Know what makes a statement of financial position a powerful tool to determine the financial health of your business.

Busy trading, running sales calls, or managing employees? Who has time for finances?

Small business owners juggle multiple responsibilities, and in the bustle, accounting often takes a back seat. But even though your bank balance seems okay, there could be declining fundamentals that may not show up until it’s too late.

If you’re a business owner, an investor, or part of management, the quickest path to peace of mind is knowing the numbers of your business. Whether you hire in-house accounting talent, outsource your accounting needs, or do it yourself, it’s crucial to know where you stand financially.

One of the best ways to keep an eye on your finances is through a statement of financial position, also called a balance sheet. It’s the most commonly prepared of all basic financial statements.

In this article, we explain what a statement of financial position is and why it’s a powerful tool to determine the financial health of your business. We also provide some tips to easily prepare and analyze it using financial planning and analysis technology.

What is a statement of financial position?

A statement of financial position is another name for your company’s balance sheet. It reveals what your firm owns (assets), how much it owes (liabilities), and the value that would be returned to the investors if your business was liquidated (equity).

A statement of financial position is prepared at the end of an accounting period—which is typically 12 months—and provides a snapshot of the overall financial position of your company at a given time. This is in contrast to other financial statements such as an income statement that shows where money is being spent on a day-to-day basis.

Who uses a statement of financial position?

A statement of financial position is used by business owners, investors, and management to quickly get an overview of the financial strengths and potential of a business. These stakeholders use the statement to guide their fiscal decisions for the future.

Business owners and department heads use a statement of financial position to take internal decisions about:

Buying more inventory based on current inventory buildup. The current asset component in the statement of financial position allows business owners to take strategic calls on how much to expand in terms of production.

Applying for credit based on outstanding payments. Before applying for credit, business owners should take a look at how their company is financed (via equity or liabilities) presently and decide if they can afford to take on more credit.

Cutting expenses based on a comparative analysis of various current expenses. Business owners should determine which items their company is spending the most on and trim down unnecessary expenses. They can use sales numbers from other financial statements—the income statement, for instance— to draw a correlation between expenses and revenue.

Shareholders and investors use a statement of financial position to:

Understand how assets are built in a business—too much debt can be dangerous for new investors.

Decide if a business presents a good investment opportunity.

Compare a business’s present financial performance against its past performance or the performance of industry peers.

Creditors are more interested in using a statement of financial position to:

Understand a company’s ability to pay back debt.

Assess and manage the risk involved in extending credit to a company.

Overall, a statement of financial position helps users of financial information keep the business profitable in the short as well as long run. It also helps reaffirm stakeholders’ vision and mission by evaluating the pace toward their goals and refining their strategies.

Who prepares a statement of financial position (or balance sheet)?

Depending on the size of an organization, different people may be involved in creating the statement using GAAP (accounting system used in the U.S.) or IFRA (accounting system adopted by 100+ countries) standards.

In independent and small businesses with 1 to 500 employees, business owners or bookkeepers usually prepare the statement of financial position. In midsize firms with over 500 employees, in-house accountants usually prepare the statement, and external auditors are consulted to look over and approve it.

Preparation of this financial statement follows a particular format for arranging its major components and items, which we explain in the next section.

Components of a statement of financial position

To depict how a business acquires resources to run operations, a statement of financial position highlights three sections: assets, liabilities, and equity. At any given time, assets must equal liabilities plus owners’ equity.

Assets = Liabilities + Equity

On the financial position statement, assets are represented on the left, and liabilities and equity on the right. Assets and liabilities are further subdivided into current and noncurrent (or long term) depending on the ease with which assets can be converted into cash and liabilities can be settled.

Current assets: Resources that can be converted into cash within the next 12 months. Examples include cash equivalents and accounts receivables.

Current liabilities: Obligations that are to be paid off within a year. An example is the money your business owes to creditors (accounts payable).

Noncurrent assets: Also called long-term or fixed assets, these resources cannot be converted into cash within a year and are used to run the business. Examples include furniture (tangible assets) and patents (intangible assets).

Noncurrent liabilities: Obligations or debt (or their portions) that take more than a year to be repaid. An example is your employees’ pension.

Shareholders equity: The amount an investor or a shareholder will receive if your company is liquidated after clearing all debt obligations.

