One in 100 businesses gets audited each year. Make sure you're part of the 99 that don't.

As a business owner, what keeps you up at night? Rodents in the ingredients supply? A crippling computer virus that blocks access to your accounting software? The dreaded audit notification from the IRS?

Audits can be especially scary for small- or midsize-business owners because of the prospect of owing more taxes on a limited budget or being held personally liable without an experienced accounting department to back you up.

If the IRS is haunting your dreams, allow me to soothe you back to sleep: Only about one in 100 businesses is audited each year. On top of that, there are a few simple things you can do to avoid the menacing gaze of the IRS.

As a small-business owner, your chances of being audited spike if you:

Earn more than $1 million per year (this isn't a bad thing, but if this is you, it's probably time to incorporate to protect yourself and your assets).

Fail to report all of your income.

Claim business deductions that are disproportionate to your income.

As the old saying goes, an ounce of prevention is worth a pound of cure, and we're here to help you prevent the mistakes that lead to an IRS audit in the first place.

Why do small businesses get audited?

In this article, we'll look at six of the top reasons small businesses get audited, along with tips on how to avoid becoming one of them.

It's worth noting, though, that you can be audited for reasons beyond your control. The IRS uses random selection to audit some returns, and your return can also be targeted for an audit because of something shady that one of your business partners or investors did.

What to do if you get an audit notice from the IRS (Source)

For those things you can control, however, I reached out to our friendly neighbors over at the IRS for some helpful tips and resources, and put the following list together:

6 tips for preventing an IRS audit

1. Stop expensing entertainment events

Planning to take a potential client out to the old ballgame or a concert to win them over? That's fine, but it's going to have to be on your own dime.

As part of the Tax Cuts and Jobs Act of 2017, the government did away with business-related entertainment deductions. So if you try to skirt the system to keep your annual customer appreciation night, you're raising a big red flag to the IRS to send an auditor your way.

Meals are still OK, though, so eat up.

"Taxpayers may continue to deduct 50 percent of the cost of business meals if the taxpayer (or an employee of the taxpayer) is present and the food or beverages are not considered lavish or extravagant. The meals may be provided to a current or potential business customer, client, consultant or similar business contact. Food and beverages that are provided during entertainment events will not be considered entertainment if purchased separately from the entertainment, if the cost is stated separately from the entertainment on one or more bills, invoices or receipts."

In addition to entertainment expenses, here is a helpful guide for businesses on common deductions under 2017 tax law versus post-Tax Cuts and Jobs Act tax law.

2. Don't go overboard with your deductions

Don't get me wrong: As a hard-working business owner, you should be taking every last deduction you are entitled to. But you should also know that the IRS uses a computer program (Discriminate Income Function) that compares the number and amount of your deductions to other businesses in your income bracket.

So, if the standard business in your tax bracket takes 12 deductions, and you take 212, you'll be hearing from a friendly IRS agent to help you trim that number down.

This doesn't mean that you should skip deductions that you legitimately deserve out of fear of an audit. In fact, CPA Jeffrey Levine says that one of the biggest mistakes he sees small-business owners make is not deducting legitimate business expenses such as a home office out of fear of an audit.

It does mean that if you think you can save some money by taking a $500 deduction for laying a $10 piece of plywood across a curb in front of your shop and calling it a wheelchair ramp, you should think again. Taking dozens of "miscellaneous" deductions is also not a good idea, because they are no longer allowed by the IRS.

Home office deductions, business travel, and vehicle mileage are among the most misused business deductions, according to CPA and QuickBooks consultant Hector Garcia. So use them when appropriate, but know that the eyes of the IRS are upon you.

3. Incorporate or form an LLC

Small businesses are audited more than corporations because incorporating shows some level of organization and financial competence on the part of the business.

In addition to a lower audit risk, there are other compelling reasons to consider incorporating:

For many small-business owners, personal assets (home, vehicles, savings) are also on the line to pay back creditors if their business goes under.

Corporations are more likely than small businesses to secure business loans from banks.

Corporations can take more deductions than small businesses (such as retirement plans and employee healthcare).

