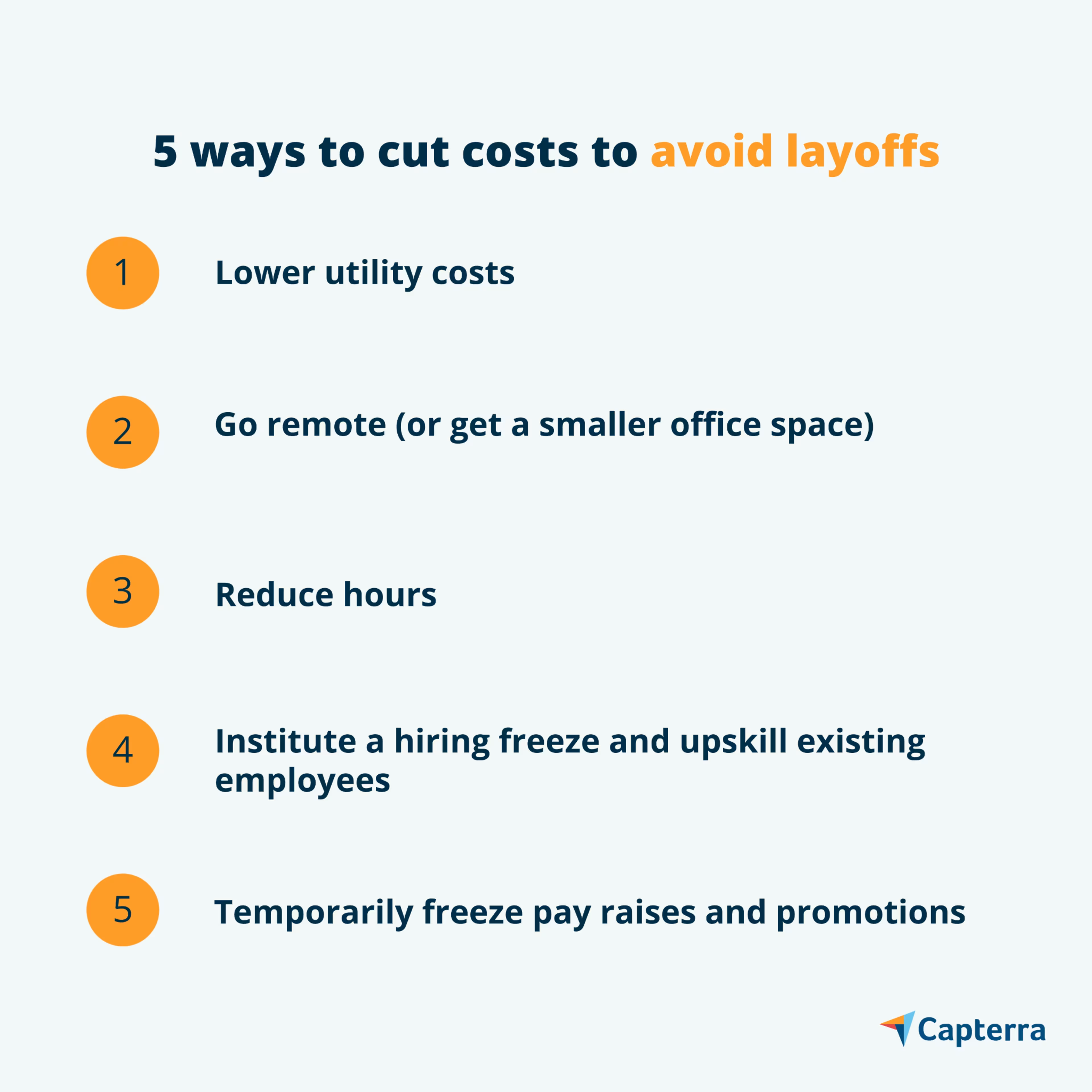

There’s more than one way to go about cutting business expenses. Here are five things you can do within your budget to save your business’s most valuable resource: your employees.

No one likes layoffs: Business leaders and managers are forced to make difficult decisions about which team members to let go and which to keep on staff. Employees either lose their jobs or are left behind, often with increased workloads.

And for what? According to the Harvard Business Review, layoffs are often a short-term solution that can end up costing businesses more in the long run.

Those who survive layoffs are often more stressed, more likely to burn out, and less trusting of the company that let their colleagues and friends go, which lowers morale, decreases productivity, and leads to higher turnover rates.