Types of statement of financial position (with visual examples)

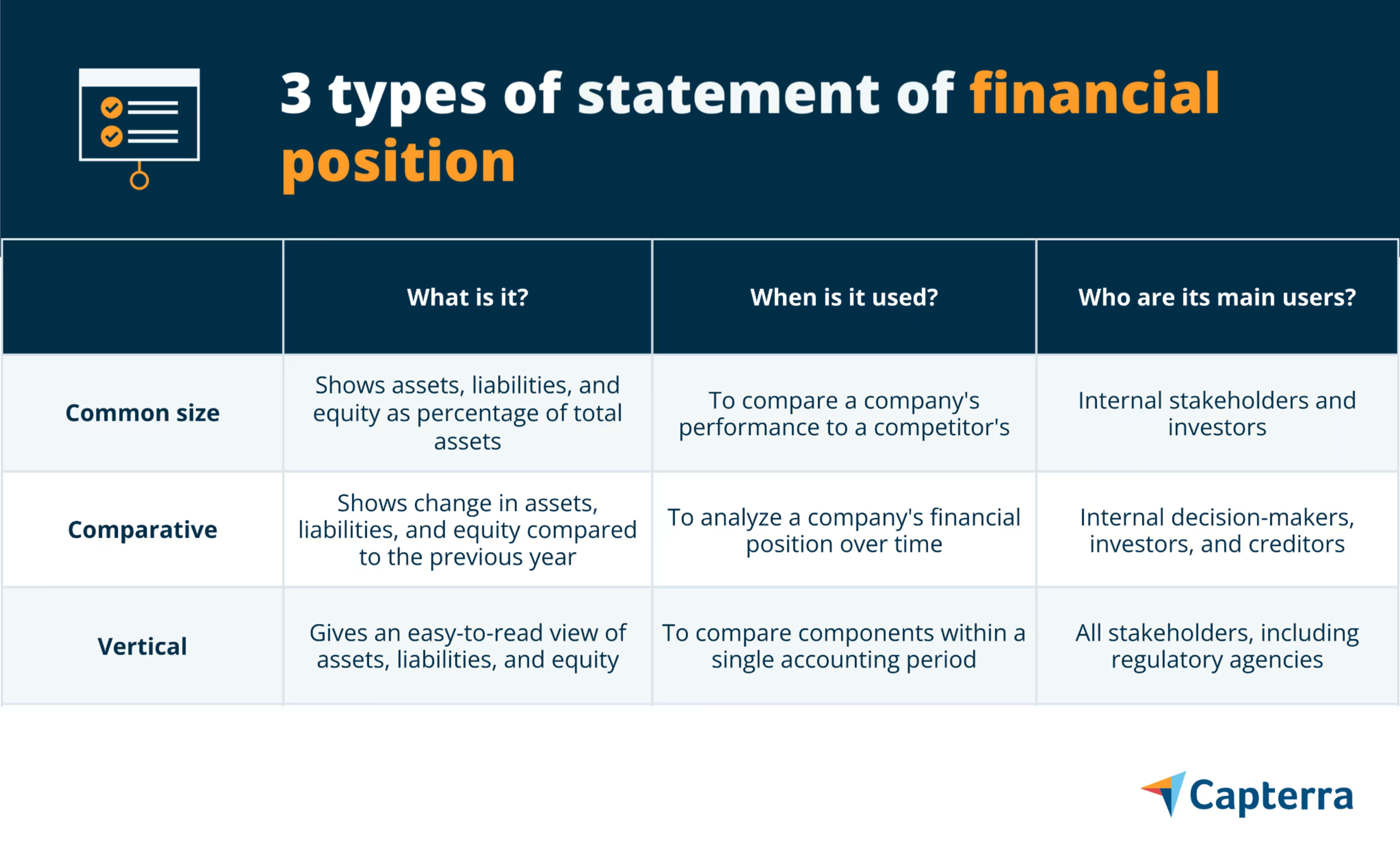

Independent and small businesses tend to have simpler statements of financial position compared to large businesses, which usually have many complex classifications under all components. Irrespective of the business size, there are three ways accountants format a statement of financial position: common size, comparative, and vertical.

1. Common size statement of financial position

It’s the most popular format to prepare a statement of financial position. Unlike other formats, each column in a common size balance sheet notes the information as a percentage of total assets.

It displays information in the form of an accounting equation with assets on the left and liability and equities on the right (illustrated below). In practice, however, you don’t necessarily have to follow the equation format for representation; you can also use vertical presentation.

Use a common size statement to:

Determine the contribution of individual components (asset, liability, and equity) and items listed with respect to the total assets.

Compare your company’s performance against competitors’.

Identify how your business has sourced assets over time.

