to take very seriously.

In a subatomic nutshell, quantum computing allows computations to be performed hundreds of thousands of times faster than they currently are by changing the basic methods of computing. Instead of running on zeros and ones, quantum computers run on an infinite number of states between zero and one. Instead of performing one calculation before moving on to the next, quantum computers can manage multiple processes all simultaneously.

Because blockchain technology relies on cryptography—which is one of the things quantum computing is good at—quantum computing will affect it. There's a chance quantum computing will make today's cryptography look like a cheap lock on middle schooler's diary.

I say “chance" because we're still a long way out from this becoming reality. While one company—D-Wave—claims to have built a massive quantum computer, there are doubts about its effectiveness in the scientific community.

If you look at the biggest systems everyone agrees on—a few "quantum computers" that aren't really quantum computers—you're talking about very small quantum computers. You would need systems hundreds of times larger to make any impact on the basics of the blockchain.

Eventually, we may end up with a quantum-ready blockchain built on new technology and tougher algorithms.

To do:

Make sure any blockchain technology you adopt has a plan for quantum computing. While there's little to be done at this point, there's plenty to plan for. There's debate in the blockchain community about how to respond to quantum computing, if the community needs to respond at all.

Read up on quantum computing. Even if your business has nothing to do with the blockchain, quantum computing will likely impact the security you use. We might be over a decade away from that impact, but it's never too soon to start prepping.

Peak of Inflated Expectations—Distributed Ledgers

With five to ten more years until it plateaus, distributed ledger technology is sitting at the Peak of Inflated Expectations.

Distributed ledgers are the backbone of a blockchain, containing information about all transactions that have taken place in the chain. In many ways, distributed ledgers are like traditional databases with a few key distinctions.

The biggest difference is that distributed ledgers don't have a single location in which they reside. Everyone participating in the blockchain has a copy of the ledger.

There's also a major difference in how data is added to the ledger. Instead of one single source of truth that everyone copies, each participant decides the truth for themselves. The participants then vote—all of this is automated and computational—and add the information only if there's a majority consensus.

The beauty of this system is twofold.

First: There's no one place that all important information is kept, removing any dependence on a single provider or service.

Second: No one is reliant on any a provider that could—theoretically—alter history by altering the records. That allows every participant to trust that the data they're holding is a true representation of what's happened.

Gartner sees distributed ledgers as holding a lot of promise, but being a ways off from real implementation. Right now, there are challenges around scaling private distributed ledgers, and the value of a ledger versus existing technology is still murky.

Over the next decade, Gartner expects distributed ledger technology to begin converging on a single style. In the same way that accounting software competitors all manage accounts, storage and integrations in similar ways, ledger features and security will start to look the same.

To do:

Plan, plan, and plan some more. Having a clear understanding of the benefits and challenges of distributed ledger technology is a great place to start. From there, you can make a list of your business needs, allowing you to quickly evaluate new ledger technologies as they hit the market.

Start working with existing ledger technology to see how it can make your business run smoother or give more control to users without sacrificing efficiency. Distributed ledgers have major benefits for financial companies and the businesses those companies service. See if your business could benefit.

Trough of Disillusionment—Bitcoin

Bitcoin. As of writing, bitcoin's value is sitting at just over $7,000, putting the market capitalization of the currency at $117.6 billion. For some perspective, bitcoin started the year around $1,025, with a cap of about $16.5 billion.

The currency's 2017 rise has been largely driven by speculative investment, though there is also increasing demand for bitcoin as a currency.

In Gartner's eyes, bitcoin is moving through the Hype Cycle on two paths.

The bitcoin as currency cycle is in the Trough of Disillusionment; it has experienced slow growth and accounts for just a fraction of all financial transactions. The second cycle—bitcoin as a speculative investment vehicle—is headed toward the Peak of Inflated Expectations.

The cycles exist simultaneously, as the currency has two different functions. On the bitcoin as currency side, we're seeing new entrants into the field, making bitcoin's value as a currency hard to determine. While it may continue to be the most popular cryptocurrency in the world, there are other offerings that could yet surpass it.

Technologists and observers are becoming more interested in the underlying blockchain technology than the currency itself, which seems to have limited real world applications at this time.

Along the way, struggles with speed and scale have made it easy for other currencies to enter the market with clear value propositions, even if those values turn out to be underwhelming.

To do:

Bitcoin may still end up being a very valuable currency, due to its lack of reliance on external currencies for value and its immutable transaction history. Businesses with customer bases in certain areas or among certain social groups may find that accepting bitcoin is easier than dealing with foreign exchange fees and processes. Your first step is determining whether bitcoin aligns with your customers' needs and histories.

Don't bet the farm on bitcoin. As a largely speculative play, expect continued wild fluctuations in the USD value of bitcoin. If your business needs X amount in reserve cash, keeping it in bitcoin could be bad news if prices decline quickly.

Other Hype Cycle points

These are just three of the almost 20 technologies on the blockchain technology Hype Cycle. Which other trends do you think should be on the line? Let me know in the comments, and we can dive deeper into those issues in a later piece.

I'm also interested in whether any of these technologies are cropping up in your business, or if you have plans in place to address them in the next five years.