If you've been thinking about incorporating anyway, you can add "less chance of being audited" to your list of reasons to do so.

4. Be proactive about anomalies

Imagine this scenario: for each of the past three years, your small landscaping company has earned about $80,000 in income. This year, looking to expand, you earned a lucrative new contract with the local government and invested in three new commercial lawnmowers to handle the extra work. So, your income triples from the previous year, and you're suddenly claiming more than $10,000 in additional Section 179 deductions.

There's a good chance this will set off some alerts at the IRS. But rather than sending over the numbers and hiding under your desk with your fingers in your ears waiting for the auditor to come knocking, be proactive.

Irene Wachsler

CPA

"If there is a legitimate outlier number, then we always recommend that this information be disclosed on Form 8275 (Disclosure Statement) so that if the return comes up for an audit, an IRS agent can review the explanation and decide whether or not the explanation is reasonable,"

So gather those receipts for the riding mowers, the contract with the local government, even documentation of your plans for expansion, and include it with your return. It may take a little longer up front, but it will likely prevent an audit (during which you'd have to gather that evidence, anyway).

5. Don't file an amended return unless absolutely necessary

When you're up against the clock, it may be tempting to think, "I'm exhausted and I still have to open up the shop at 6 a.m. tomorrow. I'll just file this for now to make the deadline, and then file an amended return later to clean up any mistakes."

Bad idea. Filing an amended return is like holding up a big sign telling the IRS that you're not sure what you're doing. According to the IRS:

"Filing an amended return does not affect the selection process of the original return. However, amended returns also go through a screening process and the amended return may be selected for audit."

In other words, while you may have gotten away with a mistake or two on your original return, your amended return gives the IRS another opportunity to audit you, and the amended return itself may be a red flag.

If you really, honestly, screwed up and forgot to take a legitimate deduction that is going to cost you thousands of dollars, file an amended return. But you're much better off spending an extra hour or two to get it right the first time.

6. File electronically

In the year 2019, this should be the only way, but around 10% of individual taxpayers still used paper to file in 2018, according to the IRS. I'm sure there are some business owners out there who file manually with paper forms because they're Luddites or trying to stick it to the IRS in a hipster kinda way. But you might as well include a handwritten note with those paper forms that says "Dear IRS, please have an auditor double check this return."

