Discover how Excel can help transform your small-business accounting.

After calculators, spreadsheets are an accountant's best friend when it comes to managing basic accounting tasks (think ledgers and balance sheets). But does Microsoft Excel still live up to the hype in this era of innovative technologies like AI and blockchain?

Yes, depending on what your accounting and finance requirements are.

If you need help standardizing your processes and speeding up your tasks, Excel is the tool for you.

Streamline your software search with our Shortlist guide

Quickly find the right tool with this snapshot of the most popular Accounting Software

Excel can help with most of the basic ones (e.g., bookkeeping, invoice management), but if you're looking for help with advanced accounting functions such as cash flow and tax management, you might want to consider accounting software.

In this article, we'll look at some key Excel usage trends, benefits, and features, free Excel templates, and when should you consider Excel for your small-business accounting.

Excel usage trends for small-business accounting

Before we dive into Excel's features and benefits, it's important to understand how the use of Excel for small-business accounting has changed over the past few years.

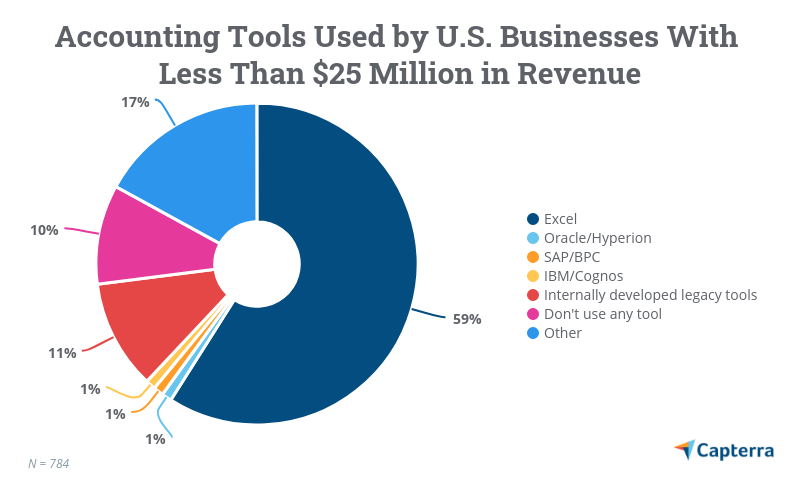

Excel continues to be one of the most popular accounting tools used by small-business finance managers. Smaller businesses tend to have and use less financial data when compared with enterprises, and Excel allows such businesses to focus on basic accounting tasks, such as budget planning and forecasting.

Here's a breakdown of accounting tools used by U.S. businesses:

Breakdown of accounting tools used by U.S. businesses (Source)

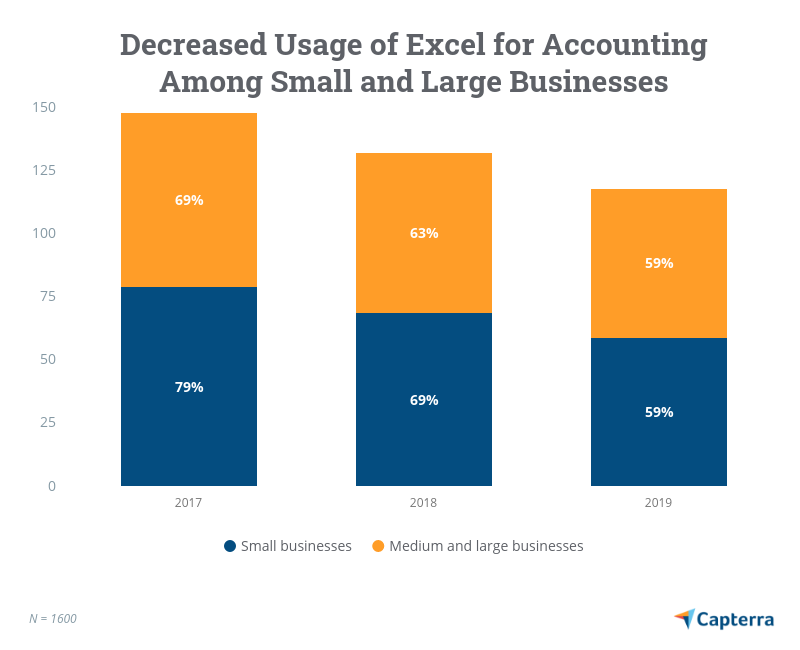

Despite Excel's popularity, its usage in accounting is progressively declining among businesses of all sizes, as shown in the chart below.

