Running a small business is a tricky balancing act. To be successful, you have to dream big enough to separate your business from the competition, while also focusing on the fundamentals enough to keep the lights on and avoid becoming one of the 50% of businesses that fail within five years.

The chances of your small business becoming the next trillion dollar company after Apple are about one in a trillion.

But if your big dreams as a small business owner involve going public, the Investors Exchange (IEX) is making that dream a little more realistic by allowing companies to list for free for the first five years, and then charging about half as much as the NYSE and Nasdaq after that.

Even if your business is nowhere near the IPO stage, the IEX story—which underlines an open market, transparency, and a level playing field—has some important takeaways for business owners.

As of late 2018, the IEX is still in the experimental phase, but small business owners need to pay attention to what happens with this new market—not just because it will affect their own business but because it will change the way business is done around the world.

First, let's go over a brief history of the IEX, then we'll look at some takeaways for small business owners.

What is the IEX?

The IEX, or Investors Exchange, is an alternative stock market conceived in 2012 by Brad Katsuyama, a Canadian financial services executive.

His goal was to create a fairer stock trading market for businesses of all sizes.

What did he see as being unfair about the New York Stock Exchange and Nasdaq? It comes down to access and speed.

While working for the Royal Bank of Canada, Katsuyama and his global electronic trading team noticed that nefarious stock scalpers, known as high-frequency traders, were taking advantage of minute delays—imperceptible to humans but not high-powered computers—in transaction time to game the system. The phenomenon was dramatized in Michael Lewis' 2014 book, "Flash Boys: A Wall Street Revolt."

Katsuyama's solution was to build a throttling system in to the IEX so that every trader—whether they have access to high-powered computers or not—is able to make transactions on a level playing field. This became known unofficially as the "speed bump" model.

The IEX does this by wrapping almost 40 miles of fiber optic cable around its main computer, delaying transactions by less than one-thousandth of a second but long enough to negate any unfair advantages for high-frequency traders.

The IEX was approved as a national stock exchange by the U.S. Securities and Exchange Commission in June of 2016 and plans to list its first public company in the near future.