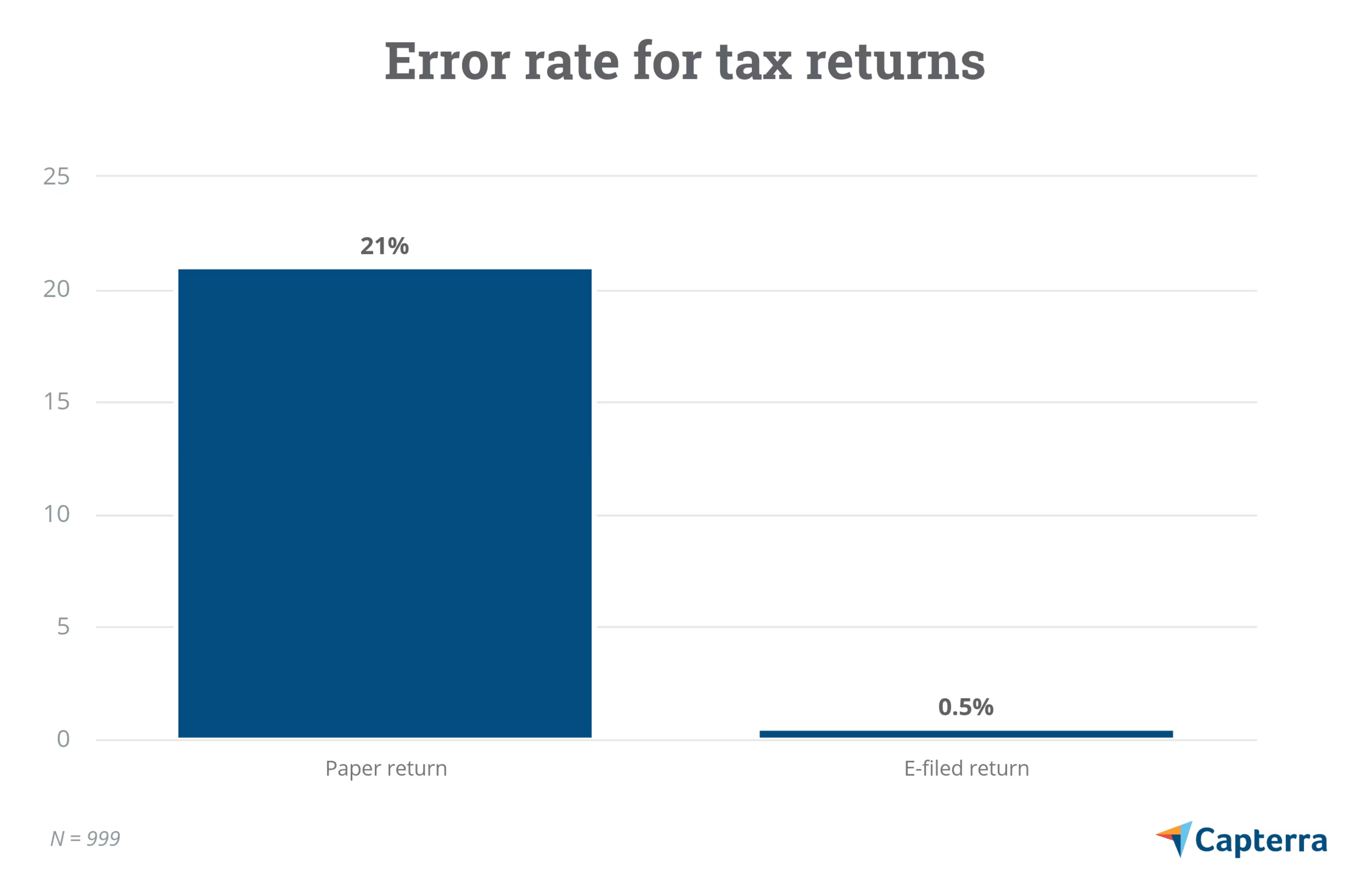

Why? According to e-file, the IRS electronic filing system website, "The error rate for a paper return is 21%. However, the e-filed returns generate an error rate of just one half of one percent."

In other words: A paper return is more than 40 times more likely to contain errors than an electronically filed return.

Other reasons to file electronically:

Electronic tax filing software helps you find tax credits and deductions that you're more likely to miss using pen and paper.

By using direct deposit and electronic filing, you can get your return in less than three weeks as opposed to waiting around two months for a paper return.

Most tax filing software includes audit warnings for things like deducting a home office or combining personal and business mileage.

More help from the IRS

Despite what you may have learned from Irwin R. Schyster, the IRS is not out to get small businesses, and they'd rather process a clean return than have to do additional work to collect taxes.

Here are a few additional resources to make your tax process easier:

What should you do if you get audited anyway?

In this article, we looked at some things you can do as a small-business owner throughout the year to avoid triggering an IRS audit. But what if you still get flagged for an audit?

Don't panic. Now is the time to be completely forthcoming, provide as much relevant paperwork as you have, and cooperate politely with the IRS rep you are working with. The IRS provides their own guide for how to make an audit go as smoothly as possible.

And if you really want to play it safe, get good accounting software and use it every day to weed out mistakes before they happen and find a trusted business accountant that you can turn to in times of trouble and keep you on the right path.

Have you been audited? If so, what lessons did you learn that you can share with your fellow small-business leaders? Share with other business leaders in the comments!

To stay on top of small business accounting and finance trends all year round, follow our blog. Here are a few recent articles to get you started:

Small Businesses Are Upping Their Fintech Spending in 2019: Here's Why

The 6 Biggest Challenges Facing Accounting Today and How to Solve Them

Thinking about hiring an accounting firm to help your secure your business from audits? Browse our list of top accounting firms and learn more about their features in our hiring guide.