A mass layoff can also result in bad press and consumer boycotts of your product and services, like what happened to Nokia in 2008 when the company laid off 2,300 employees.

Payroll might be your biggest expense, but that doesn’t mean it’s the best place to start when cutting business costs.

Let’s take a look at five ways to cut costs that might help you avoid layoffs and protect your employees.

1. Lower utility costs

One of the first things you should do when trying to cut business expenses is know where your money is going. What is the business paying for on a monthly or yearly basis?

Recurring costs likely include water, gas, electricity, and internet. While you cannot cut utilities down to zero, your business can become more mindful of how they’re used.

If you want to monitor and cut back on your business’s energy consumption, your first step will be to conduct an energy audit to identify how much energy your business uses and how much it might be wasting.

To conduct an energy audit, you can either hire a professional or get an idea yourself by walking around the office. During an energy audit, pay attention to things such as air leaks around doors and windows, ventilation, heating and cooling equipment, lighting, appliances, and devices.

Lowering utility costs long-term might require investments such as having a programmable thermostat, replacing light bulbs with energy efficient ones, or upgrading devices to conserve energy.

If you can’t replace your business’s devices with energy efficient upgrades, especially if you’re in the middle of trying to reduce costs, focus on the no-cost ways your business can save energy (and money).

This might mean encouraging employees to make sure water isn’t left running, lights are turned off, and appliances are unplugged when they’re not in use. Other no-cost ways your business can save energy and money include using natural daylight as opposed to lamps on sunny days, fixing air leaks to prevent energy waste, and making sure doors and windows are not left open.

2. Go remote (or get a smaller office space)

Rent for office space is another large business expense. Many businesses went remote during the COVID-19 pandemic, and some are planning to keep it that way, adopting either a fully remote or hybrid work model.

In the post-pandemic workplace, businesses are predicted to sell or repurpose their office real estate as neighborhood hubs, coworking spaces, storage spaces, or on-site childcare facilities for employees.

By repurposing or downsizing your office space, you can cut down on rent as well as recurring utility and maintenance costs. If you choose to sell your space, you’ll be forgoing these costs altogether.