One possible reason for this decline is the decreasing price of ERP software and cloud-based accounting tools specifically targeting basic functions such as invoice management.

Use of Excel for business accounting has been declining since 2017(Source)

Benefits of using Excel for small-business accounting

Compare datasets: Helps compare financial datasets such as total accounts payable versus receivable to calculate cash flow volume within a given period. You can track recurring costs to get a clearer picture of where your money is going, and (if applicable) divide customers into groups based on size, location, or purchase to see which groups generate the most revenue for your business.

Generate customizable reports: Create template-based reports (including tables and charts) that can be reused for tasks like invoice management and estimating cash flow volumes. These reports can be customized as needed to add more data points (such as multiple/differing state sales tax rates) without having to create a new template from scratch.

Automate data entry: Excel macros help automate repetitive financial data entry tasks (e.g., copying data from primary sources to an Excel sheet). For example, you can create a macro to export invoice-related data from a CSV file and populate the relevant invoice management template in your Excel sheet.

Key Excel features that can be used for small-business accounting

Pivot tables: Located in Excel's “Insert” menu, pivot tables are an advanced table format that summarize complex datasets based on a selected cell range. From there, users can filter the selected data in a separate window.

WHEN TO USE IT FOR SMALL-BUSINESS ACCOUNTING:

Pivot tables are excellent for summarizing raw accounting data and sorting it into different categories. Let's say you have to sort through itineraries for expense management. You can use a pivot table to filter through complex datasets and summarize expenses by category.

What-if analysis: Located in Excel's “Data” menu, what-if analysis helps you forecast results by changing datasets in a formula. In other words, this feature lets users test new results by modifying data without removing or changing the primary dataset.

WHEN TO USE IT FOR SMALL-BUSINESS ACCOUNTING:

This feature is ideal for cash flow management and the overall budget and forecasting processes. The feature allows users to test various budget estimates in a graphical format (trend line or bar graph) and change the forecast for these estimates based on modification that the user makes to the budget data.

Forecast sheets: This feature is located in the same menu as “what-if analysis”, and helps users forecast data trends based on historical values. This feature predicts trends in a graphical format instead of simply changing data values in a cell.

WHEN TO USE IT FOR SMALL-BUSINESS ACCOUNTING:

This feature is only relevant if you have historical data spanning multiple years. For example, if you have cash flow data from past years, you can include that data in a table and use this feature to create a new worksheet with a graph forecasting future trends in your cash flow volume.

Free Excel accounting templates

Excel comes with ready-made templates for all sorts of accounting functions, such as invoices, budgeting, and more.

You can get bank reconciliation sheets, ledgers, invoicing templates, and personal finance trackers right from Microsoft. From there, there's a host of online resources to help you set up your free Excel accounting templates, such as YouTube videos that walk viewers through various templates including formatting and formulas, along with tips on how best to use this type of sheet once you’ve set it up.

4 recommendations for using Excel for small-business accounting

Here are some things to keep in mind if you're using (or considering using) Excel for accounting at your small business.

Make sure the program you want is actually Excel. If this article sounds like too much to learn or not quite what you're looking for, don't forget that you can explore other accounting and spreadsheet software options. Here's our list of the top free and open source accounting software options to get started.

Familiarize yourself with the templates offered by Microsoft. Search for accounting and bookkeeping templates online to determine whether what Microsoft offers meets your needs. Click here to view Excel sheets that have been customized by Microsoft. Once you have familiarized yourself with a template, you can customize it based on your unique requirements (e.g., estimating your budget monthly vs. quarterly, adding pivot tables, including your logo).

Walk through the template-building process using online resources. Search for online articles or videos that walk you through creating and/or using a template from start to finish. This will help you understand Excel's interface, introduce you to additional functions you may want to use, and give you hands-on practice before using your own data.

Focus on learning from prefilled datasets. Practice makes perfect. This holds true for using Excel for any accounting tasks, such as cash flow management. Once you finalize a template, you can practice using it with prefilled datasets to ensure you understand how to use it before inputting your own data.

Next steps and additional accounting resources

If you're already using Excel and are ready to upgrade, check out our accounting software directory where you can filter by desired feature(s) to build a shortlist.

Here are some additional Capterra resources to help you meet your business' accounting needs:

This Free Small-Business Budget Template Will Take Your Bookkeeping to the Next Level

6 Reasons Why Businesses Get Audited (and How to Avoid Them)

Want to learn about hiring an accounting firm for your business needs? Our list of the top accounting firms and their features will help you narrow your search. Read more in Capterra’s accounting firm hiring guide.