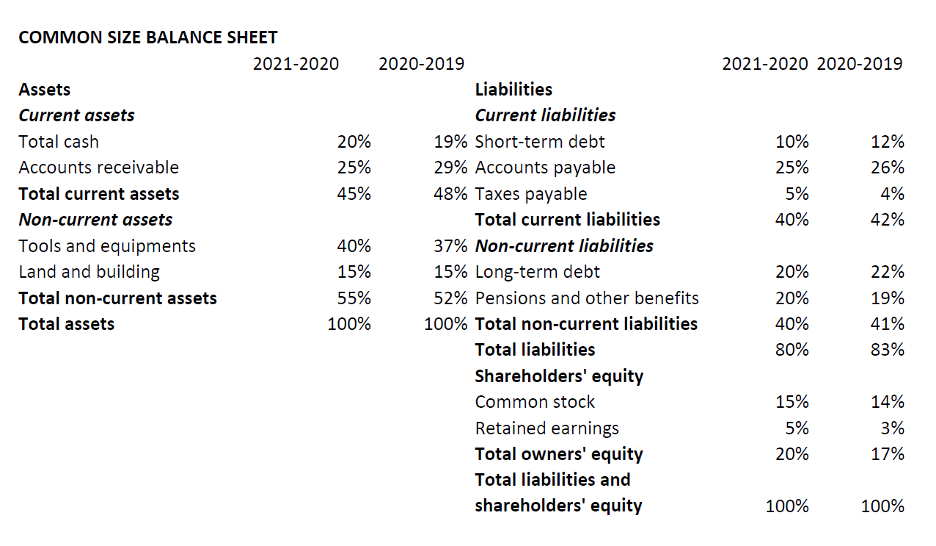

Example of a common size balance sheet

2. Comparative statement of financial position

This format represents the performance of the three components over time. It shows historical figures alongside the latest figures and the percentage change. The right and left division (as in a balance sheet) is generally not used in this format.

Use a comparative statement to:

Track and analyze your company’s progress over time.

Explore changes and identify underlying trends year-by-year.

Weigh your company’s performance against that of industry peers. For instance, you can compare responses to the same market conditions by comparing the percentage changes.

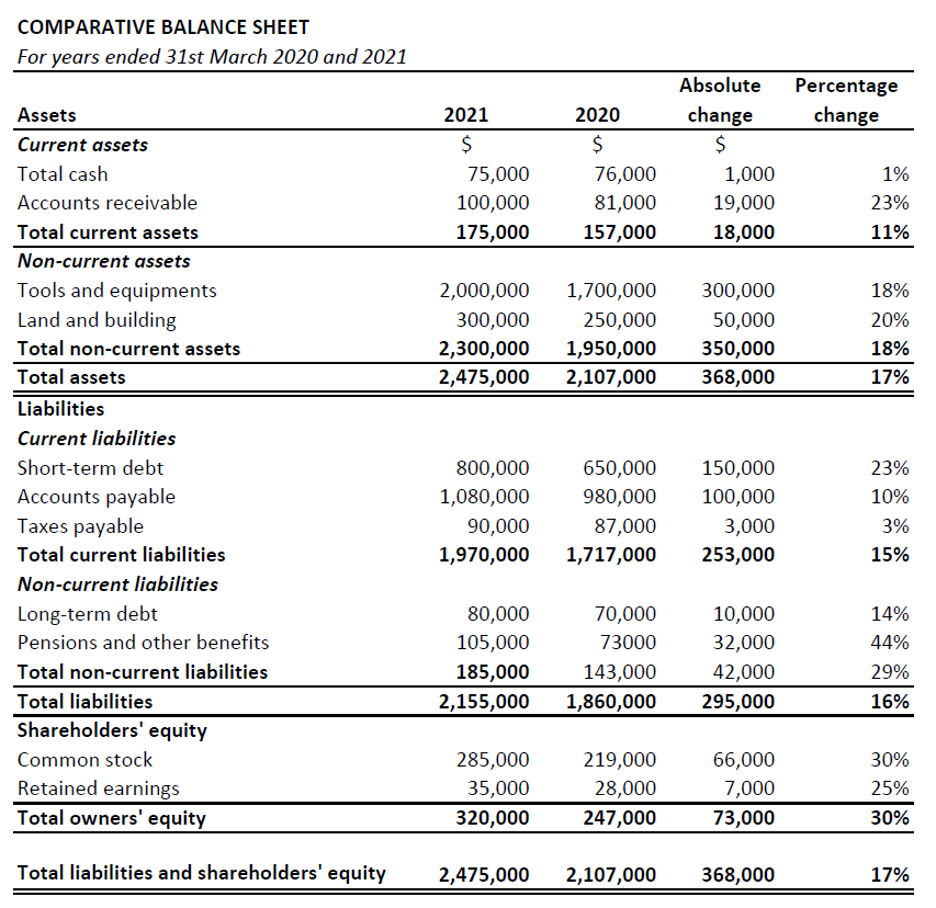

Example of comparative balance sheet

3. Vertical statement of financial position

In vertical format, the components are presented in a single column, starting with assets and then equity and liabilities. Also, within each category, the items are arranged in order of liquidity—from less liquid (such as long-term or noncurrent asset) to more liquid (such as cash equivalents). Liquidity refers to the ease with which a resource can be converted into cash.

Use a vertical statement to:

Compare the components within the same accounting period.