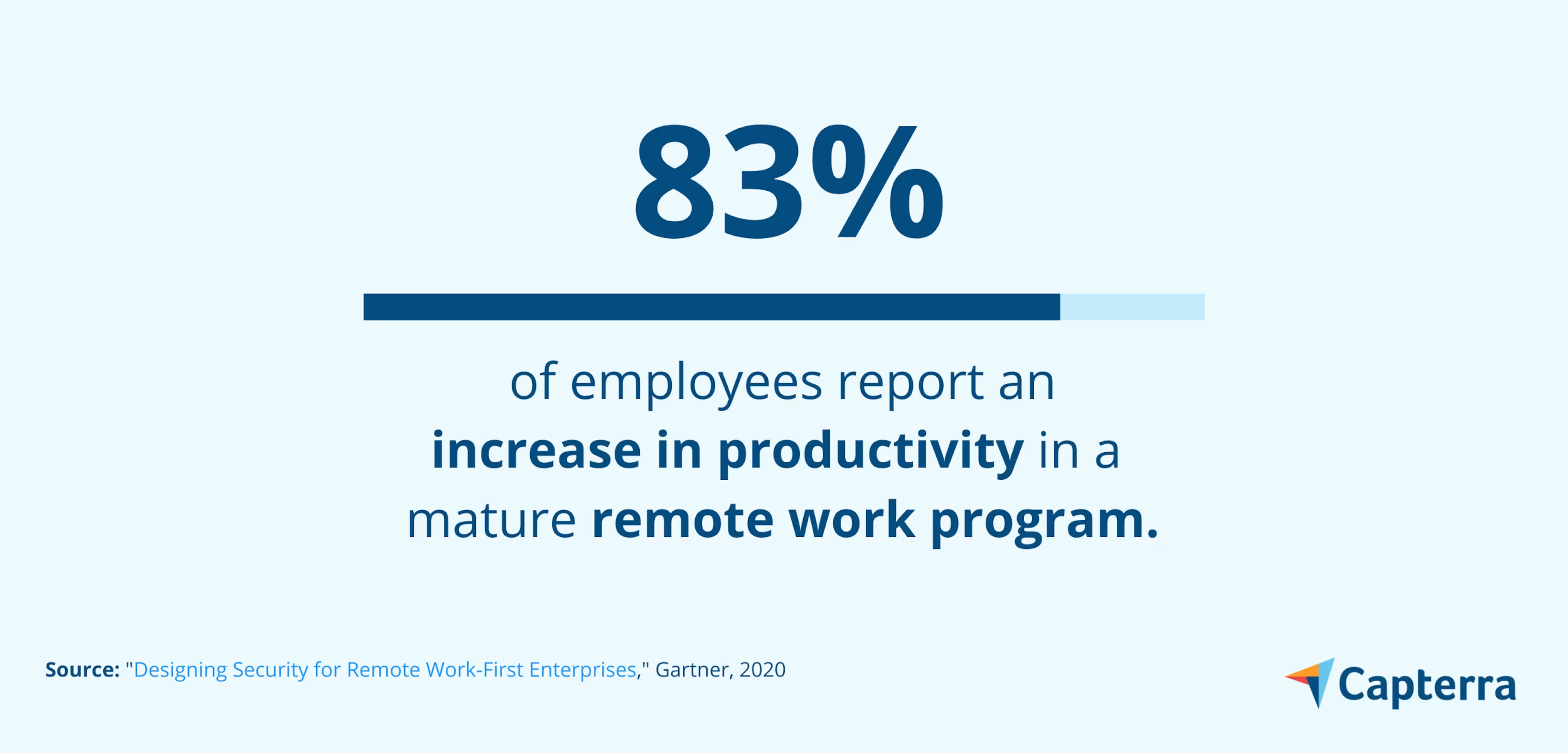

Going remote can mean other benefits too: Many employees want the option to work from home with 25% of small-business employees wanting to work fully remotely, and 61% opting for a hybrid model. Your business could benefit from it too, with 83% of small-business employees reporting increased productivity in a mature remote work program.

It’s important to consider that going remote will reduce or eliminate costs associated with having an office space, but you might acquire new costs associated with remote work.

These might include upping your business’s cybersecurity measures and making sure your teams have the video conferencing and project management software tools they need to stay connected.

3. Reduce hours

According to Cavanaugh & Co, LLP, an accounting firm, going to a four-day workweek from a five-day workweek can cut payroll costs by 20 percent. Alternatively, you could reduce the number of hours in the work day from eight to, say, six.

This could be a good compromise of trimming down payroll costs without laying anyone off.

4. Institute a hiring freeze and upskill existing employees

If your business is struggling financially, take care of your existing employees by instituting a hiring freeze for non-essential positions, and hold off on filling positions that become vacant due to normal attrition.

This will allow your business to re-evaluate how departments are structured and the division of responsibilities among employees. Instead of investing in new employees, it may be more cost effective to invest in employees you already have.

Training can cost businesses money–in 2020, small businesses spent an average of $1,678 per learner, but there are low-cost and even no-cost ways to train and upskill your team.

This process begins with a skills gap analysis. What skills are your teams missing? From there, you can look into free and open source learning management systems (LMS) that can help your business promote skills development on a budget.

During the hiring freeze and skills gap analysis, you might find that your business needs talent with very specific skills that cannot be simply taught to your existing employees. For positions such as these, lift the hiring freeze.

It’s also important to be mindful of your employees’ workloads when in the midst of a hiring freeze and upskilling process, and check in on them to make sure they’re not overwhelmed.

5. Temporarily freeze pay raises and promotions

To save payroll costs, you can also put pay raises and promotions on hold. If you select this option, be transparent and fair with who this applies to—if it applies to all employees, it should apply to executive level employees as well.

Communicate to your employees that the business is looking for ways to cut costs temporarily and want to avoid layoffs. To do this, the business needs to put a temporary freeze on all pay raises and promotions, including for business executives and those at the C-suite level.

Communicate that you will review this decision and provide the team with updates within a specified time window. It’s critical that you follow through on communication promises.

Save layoffs as a last resort

Unfortunately, laying off employees will sometimes be the only option, but it should be one that has been carefully weighed. The decision to layoff employees due to budget cuts should be the last resort.

If you choose to take your business remote to save costs associated with having an office space, be sure to check out Capterra’s remote work resources to help you along the way.

Looking for Talent Management software? Check out Capterra's list of the best talent management software solutions.