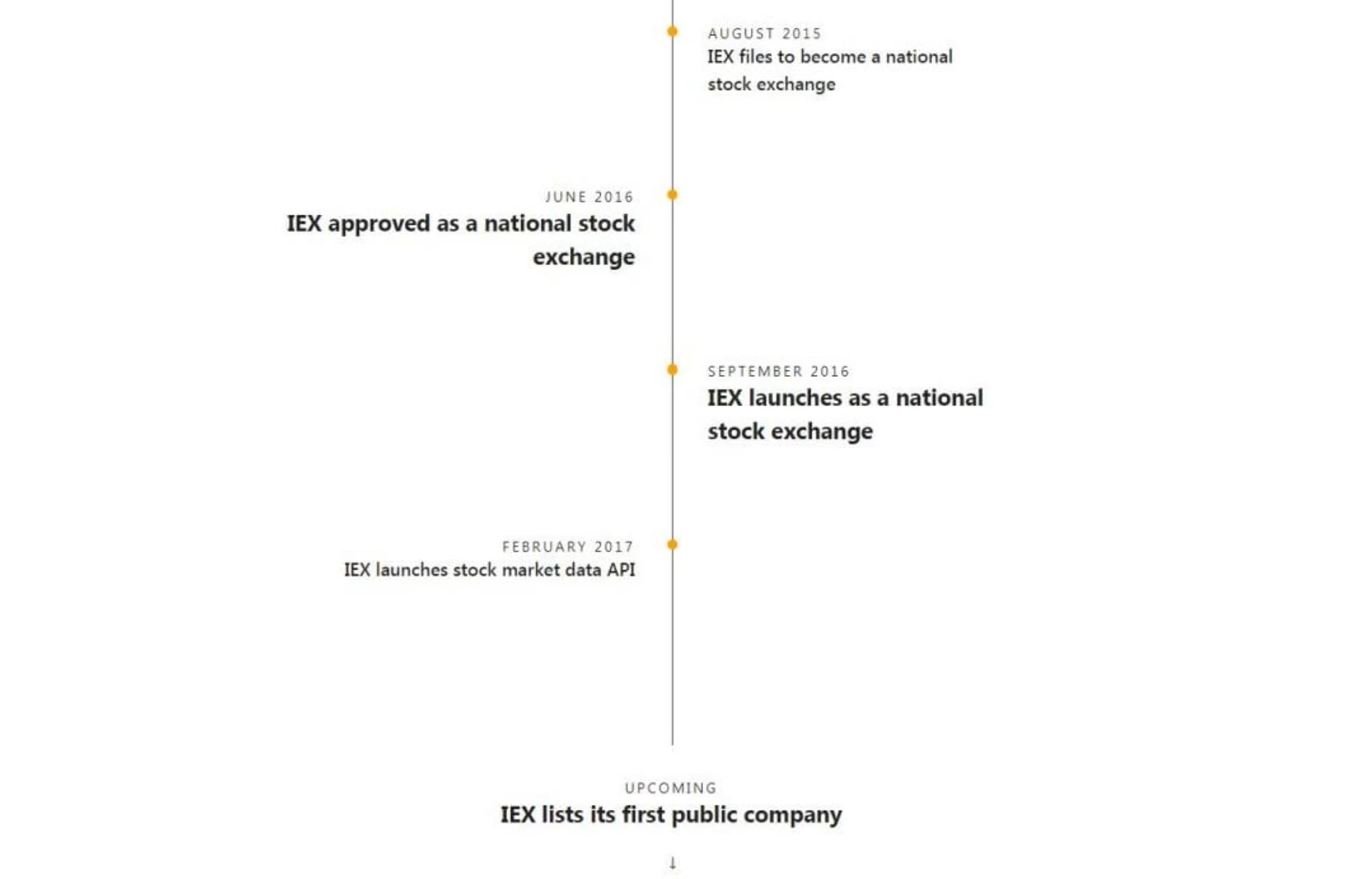

A timeline of notable milestones of the IEX (Source)

The IEX has attempted to lure established publicly traded companies away from the NYSE and Nasdaq by offering five years of free listings but has yet to entice any companies to list with them.

What does the IEX mean for small businesses?

As a small business owner, you may wonder, "What does the IEX mean for me?"

Potentially, quite a lot.

As Katsuyama says on the IEX web site:

"Markets are the natural vehicle for the exchange of products, services and even ideas. At IEX, we believe that everyone should have the opportunity to compete on a level playing field with transparent rules and processes—and that's why we're working each day to build fairer markets."

Brad Katsuyama, IEX

Theoretically, that mission statement could apply to the business world as a whole.

If the IEX succeeds, we could see a greater movement toward an open market in businesses large and small. If it fails, it could mean a continuing trend toward the status quo.

The IEX story is also an interesting look at how the market responds to new technology. Similar to the sports world, when someone tries something new and it works, the competition either quickly follows suit, or falls behind.

In 2017, NYSE American—the New York Stock Exchange's market for small-cap companies—announced that it would follow IEX's lead by implementing a 350-microsecond delay into its own transactions to even out the playing field.

Around that time, NYSE president Tom Farley told Business Insider:

"Our view is that we need to work together as an industry toward consolidation and simplicity. The way we operate our business is, we are going to do everything we can to have the best listings franchise, and we're going to look at what competitors are doing ... We're the first ones to throw our hands up. In fact, we've told the industry for three years that we think that there is a much better way out there."

If IEX's own competition is buying into this leveling of the playing field, it's a good indicator that the rest of the business world won't be far behind.

Think of Uber as another example. For decades, traditional taxi cab companies ruled the marketplace and controlled the competition. Then Uber used technology to reopen the marketplace and within a few years there was an "Uber" for everything.

Lessons from the IEX for small businesses

As a small business owner, you likely won't be the first company to go public on the IEX, but that doesn't mean that you should just ignore it.

Say, for example, your company does become an enormous success. Because of its relatively low listing fees (free for five years, then $50,000 per year, as opposed to $100,000+ on the NYSE and Nasdaq) the IEX has positioned itself as an attractive avenue for young, growing companies to go public.

Keep up-to-date on news about the IEX. If and when companies begin to go public on the IEX, pay close attention to how the market responds. Depending on the outcome, you may more seriously consider the possibility of listing your own company on the IEX.

Even if going public is not part of your plans, there are some useful lessons that you can take from the IEX story right now:

1. Prepare for a more level playing field

If the IEX has proved anything, it's that loopholes have a short lifespan. By nature, the market will catch up and correct itself, and only the best-run businesses will survive, while those looking to cut corners or take advantage of errors in the system will die off.

OUR RECOMMENDATION: Don't give into the temptation to chase volatile trends, such as the latest Cryptocurrency, or high-frequency trading. Keep clean books, follow best practices, and treat your customers and employees well and you will be successful while also sleeping well at night.

2. Stay up-to-date with the latest technology

For a brief period, high-frequency traders—or stock scalpers—were taking advantage of gaps in technology to earn an unfair advantage. But eventually the technology gap closed and the market corrected.

OUR RECOMMENDATION: At the small business level, make sure that you're on the right side of the technology gap to avoid falling behind in the first place. Use accounting and finance software to save time and money, and read industry news to keep aware of the latest trends.

3. Embrace transparency

In addition to leveling the playing field, a core principle of the IEX model is embracing transparency: They publish their operating rules and charge fixed fees and flat rates.

OUR RECOMMENDATION: As a small business owner, you may be tempted to fiercely protect proprietary information and company info. While some of this information—such as future business plans and private employee data—should be protected, sharing other information—such as your pricing model, quarterly profits, and forecasts—can build loyalty, trust, and accountability.

What are your thoughts on the IEX?

Whether you think the IEX is a glimpse into the future of business, or a half-baked, failed experiment, it's an interesting topic of conversation for anyone with a stake in business and finance.

I'd love to hear your thoughts about the IEX in the comments.

To stay up-to-date with the latest in accounting and finance technology, follow our blog.