Understand the correlation between different line items on the balance sheet.

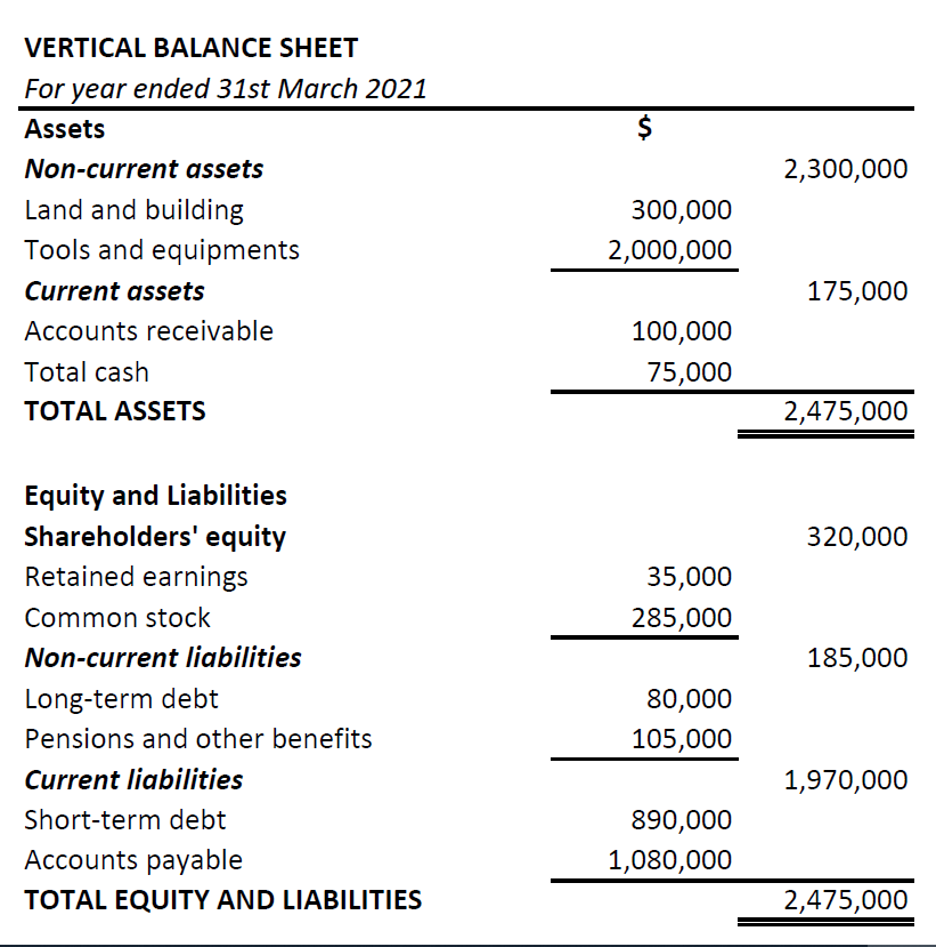

Example of a vertical balance sheet format

Be mindful of the value problem in a statement of financial position

Exercise judgment when drawing conclusions from the numbers on a statement of financial position. The method used to prepare the financial statement results in certain limitations that you must keep in mind. Here are some of them:

An asset cannot be valued on a statement of financial position unless it has been involved in a transaction. So, if a company has developed a web platform, its value will not be mentioned in the statement.

Assets such as machinery cannot be valued correctly despite accounting for depreciation (due to wear and tear), as they fail to account for changes in current value due to market fluctuations.

The statement only shows a snapshot of a company's financial condition at the year-end. So, it will show a company as financially healthy even if it settles its debts on the last day of the accounting period. It fails to look for consistency.

As you prepare a statement of financial position, be more critical than a passive user of the statement of financial position.

Use software to create a statement of financial position

Excel and spreadsheets, popularly deployed to prepare statements of financial position or balance sheers, are often prone to human errors. The easiest and more accurate way is to use financial reporting software. Here are a few ways using software can speed up and improve your accounting process, from record to report (R2R):

Get more time to focus on analysis. Depending on the financial reporting software you use, along with auto tools to prepare a balance sheet, you would have access to business intelligence tools and add-ons. These will equip you to take time for deeper financial analysis—from projecting net income and forecasting expenses to determining profitability.

Extract data to create interactive financial reports. You can automate the collection of financial data from across the organization and use intuitive financial dashboards to report the most important data and track metrics that impact business goals.

Reconcile balance sheet easily. Reconciling the balance sheet is about going back to the source of money and comparing balance sheet accounts to the sources. For most small businesses, the source is their bank statements. Financial accounting software enables you to easily track and correct discrepancies and ensure your balance sheet is correct.

Ready to hire an accounting firm for your business needs? Browse our list of top accounting firms and learn more about their services in our hiring guide.